| Sendedatum | 2010-05-09 21:02:23 |

|---|---|

| Ausgabe | 90 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Inhaltsverzeichnis:

- Anno Domino?

- Slick Operator: The BP I've Known Too Well

- Peak of oil production was actually in 2008.

- Global economy to roll over in six to nine months’ time; bearish for shares

- Junk Bonds Poised for Par as Upgrades Increase: Credit Markets

- Fears for crops as shock figures from America show scale of bee catastrophe

- The effects of 118 years of industrial fishing on UK bottom trawl fisheries

- The incompetence at the level of top European institutions

- Primärdefizite in Europa

- Greece: This Time It’s Different This Time

- Europe's Web of Debt

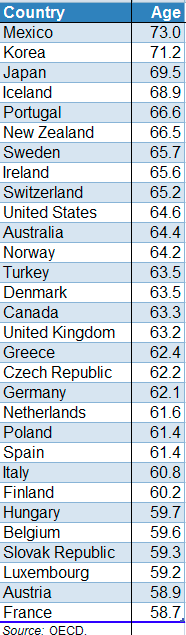

- Retirement Ages Around the World

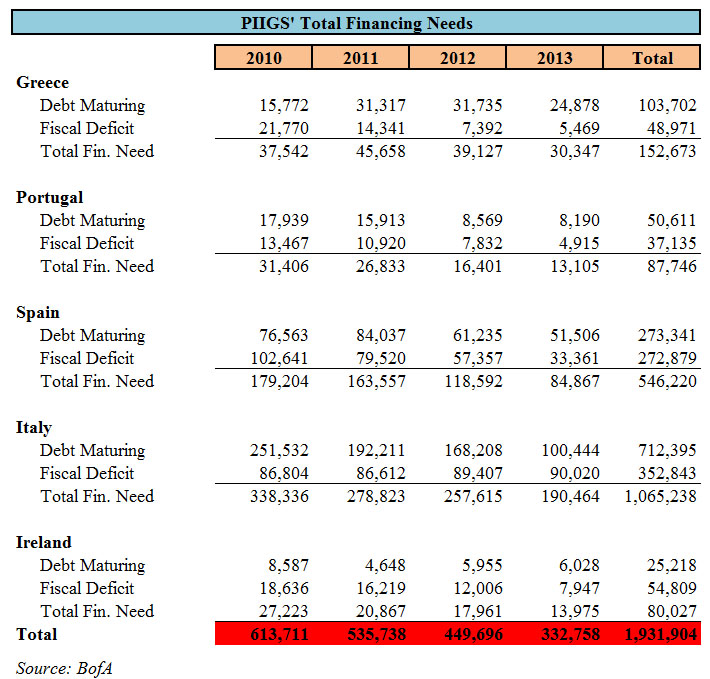

- With $2 Trillion In 3 Year Funding Needs By the PIIGS, The IMF Is Helpless To Do Anything But Sit Back And Watch

- Risky Loans in Foreign Currencies Persist in Eastern Europe

- Äthiopien: White honey grows scarce as bees abandon Ethiopia's parched peaks

- Afghanistan: Violence up nearly 90 percent in last year

- Beijing Cancels Land Auction After Bids Exceed Price Ceiling

- Beijing unveils tough measures to curb housing price rises

- Kanam und SEB schließen offene Immobilienfonds

- Japan Consumer Prices Fall 1.2%, 13th Straight Drop

- Bank of Japan Considers Venture-Capital Route to Spark Economy

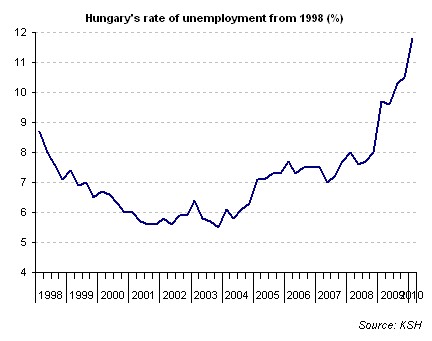

- Hungary's jobless rate rises further to a record high of 11.8% in Q1

- Russia Cuts Main Interest Rates as Easing Cycle Draws to Close

- Spain unemployment rate hits 20%

- How to roll debt, Spanish style

- Sudan: Dollar Scarcity in Juba

- Distressed UK companies owe £55bn, new report warns

- Waukesha, once swimming in water resources, now struggles

- Time, Water Running Out for America's Biggest Aquifer

- Boston: A ‘catastrophic’ rupture hits region’s water system

- Lyondell Wins Reorganization Plan Approval

- Food-stamp tally nears 40 million, sets record

- US to expand Pakistan drone strikes

- US Treasury had to roll over two thirds of a trillion in debt in April

- More Than a Million in U.S. May Lose Jobless Benefits

- Who Knew Bankruptcy Paid So Well?

- USA: Auto sales: Up for the year, down for the month

- USA: Silverdome sale price disappoints

- U.S. Role in Mortgage Market Grows Even Larger

- Freddie Mac Reports First Quarter 2010 Financial Results

- Tainted Nuclear Power Plant Water Reaches Major NJ Aquifer

- Uganda's highest ice cap splits on Mt Margherita

- Doctors sterilise Uzbek women by stealth

- Water crisis threatens Yemen

Inhalt:

Paul Krugman schreit nach noch mehr Staatshilfe:

I really really hope the ECB staff are huddling right now, nerving themselves up to do some serious quantitative easing. Otherwise Anno Domini 2010 is shaping up to be Anno Domino instead.

