| Sendedatum | 2010-04-29 09:49:14 |

|---|---|

| Ausgabe | 89 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Inhaltsverzeichnis:

- Acidic oceans worsening, experts warn

- "Plastic Soup" Found in Atlantic Ocean

- Challenges in Reducing Pollution From Ships

- Smog in a Rural Valley? Mystery Is Solved

- Chernobyl Radiation Killed Nearly One Million People: New Book

- The economics of modern-day piracy

- Inflation oder Deflation

- Immobilienfonds

- Iberische Banken trocknen aus

- Maastricht madhouse fuels EMU-wide contagion from Greece

- We Cannot Allow Greece to Turn into a Second Lehman Brothers

- German Soldiers in Afghanistan Wear Protest on Their Sleeve

- Arbeitslose müssen auf Griechen warten

- Failed Bund Auction Having Spillover Effects On Europe

- Desertification affects half of Bolivia

- German Inflation Unexpectedly Slowed in April on Early Easter

- Ninety-Four Percent of Kandaharis Want Peace Talks, Not War

- Canada's brewing debt storm

- Canada home resales rise in March, new listings up

- Chile’s March Industrial Output Falls 17.4% on Quake

- China oil demand up on double-digit growth

- China tries to sterilise 10,000 parents over one-child rule

- Chinas größte Geldhäuser brauchen 70 Mrd. Dollar

- In China, real estate fever is rising

- Property trading down following new policies

- China May Announce 4 Trillion Yuan Stimulus, China Business Says

- Colombia faces gas shortages on El Nino

- Czech Eurobond Delayed as Greek Crisis Raises Yields

- Lettland: General government deficit in 2009 reached 1,188.7 mln lats or 9.0% of GDP

- Living with Latvia's burst bubble

- Mexico Left to Play Catch-Up as Oil Majors Drill Deep in Gulf

- Pakistan: Inequity in power outages

- Pakistan: Ethanol and bio-diesel could help in achieving import substitution

- Karachi upset: Power share cut stuns city

- Pakistan: Ladenschluß um 8

- Russia Pays Ukraine $40 Billion to Halt ‘Gas War’

- Russia teaches EU a lesson in its Ukraine gas-for-naval base deal

- Saudis see demand peak looming

- Saudi Arabia global oil exports to wane post-2010

- Spanish unemployment

- UK energy production down 6% in 2009

- Uruguay, World Bank Working on $700 Million Financing Package

- Report: U.S. electricity demand drops

- Generation Y: The Broke Generation

- Hundreds Camp Out For Job Opps In Queens

- USA: Water emergency in the West

- Do you notice the end of ZIRP?

- AIG May Be on the Hook in Lawsuits Against Goldman Sachs Board

- GM Pays Back TARP Loans With...TARP Loans!

- Gamble Sours for Many Kentucky Horse Breeders

- Barretts January mixed sale

- Southern California office market continues to weaken

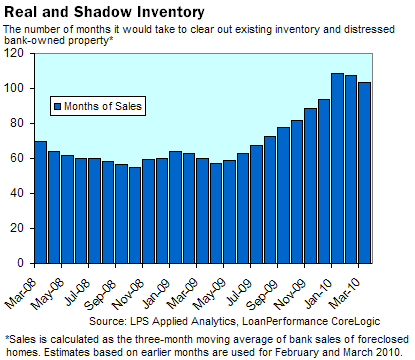

- Number of the Week: 103 Months to Clear Housing Inventory

- AAA -> junk

- US military warns oil output may dip causing massive shortages by 2015

- Lawmakers: Military could quell Chicago violence

- Your Tax Dollars at War: More Than 53% of Your Tax Payment Goes to the Military

- National Guard recruiters forged re-enlistment papers: report

- Venezuela: China lines up 100,000 bbl/day using hard-earned U.S. Dollars

- Food aid shortfall threatens Yemen

Inhalt:

Manmade emissions of carbon dioxide are making our oceans more acidic — and thus threatening corals and shellfish — at a rate unseen in at least 800,000 years, a blue-ribbon panel of scientists reported Thursday.

[...]

"The average pH of ocean surface waters has decreased by about 0.1 unit — from about 8.2 to 8.1 — since the beginning of the industrial revolution," the scientists said in noting earlier research. Moreover, models project "an additional 0.2-0.3 drop by the end of the century, even under optimistic scenarios," they added.

"It is important to note that the concentration of atmospheric CO2 is rising too rapidly for natural ... processes to maintain the pH of the ocean," the experts stated. "As a consequence, the average pH of the ocean will continue to decrease as the surface ocean absorbs more atmospheric CO2."

Soweit nichts Unerwartetes oder Neues, aber neu ist die Untersuchung über die Auswirkung auf Austern:

Even with small changes in acidity, seawater becomes corrosive to the shells of marine organisms. "Similar to what happens in carbonated soda, increasing carbon dioxide in seawater makes it more acidic," he said in a statement summarizing his research,

His testing used lab seawater with present-day CO2 ocean concentrations, as well as lab seawater that used higher CO2 levels that scientists say could occur by 2100.

In the higher CO2 environment, the larval shells at day 9 of their growth were 16 percent smaller than those reared in the present-day seawater conditions.

A week later, the difference was 41 percent and the smaller oysters never caught up.

"One and a half months after being transferred back to normal seawater, juveniles that had come from the high carbon dioxide environment were still 28 percent smaller than oysters reared for the entire experiment in control conditions," Gaylord said.

Austern in saurerem Seewasser wuchsen in den ersten 16 Tagen 41% weniger als die in der Kontrollgruppe, und holten das auch nicht auf, als sie in normales Meerwasser gesetzt wurden.

