| Sendedatum | 2010-09-03 19:01:53 |

|---|---|

| Ausgabe | 94 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Inhaltsverzeichnis:

Welt

Deutschland

Afghanistan

Bulgarien

Kanada

- Two Charts: All You Need To Know About Canada’s Housing Bubble

- Canada: Vancouver Housing prices threaten growth

China

- Beijing District Releases Official Housing Vacancy Rates

- China: Society Shortage of farms and water threatens grain output targets

Spanien

USA

- USA: Without Government Spending, GDP Growth Would Have Been Less Than Half Of What It Was

- USA: Toyota, GM, Ford Sales Slump as Buyers Shun New Cars

- History of US Interest Rates: 1790-Present

USA

Venezuela

Inhalt:

Welt

"They're taking in twice the amount of calories as the control rats," Kenny said.

"They actually voluntarily starved themselves," Kenny said.

"It's almost as if you break these things, it's very, very hard to go back to the way things were before. Their dietary preferences are dramatically shifted."

Deutschland

Brainfuck des Tages:

Schindler, der auch CDU-Bundestagsabgeordneter ist, forderte die rheinland-pfälzische Umweltministerin Margit Conrad (SPD) auf, umgehend die Zwangsbejagung in den besonders betroffenen Gebieten in der Nord- und Westpfalz anzuordnen. Andernfalls drohten den betroffenen Landwirten enorme Schäden.

Und wenn die Bundeswehr mit den Wildschweinen fertig ist - was, in Anbetracht bisheriger Leistungen des Trachtenvereins nicht wirklich absolut sicher ist - brauchen unsere Bauern dann Hilfen, weil Leopard, Fuchs, Tornado und Co. die Felder verwüstet haben...

http://www.proplanta.de/Agrar- [verkürzt] stpfalz_article1283159688.html

Vor allem in der Nord- und Westpfalz, in der die Ernte immer noch nicht vollständig abgeschlossen werden konnte, hätten die Landwirte mit diesen zusätzlichen Problemen zu kämpfen. Der BWV-Präsident forderte daher eine Zwangsbejagung, eventuell auch unter Einsatz der Bundeswehr, da das Problem mit normalen jagdlichen Methoden nicht mehr zu lösen sei, so Schindler.

Besonders dramatisch seien die Schwarzwildschäden in der Nähe von Waldgebieten. Hier sei, neben den Schäden in den landwirtschaftlichen Kulturen, das Risiko beim Mähdrusch besonders groß. „Man kommt sich vor wie bei einer Springprozession, zwei Schritte vor, zehn zurück“, so BWV-Präsident Schindler. Immer wieder gebe es Probleme, da die Mähdrescher mit dem Schneidwerk in durch Wildschweine verursachte Erdhügel gerieten, die von der Kabine aus nicht zu erkennen seien. Hier sei das Risiko besonders groß, die wertvollen Maschinen zu beschädigen, erläuterte der BWV-Präsident.

Hat da jemand die falschen "wertvollen Maschinen" angeschafft? Sollte da jemand die Pfalz mit der norddeutschen Tiefebene verwechselt haben?

btw, liebe Bauern: Vielleicht pflanzt ihr die Lekkereien demnächst nicht mehr am Waldrand, sondern laßt denn Platz, wie früher auch, für Wiesen und Weiden? Das würde das Jagen einfacher machen...

Afghanistan

Mahmood Karzai, brother of Afghanistan's president and the third-largest shareholder in Kabul Bank, urged the U.S. to calm the situation, saying the lender could keep up with the pace of withdrawals for only a few more days.

"America could support Kabul Bank to the last penny, of course that would help," he said in an interview at his Kabul home. "The full faith and credit of the U.S. government behind Kabul Bank—what more do you want?"

[...]

Kabul Bank's woes became public late Tuesday when word emerged that Afghanistan's central bank had quietly forced out the bank's two top executives, and its biggest shareholders, amid allegations that they made hundreds of millions of dollars in often-clandestine loans to themselves and Afghan government insiders.

Bank Run auf eine aghanische Bank... und von wem will die gerettet werden? Vom US-Steuerzahler.