Ja, Anno Domino könnte das wirklich werden, aber welchen Zweck soll quantitative Erleichterung in der Euro-Zone eigentlich erfüllen?

In Japan hat sie auch zu keine Form von Verbesserung geführt, nur Zeit gekauft. Und das klappt so in der Eurozone nicht - das tiefer liegende Problem ist ja nicht, daß es allen Ländern gleichermaßen schlecht geht, sondern daß sich die finanziellen Verhältnisse explosiv auseinander entwickeln.

Und QE ändert an diesem Umstand überhaupt nichts.

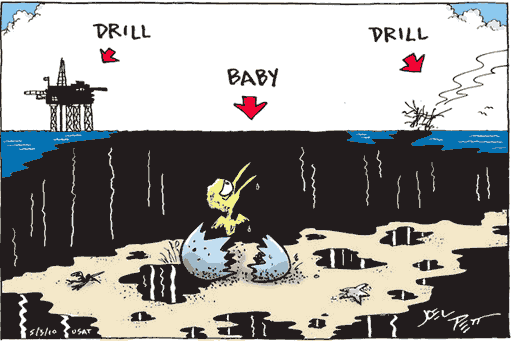

Greg Palast über BP:

[...]

To contain a spill, the main thing you need is a lot of rubber, long skirts of it called a "boom." Quickly surround a spill, leak or burst, then pump it out into skimmers, or disperse it, sink it or burn it. Simple.

But there's one thing about the rubber skirts: you've got to have lots of them at the ready, with crews on standby in helicopters and on containment barges ready to roll. They have to be in place round the clock, all the time, just like a fire department, even when all is operating A-O.K. Because rapid response is the key. In Alaska, that was BP's job, as principal owner of the pipeline consortium Alyeska. It is, as well, BP's job in the Gulf, as principal lessee of the deepwater oil concession.

Laut Palast war BP bei der Exxon Valdez-Katastrophe verpflichtet, für die Notfallmaßnahmen zu sorgen - wie auch bei der derzeitigen Katastrophe.

Before the Exxon Valdez grounding, BP's Alyeska group claimed it had these full-time, oil spill response crews. Alyeska had hired Alaskan natives, trained them to drop from helicopters into the freezing water and set booms in case of emergency. Alyeska also certified in writing that a containment barge with equipment was within five hours sailing of any point in the Prince William Sound. Alyeska also told the state and federal government it had plenty of boom and equipment cached on Bligh Island.

But it was all a lie. On that March night in 1989 when the Exxon Valdez hit Bligh Reef in the Prince William Sound, the BP group had, in fact, not a lick of boom there. And Alyeska had fired the natives who had manned the full-time response teams, replacing them with phantom crews, lists of untrained employees with no idea how to control a spill. And that containment barge at the ready was, in fact, laid up in a drydock in Cordova, locked under ice, 12 hours away.

Aber BP hatte in Alaska die ausgebildeten Notfallmannschaften entlassen, und der Kahn, der für den Transport der Sachen ("booms" - die kann man sich analog der Leinen in Schwimmbecken vorstellen, die Bahnen trennen) da sein sollte, war im Trockendock.

Was das mit heute zu tun hat? Alles:

It's what you didn't do, Mr. Hayward. Where was BP's containment barge and response crew? Why was the containment boom laid so damn late, too late and too little? Why is it that the US Navy is hauling in 12 miles of rubber boom and fielding seven skimmers, instead of BP?

Last year, CEO Hayward boasted that, despite increased oil production in exotic deep waters, he had cut BP's costs by an extra one billion dollars a year. Now we know how he did it.

Die Sache ist nur eine Neuauflage desselben schlechten Spiels von 1989.

Der unregulierte, freie Markt hat der Menschheit so viel Gutes gebracht.

Wohlgemerkt - sogar wenn man extrem optimistische Annahmen über die zukünftige Ölproduktion macht, war Peak Oil in 2008.

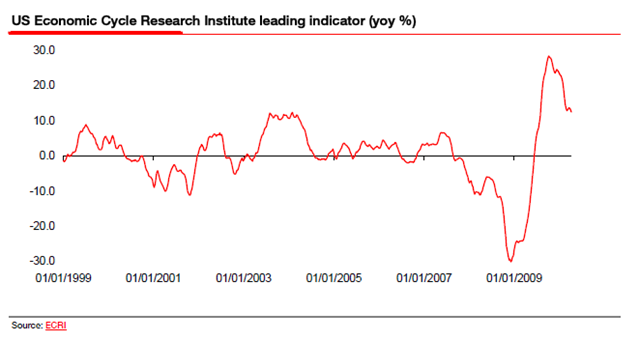

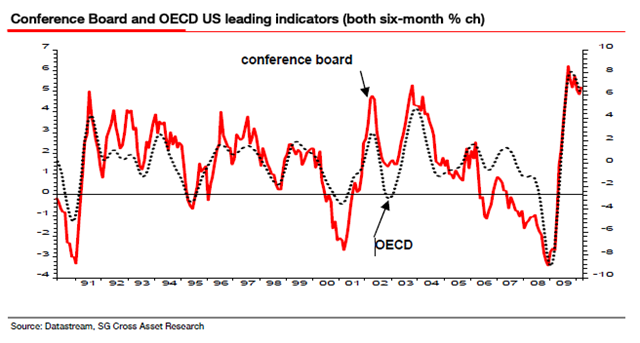

US Economic Cycle Research Institute leading indicator:

Conference Board and OECD US leading indicators:

Wir sind wieder... direkt vor der Krise?