The floating garbage - hard to spot from the surface and spun together by a vortex of currents - was documented by two groups of scientists who trawled the sea between scenic Bermuda and Portugal's mid-Atlantic Azores islands.

The studies describe a soup of micro-particles similar to the so-called Great Pacific Garbage Patch, a phenomenon discovered a decade ago between Hawaii and California that researchers say is likely to exist in other places around the globe.

"We found the great Atlantic garbage patch," said Anna Cummins, who collected plastic samples on a sailing voyage in February.

Der Pazifik (siehe Floating rubbish dump 'bigger than US') hat nicht mehr alleine die zweifelhafte Ehre, eine Plastikmüllhalde zu sein.

But with shipping volumes up about 50 percent in the past 20 years, and now accounting for about 90 percent of global trade, that is a lot of CO2 emissions: 3 percent of the global total, comparable to the level of a major national economy, according to the International Chamber of Shipping.

Perhaps even more worrying, though, is the other nasty stuff contained in bunker fuel, like nitrogen, sulfur and particulate matter — tiny particles that can penetrate deep into the lung when inhaled. Academic studies have estimated that 15 percent of global nitrogen oxides and between 5 and 8 percent of global sulfur oxide emissions are attributable to oceangoing ships. Health experts have long linked such pollution to respiratory illnesses, cardiopulmonary disorders and lung cancers, particularly among people who live near heavy ship traffic.

Ok, es ist dreckig, aber wenigstens ist es billig!!!

Some have speculated that animal waste or pesticides are the cause: both emit ozone, a primary ingredient in smog. But a recent study published in the journal Environmental Science and Technology suggests that the primary culprit is actually cattle feed.

Researchers found that animal feed is the largest emitter of ozone in the valley, at 25 tons per day, followed by motor vehicles at 14 tons.

Smog durch Tierhaltung - faszinierend.

[...]

Their findings are in contrast to estimates by the World Health Organization and the International Atomic Energy Agency that initially said only 31 people had died among the "liquidators," those approximately 830,000 people who were in charge of extinguishing the fire at the Chernobyl reactor and deactivation and cleanup of the site.

The book finds that by 2005, between 112,000 and 125,000 liquidators had died.

[...]

Drawing upon extensive data, the authors estimate the number of deaths worldwide due to Chernobyl fallout from 1986 through 2004 was 985,000, a number that has since increased.

By contrast, WHO and the IAEA estimated 9,000 deaths and some 200,000 people sickened in 2005.

But no matter how many destroyers, frigates and accompanying helicopters are deployed, an estimated 1,500 pirates in hundreds of smaller craft are sailing circles around them.

Instead of decreasing, as expected, pirate attacks appear to be enjoying an unprecedented bonanza.

Today, as many as 200 commercial ships are being attacked each year, with up to 50 being hijacked along with all their crews.

Most shipping owners quickly pay up the demanded ransoms, which have earned pirates an estimated $150 million a year, according to international shipping authorities.

The admiral is right about the sheer vastness of the area now threatened. By using larger mother ships, the pirate carry their fast attack boats well beyond East African shores.

Recently there have been sea-hijackings close to India and as far south as Mozambique.

This month, a South Korean super-tanker, with $200 million worth of crude oil, was seized by pirates over 600 nautical miles off the coast of Africa.

600 nautical miles = 1000 KM.

So far this year alone, Somali pirates have held 20 captured vessels and 242 crew, while the price of freeing them was negotiated.

The pirates themselves face relatively low risk if caught. As few countries want to try them and house them in their jails, they are generally released at sea. Little wonder there's no shortage of those willing to sign on.

Frustrated by the inability to destroy piracy, the U.S. is now calling on allies to go after the profits from the crime.

It believes there are seven large syndicates operating in Somalia, Kenya, Dubai and Lebanon, which organize these pirates. These syndicates have been buying up prime real estate in regional cities from Nairobi to Addis Ababa.

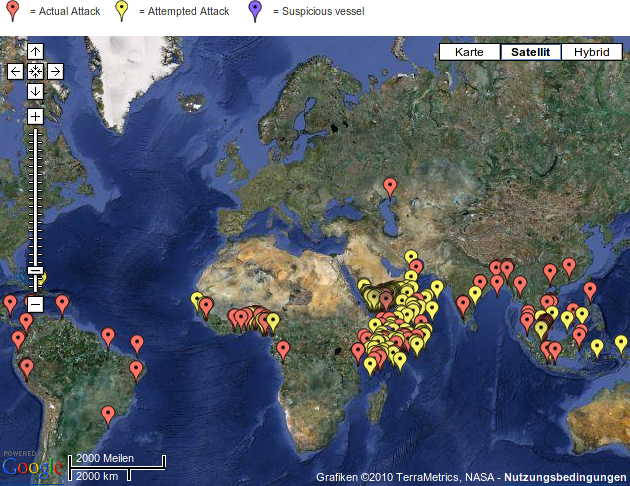

Bei dieser Gelegenheit möchte ich auch auf die Weltkarte der Piraterie 2009 von www.icc-ccs.org hinweisen:

http://www.icc-ccs.org/index.p [verkürzt] ation.googlemap&Itemid=261

Der Rollover zeigt die Karte von 2008 - man sieht, Piraterie ist ein Wachstumsmarkt.

governments will be forced to inflate their way out. They have no

alternative because they cannot afford otherwise. I am not convinced it is

that simple. Morgan Stanley published a very interesting research report

recently in which they made the observation that nearly half of all US

budget outlays are now effectively indexed to inflation 2 . The obvious

implication of this simple fact is that it is no longer possible for the US

government to inflate its way out of its deep deficit hole, however tempting

that may be. We should also learn from the Japanese experience.