Nun gut, man könnte argumentieren, daß das immer noch besser ist als mehr Waffen...

Bulgarien

[...]

Capital inflows, which had been keeping the current account deficit afloat, dropped from a peak of 44 percent of GDP in 2007 to less than 10 percent of GDP in 2009. As a result, investment, which had risen by over 20 percent annually during the previous two years, fell by nearly 30%. And as the investment flows dried up, the Current Account deficit closed rapidly, as imports (and domestic consumption) dropped back sharply.

[...]

As the IMF stress, potential growth in Bulgaria is surely set to decline further in the longer term, since as I keep saying Bulgaria faces a serious ageing population problem. The median age is now through the critical 40 barrier, and headed on up towards the 45 range, in a country where male life expectancy is some 10 years below the West European average.

Bulgaria's population has been falling for a decade now, and is projected to decline by a further 28 percent between 2008 and 2060, while the old age dependency ratio would exceed 60 percent in 2060.

This population drop is already affecting the working age population, which is already in decline, and is forecast to fall by an additional 25 percent over the next 50 years.

As a result, the EU 2009–12 Convergence Programme is forecasting a steady decline in potential growth to an annual 0.3 percent in 2050, and this meagre growth is only obtained by assuming a - totally unrealistic (in what will then be such an old population) - labour participation rate of 70 percent. Personally, I think these numbers are way, way to optimistic, and all of this is badly in need of a current calibration based on what is already happening in ageing societies like Germany and Japan. Bulgaria's sustainable growth rate doesn't start to get affected in 2050, it is already on its way down now.

[...]

So, Bulgaria as a country is certainly not short of problems. What with the evident demographic ones, and the limitations of the currency peg, it is hard to see how they are easily soluable. To put it bluntly, Bulgarian industry only accounts for some 18% of GDP (in value added terms). If we assume as a rule of thumb that about 50% is geared to the domestic market, then this means that Bulgarian GDP is going to have to leverage itself forward through growth in about 10% of its output, while other sections shrink. A difficult, if not impossible task.

And there are more problems. As the IMF point out, Bulgaria's fiscal situation is challenging, since the earlier revenue boom has come to an end, while expenditure pressures are considerable. The pre-crisis revenue boom, was fuelled by higher receipts on goods and services on the back of Bulgaria's rapid domestic demand growth, but returning to pre-crisis revenue levels will be a major challenge, not only because the economy is expected to recover slowly but also because the growth pattern will need to shift, with less contribution from domestic demand and more contribution from the external sector, which will result in lower tax revenues. Put simply, since Bulgaria's treasury is stongly dependent on VAT, and exports evidently don't attract VAT, the situation becomes even more difficult.

Kanada

Ich zitiere mal zu 100%:

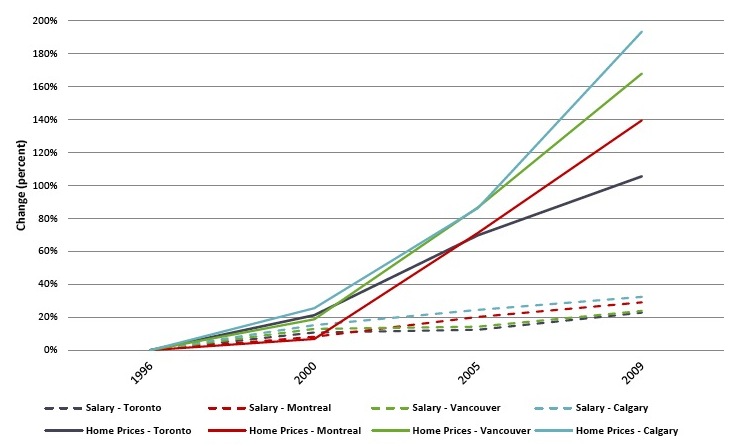

Gehalts- und Hauspreisentwicklung in Kanada, 1996-2009.

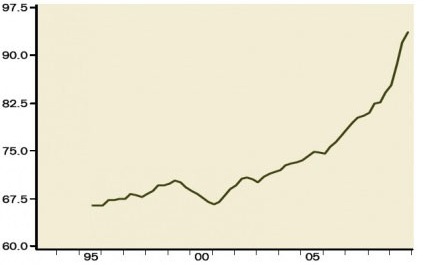

Kanadische Haushaltsschulden im Verhältnis zum BIP.