[...]

The number of managed honeybee colonies in the US fell by 33.8% last winter, according to the annual survey by the Apiary Inspectors of America and the US government's Agricultural Research Service (ARS).

The collapse in the global honeybee population is a major threat to crops. It is estimated that a third of everything we eat depends upon honeybee pollination, which means that bees contribute some £26bn to the global economy.

Die £26bn sind natürlich ausgemachter Schwachsinn, schließlich wäre, wenn ein Drittel der Früchte weniger bestäubt würden, der Preis, den man für die verbleibenden Früchte erzielen würde, deutlich höher - und die Summe des Elends auf der Welt auch, um deutlich mehr als lausige 26 Mrd. Pfund.

Aber _ob_, wenn die Bienen die Bestäubung nicht mehr in dem Maße übernehmen würden, in den USA überhaupt weniger bestäubt würde, ist ja schon fragwürdig. Die Honigbiene, die dort fliegt, ist kein Ureinwohner, sondern Abkömmling der guten westlichen Honigbiene, die in Europa, dem nahem Osten und Afrika zu Hause war, bis sie transplantiert wurde.

Kurz gesagt: Vor Einführung der Honigbiene hat Amerika ja auch geblüht.

So viel zur Qualität dieses Artikels.

Aber die Tatsache, daß ein Drittel der von Imkern kontrollierten Bienen in den USA es nicht über den Winter geschafft haben, und daß solche Verluste vier Winter in Folge statt fanden, ist durchaus beunruhigend.

Aber das ist noch nicht mal die ganze Wahrheit, denn:

Pettis agreed that losses in some commercial operations are running at 50% or greater.

schließlich gibt es nicht nur im Winter Verluste.

Und wie sieht es anderswo aus?

[...]

The government's National Bee Unit has always denied the existence of CCD in Britain, despite honeybee losses of 20% during the winter of 2008-09 and close to a third the previous year. It attributes the demise to the varroa mite – which is found in almost every UK hive – and rainy summers that stop bees foraging for food.

Nicht grundsätzlich beruhigender.

http://www.bienenkunde.rlp.de/ [verkürzt] 6c12577120024194e?OpenDocument

http://www.bienenkunde.rlp.de/ [verkürzt] 2c1257715003a4a3a?OpenDocument

Und was wäre normal?

http://www.bienenkunde.rlp.de/ [verkürzt] cc12572ba0023e80a?OpenDocument

[...]

Zuletzt sind im Winter 2002/2003 außergewöhnlich viele Bienen gestorben, zwischen 15 und 20 Prozent.

12% wären also "nicht außergewöhnlich", und 15-20% sind bereits "außergewöhnlich".

Ansonsten wäre ich nicht überrascht, wenn die Ursache für all das einfach eine deutlich gesunkene Widerstandsfähigkeit wäre, die durch eine Kombination von einseitiger Ernährung (Monokulturen), Inzucht, Klimawandel, Stress und Umweltbelastung (die Reihenfolge ist absichtlich alphabetisch) zustande gekommen ist.

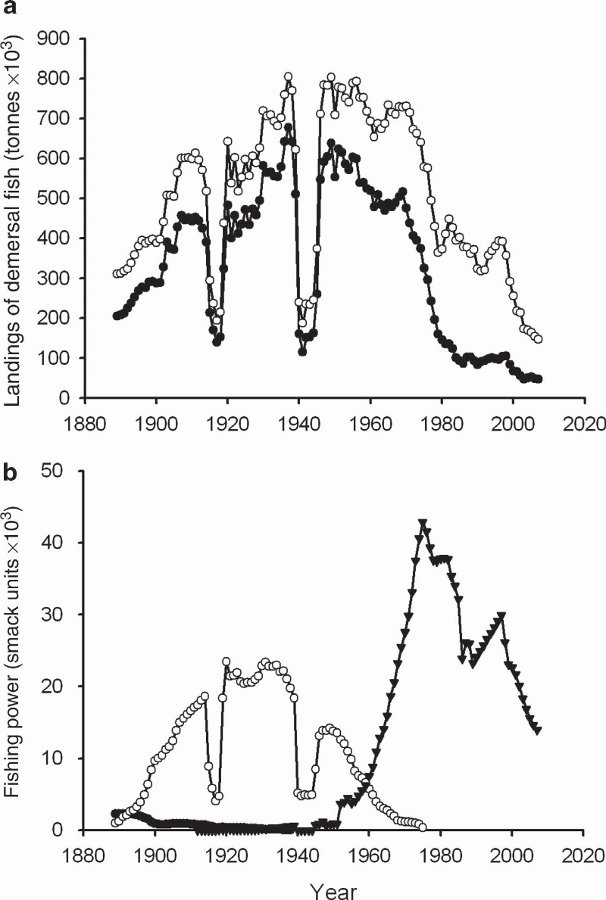

Fishing power mißt die Fähigkeit von Fischern zum Fangen von Fischen, unter Einrechnung technischer Verbesserungen.

. Solche Messungen sind nie ganz korrekt, aber meist doch recht nah an der Realität - jedenfalls sind sie selten ganze Größenordnungen

falsch.

Single species landings per unit of fishing power (LPUP)

by the English and Welsh trawl fleet.