They have made repeated attempts to inflate their debt away in recent

years but have found it much more difficult than anybody would have

anticipated. The inescapable conclusion is that when you need inflation the

most, it is the hardest to engineer whereas, when you don’t want it, you can

have it in spades.

Laut MS sei fast die Hälfte der Ausgaben im US-Budget inflationsgekoppelt. Das und die Tatsache, daß auch Japan es in 20 Jahren nicht geschafft hat, Inflation herbei zu führen, läßt darauf schließen, daß Inflation nicht kommt, wenn man sie braucht, sondern wenn man sie nicht braucht

Die Deutsche Bank ist an dem 2,6-Milliarden-Dollar-Fonds, der unter anderem in Wolkenkratzer in Philadelphia und Büros im Silicon Valley investiert hatte, mit knapp zehn Prozent beteiligt. Das restliche Geld sammelte Rreef, die US-Anlagegesellschaft der Deutschen Bank, bei US-Pensionsfonds ein. Diese beklagen vereinzelt einen Verlust von bis zu 82 Prozent.

http://www.spiegel.de/wirtschaft/unternehmen/0,1518,689302,00.html

Von 1,8 Milliarden Dollar (1,3 Milliarden Euro) seien beim Whitehall Street International nur noch 30 Millionen Dollar übrig, berichtete die "Financial Times Deutschland" ("FTD"). Goldman Sachs als größter Anteilseigner habe 436 Millionen Dollar in den Fonds investiert. Ein Sprecher der Bank wollte den Bericht nicht kommentieren.

http://www.spiegel.de/wirtschaft/unternehmen/0,1518,688950,00.html

Wie gut, daß die Krise vorbei ist, sonst würde ich mir Sorgen machen, weil dieses Stützen von irgendwelchen Fonds mich so an Bear Stearns im Sommer 2007 erinnert...

Der Grund sind die steigenden Risikoaufschläge auf spanische und portugiesische Staatspapiere, die auch die Kosten für Pfandbriefe und Anleihen der Banken in die Höhe treiben - so sehr, dass die Institute Neuemissionen von Schuldtiteln gar nicht erst wagen.

Selbst der Handel mit bereits umlaufenden Bankanleihen aus Spanien und Portugal stockt. "Der Handel ist zur Zeit extrem schwierig. Die Lage erinnert stark an die Situation, als der Markt von der US-Hypothekenkrise getroffen wurde", sagte Michael Arnold, Händler der BHF-Bank.

Wie stark ihre Refinanzierung von der Zentralbank abhängt, zeigen Daten vom März: Im vergangenen Monat hatten spanische Banken 15,7 Prozent aller EZB-Gelder abgesogen, die die Notenbank zur Verfügung stellte. Vor Beginn der Finanzkrise vor drei Jahren waren es noch weniger als fünf Prozent gewesen.

This was an entirely logical response to the twisted events that are unfolding. The rescue obliges countries in trouble to go deeper into trouble. Portugal must come up with €774m as its share of the EU's initial €30bn package. Ireland must find €491m, Spain €3.7bn.

Gna... 16% der Griechenland-Rettung sollen die drei anderen Pleitekandidaten auftreiben. Ob das funktionieren kann?

In der Tat: Ausgerechnet für die anderen Pleitekandidaten ist das Geschäft keines...

[...]

A country such as Portugal with total debt of 300pc of GDP, a current account deficit of 11.2pc, and a budget deficit of 9.4pc should not think it has the luxury to trim spending at a leisurely pace. Portugal has an ugly choice. If it tightens hard to soothe bond markets, it too risks depression. EMU's Faustian Pact is closing in.

Lehman war Kleinkram verglichen mit Südeuropa.

Schäuble im Spiegel-Interview - das ich übrigens nicht auf Deutsch gefunden habe:

SPIEGEL: You are exaggerating. In past years, it's happened again and again that a country couldn't pay its debts, and yet that hasn't led to a collapse of the global financial system. Why should this be different in Greece's case?

Schäuble: Because Greece is a member of the European monetary union. Greece's debts are all denominated in euros, but it isn't clear who holds how much of those debts. For that reason, the consequences of a national bankruptcy would be incalculable. Greece is just as systemically important as a major bank.

WOW. Es gibt also keinen Weg herauszufinden, wer der Gläubiger der Griechen ist.

Woran könnte das liegen? Inkompetenz vielleicht? Sehr geehrter Herr Schäuble, es wäre ihre Aufgabe gewesen, dafür zu sorgen, daß in den Finanzmarkt Transparenz kommt.

Abgesehen davon: Die Konsequenzen eines Staatsbankrotts sind natürlich kalkulierbar. Und im Falle Griechenlands sowieso.

Don't you mean "how long nothing at all has happened"?

Schäuble: Not at all. We're talking about a loan, which will earn a decent rate of interest. If all goes well, the German state will even turn a profit.

SPIEGEL: You don't even believe that yourself. If Greece is unable to repay its debts in full, it will come at the taxpayers' expense.

Schäuble: The risk is manageable. The package will consist of loans issued by the (German state bank) KfW, which the federal government guarantees. We don't need a supplementary budget for that. However, we will introduce a law that will have to be ratified by (the German parliament) the Bundestag.

KfW: SIV / Repo 105 / Schattenhaushalt des deutschen Staats => sofort abschaffen!

Gruß, Uwe

German troops have been buying up badges saying “I Fight For Merkel,” an ironic jab at German Chancellor Angela Merkel who they say has failed to explain why German troops are fighting and dying in Afghanistan. The protest badges have reportedly sent shock waves through the Bundeswehr leadership.

