| Sendedatum | 2010-05-30 20:41:49 |

|---|---|

| Ausgabe | 92 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Inhaltsverzeichnis:

- Millions face hunger in arid belt of Africa

- Africa: Alien Species 'Huge' Threat to Continent, Experts Warn

- Africa: Most of Continent's Water Sources Are Polluted with Toxic Matter - Report

- Polar bear population could fall by 30 per cent in a year: study

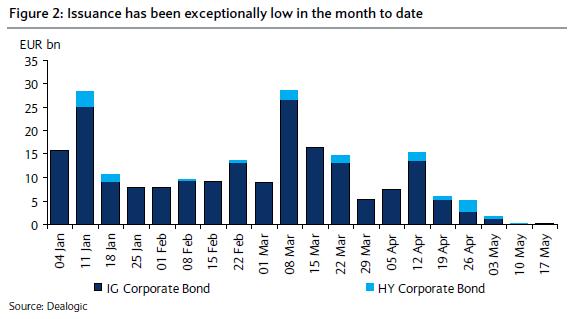

- Forget the shorts, issuance is slaughtered

- Goldblase?

- Unternehmensanleihen im Mai 2010, Teil 2

- European cities on the edge of a debt crisis

- French minister says bail-out alters EU treaty

- Euro Disney hit by growing debt fear

- Oil sands: the clean alternative?

- Gulf Oil Spill: Media Access 'Slowly Being Strangled Off'

- BP bused in 100s of temp workers for Obama visit, state official says

- BP Lobbyarbeit

- BP Presseerklärung, Auszug

- The Gulf Of Mexico Before The Oil Spill

- China says too early to exit fiscal stimulus

- Car plate prices continue to rise

- Geely to build car cheaper than Tata Nano?

- China: The number of private owned Fortune 500 Global 500 companies: 0

- New home deals may fall 70%

- Unrest May Signal New Phase in China Economy

- Nordsparkasse droht Ertrinken

- Uni Lübeck vor dem Aus

- Bundesbanker vermuten französisches Komplott

- Pigeon held in India on suspicion of spying for Pak

- Indonesia mud volcano still spewing sludge four years later

- Namibia: Biodiversity Loss Increasing

- Nigeria's agony dwarfs the Gulf oil spill. The US and Europe ignore it

- Nigeria: Special Report On Desertification

- Irland: IT IS no longer a question of whether Ireland will go bust, but when.

- Rom: S&P droht mit Abwertung

- Whither Spain – Towards Finland or Argentina?

- Tanzania: Environmental Cost of Soil Erosion Amounts to One-Third of GDP

- Tanzania: Forests to Disappear in Ten Decades

- Gazprom and Naftohaz test waters

- UK: 300,000 jobs in public sector face the axe

- UK: Falling retail sales dampen recovery hopes

- US money supply plunges at 1930s pace

- U.S. cities face deepening fiscal problems

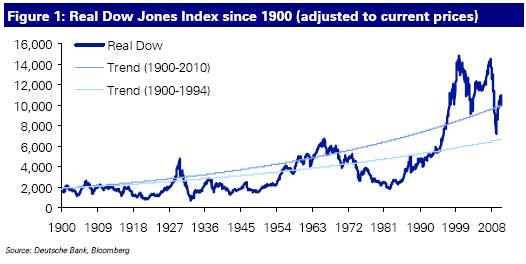

- A century-long look at the US equity market

- The War Is Making You Poor Act

- 25 Questions To Ask Anyone Who Is Delusional Enough To Believe That This Economic Recovery Is Real