Species Early averaged LPUP Early LPUP Latest averaged LPUP Latest LPUP Percent

(t) (s.d.) timescale (t) (s.d.) timescale decline

Cod 4.27 (0.350) 1889–1893 0.58 (0.074) 2003–2007 86.6

Brill 0.20 (0.010) 1890–1894 0.03 (0.005) 2003–2007 85.7

Plaice 8.18 (0.344) 1889–1893 0.23 (0.024) 2003–2007 97.2

Skates and rays 1.34 (0.092) 1902–1906 0.22 (0.008) 2003–2007 83.4

Turbot 0.21 (0.040) 1903–1907 0.03 (0.003) 2003–2007 84.8

Wolffish 0.19 (0.026) 1903–1907 0.01 (0.002) 2001–2005 95.8

Conger eel 0.20 (0.021) 1902–1906 0.02 (0.003) 2002–2006 89.2

Haddock 20.72 (1.335) 1889–1893 0.19 (0.041) 2003–2007 99.1

Hake 1.63 (0.392) 1891–1895 0.07 (0.014) 2003–2007 95.2

Halibut 1.03 (0.154) 1890–1894 0.00 (0.000) 2002–2006 99.8

Ling 1.17 (0.146) 1889–1893 0.05 (0.009) 2003–2007 95.7

Messmethoden wie diese Fishing Power sind nie ganz korrekt, aber meist doch recht nah an der Realität - jedenfalls sind sie selten ganze Größenordnungen falsch. Zur Abschätzung, ob das einen Größenordnung daneben liegt, kann man die Fangmengen betrachten:

from 1889 to 2007. (a) Total landings of bottom-living fish species into

England and Wales (closed circles) and the United Kingdom (open circles)

by British vessels from 1889 to 2007. (b) Estimated total fishing power of

large British trawlers registered to England and Wales from 1889 to 2007.

Closed circles indicate sail trawlers, open circles indicate steam trawlers

and closed triangles indicate motor trawlers.

Obere Graphik: Fangmengen: Helle Kreise = UK insgesamt, dunkle England+Wales.

Untere Graphik: Fishing Power: Dunkle Kreise (ungezackte dunkle Linie bis etwa 1910/1920) Segelschiffe, Helle Dampfschiffe, Dreiecke Motorschiffe.

You simply cannot do a low-cost or small unilateral restructuring of government debt in this kind of situation; the market will at once take that as a signal that Portugal, Spain, Italy and perhaps even Ireland will face difficulties (in fact, this is exactly what spreads in the 2-year European government bond market are saying today). The French may smile upon such outcomes with a feeling of superiority, but they might also consider not throwing bricks in glass houses.

[...]

The Europeans will do nothing this week or for the foreseeable future. They have not planned for these events, they never gamed this scenario, and their decision-making structures are incapable of updating quickly enough. The incompetence at the level of top European institutions is profound and complete; do not let anyone fool you otherwise.

[...]

The Europeans will not lift a constructive finger. The leading emerging markets are too busy battening down the hatches (and accumulating ever more massive chests of reserves). And the White House still seems determined to sleep through this crisis. Expect nothing.

Er ruft nach einer Lösung auf G20-Ebene, erwartet sie aber nicht in nächster Zeit:

Es ist auch meine Befürchtung, daß wir keine bessere Handhabung der Krise bekommen werden, bis die Situation noch weiter eskaliert.

Von Eurostat extrahierte, sortierte Liste der Primärdefizite der europäischen Staaten in 2009:

-12.2 Irland Eurozonme

-9.5 UK EU

-9.4 Spanien Eurozone

-8.5 Griechenland Eurozone

-7.9 Litauen Euro-Kandidat (WKM II)

-7.4 Lettland Euro-Kandidat (WKM II)

-6.8 Rumänien Euro-Kandidat

-6.6 Portugal Eurozone

-5.3 Slowakei Eurozone

-5.2 Frankreich Eurozone

-4.6 Tschechei Euro-Kandidat

-4.5 Polen Euro-Kandidat

-4.1 Slowenien Eurozone

-3.6 Zypern Eurozone

-3.1 Bulgarien Euro-Kandidat (fester Wechselkurs)

-3.0 Niederlande Eurozone

-2.3 Belgien Eurozone

-2.3 Island

-1.4 Estland Euro-Kandidat (WKM II)

-1.0 Finnland Eurozone

-0.7 Dänemark EU (WKM II)

-0.7 Deutschland Eurozone

-0.7 Österreich Eurozone

-0.6 Italien Eurozone

-0.6 Malta Eurozone

-0.2 Luxemburg Eurozone

0.4 Schweden EU

0.7 Ungarn Euro-Kandidat

11.1 Norwegen

Positiv festzuhalten ist,daß es tatsächlich solide wirtschaftende Staaten in Europa gibt.

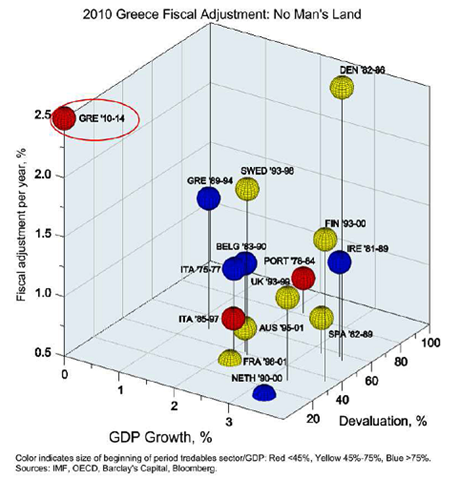

Die Graphik vergleicht die Ausgangsbasis der derzeitigen griechischen Finanzkrise mit den Ausgangsbasen vergangener europäischer Staatsfinanzkrisen.