McChrystal ist zwar eben nicht ein Afghane, aber sei's drum: Bundeswehrtruppen scheinen ein Problem damit zu haben, ihre Meinung

Die gesetzliche Grundlage für die Hilfen soll als Änderungsantrag an ein ganzes Bündel anderer Gesetze gehängt werden, die eigentlich in dieser Woche im Bundestag verabschiedet werden sollten. Zu diesen Gesetzen, die nun auf unbestimmte Zeit warten müssen, zählen die Härtefallregelungen für Hartz-IV-Empfänger und das Zukunftsinvestitionsgesetz, das den Ländern Investitionen aus dem Konjunkturpaket II erleichtern sollte.

[...]

Nun sollen alle Gesetzesvorhaben warten, bis Griechenland einen Antrag auf Hilfe stellt. Dies könnte möglicherweise noch Wochen dauern. Danach müsste auch zum Griechenland-Gesetz erneut eine Anhörung stattfinden und am Ende auch der Bundesrat zustimmen. Andererseits zeigen die Vorbereitungen der Bundesregierung auch, dass Hilfen für Griechen immer näher rücken.

Was in aller Welt hat Griechenland mit Hartz IV zu tun?

Außer daß beide irgendwie durch die inkompetente deutsche Politik verquickt werden, natürlich?

The German government sold €2.458 billion of the 4.75% July 2040-dated bund at an average yield of 3.83%. Its €3 billion offer, however, attracted only €2.752 billion in bids.

The German debt agency played down the failure to get a full allotment, the first for any German government bond for more than a year. "Underbidding happens once in a while—we don't have a problem with it," Joerg Mueller, a spokesman at the agency, said. Mr. Mueller dismissed some speculation in the markets that higher inflation expectations may have generated disappointment in the yield on offer.

Nun, immerhin muß noch nicht, wie in den USA, die eigene Notenbank 80% des Rotzes aufkaufen.

The ministry said in a statement that the problem is becoming more serious each year, which puts at risk the food security of the country.

"The desertification in Bolivia affects 41 percent of the national territory, 439,432 square km, where 77 percent of the national inhabitants live, some 6.4 million people," the ministry said.

The inflation rate, calculated using a harmonized European Union method, fell to 1 percent from 1.2 percent in March, the Federal Statistics Office in Wiesbaden said today. Economists had expected it to rise to 1.3 percent, the median of 23 estimates in a Bloomberg News survey showed.

Oil prices have risen 67 percent in the past year as the global economy pulled out of a recession. Still, growth in Europe remains muted as companies cut costs to bolster profits and higher unemployment makes consumers reluctant to spend. The earlier timing of Easter this year also made holiday-related services cheaper in comparison with April last year.

“The Easter bunny effect, when Germans went on holiday, was in March and now we’re seeing the absence of that,” said Carsten Brzeski, senior economist at ING Group in Brussels. “The broader picture is that this year is about deflationary, not inflationary, trends.”

Consumer prices fell 0.1 percent from March, today’s report showed.

Wir haben also fallende Preise und Inflation gleichzeitig

The survey, conducted by a private U.S. contractor last December, covered Kandahar City and other districts in the province into which Gen. Stanley A. McChrystal is planning to introduce more troops in the biggest operation of the entire war. Those districts include Arghandab, Zhari, rural Kandahar and Panjwayi.

Afghan interviewers conducted the survey only in areas which were not under Taliban control.

"Corruption" is a term that is often understood to include not only demands for payments for services and passage through checkpoints but violence by police against innocent civilians.

Angesichts der Prozentzahlen könnten Zweifel an der Legitimität der ganzen Sache aufkommen...

[...]

Household debt has surged three time faster than income in recent years and now stands at a record high of more than $1-trillion. Put another way, Canadians owe about $1.47 for every dollar of disposable income. Even more remarkably, they took on more debt during the slump – a first for a recession – because borrowing was so cheap.

[...]

For some, the trouble has already begun. John Silver, who runs Community Financial Counselling Services in Winnipeg, has seen his caseload increase 20 per cent from last year. “We re seeing more people coming in with more stress with regard to their debt,” he said.

[...]

Most of the increased debt, roughly 70 per cent, has been in mortgages, reflecting the still hot housing market in much of the country. That has left many households struggling to meet monthly payments on hefty mortgages and more susceptible to rising rates. Families in Vancouver, for example, spend about 68 per cent of their disposable income on the cost of maintaining their house, compared to less than 40 per cent 10 years ago.

[...]

* 68%: Average amount of disposable income households in Vancouver spend on the cost of a home

* 44%: Average in Toronto

* 35%: Average in Calgary

* 36%: Average in Montreal

* 30%: Average in Ottawa

* 21%: Percentage of Canadians who say they can’t manage their debt load

* 147%: Debt-to-income ratio in Canada, a record high

* 157%: Debt-to-income ratio in the United States

* 70%: Percentage of debt held in mortgages in Canada

Auch da wurde getanzt, so lange die Musik spielte.

The industry group said a total of 43,621 homes changed hands on a seasonally adjusted basis in March, boosted by strong activity in the Toronto and Ottawa markets, which more than offset a decline in activity in Vancouver that was possibly due to the Winter Olympics.

The increase in listings has created less of a buying frenzy than last year when demand was high and supply was short -- which pushed prices higher and fed debate about whether there was a housing bubble in the making.

"After a blistering supply-starved recovery, Canada's housing market is gradually returning to balance," said Robert Kavcic, an economist at BMO Capital Markets.

Nearly 100,000 homes were listed during March, up 20 percent from a year ago, CREA said, bringing the total new listings to a first-quarter record of 233,402.