- New York Is Almost Out of Cash

- Legislation Addresses Housing Production Credit Crisis

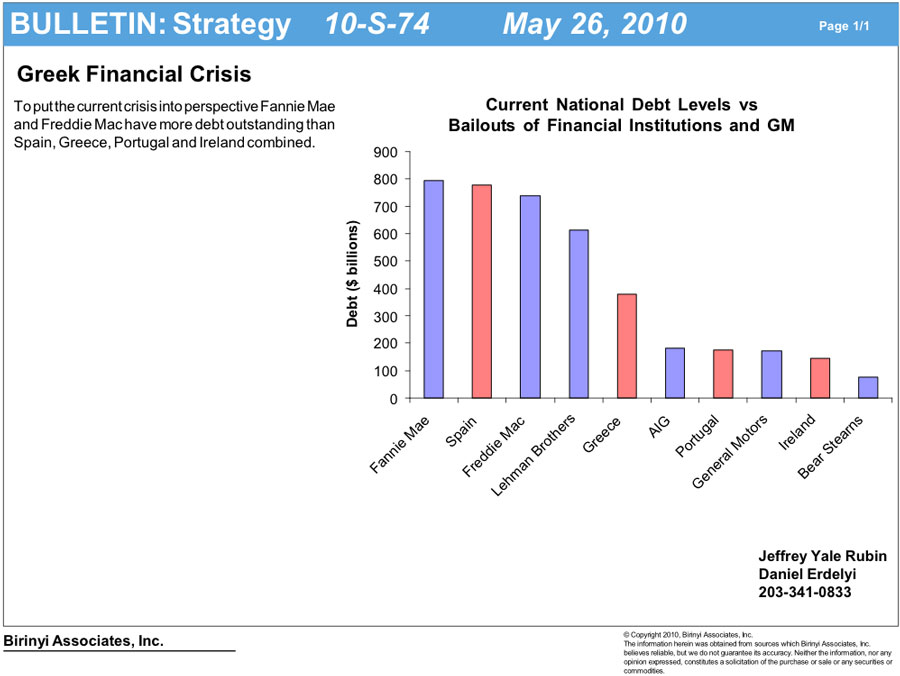

- USA: Compared To Our Bailout, The Euro Bailout Is NOTHING

- USA: Congress Weighs a Pension Bailout

- Not just oil: US hit peak water in 1970 and nobody noticed

Inhalt:

Africa's protected biodiversity areas are under increasing threat from the species introduced - usually through human activities - to areas outside their natural range where they damage biodiversity, agriculture and human health.

"The government is now spending substantial amounts of money on trying to control this insidious weed," Howard said.

Uwe Ohse, 2010-05-30

[...]

Last year, Africa's population exceeded one billion and is increasing at a rate of 2.4 per cent annually. Over 341 million people lack access to clean drinking water and 589 million have no access to adequate sanitation. This makes it difficult for the continent to meet its 2015 MDGs.

“This is much, much different. This is not a gradual change,” said Dr. Andrew Derocher, one of the world’s leading polar bear authorities and co-author of the study. “We’re looking at a decrease by 20 or 30 per cent or even much more in a year.”

All of that information can be subjected to “some fairly advanced math” to create data tables that chart the estimated time of death by starvation for adult male polar bears.

Typically 120 days in the 1980s, the time polar bears have to spend fasting has increased by about seven days per decade and is continuing to increase.

While 3 to 6 per cent of polar bears in the Western Hudson Bay die during a 120-day summer fast, 28 to 48 per cent would die if it reached 180 days, the study found. The fast occurs because polar bears depend on frozen sea surface to cover distances.

Blöde Viecher aber auch - jetzt, wo es da wärmer ist,

Es sind interessante Zeiten.

It compares the rise in gold today with the rise of the Nasdaq in the 1990s and the Dow Jones index of home-building stocks in the 10 years leading up to 2005-06.

Eurasian Natural Resources Corp., a London-based iron ore and alumina miner, delayed a debut dollar-denominated note sale this month because of market volatility, people familiar with the matter said. Towergate Partnership Ltd., Europe’s largest independent insurance broker, postponed a 665 million-pound ($961 million) sale of high-yield bonds on May 13 until markets improve, said people with knowledge of the deal.

Der Krise zweiter Teil.

A quarter of Venice's income comes from the City-owned casino near the famous Rialto bridge, where thousands of tourists gamble, unaware that they're funding the city's battle against rising lagoon levels, or paying for its world-renowned carnival. But a credit crunch-led drop in tourism has starved the municipal coffers, and forced the city into new fundraising ventures. Venice recently created an 18-property fund, valued at €82m (£71.3m), expected to be sold within three to five years.