Je eine Achse für durchgeführte Abwertung, Wirtschaftswachstum und Sparen.

Griechenland betritt Neuland.

Diese wunderschöne Graphik zeigt, wie die Schulden der PIIGS untereinander und nach Deutschland, Frankreich und Großbritannien verteilt sind.

UK F D Total

Portugal 24 45 47 286 Alle Zahlen in Milliarden Dollar

Irland 188 60 184 867

Italien 77 511 190 1400

Griechenland 15 75 45 236

Spanien 114 220 238 1100

Portugal hat danach $24 Mrd. Schulden bei britischen Banken.

Wenn man das mal so rechnet, können wir uns schon darauf freuen, daß D-Land dann Portugal mit 23 Mrd, Irland mit 90, Italien mit 90 und Spanien mit 110 Mrd. helfen wird. Naja, sind ja nur so 300 Mrd.

Oder vielmehr den eigenen da engagierten Banken, in einem weiteren Akt der Sozialisierung der Verluste.

Aus OECD-Daten.

Griechenland: 62.4

Deutschland: 62.1

Uwe Ohse, 2010-05-01

Below is a table summarizing the funding needs of just the PIIGS.

1900 Mrd.

250 Milliarden.

Da sollte man wohl hoffen, daß das Vertrauen in die Fähigkeit der PIIGS, ihre Schulden zu bedienen, zurückkehrt.

[...]

In Hungary, foreign-currency loans slipped to 63 percent of all loans at the end of 2009, from 68 percent in the first quarter of the year. But they still dominate.

Most of the decline was in loans denominated in more exotic currencies like the yen, which have all but disappeared from the market. Euro-based loans actually rose in the fourth quarter, according to data from the Hungarian central bank.

Die Bomben in den Büchern von Unicredit und Raiffeisen bleiben spannend.

Abera is paid £65 a month to mind 270 hives for the Asira Metira monastery, one of a dozen religious centres in an area whose 4th-century rock churches are among the wonders of the world. "We know about bees,'' said honey seller Sheikh Mohamed Ahamedin. He grips a large screwdriver with both hands to ladle a dollop of thick and lumpy white honey out of a plastic bucket. It is snow-white and tastes sweet and more waxy than yellow honey.

"The price is the highest it has ever been this year, because of scarcity,'' said Ahamedin who sells white honey for £7.75 per kilo. Last year he charged £4.50.

Kein Regen, keine Blüten in den Hochlagen, kein weißer Honig.

btw: £7.75 pro KG ist mehr als man in D-Land für Honig zahlt.

Despite that increase and a 240 percent spike in roadside bomb attacks - a major factor in overall violence statistics - and increasing Taliban tactics to discredit President Hamid Karzai's government with shadow governments, some officials said they are seeing encouraging trends.

The highest price bid for the Beijing lot, zoned for residential development, at the April 26 auction was 4,718 yuan ($691) per square meter, exceeding the 4,700 yuan per square meter limit set by the government, the Ministry of Land and Resources said on its Web site today. The ministry's Beijing branch said it began setting limits on the price of land this month on a trial basis.

Eine Baulandauktion in Peking wurde abgebrochen, weil die Gebote zu hoch waren.

As of Friday, "one family can only buy one new apartment in the city for the time being," the municipal government said in a statement.

The government also ordered the implementation of central government policies that ban mortgages for purchases of a third or third-plus home.

Bald werden wir sehen, ob China eine Immobilienblase hat oder nicht.

Ein Run auf den Fond.

Prices excluding fresh food slid 1.2 percent from a year earlier, after dropping 1.2 percent in February, the statistics bureau said today in Tokyo. The result matched the median estimate of 28 economists surveyed by Bloomberg News.

[...]

A separate report showed the unemployment rate climbed to 5 percent in March from 4.9 percent. The ratio of jobs to applicants climbed to 0.49, meaning there are 49 jobs for every 100 candidates, the Labor Ministry said.

Deflation, wie gehabt.

“We have to be prepared for just a little bit of inflation six, seven months from now,” Niinami said on Bloomberg Television on April 28.

Soso. Der überlegt also, in 6 Monaten die Preise anzuheben.

Bank of Japan Governor Masaaki Shirakawa yesterday said he wants to bolster economic growth by helping private companies nurture technological innovation in such industries as energy and the environment. A reference for the initiative is a 1998- era program that funneled credit to banks making new loans, he said at a press briefing in Tokyo.

Ist das nun Verzweiflung oder nicht?

Nein, es ist primär ein politisches Spielchen - genau der Spielplatz, an dem Zentralbanker eigentlich nichts zu suchen haben.

The three-month moving average seldom jumps as dramatically from one month to another as it did in Dec09-Feb10 (to 11.4% from 10.8%), but the 0.4ppt rise is almost as bad. Interestingly enough, an even sharper increase (0.6ppt) was observed in the very same period a year ago, as well.

Dies ist nicht gut.

Bank Rossii reduced the refinancing rate a quarter point to 8 percent, effective April 30, it said on its Web site today. It also cut the repurchase rate charged on one- and seven-day central bank loans by the same amount to 7 percent. The decision was expected by 20 of 27 economists in a Bloomberg survey. The bank also cut the overnight deposit rate to 2.5 percent from 2.75 percent. It last cut rates a quarter-point on March 26.

There were 4,612,700 people unemployed in the country at the end of March, the national statistics agency INE said.

http://www.google.com/hostednews/afp/article/ALeqM5h_A-mApL2tL_Sqet4WIS05-hd5pA

The data from the labour ministry shows the total number of those out of work stood at 4,142,000 at the end of last month, the leading daily El Pais reported.