This achievement was made possible by a potent mix of dysfunctional local policies, processes, public attitudes and a wanton disregard for the economic realities of present and future residents and of the future ability of the region to attract and retain jobs.

Da will ich mich gleich mal der Gratulation anschließen

China

Among the empty residences, villas and luxury apartments totaled 521,000 square meters, accounting for 39.2 percent of the total and 54.9 percent of homes have remained empty for over three years. Ordinary flats accounted for 18 percent of the empty residential space, according to the report.

Mehr als die Hälfte des leerstehenden Wohnraums im Pekings Chaoyang-Distrikt ist drei Jahren leer.

Xie estimated that the vacancy rate for the China's private, commercial housing stock is between 25 and 30 percent, at least double compared to normal market conditions. Xie said the value of the inventory held by speculators probably accounts for around 15 percent of GDP.

By contrast, the cultivable land in the country sharply decreased from 130.04 million hectares in 1996 to 121.72 million hectares in 2008 due to rapid urbanization and natural disasters, figures from the National Bureau of Statistics show.

Also, the current per capita cultivated farmland is about 0.092 hectares, which is only about 40 percent of the global average. Less than 4.7 million hectares in the country can be considered reserve farmland, Zhang told the legislature.

Spanien

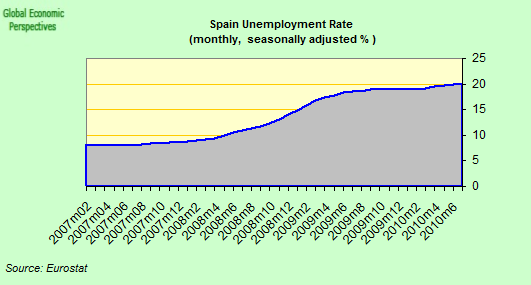

- Arbeitslosigkeit:

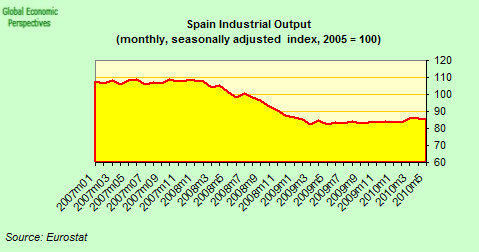

- Industrieproduktion:

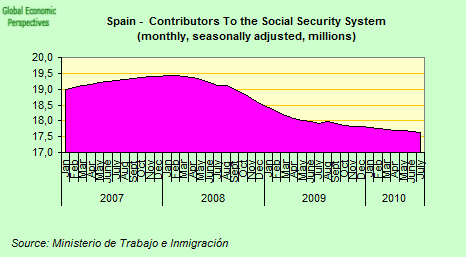

- Einzahler in Sozialversicherung:

das sieht irgendwie gar nicht nach Aufschwung aus.

The financial daily Cinco Dias reports that the share of the Fondo’s total portfolio invested in Spanish government bonds rose from below 50pc in 2007 to 76pc in 2009.

The Social Security minister Octavio Granado said it will rise to 90pc by the end of this year.

It is clear from an analysis of the data that the Fondo is not just investing fresh revenues in Spanish bonds, but also rotating out of Dutch, French, and German bonds into Spanish debt. The Spanish government is also funnelling 90pc of its sickness fund into state bonds.

Ok, Spanien ist längst nicht das einzige Land, in dem Pensionsfonds Staatsanleihen des eigenen Landes halten, und längst nicht das einzige Land, in dem Pensionsfonds den Preis der Staatsanleihen drücken, aber ein besonders gutes Zeichen für das Marktvertrauen in spanische Staatsanleihen ist das trotzdem nicht.

USA

Uwe Ohse, 2010-08-30

Government spending contributed +0.86% to the 1.6% GDP growth value, which was one of the highest quarterly government contribution to GDP since at least 2007. The only quarters to beat it since the beginning fo 2007 were Q3 of 2008 and Q2 of 2009, at +1.04% and +1.24% respectively.