"The market is shut, nobody's doing anything," the banker says. "Money can't be kept in a drawer but it was shut two weeks ago, and it will have to reopen."

Darüber werden wir spätestens im Herbst noch mehr lesen.

Äh, nein. De facto habt ihr das Abkommen nicht geändert, sondern ignoriert.

Im Grunde besteht die EU nun aus kriminellen Staaten

[...]

Euro Disney still has €1.9bn (£1.6bn) of the debt used to fund the park’s construction on its books. The company made a €26.4m operating profit on revenue of €1.2bn in the year ending September 30 2009 but paying €89.2m of financial charges on the debt left it with a €63m net loss.

Its shares fell 13pc – the stock’s biggest fall in nearly two years – when it announced in November that it will delay subordinated debt repayments of up to €45m after missing its financial targets.

Eigentlich sollte ein Blick auf

aus Alles wird gut! Digest #83 doch ausreichen, um leichte Zweifel an der Umweltfreundlichkeit der Ölsandförderung zu wecken oder?

aus Alles wird gut! Digest #83 doch ausreichen, um leichte Zweifel an der Umweltfreundlichkeit der Ölsandförderung zu wecken oder?Aber es ist doch schön zu sehen, daß die PR-Maschinerie in der Wirtschaftskrise nicht unter gegangen ist, aber auch nichts dazu gelernt hat - "hey, seht her, da drüben ist 'ne Katastrophe passiert. *Die* würde uns *nie* passieren".

Darf ich "Change you can believe in" mal übersetzen? "Du kannst nur glauben, daß sich etwas ändert".

Ich weiß gar nicht, worüber die sich aufregen? Es weiß doch jeder, daß die Strände gleich viel sauberer sind, wenn niemand das Öl darauf fotografiert!

Kurz vor dem Besuch des Präsidenten hat BP "hunderte" Leute zum Standsäubern eingestellt und direkt danach wieder entlassen.

Ich fürchte, irgendjemand in den PR-Abteilung von BP und / oder Obama ist ernsthaft überfordert.

Cullen argued the companies had made this request because drilling a relief well within the required time limit would be too expensive, given the difficult Arctic conditions.

In Kanada gibt es offenbar eine Vorschrift, nach dem beim Bohren in der Arktis Entlastungsbohrungen mit der Hauptbohrung gemacht werden müssen.

Und BP (und andere Ölunternehmen) haben kurz vor der Deepwater-Horizon-Katastrophe daran gearbeitet, diese Vorschrift aus Kostengründen zu kippen.

Zu BP gehören übrigens auch die Marken Aral und Castrol - nur so für den Fall gesagt, daß jemand vermeiden möchte, dort zu kaufen. Allerdings kann man Zweifel haben, daß andere Ölunternehmen irgendwie besser sind.

Was in aller Welt war denn da erfolgreich?

BP-Marken: BP, Aral, Castrol.

Die Umweltprobleme im Golf von Mexiko vor der Deepwater Horizon (ich bin mir sicher, die Liste ist nicht vollständig):

As a result, for the past 70 years or so, the sinking of the delta coast has continued unabated. As salt water pushes inland from the gulf, it kills wetlands and marshes, habitat for wildlife and fish, and is increasingly threatening homes for many thousands of people.

The dead zone is caused by nutrient enrichment from the Mississippi River, particularly nitrogen and phosphorous. Watersheds within the Mississippi River Basin drain much of the United States, from Montana to Pennsylvania and extending southward along the Mississippi River.

Und das ist natürlich längst nicht alles.

"There are still a lot of uncertainties in the world economy. Therefore we believe it is too early for us to talk about an exit strategy from our stimulus package," Chen told reporters after a meeting with European Union (EU) Trade Commissioner Karel De Gucht.

Wie? Was? Es ist sogar zu früh, über ein Ende der Stimuli nur zu reden?

Wow.