März 2010 gegenüber Februar 2010: +1.4% Verkäufe = 43621 Verkäufe.

März 2010 gegenüber März 2009: +20% mehr Angebot auf dem Markt.

Der Tag, an dem diese Blase platzt(e), ist entweder gerade vorbei oder in den nächsten 12 Wochen.

http://www.greaterfool.ca/2010/04/15/list-this/

Several days ago I gave you the timetable for the next year. Two mortgage rate increases in as many weeks confirmed it. The listings avalanche cements it. Next week mortgage regulations tighten, knocking out a mess of first-timer newbies. In June the prime and variable rate loans jump. In July the new taxes hit. And by Christmas we`ll be feeling our vultch juices flowing.

The big question cannot be answered yet, however: Will this be a quick 15% or 20% market correction over 12 or 18 months? Or are Canadians starting into a Yankee-style slow real estate grind which can churn lower for the next five years, taking those areas where prices soared the most down as much as 70%?

That ain't good news.

Industrial production declined an unexpected 17.4 percent last month from March 2009, when Chile was suffering its deepest recession in a decade. Industrial sales fell 8.9 percent over the same period, the National Statistics Institute said today..

The decline in output was more than double the 7.3 percent median drop expected by economists in a Bloomberg survey. The February quake, the fifth-largest in a century, and a following tsunami killed more than 400 people and caused almost $30 billion of damage, President Sebastian Pinera said.

Apparent oil demand rose to 8.12 million barrels per day over the year ago March according to an analysis of official data by Platts, the energy information arm of McGraw-Hill Cos.

It was the seventh month in a row of double-digit increase in demand for China. But it was short of the all-time high in February of 8.5 million barrels per day.

Platts said the increase was helped by new refining capacity at state-owned companies like Sinopec, PetroChina and China National Offshore Oil Corp.

Also driving demand was the resurgence of the Chinese economy, which posted gross domestic product growth of 11.9 percent in the first quarter. Industrial production and gasoline demand were also up during that time.

März 2009: 7.2 Mio. Barrel.

Februar 2010: 8.5 Mio. Barrel.

März 2010: 8.12 Mio. Barrel.

Frage: Wächst der Ölbedarf in China nun 75000 Barrel pro Monat, oder fällt er um 380000 pro Monat? Oder ist das der übliche Zahlenmüll der Ölwirtschaft?

About 1,300 people are being held in cramped conditions in towns across Puning county, in Guangdong Province, as officials try to put pressure on couples who have illegal children to come forward for sterilisation.

China - Vorbild bei der Umsetzung der Menschenrechte. Ahem.

Geiselnahme außerdem.

Zynisch betrachtet ist es allerdings erfreulich, daß China das Experiment mit der Überalterung der Gesellschaft zwei Generationen laufen läßt - das gab es sonst m.W. noch nirgends.

Das Kapital müsse stets mindestens 11,5 Prozent der risikogewichteten Aktiva ausmachen - und das angesichts geschätzter 15.000 Mrd. Yuan an neuen Darlehen, die die Banken in den nächsten fünf Jahren ausreichen würden, so Yang in dem am Dienstag veröffentlichten Beitrag. "Wir müssen einen neuen Weg für nachhaltiges Wachstum finden, dabei aber den Kapitalbedarf begrenzen."

Naja, was sind schon 70 Mrd. Dollar?

Dafür müssen ja nur 22 Mio. durchschnittlich verdienende Chinesen ein Jahr arbeiten (2008)...

Rows of half-completed apartment buildings rise over former farmland, each crowned with yellow construction cranes that seem to outnumber trees in parts of this dusty city of 5 million residents.

Taxi drivers boast of owning multiple flats for investment. Billboards hawk developments with names such as Villa Glorious and Rich Country. Frenzied crowds pack sales events with bags of cash, buying units that exist only on blueprints. Average home values in Hefei soared 50% last year.

China's real estate rush, once confined to a handful of leading cities, has spilled into the hinterlands with a ferocity reminiscent of American expansion into exurbs like the Inland Empire.

Fieber tritt im Allgemeinen während der Bekämpfung einer Infektion ein, daher wären Begriffe aus der Psychiatrie passender.

Der Rest in Stichworten:

- All this in a city where many residents are barely a generation removed from working the fields. The average annual income here is $2,000.

- Xi Zhou, a cameraman for a local news channel, paid $50,000 for his 900-square-foot unit in December. He figures it's now worth $80,000.

- "For people of my generation, property is all we talk about," said Xi, 27 [...] "I felt a lot of pressure to buy because the longer I didn't, the more likely I wouldn't be able to afford anything."

- About 15% of the city's residents are now estimated to be construction workers.

- For the local government, it's a small price to pay for the city's mad march from backwater to metropolis.

"This time it's different"?

Property trading volume went down 64 percent last week from a week earlier in Shenzhen, down 45 percent in Beijing, down 38 percent in Shanghai, and down 2 percent in Guangzhou.

Ob das noch rechtzeitig kommt?

The plan, from China’s National Development and Reform Commission, will likely cover nine industries including information technology and new energy, the report said.

Selbst wenn das nur ein Wunschtraum sein sollte: Wieso in aller Welt sollte der chinesische Staat das tun wollen, wenn doch der Aufschwung prima läuft?

The phenomenon sent dam levels across Colombia to historic lows, are forcing officials to evaluate deficiencies in the natural gas sector.

As thermo power generators have increased demand for the clean burning fuel because of low hydrology, the country has faced widespread difficulty in coordinating supply.

[...]

Storage facilities are inadequate in Colombia and the internal and exports markets for both natural gas and thermo-fired power remain insufficient to increase investment.