According to the Cadena Ser radio station, the government decided to leak the figure, due to be officially released on Tuesday, to silence criticism sparked by the release on Friday of quarterly figures showing the number out of work had topped 20 percent, the highest rate since 1997.

The quarterly figure from the national statistics institute INE, which uses a different calculator method from the labour ministry, said the average number of unemployed in the first three months of the year jumped by 280,200 to 4.61 million.

Das Arbeitsministerium errechnet 4.1 Mio. Arbeitslose für Ende April, das nationale Statistikinstitut 4.6 Mio. für Ende März. Eine Differenz von 24000.

Irgendwo ist wohl ein Taschenrechner kaputt

In this way, managed to avoid a similar failure to that of Greece in late March, which gave rise to the top of the current resurgence of the debt crisis of the peripheral countries.

The allegation here is that the Spanish government was forced to lean on domestic institutions to pick up sovereign bonds, in case foreign investors didn’t show up.

Nunja, auch das ist ein weg zu vermeiden, daß man die Anleihen nicht los wird - man

Residents of Juba are complaining that Forex Exchange Bureaus do not sell to Dollars them, claiming it’s scarce.

[...]

Edwin said despite the Sudanese pound being the official currency in Sudan, the dollar is used more often by Sudanese than the Sudanese pounds. The Sudanese pound was launched as the official currency in Sudan three years ago.

Dollarknappheit im Sudan - scheinbar hat da keiner mitbekommen, daß die große Inflation vor der Türe steht?

(ich bin übrigens immer noch im Lager der Deflationisten).

In its latest Red Flag update, which highlights troubled businesses, the professional services group found a 14pc jump in the number of distressed companies. There were 161,601 red flagged companies in the first quarter of this year compared with the final quarter of 2009.

Die Zahl der britischen Firmen mit signifikaten oder kritischen Finanzproblemen hat im letzten Quartal um 14% zugelegt. Diese Firmen haben 55 Mio. Pfund Schulden.

Das ist sicher alles kein Problem, denn schließlich kann .uk das Pfund abwerten und die Schulden damit entwerten und gleichzeitig den Export ankurbeln, oder?

Oops - ausgerechnet die Wachstumssektoren in der Liste werden vom dann vielleicht folgendem Exportboom nicht profitieren...

Waukesha genoß über ein Jahrhundert lang den Luxus, ein großes Wasserbasin unter der Stadt zu haben. Das versiegt nicht nur, sondern ist aus mit Radium verseucht.

Die Geschichte in kurzen Abschnitten:

- In the late 1800s, mineral water bubbled to the surface from about 60 natural springs in Waukesha, said John Schoenknecht, a former teacher and author of the book, "The Great Waukesha Springs Era: 1868-1918."

- [soon after World War I]

As more industries located in the city and dug their own wells, shallow water that previously flowed to some springs would have been intercepted, eventually halting spring flows, Bradbury said. - The city needed larger volumes of water and dug ever deeper wells into a deep sandstone aquifer. Records show the utility completed a 1,835-foot-deep well in 1927, said Dan Duchniak, general manager of the utility.

- Other deep wells followed. Three remain in use today: one was drilled in 1930 to a depth of 1,995 feet, a 1968 well was drilled to a depth of 2,024 feet and a third was drilled to a depth of 2,145 feet in 1980.

Today, the city gets 87% of its water supply from the three deep wells. - When Nelson became mayor in 2006, the city faced a December 2009 deadline for complying with federal drinking water standards for radium. His administration negotiated an extension to 2018 that became the basis of a state court order, but the city was required to meet interim restrictions on radium levels before then.

- Even then, the city would be facing a dwindling supply. Water levels in wells tapping the deep sandstone have dropped 500 feet between the years 1900 and 2000, and continue to drop from 5 to 9 feet a year, as municipalities draw water from it.

- This month, the Waukesha Common Council agreed to ask Illinois, Wisconsin and the other six Great Lakes states for permission to pipe Lake Michigan water to the city to replace Waukesha's radium-contaminated water.

Das ist eine Geschichte aus den Trockengebieten der USA? Nicht wirklich - das spielt sich in der Gegend der großen Seen ab.

I do not hesitate in giving the opinion that it is almost wholly unfit for cultivation, and of course, uninhabitable by a people depending upon agriculture for their subsistence.

er schrieb über die Präriegebiete der USA - heute eine der Kornkammern der Welt.

That groundwater for irrigation comes from the Ogallala Aquifer, a massive underground lake that stretches from southern South Dakota through northern Texas, covering about 174,000 square miles. It is being drained at alarming rates, and some places have already seen what happens when local levels drop below the point where water can no longer be pumped.

"You go to areas where the aquifer has been depleted, [they] look pretty poor now," David Brauer, program manager for the U.S. Department of Agriculture's Agricultural Research Service Ogallala Aquifer Program, told AOL News. "And it only takes a few years.

"The magnitude of this is incredible," he continued. "We're talking about, for the last 20 years, 20 percent of the irrigated acreage of this nation is over the Ogallala."

20% der Agrarflächen der USA liegen über dem Ogallala-Untergrundsee, und der Wasserspiegel da fällt deutlich - so deutlich, daß an einigen Stellen bereits kein Wasser mehr gepumpt werden kann.

http://www.newwest.net/topic/article/new_west_new_dust_bowl/C35/L35/

In fact, they have determined that in many spots industry will run out of useable water (i.e., 30ft of water or less) not by the end of the century, as predicted, but by 2030 – only twenty years from now.

