| Sendedatum | 2010-04-09 15:26:59 |

|---|---|

| Ausgabe | 88 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Inhaltsverzeichnis:

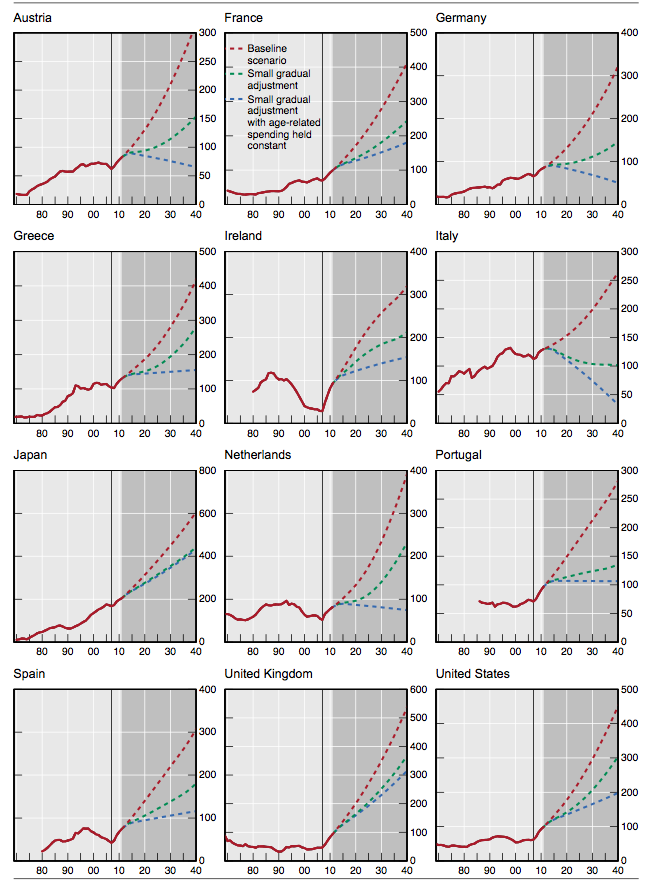

- The future of public debt: Prospects and implications

- The World’s Riskiest Sovereign Debt

- Uranbedarf weltweit

- Aus dem Ruder gelaufen

- Finanzaufsicht verdächtigt Versicherer

- Home prices in Vancouver hit million-dollar landmark

- China Fails to Complete Bill Sales on Rate Concern

- Drought in south-west China and the Mekong basin

- New evidence against Chevron in Ecuador case

- Greece to target US investors with 'emerging market' bond

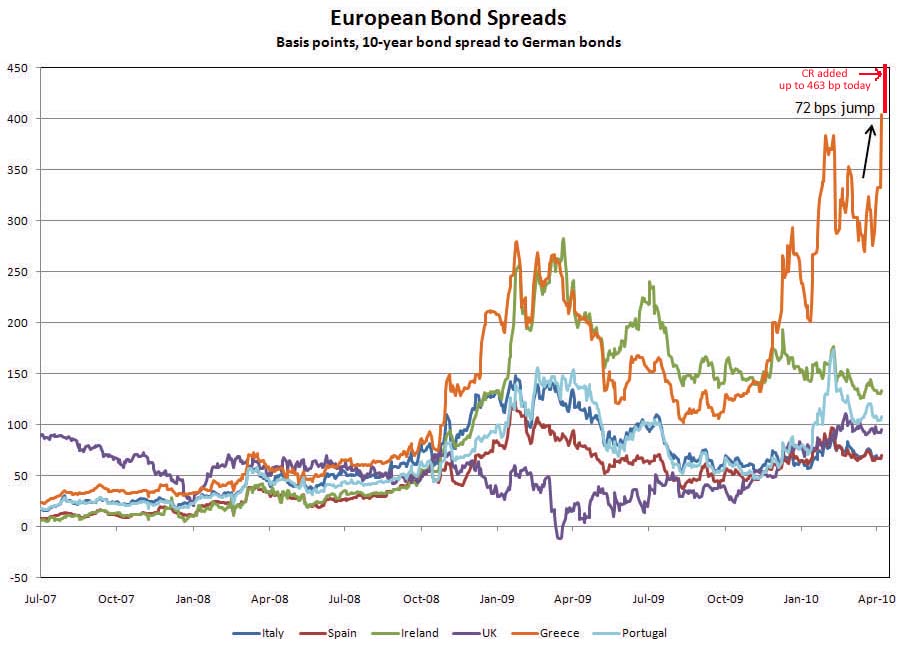

- Euro Bonds Spreads: Greece at Record

- Irland: Banks write down €40bn in loans

- Municipal finance datapoint of the day, Latvia edition

- Pakistan: Energieversorgung

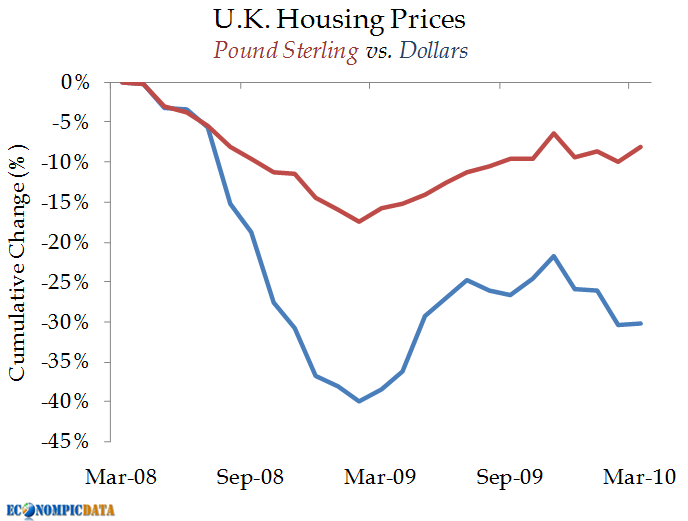

- UK Housing: The Benefit of a Weaker Currency

- UK household savings lowest in 40 years

- £1TRILLION PENSIONS TIMEBOMB

- Ukraine wünscht geringere Gaspreise?