El Nino -> Zu wenig Wasser in dem Stauseen -> zu wenig Gas, um das aufzufangen.

Was da wohl herauskommt? Vielleicht "zu wenig Strom"?

“We are waiting for better conditions” on the market before selling the euro-denominated bonds, Deputy Finance Minister Ivan Fuksa said in an interview in Prague today.

Investor concern that a European Union-led bailout package won’t stop Greece’s debt crisis from spreading sent the euro toward its weakest level against the dollar in a year as emerging-market stocks plunged for a second day. Czech bonds fell the most in 11 weeks, lifting the yield on 3.8 percent koruna notes due 2015 by 15 basis points to 2.726 percent, from a five-year low of 2.556 two days ago.

Warten auf bessere Bedingungen hat in dieser weltweiten Wirtschaftskrise noch niemandem geschadet, oder?

Oder vielleicht doch auffällig vielen?

Uwe Ohse, 2010-04-19

Und wie war die Vorhersage?

Naja, nicht ganz akkurat.

Wohnimmobilien in Lettland: 2/3 Wertverlust in weniger als 3 Jahren.

The recent startup of the massive Perdido offshore drilling hub -- a joint-venture of Royal Dutch Shell Plc (RDSB), Chevron Corp. (CVX), and BP Plc (BP) -- even has some Mexicans fearful that oil from the Mexican side could seep over and get sucked up in what has been dubbed locally as "the drinking straw effect.

"Perdido is a floating complex 200 miles from the Texas coast that can be fed with oil and gas from nearby deposits. The first ones -- Great White, Silvertip, and Tobago -- are expected to reach average daily output of 100,000 or more barrels of oil equivalent.

As Pemex doesn't have the technology to drill anywhere near the depth of the deep-water experts, and under Mexican law can't share risk with them, government officials found themselves on the defensive as Perdido went on stream.

Perhaps the government underestimates the seriousness of the issue so it might be helpful to explain it in terms that they would understand. The PPP government seems to have accomplished a great deal politically in the first two years in office. However, if it hopes to have even the remotest chance of winning re-election in 2013, it must resolve the energy crisis.

Die Energiekrise in Pakistan geht also munter weiter, und welch Wunder: nicht jeder ist gleichermaßen von der Stromabschaltung betroffen: Diejenigen, die in erster Linie für die Behebung des Mangels verantwortlich sind, haben genug Strom

Das kommt ganz klar aus einem alternativem Universum:

While talking to various delegations, Neelam Jabbar Ch. said that the world was moving about new fuel technologies and Pakistan could not afford to lag behind and be continued on traditional energy sources.

She said that ethanol and bio-diesel could help in achieving import substitution and also enable to escape the hazards of oil price validity.

Ich bin gespannt, wo Pakistan die gewaltigen Anbauflächen finden will, die die Produktion von Biodiesel und Ethanol so erfordern.

The policy has declared the Karachi Electric Supply Company (KESC) would face a slash of 300MW to cope with the energy crisis currently prevailing across the country.

Das ist nicht unbeeindruckend.

However, it is on the condition that they are given uninterrupted power supply for 4 hours before they close shops. According to the agreement, wedding halls will close at 10pm.

Ich dachte, es gälte diese Gleichung:

längere Öffnungszeiten = mehr Umsatz = mehr Gewinn = mehr Steuern = mehr Geld für Öl und Kraftwerke?

*Das* Land hat eine schwierige Zukunft.

Russia will cut the natural-gas prices it charges Ukraine by 30 percent in a deal that obliges Ukraine to import more gas from its neighbor to the east. As part of the accord, Russia will keep its Black Sea Fleet base 25 years longer than the existing lease allows.

[...]

The $40 billion is to be considered “investment aid” in Ukraine’s economy, Yanukovych said. The lease on Russia’s Black Sea Fleet base on the Crimean peninsula was extended until 2042, with the possibility of a five-year extension.

“This is a geopolitical success,” said Fyodor Lukyanov, editor of Russia in Global Affairs magazine. “The naval base itself isn’t worth that much, but it’s a sign that Russia will remain the major power in the post-Soviet space.”

Gas gegen Flottenbasis - da war sogar "oil for food" irgendwie sympatischer.

This deal illustrates how Russia deploys hard political and economic power in a way that the EU can never match. Economically speaking, Ukraine is on its knees right now. The prospect of cheaper gas was too enticing to refuse. The Kremlin spotted its chance and went for it.

The accord surely puts paid to any prospect that Nato might one day embrace Ukraine as a member. How on earth could Nato contain a country that hosts a foreign naval base - a base, moreover, that was used by Russia as recently as August 2008 to support its military incursion into Georgia?

Damit ist die Gefahr, daß die Ukraine Mitglied der Nato wird, erst mal gebannt.

Wobei Tony Barber aber richtig liegt, wenn er das für ein Meisterwerk russischer Politik und ein Versagen der EU-Außenpolitik hält, daß die Ukraine näher an Rußland rückt.

Gemeint ist übrigens das: Russia Pays Ukraine $40 Billion to Halt ‘Gas War’

Das ist aus der Reihe "Nachrichten aus einem freundlichen Paralleluniversum":

"The demand in emerging economies will take time to peak but definitely it will peak maybe this decade or early next decade," he said.

Und hier dann mal eine Nachricht aus diesem Universum:

Global oil exports from Saudi Arabia, the world's largest oil producer alongside Russia, will start to wane in the coming years as domestic demand surges and spare capacity drops, warned Khalid al-Falih, chief executive officer of Saudi Aramco in a speech published on the company's website.