.

Daß die USA beim Raten der BIP-Zahlen offenbar ziemlich falsch liegt, ist zwar peinlich, aber nicht wirklich neu. Daß die Revisionen der geratenen Zahlen eher niedriger ausfallen: dito.

Ergo: nichts neues unter der Sonne. Alles wie erwartet, die Party kann weitergehen.

ach bitte, wer will sich von soetwas die Party verderben lassen?

http://www.businessinsider.com/us-gdp-defense-driver-2010-8

Meanwhile, state consumption actually fell, sub tracing 0.10% from US GDP growth. You can see the breakdown below. Note that the numbers don't add up to precisely 0.86% due to rounding. All data is from the BEA.

GM said deliveries fell 25 percent to 185,176 from 246,479 last August, when the U.S. government’s “cash for clunkers” incentive program boosted sales. The biggest U.S. automaker was expected to report a 19 percent decrease, including an adjustment for the number of selling days in August, the average estimate of four analysts surveyed by Bloomberg. On that basis, sales fell 22 percent, Detroit-based GM said in a statement.

Die Krise ist vorbei?

Die Erträge 10jähriger US-Staatsanleihen sind rekordverdächtig niedrig? Eine Blase? Können nur noch steigen?

Ja, wirklich?

The Norfolk, Va.-based railroad is taking advantage of soaring investor appetite for corporate debt and low interest rates. The bonds were added to an existing $300 million 6% debt issue due 2105 that the company first sold in 2005.

Investor interest was strong enough that the company increased the size of the new sale from $100 million. Market participants said investors had expressed an interest in buying at least $75 million of the debt before the company decided to announce the $100 million deal. Before 2005, Norfolk Southern had one other 100-year issue, in 1997.

100 Jahre laufende Anleihen mit 6% Zinssatz sind für meinen Geschmack etwas gewagt... ich meine, wer in aller Welt ist

- bereit, sein Geld für 100 Jahre festzulegen?

- in der Lage, auf einen derartig verdammt langen Zeitraum Zinsentwicklungen auch nur ansatzweise vorherzusagen?

- oder in der Lage, abzusehen, wie die Bonität eines Eisenbahnunternehmens dann aussieht?

- so verzweifelt, um jeden Preis 6% Zinsen zu brauchen?

USA

The influx of illegal immigrants plunged to an estimated 300,000 annually between March 2007 and 2009, from 850,000 a year between March 2000 and March 2005, according to new study released Wednesday by the Pew Hispanic Center, a nonpartisan research group.

According to data related to the public and private sectors, in the first half of 2010, a total of 26,000 housing units were completed, compared to 47,000 units in the same period in 2009. This represents a 45-percent downturn.

Venezuela

The result last week shows a slight jump of 0.2 percent over 8.5 percent in July 2009.

Laut http://www.latin-focus.com/latinfocus/countries/venezuela/venunemp.htm war sie 2008 bei 6,irgendwas Prozent (laut https://www.cia.gov/library/publications/the-world-factbook/geos/ve.html: 7.4%).

Mich dünkt, der Trend arbeitet gegen Chavez.

[...]

Minister of Energy and Petroleum Rafael Ramírez said earlier this year that the energy crisis hitting Venezuela could be partially solved with thermal power generation. Therefore, 100,000 barrels per day (bpd) of diesel and fuel oil that were intended for export have been allocated to supply the domestic market.

The decline in exports of crude oil and byproducts in the second quarter of the year added to a 3.3 percent drop over the same period last year. In the first quarter of the year, exports declined by 5.9 percent, according to the Central Bank of Venezuela.

Official data show that gross fixed capital formation (GFCF) decreased by 11.9 percent in the first half of the year. The GFCF declined by a significant 23.8 percent between January and March. In the second quarter, however, it dropped only 0.8 percent.

[...]

The Central Bank said in the report that "most funds were allocated to the electricity infrastructure plan, mainly due to the new social responsibilities of the state-run oil industry." This caused a slight improvement with regard to the negative results recorded in the previous quarter.

und wenn der Stimulus erst mal nachläßt?

Wollen Sie den Digest abbestellen?