Aus der Abteilung für Sonderbares: Die Nummernschildpreise in Shanghai.

CAR plates prices in Shanghai continued to rise this month.

The average price for a car license was 42,262 yuan (US$6,187), up 625 yuan from April, the Shanghai International Commodity Auction Co said. The lowest price was up 900 yuan to 41,900 yuan. Both prices have been rising for eight months and are at their highest since January 2008.

A total of 8,500 car plates were up for auction this month, the same number as last month but more than February's 7,500.

The number of bidders dropped for a fifth month to 16,324, or 989 fewer than April.

Ein Nummernschild für ein Auto kostet $6187 in Shanghai.

Frage1: Ist das nun inflationär oder deflationär?

Frage2: Wie passen Volvo und ein $2250-Auto in ein Unternehmen?

Frage3: Welchen Nutzen könnte man aus einem solchen Auto bei der nächsten Abwrackprämie ziehen?

Frage4: Wann sehen wir das $1000-Auto?

Beeindruckender Kapitalismus.

[Shanghai New Home Sales]

"For the whole month, the figure should be around 300,000 square meters, and that could be a plunge from a month earlier when 1.02 million square meters of new houses were sold across the city," said Lu Qilin, a researcher at the firm. "On the supply side, more than 850,000 square meters of new housing were launched for sale this month, compared with 1.23 million square meters in April."

Ein Absturz.

Der Triumph des freien Marktes: "Immobilienunternehmen warten auf klarere Signale der Regierung, bevor sie Preise kürzen".

[...]

The biggest eye-opener for multinationals in China recently has been a nine-day-old strike at a sprawling Honda transmission factory here in Foshan, about 100 miles northwest of Hong Kong.

The strike, which has forced Honda to suspend production at all four of its joint venture assembly plants in China, has shown that Chinese authorities are willing to tolerate work stoppages at least temporarily, even at high-tech operations on which many other factories depend.

[...]

Even before the strike, manufacturers and buyers of low-cost products were already actively seeking alternatives to China, like Vietnam and Cambodia, said Richard Vuylsteke, the president of the American Chamber of Commerce in Hong Kong.

“They’re looking very seriously, and we’re seeing that in apparel and footwear,” he said. “A lot of our members are seeing appreciating wages.”

[...]

Labor advocacy groups say that they hear of frequent strikes in China, with work stoppages occurring somewhere every day. But strikes are typically hushed up and are often resolved in a day or two by the authorities, either with the police or through pressure on employers and workers to resolve their differences.

Krise? Welche Krise?

Ab Wintersemester 2011/2012 sollen keine neuen Medizinstudenten in Lübeck mehr angenommen werden, das Studium werde an die Uni Kiel "verlagert", heißt es in den Empfehlungen zur Konsolidierung der Finanzen des Landes Schleswig-Holstein, wie die CDU-FDP-Haushaltskommission sie verabschiedete.

In Anbetracht der großen Ärzteschwemme in Deutschland ist das ja sicherlich verzeihlich, man wartet ja noch weniger als ein Jahr auf einen Facharzttermin.

Ach, damit spart man doch noch viel mehr - was man alleine pro Jahrgang einspart, wenn die 200 Mediziner nicht hinterher noch 30 Jahre lang Medikamente verschreiben!

Und auch die Schulen müssen empfindliche Einschnitte hinnehmen. 300 Lehrestellen werden im Sommer 2011 und weitere 300 im Sommer 2012 gestrichen, berichtete das "Hamburger Abendblatt". Insgesamt sollen so bis 2020 3650 Lehrstellen wegfallen. Ausnehmen wird das schwarz-gelbe Bündnis in Kiel die Gymnasien: Sie erhalten schon im kommenden Schuljahr 180 Lehrerstellen mehr.

Hamburg/Berlin - In Frankfurt am Main wundert sich in diesen Tagen mancher: Der Kauf von Staatsanleihen hochverschuldeter Euro-Länder durch die Europäische Zentralbank (EZB) sorgt nach SPIEGEL-Informationen für erhebliche Irritationen in der Bundesbank.