2030 dürfte die Weltbevölkerung noch etwas gewachsen sein - ich hoffe, jemand denkt daran, Menschen mit geringerem Nahrungsbedarf zu züchten.

Eine gebrochene Wasserpipeline => 2 Millionen Menschen ohne Wasser in Trinkwasserqualität.

Ahem, wo in aller Welt ist da die Redundanz?

Ah, das Backupsystem ist 3 bis 4 Jahre in der Zukunft.

Nun, da konnte es wenigstens nicht kaputt gehen

LyondellBasell (LyondellBasell ist pleite) ist nun nicht mehr insolvent.

Die Firma hatte 24 Mrd. Schulden, weil sich die Besitzer mit einem zu 100% schuldenfinanziertem Merger verhoben hatten.

U.S. Bankruptcy Judge Robert Gerber approved the Chapter 11 plan yesterday in Manhattan, at a hearing in which he also approved a settlement that resolves U.S. government claims for more than $5.5 billion in environmental damage. Lyondell plans to exit court protection by April 30, lawyer George Davis told Gerber. The company’s consolidated debt of $7.2 billion compares with $24 billion before it filed for bankruptcy, Davis said.

So rund 17 Mrd. Schulden sind nun verschwunden. Und 5.5 Mrd. Umweltschäden ebenso.

The settlement puts $108.4 million into a trust to pay for cleanup costs at various sites. Another $61.6 million will go to U.S. and California government agencies. The U.S. Environmental Protection Agency also will get a $1.18 billion unsecured claim in Lyondell’s bankruptcy.

Anderswo heißt es dazu:

The chemical company also will shed most environmental liabilities, many of which it settled in a $250 million agreement with the U.S. government and state governments. Judge Gerber of Manhattan Federal bankruptcy court earlier on Friday approved that settlement.

Nicht nur, daß die Gläubiger an dem Merger üble Verluste gemacht haben: Auch darf der amerikanische Staat für über 5 Mrd. Dollar Umweltschäden aufkommen.

Der amerikanische Staat? Und wieviel Umweltzerstörung wartet noch in anderen Ländern?

[...]

Enrollment has set a record each month since reaching 31.78 million in December 2008. USDA estimates enrollment will average 40.5 million people this fiscal year, which ends Sept 30, at a cost of up to $59 billion. For fiscal 2011, average enrollment is forecast for 43.3 million people.

Wie gut der Aufschwung auf dem US-Arbeitsmarkt wirklich ist, wird man an der Entwicklung dieser Zahl sehen können.

[...]

The US announced on Wednesday that targets will now include low-level combatants, even if their identities are not known.

Change you can believe in?

Oder gibt's wieder neue Schafsherden? Oder beginnt die Hochzeitssaison?

In April, the Treasury issued a net of $176 billion in total debt (includes Trust Funds and marketable debt), to end the month at $12,892,729,000,000. The final Bill redemption balance in April was a paltry $596 billion, or $675 including Bonds. Let us repeat: in April the US Treasury had to roll over two thirds of a trillion in debt. Assuming the treasury is correct, the Treasury balance will be $13.23 trillion on June 30, and $13.6 trillion on September 30.

Keine Wunder, daß Griechenland die Schlagzeilen beherrscht - 110 Mrd. EUR für 3 Jahre sind doch viel, viel kritischer als 675 Mrd. Dollar Refinanzierungsbedarf pro Monat, oder 176 Mrd. Dollar Neuverschuldung pro Monat, nicht wahr?

http://www.zerohedge.com/artic [verkürzt] lion-bills-first-four-days-may

144 Mrd. Refi in den ersten 4 Arbeitstagen im Mai, was ist das schon?

They are quietly drawing the line at 99 weeks of aid, a mark that hundreds of thousands of Americans have already reached. In coming months, the number of those who will receive their final government check is projected to top 1 million.

Those numbers will grow, according to Goldman Sachs Group Inc., which projects that more than 400,000 may soon begin losing benefits every month.

Laut Goldman Sachs können in den USA mehr als 400000 Langzeitarbeitslose pro Monat ihre Arbeitslosenhilfe verlieren.

Ich würde jetzt gerne eine Statistik sehen, wie sich die Zahl der Langzeitarbeitslosen in den 30er Jahren des letzten Jahrhunderts entwickelt hat...

With first- and second-year associates charging more than $500 an hour in some of these bankruptcy cases, according to court records, that can amount to some pretty expensive downtime. At several firms, including Weil and Milbank, Tweed, Hadley & McCloy, partners now charge $1,000 an hour or more for their bankruptcy services.

$500 die Stunde - für Berufsanfänger nicht schlecht. So dreist muß man erst mal sein.

In court documents, the firm responded that it could be tough to find hotel rooms in New York City for $400 or less and that dry-cleaning or laundry bills were appropriate for out-of-town lawyers required to stay in New York for 9 or 10 days.

Ich habe ganz im Gegenteil gerade Schwierigkeiten gehabt, auf die Schnelle ein Hotel in NY zu finden, was mehr als $400 pro Nacht will...

[...]

Mr. Marsal is unapologetic about the fees that he and his staff are earning. Those fees pay for the salaries of the 150 people from Alvarez & Marsal now working inside Lehman (down from a peak of 185), including Mr. Marsal himself.

13 Mio. pro Monat für 150 Leute -> $86000 pro Monat und Person. Nicht schlecht.

Mich dünkt, da ist ein leichter Hang zur Verschwendung zu bemerken.