Domestic energy demand is expected to increase by almost 250%, from about 3.4 million barrels per day (b/d) in 2009 to about 8.3 million b/d by 2028, which will eventually affect the country's ability to export oil, he said.

T

Irgendwie ist das ja schon zynisch

Zusammenfassung: Hoher Anteil Ungebildeter in der Bevölkerung und hohe Arbeitslosigkeit => viel Militär.

Das klingt irgendwie bekannt... Hm, Ägypten? USA? UK?

According to the official data, between 2008 and 2009 coal and other solid fuel consumption fell by 14.2%, while consumption of oil and gas fell by 3.5% and 7.2%, respectively. Primary energy consumption fell for the fifth consecutive year, and at its fastest rate since 1980.

Coal production last year – including an estimate for slurry – was 1.0% down on 2008 at 17.9 million tonnes. Deep mined production was down 7.1% while opencast production was up 3.6%. Imports of coal in 2009 as a whole were 12.9% down on 2008 at 38.2 million tonnes.

6% sind ein gewaltiger Einbruch.

Uruguay is a “model of macroeconomic stability,” World Bank Vice President Pamela Cox said.

Aha. Und trotz der makroökonimischen Stabilität braucht Uruguay einen Weltbankkredit?

Sehr merkwürdig.

In the agency’s “State of the Markets Report 2009,” only three of the 11 recessions in the past 60 years have resulted in a drop in electric demand, and officials said in the report “falling power demand is rare.”

Things are even worse for those under the age of 20. According to a new report based on U.S. Census Bureau data, only 26 percent of American teens between the ages of 16 and 19 had jobs in late 2009 which represents a record low since statistics began to be kept back in 1948.

So weit, so schlecht.

*The Pew Research Center study also found that only 61% of Americans between the ages of 18 and 29 are covered by some form of a health plan.

*According to a National Foundation for Credit Counseling survey, only 58% of those in "Generation Y" pay their monthly bills on time.

*Not only that, but according to a November MetLife poll, nearly 70% of those in "Generation Y" are not building up a cash cushion, and 43% are accumulating too much credit card debt.

*According to Fidelity Investments, those in Generation Y have more than three credit cards on average, and 20 percent of them carry a balance of at least $10,000.

Hundreds of job-seekers did just that in Queens in the hopes of landing a coveted union job.

[...]

After three days of sleeping on the street, he left with one of just 750 job applications handed out for a position as an elevator technician apprentice -- a secure job with pension and benefits and an earning potential up to $40 an hour.

[...]

More than 1,000 eager applicants began lining up as early as Friday morning armed with a variety of skills -- and warm blankets.

[...]

The union plans to hire about 75 people -- and possibly more depending on the economy.

NY 2010: 75 Stellen, 750 Leute durften Bewerbungen abgeben, Hunderte mehr noch nicht mal das, und dafpr haben mehr als 1000 Leute da kampiert...

Wenn das nicht mal der ersehnte Aufschwung ist.

Farther south, water shortages are predicted for northern Arizona communities, including Flagstaff, by 2050. The Central Arizona Project, which provides water to Phoenix and Tucson, may run short of water as early as 2012.

And farther downstream, Mexico is looking at a disaster along its stretch of the river due to inadequate flows, prompting one Mexican official to declare, “We are clearly on a collision course with a catastrophe,” according to the Los Angeles Times.

Tja.

Und die Abhilfe?

Wasser von anderswo holen.

Mich deucht, das endet nicht wirklich gut.

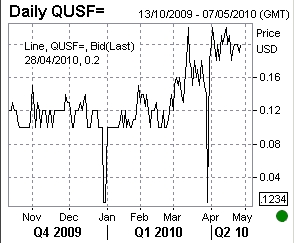

The official range, established in December 2008, may remain at “zero to 0.25 per cent” – but the actual price of money is most definitely trending higher.

In fact, a little over 20 basis points is now typical in overnight trade. That might be a small rise, in nominal terms, from the 10 bps or so seen earlier in the crisis – but it’s certainly a shift away from the zero interest rate policy.

interessant - aber wir werden sehen, wie das im Gefolge der Griechenland/EU-Krise weitergehen wird.

AIG, which was rescued from collapse by the U.S. government, sold so-called Side A directors and officers’ coverage to New York-based Goldman Sachs, according to a person with knowledge of the policy.

[...]

“If it were a derivative suit against Goldman, defense costs would be covered, and I’d prefer not to be a primary on the policy,” said John Degnan, vice chairman and chief operating officer of AIG competitor Chubb Corp., while answering a question about Goldman Sachs on an April 22 earnings call.

AIG, der große staatliche Versicherer in den USA, darf unter Umständen für die Verteidigung des Führungspersonals von Goldman Sachs zahlen.

Government misery.

[...]

Lately, however, horsemen have been betting their farms and losing. There are 265 farms of more than 20 acres for sale here in the four counties of horse country — up from 199 listed last year — and that is not counting the more than 60 “pocket listings” Mr. Kirkpatrick said he and his peers had not put on the multiple listings service.

[...]

“Even if you’re O.K. financially, you don’t want to be flamboyant or ostentatious and spend money on a yearling,” said Nick Nicholson, chief executive of the Keeneland Association, which has had a 50 percent drop in sales from more than $800 million in 2007. “We have a minimum bid of $1,000, and we’ve seen more horses go through the ring and not get bid on at all than we ever had.”