Ach, wer hätte 4979? Wo doch französische Banken noch mehr Südeuropa-Müll in ihren Bilanzen als die Deutschen?

Selbst schuld.

Direkt aus Absurdistan: Taube in Indien in Polizeigewahrsam.

The white-coloured bird was found by a local resident in India's Punjab state, which borders Pakistan, and taken to a police station 40 kilometres (25 miles) from the capital Amritsar.

The pigeon had a ring around its foot and a Pakistani phone number and address stamped on its body in red ink.

http://de.wikipedia.org/wiki/Schlammvulkan_auf_Java, der im Mai 2006 ausgebrochen ist, ist doch sicher bereits Geschichte, oder? Ich meine, soetwas sollte doch nicht nach 4 Jahren _immer noch_ aktiv sein, oder?

Doch, er ist noch aktiv. Und die Geschichte hat 'was.

The mud lake is so huge -- seven square kilometres (almost three square miles) and 20 metres (66 feet) thick -- it is now visible from space, and geologists say "Lusi" could continue gushing sludge for centuries.

Wie beruhigend - das kann noch Jahrhunderte weiter gehen.

Besonders beruhigend dürfte das für die 10000 Familien sein, die seitdem auf ihre Entschädigung warten. Die Firma, die damals an der Stelle gebohrt hat, begründet die kleine Verzögerung mit der Finanzkrise:

Es ist sicherlich nur ein Zufall, daß PT Lapindo Brantas - das damals dort bohrende Unternehmen - zur Bakrie-Gruppe gehört, und daß Aburizal Bakrie der "Coordinating Minister for the People's Welfare" ist,

richtig? (http://en.wikipedia.org/wiki/Aburizal_Bakrie)

Aber abgesehen von der ja doch zu erwartenden rücksichtsvollen Behandlung der Opfer durch die sehr wahrscheinlich Schuldigen ist auch die optimistische Haltung des Staatspräsidenten interessant:

"With good layout and good concepts, we can turn this place into something useful for the community, whether as a geological tourist attraction, fishery or for other public activities," he said.

"If it's managed well, I have confidence this will be an attractive place and bring good to the local community."

Disneyland Java vielleicht? "Spielen auf dem Platz, an dem 10000 Familien ruiniert wurden"?

Apropos Bohren: Die Ursache war hier sehr wahrscheinlich eine Bohrung nach Erdgas...

"The consequences of this collective failure, if not corrected, will be severe for us all," she said.

Nandi-Ndaitwah said wetlands such as the oshanas of north-central Namibia have been invaded by invasive species which are the manifestation of degraded ecosystems.

Within days of the Ibeno spill, thousands of barrels of oil were spilled when the nearby Shell Trans Niger pipeline was attacked by rebels. A few days after that, a large oil slick was found floating on Lake Adibawa in Bayelsa state and another in Ogoniland. "We are faced with incessant oil spills from rusty pipes, some of which are 40 years old," said Bonny Otavie, a Bayelsa MP.

This point was backed by Williams Mkpa, a community leader in Ibeno: "Oil companies do not value our life; they want us to all die. In the past two years, we have experienced 10 oil spills and fishermen can no longer sustain their families. It is not tolerable."

Consequently, Nigeria loses about 350,000 hectares of land every year to desert encroachment. This has led to demographic displacements in villages across 11 states in the North. It is estimated that Nigeria loses about $5.1billion every year owing to rapid encroachment of drought and desert in most parts of the north.

Even under the most optimistic assumptions about government spending cuts and bank losses, by 2012 Ireland will have a worse ratio of debt to national income than the one that is sinking Greece.

On the face of it, Ireland’s debt position does not appear catastrophic. At the start of the year, Ireland’s government debt was two- thirds of GDP: only half the Greek level.

What ultimately matters for national solvency, however, is not how much the State invests in its banks, but how much it is likely to lose. It is alright to invest €70 billion, or even €100 billion, to rescue your banking system if you can reasonably expect to get back most of what you spent. So how much are the banks and, thanks to the bank guarantee, you the taxpayer, likely to lose?