(Achtung: der Zeitstrahl läuft rückwärts)

Industrywide U.S. sales came in just short of 1 million vehicles, up 20% from a year ago, according to sales tracker Autodata, but a bit shy of forecasts of between a 21% to 23% gain. And sales were down 8% from March.

-8% gegenüber März 2010, +20% gegenüber April 2009.

Ob da irgendein Stimulus ausgelaufen ist, oder verschlimmert sich die Situation gerade?

The price: $583,000.

[...]

The 80,300-seat stadium opened in 1975 and has largely remained empty since the Detroit Lions left for Ford Field in 2002. The sale included 127 adjacent acres.

Daß leer stehende Stadien in den USA billig zu haben sind, hatte ich mir gedacht, aber 7.5 Dollar pro Platz ist doch ungewöhnlich günstig.

96.5% der amerikanischen Hypotheken werden durch VEB Freddie Mac und VEB Fannie Mae vergeben.

Wo war noch das Mutterland der freien Marktwirtschaft?

- Net loss of $6.7 billion;

- Improvement of $4.8 billion to accumulated other comprehensive income (loss) (AOCI); and

- Dividend payment of $1.3 billion to Treasury.

Besonders schön ist natürlich die Formulierung "Improvement to ... (loss)". Den Steuerzahler erfreuen Verbesserungen ja bestimmt, nicht wahr?

Oder auch nicht. $10.6 Mrd. in einem Quartal mal 3 Jahre macht $127 Mrd, oder fast einen Griechenland-Bailout

[...]

The department launched a new investigation Friday into the April 2009 spill and said the actions of plant owner Exelon Corp. have not been sufficient to contain water contaminated with tritium.

[...]

But the mere fact that the radioactive water — at concentrations 50 times higher than those allowed by law — has reached southern New Jersey’s main source of drinking water calls for urgent action, Martin said.

Was ist schon ein Jahr verlorener Zeit? Und wen juckt es schon, wenn Grenzwerte locker überschritten werden?

The glacier is located at an altitude of 5,109m (16,763ft) in the Rwenzori mountain range, near the border with the Democratic Republic of Congo.

[...]

Scientists say glaciers in the Rwenzori range could disappear within 20 years.

[...]

According to researchers, the ice cap covered 6 sq km (2 sq miles) 50 years ago. It is now less than 1 sq km.

The procedure had been performed immediately after she gave birth, by doctors who did not ask her consent. On learning she could not bear children, her husband left her.

Baby stirbt -> Monate später erfährt die Frau, daß sie nach der Geburt sterilisiert worden ist.

Activists say mass sterilisation began in 2003, but was eased after two years following an outcry. It is said to have restarted in February this year, when the health ministry ordered doctors to recommend sterilisation as an “effective contraceptive”. Critics claim every doctor was told to persuade “at least two women” a month to have the procedure. Doctors who failed faced reprisals and fines.

“We estimate that since February, about 5,000 women have been sterilised without consent,” said a local human rights campaigner who fears detention if she is named.

In many cases, doctors opt for delivery by caesarean section and then perform a sterilisation without telling the woman. Widespread rumours of the practice have resulted in women opting for home births to avoid the risk.

Menschenrechte, wie sie von einer Diktatur halt verstanden werden. Siehe auch China tries to sterilise 10,000 parents over one-child rule.

http://www.bmz.de/de/laender/partnerlaender/usbekistan/zusammenarbeit.html

Ich würde das für nicht ganz gelungen halten.

[...]

In the recent few years, people have started suffering water scarcity in several governorates which are threatened also by drought. Several areas in governorates of Lahj, Amran, Taiz, Beidha'a and Hajjah are witnessing the sharpest water crisis which has severely affected their life and even forced some leave their houses after drought has started in their areas.

But when one goes back with his mind to the roots of the problem in these governorates, he finds that these areas are also famous of growing qat trees and at the same time are still expanding the cultivation of the plant which according to experts consumes 60 percent of Yemen's water.

60% des Süßwasserverbrauchs im Yemen ist für den Anbau von Rauschmitteln. WOW.

Und wo kommt das Wasser her? Aus dem Sana'a Basin, einem fossilem Wasservorrat (was auch bedeutet: füllt sich _sehr_ langsam wieder auf - im Zeitraum von Jahrtausenden).

Sana'a basin is threatened by random digging for wells for irrigating qat trees. According to Dr. Gerhard Lichtenthaeler, the Manager of Integrated Water Resources Management in GTZ Yemen, there are 13,500 wells in Sana'a basin. Most of these wells are private drilled by people for irrigation which consumes approximately 80-90 percent of water; of course qat cultivation takes the lion's share.

Water and Sanitation Local Authority has 125 wells in Sana'a basin, one third of them are deepened to 1000 meter to supply people of water. Even though, some people in new constructed areas around the city's center do not get access to the public water project and depend on water trucks for supplying with water.

[...]

Minister of Water and Environment Abdul-Rahman al-Iyani said Sana'a basin is in a very critical stage now as people now digging deeper and deeper to get water. He said in the past, people used to dig 100 meters to get water but now they dig deeper to 1000 meters and some times do not get water.

Übrigens versiegt im Jemen nicht nur das Süßwasser, was man durch Entsalzungsanlagen ersetzen könnte, sondern auch die Haupteinnahme- und Energiequelle - das Öl.

Quelle unbekannt, leider.

Wollen Sie den Digest abbestellen?