These days it is far cheaper to get a date with a blue-blooded stallion. The top of the market for stallions like Dynaformer is $150,000, according to BloodHorse.com. Smarty Jones, who nearly swept the Triple Crown in 2004, once stood for $100,000, but today he can be had for $10,000.

http://www.bloodhorse.com/hors [verkürzt] imited-january-2007-mixed-sale

Ein Update zu Re: Alles wird gut!!!27! - Pferdepreise:

Year Offered Sold RNA Gross Average Median High

2010 447 273 174 $1,987,000 $7,278 $3,200 $ 65,000

2009 284 202 82 $1,232,400 $6,101 $3,600 $ 50,000

2008 489 354 135 $2,225,900 $6,288 $3,200 $120,000

2007 535 437 98 $4,168,400 $9,539 $4,500 $560,000

2006 540 440 100 $3,479,500 $7,908 $3,500 $300,000

2005 582 492 90 $3,213,100 $6,531 $3,500 $ 72,000

2004 629 517 112 $4,057,300 $7,848 $3,500 $425,000

2003 596 524 72 $4,431,000 $8,456 $4,000 $110,000

-29% bei den Medianpreisen seit 2007.

-52% bei den Umsätzen.

Aua.

Interessant ist vielleicht noch die Einzelstatistik zu den Zuchtstuten:

Year Offered Sold RNA Gross Average Median High

2010 155 91 64 $ 480,900 $5,285 $2,200 $ 65,000

2009 103 73 30 $ 340,600 $4,666 $2,200 $ 40,000

2008 203 139 64 $ 779,800 $5,610 $3,000 $120,000

2007 197 149 48 $1,200,700 $8,058 $3,700 $ 97,000

2006 219 164 55 $1,085,000 $6,616 $3,000 $280,000

2005 276 229 47 $1,357,500 $5,928 $3,000 $ 42,000

2004 280 228 52 $1,247,100 $5,470 $3,100 $ 45,000

2003 266 225 41 $2,163,200 $9,614 $4,500 $110,000

-60% Umsatz, -40% Medianpreis, -39% Zahl verkaufter Tiere - kein Anzeichen für einen langfristigen Wachstumstrend.

Die Durchschnittsmiete in Groß-LA von $2.6 pro Quadratfuß entspricht so um die 10 EUR pro Quadratmeter - was etwa die Durchschnittsmiete in der Düsseldorfer *City* ist (Umland/Nebenlagen: etwa die Hälfte).

Da ist noch Luft für den weiteren freien Fall.

103: The number of months it would take to sell off all the foreclosed homes in banks’ possession, plus all the homes likely to end up there over the next couple years, at the current rate of sales.

Alles wird gut, irgendwann, wenn all das verfallen ist...

Wann werden eigentlich die Ratingagenturen aus dem Verkehr gezogen?

The energy crisis outlined in a Joint Operating Environment report from the US Joint Forces Command, comes as the price of petrol in Britain reaches record levels and the cost of crude is predicted to soon top $100 a barrel.

"By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 million barrels per day," says the report, which has a foreword by a senior commander, General James N Mattis.

It adds: "While it is difficult to predict precisely what economic, political, and strategic effects such a shortfall might produce, it surely would reduce the prospects for growth in both the developing and developed worlds. Such an economic slowdown would exacerbate other unresolved tensions, push fragile and failing states further down the path toward collapse, and perhaps have serious economic impact on both China and India."

[...]

The request comes amid a recent surge in violent crime, including a night last week that saw seven people killed and 18 wounded, mostly by gunfire.

Fritchey says Chicago has had 113 homicide victims this year. He says the police department has done a commendable job, but its resources are stretched thin.

That figure includes the Pentagon budget request of $708 billion, plus an estimated $200 billion in supplemental funding, called "overseas contingency funding" in euphemistic White House-speak), to fund the wars in Afghanistan and Iraq, some $40 billion or more in "black box" intelligence agency funding, $94 billion in non-DOD military spending, $100 billion in veterans benefits and health care spending, and $400 billion in interest on debt raised to pay for prior wars and the standing military.

The 2011 military budget, by the way, is the largest in history, not just in actual dollars, but in inflation adjusted dollars, exceeding even the spending in World War II, when the nation was on an all-out military footing.

Military spending in all its myriad forms works out to represent 53.3% of total US federal spending.

Da hat commondreams.org einen gewissen Realitätsverlust, schließlich sind die 3000 Mrd. Dollar im US-Budget eben nicht alle durch Steuern gedeckt. Laut http://en.wikipedia.org/wiki/File:U.S._Federal_Receipts_-_FY_2007.png sind nur 2100 Mrd. Dollar Steuern herein gekommen...

was das Militärbudget dann auf 76% der Steuereinnahmen aufblasen würde.

Imperial Overstretch, anyone?

In one case, a soldier found himself fighting against deployment to Iraq after re-enlistment papers with his signature on it appeared -- even though he never signed any such papers, reports Chris Ingalls at KING channel 5 news in Seattle.

And in another case, a sergeant who had signed up for a one-year tour of duty was shocked to discover his enlistment papers stated he had signed up for two years.

Der Dienst für Uncle Sam scheint nicht ganz beliebt zu sein.

Venezuela bekommt 20 Mrd. Dollar von China, China bekommt 10 Jahre lang 100000 Barrel Öl pro Tag.

Meiner Rechnung nach kommt das auf 54 Dollar pro Barrel, nicht auf 75 Dollar, und ist ein verdammt guter Preis.

Oder anders gesagt: Chavez steht das Wasser bis weit über den Hals.

By the end of June 2010, analysts predict, the WPF will have no food to distribute to Yemen's millions of hungry.

There are fears that this will debilitate the nearly one in three Yemenis - over seven million people - who struggle daily to find enough food to live a healthy and productive life, leading to rates of malnutrition that are the third highest in the world.

Wollen Sie den Digest abbestellen?