[...]

So between developers, businesses, and personal loans, Irish banks are on track to lose nearly €50 billion if we are optimistic (and more likely closer to €70 billion), which translates into a bill for the taxpayer of over 30 per cent of GDP. The bank guarantee may have looked like “the cheapest bailout in the world, so far” in September 2008, but it is not looking that way now.

There is more. The ability of a government to service its debts depends on its tax base. In Ireland the proper measure of tax base, at least when it comes to increasing taxes, is not GDP (including profits of multinational firms, who will walk if we raise their taxes) but GNP (which is limited to Irish people, who are mostly stuck here). While for most countries the two measures are the same, in Ireland GDP is a quarter larger than GNP. This means our optimistic debt to GDP forecast of 115 per cent translates into a debt to GNP ratio of 140 per cent, worse than where Greece is now.

And even this catastrophic number assumes that our economy does not contract further. For the last two years the Irish economy has not been shrinking, so much as vaporising. Real GNP and private sector employment have already fallen by one-sixth – the deepest and swiftest falls in a western economy since the Great Depression.

In der Tat, Irlands Aussichten sehen nicht besonders gut aus.

[...]

If the parliament passes the government decree in the current form, it would weaken our current opinion on extraordinary support by the government to Rome. This support generates a one-notch rating uplift for the city’s long-term rating, which would otherwise be at the ‘A’ rating level…

Lustige Zeiten, in denen wir leben.

Erward Hugh über Spanien:

[...]

Following a decade long housing “boom” Spain now has an enormous debt problem. The combined debt level of Spain’s households, companies and government now amounts to some 265% of GDP.

[...]

However, in contrast to the situation in countries like Greece and Italy, Spain’s endebtedness problem is not principally one of massive public sector debt. The main component of Spanish debt is private – between households and companies accumulated debt amounts to some 210% of GDP.

[...]

According to the National Statistics Office (INE), the slight economic expansion that was achieved in the first quarter of 2010 (0.1% growth) was the combined result of an increase in internal demand and a worsening of the net impact of external demand – precisely the opposite of what you would want to achieve. In other words, while Spain’s exports did increase, the growth in domestic demand in conditions of limited international competitiveness meant that imports increased even more.

[...]

As the Spanish government stresses, the country’s share in world exports has remained more or less constant since the start of the century, but at the same time Spain’s share of world imports has increased. [...] In this sense what Spain’s economy needs is not rejuvenation but resurrection.

[...]

To conclude, Spain stands at a crossroads, and important decisions need to be taken. A fiscal adjustment is necessary, but the country also needs a competitiveness adjustment in the form of a substantial reduction in the wage and price level (possibly by 20%). If this is not implemented the dynamic of Spain’s debt will surely become unsustainable. Spain has two – and only – choices at this point. It can follow Finland’s example in the 1990s, take the bull by the horns and use the present crisis as an opportunity to transform the Spanish economy into a new economic miracle, or it can remain in denial about the severity of the problem, let things drift until they can do so no longer, and then follow Argentina down the road of ruin and despair.

Ich habe Schwierigkeiten, mir ein Spanien (Griechenland, Italien, Frankreich, Deutschland) vorzustellen, in dem derartige Umstellungen möglich wären - eine interne Abwertung um 20% ist heftig.

The estimated costs of environmental degradation in the lakes and rivers due to excessive loads of sediments and nutrients caused by soil erosion may be even higher.

While the survey by Conservation International, a non-profit organisation with its headquarters in Washington, DC, United States, has revealed that 2,300 square kilometres of forests is being destroyed yearly, the United Nations Food and Agricultural Organisation (FAO) has put the annual deforestation rate at whopping 4,200 square kilometres.

Currently, Tanzania has 385,000 square kilometres of forest cover, but experts warn that this could disappear fast if measures are not taken to reverse the alarming situation. According to experts, the wanton felling of trees or burning of forests releases carbon dioxide and other greenhouse gases into the atmosphere, leading to global warming that could result in increased drought, flooding, poor harvests, water shortages and a growing number of refugees driven from the worst hit areas.

Ein weiterer Schritt Rußlands, die Kontrolle über die Ukraine zurückzugewinnen - siehe Russia teaches EU a lesson in its Ukraine gas-for-naval base deal.

As George Osborne, the chancellor, prepares to unveil the first £6 billion of cuts tomorrow, the full scale of the job losses that will follow has begun to emerge.

The initial savings to be announced will target such items as civil servants’ perks, which include taxis, flights and hotel accommodation.

Oh, oh - 300000 Arbeitslose sind eine verdammt große Zahl. Und das ist noch nicht der schlimmstmögliche Fall:

Some estimates suggest that the number of job losses could reach 700,000. These will include tens of thousands of health service managers as well as many thousands of doctors and nurses, according to internal documents from the National Health Service.

Immerhin, Europas neues großes Armenhaus ergreift Maßnahmen. Ob es die Richtigen zum richtigen Zeitpunkt sind?

Hallo Japan.

The stock of money fell from $14.2 trillion to $13.9 trillion in the three months to April, amounting to an annual rate of contraction of 9.6pc. The assets of insitutional money market funds fell at a 37pc rate, the sharpest drop ever.

Almost all -- 90 percent -- said unemployment was a problem for their communities and that joblessness has mounted over the last year.

"City budget shortfalls will become more severe over the next two years as tax collections catch up with economic conditions," the report said. "These will inevitably result in new rounds of layoffs, service cuts, and canceled projects and contracts."

Already, 71 percent of cities have cut personnel and 68 percent have delayed or canceled infrastructure projects, it found.

Der Aufschwung in den USA scheibt auf tönernen Füßen zu stehen.

FT Alphaville über die Frage, ob der Dow Jones im langfristigen Trend liegt:

Überraschung - er liegt nicht.

Liegt das nun daran, daß heute alles besser ist?

Mich interessiert die amerikanische Innenpolitik nicht wirklich (unsere ist schon schlimm genug, um Schwierigkeiten zu bekommen, den Brechreiz zu unterdrücken), aber ab und zu bekomme ich davon doch etwas mit. Diesmal ist es der "The War Is Making You Poor Act" - eine Gesetzesinitiative.

And that's what this bill does. It eliminates separate funding for the occupation of Iraq and Afghanistan, and eliminates federal income taxes for everyone's first $35,000 of income ($70,000 for couples). Plus it pays down the national debt.

The costs of the war have been rendered invisible. There's no draft. Instead, we take the most vulnerable elements of our population, and give them a choice between unemployment and missile fodder. Government deficits conceal the need to pay in cash for the war.

We put the cost of both guns and butter on our Chinese credit card. In fact, we don't even put these wars on budget; they are still passed using 'emergency supplemental'. A nine-year 'emergency'.

In der Tat, eine neun Jahre andauernde Notlage - für Schafherden und Hochzeitswillige in Afghanistan auf jeden Fall.

Und es ist auch schön zu sehen, daß abseits von Michael Moore jemand das Thema "entweder Arbeitslos oder Kanonenfutter" aufnimmt.

Uwe Ohse, 2010-05-28

Eine Zusammenfassung der realen Situation:

- 39.68 million Americans on food stamps

- foreclosure filings were reported on 367,056 properties in the month of March

- more than 10 percent of U.S. homeowners with a mortgage had missed at least one payment in the January-March period

- for the first time in modern history, banks own a greater share of residential housing net worth in the United States than all individual Americans put together?

- U.S. Congress planning to quadruple oil taxes, what do you think that is going to do to the price of gasoline in the United States?

- “terrible cuts” are urgently needed in order to avoid a complete financial disaster in his state? [California]

- Dozens of U.S. states are in such bad financial shape that they are getting ready for their biggest budget cuts in decades.

- In March, the U.S. trade deficit widened to its highest level since December 2008.

- the U.S. government is projected to have a 1.6 trillion dollar deficit in 2010

- the U.S. government suffered a wider-than-expected budget deficit of 82.69 billion dollars in April

- the U.S. national debt will reach 100 percent of GDP by the year 2015

- analysts are already projecting that the seafood and tourism industries along the Gulf coast will be devastated for decades

- The FDIC’s list of problem banks recently hit a 17-year high

- The FDIC is backing 8,000 banks that have a total of $13 trillion in assets with a deposit insurance fund that is basically flat broke

- Existing home sales in the United States jumped 7.6 percent in April. That is the good news. The bad news is that this increase only happened because the deadline to take advantage of the temporary home buyer tax credit (government bribe) was looming.

- Both Fannie Mae and Freddie Mac recently told the U.S. government that they are going to need even more bailout money.

- 43 percent of Americans have less than $10,000 saved for retirement. Tens of millions of Americans find themselves just one lawsuit, one really bad traffic accident or one very serious illness away from financial ruin

- The mayor of Detroit says that the real unemployment rate in his city is somewhere around 50 percent.

- Gallup’s measure of underemployment hit 20.0% on March 15th

- One new poll shows that 76 percent of Americans believe that the U.S. economy is still in a recession

- The bottom 40 percent of those living in the United States now collectively own less than 1 percent of the nation’s wealth

- [Nur eine Ableitung]

- Defaults on apartment building mortgages held by U.S. banks climbed to a record 4.6 percent in the first quarter of 2010.

- In March, the price of fresh and dried vegetables in the United States soared 49.3% - the most in 16 years.

- 1.41 million Americans filed for personal bankruptcy in 2009 – a 32 percent increase over 2008.

On June 1, New York is due to send $3.8 billion in aid to local school districts, including $2.1 billion that was supposed to be paid in March but not sent for lack of funds. Yet New York is still $1 billion short. This could affect school operations, the solvency of any business that sells goods or services to the state, the paychecks of state workers, and ultimately home values.

“We applaud these lawmakers for taking the lead to address the housing production credit crisis that is jeopardizing the housing and economic recovery now under way,” said NAHB Chairman Bob Jones, a home builder from Bloomfield Hills, Mich.

Warum nicht ein Schuldenproblem durch noch mehr Schulden lösen?

Wo doch jeder weiß, daß man Alk-Probleme nicht durch Entzug, sondern mehr Alk. löst.

The effort reflects a worrisome new problem in the nation's troubled retirement-savings system: the grim financial condition of such pension plans, known as multi-employer plans. They are common in the hotel, construction, trucking and other industries, and cover about 10 million workers, or almost one in four workers who have a private pension.

[...]

A 2009 study from ratings firm Moody's Investors Service estimated that the country's largest multi-employer plans have long-term deficits of about $165 billion. Some employer groups that are supporting efforts to help the plans question whether that estimate accurately reflects the government's potential exposure, however.

Although the outlook for Mr. Casey's proposal is uncertain, Congress likely will be forced to address the problem soon. The Moody's study estimated that multi-employer plans in the construction industry are only about 60% funded, with long-term liabilities of $158 billion versus assets of $85.5 billion. In the transportation industry, including many Teamsters plans, the overall funded status was 58.6%.

So weit, so gut - das Maximum der Wasserförderung in den USA war 1975, und nichts allzu schlimmes ist passiert.

Is large-scale desalinization inevitable? The authors make the case that it's not, based on the US. Although they caution that water-use figures, which are notoriously fragmented, aren't entirely reliable, they use them to suggest that US water use roughly paralleled GDP growth for most of the 20th century. The two separated around 1970, as water use tailed off, peaking around 1975. After a short period of decline, water use has remained stable even as both GDP and population have continued to climb.

Was dabei aber IMO übersehen wird: Wasser wird nun über weitere Entfernungen, aus reicheren Lagern, geholt, und daß das bisher möglich ist, heißt ja nicht, daß es in Zukunft weiter möglich sein wird.

Wenn alle unterirdischen Seen erschöpft und alle überirdischen vergiftet sind, dann ist halt Schluß.

Wollen Sie den Digest abbestellen?