- Uefa stellt Ukraine Ultimatum

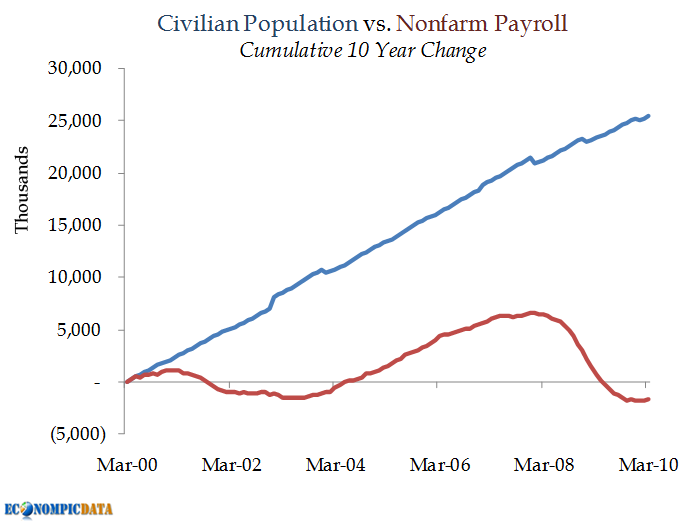

- US: Employment vs. Population Growth

- The illustrative Maiden Lane I portfolio

- Thoughts on Maiden Lane II

- Thoughts on Maiden Lane III

- Foodstamp heißt nun SNAP

- US-Staatsanleihen: An historical turning point?

- US consumer credit and personal savings

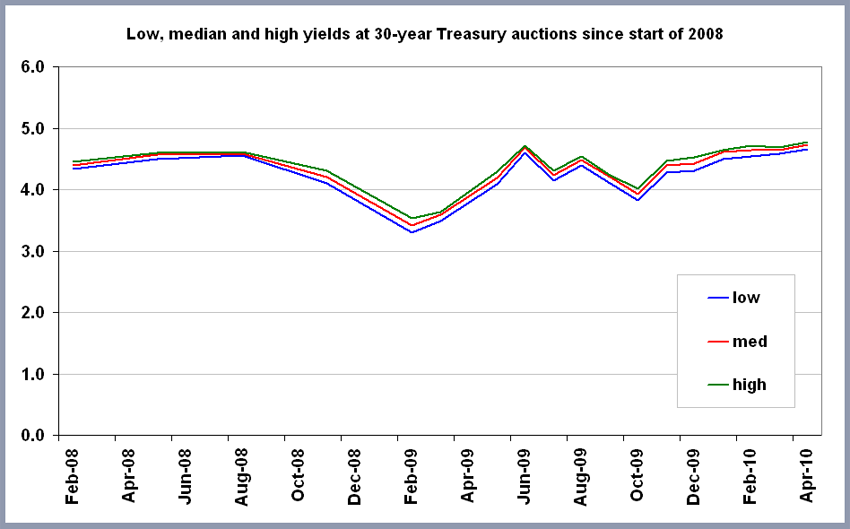

- Yields der 30-jährigen US-Anleihen wieder auf vor-Lehmann-Niveau

- Venezuela: Wasserknappheit, Energiekrise

- Venezuela recession deepens; GDP shrinks 5.8 percent

Inhalt:

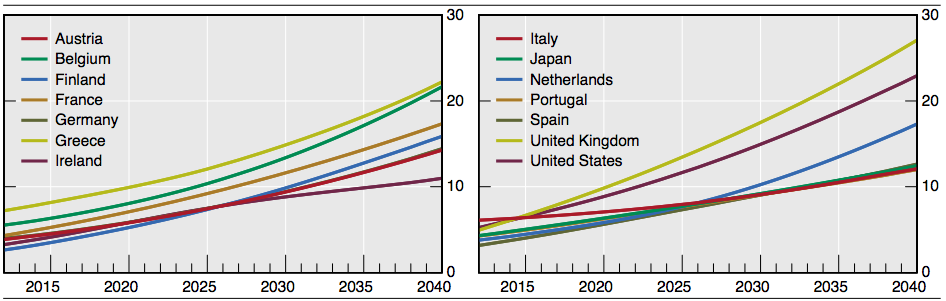

BIS Working Paper über die Schuldenentwicklung diverser Länder:

Rot: weiter wie bisher.

Grün: Kleine Anpassungen

Blau: Kleine Anpassungen, bei Einfrieren der altersbedingten Ausgaben.

Ob da die demographische Entwicklung berücksichtigt ist?

Geschätzter weltweiter Uranbedarf 2010: 68646 Tonnen.

Atomstrom 1.4.2010: 374127 MWe

Atomstrom inkl. im Bau befindlicher Reaktoren: 425369 MWe.

Atomstrom inkl. geplanter Reaktoren: 583301 MWe.

Atomstrom inkl. "PROPOSED" Reaktoren: 946476 MWe.

http://www.world-nuclear.com/info/uprod.html

Geschätzte weltweite Uranproduktion 2008: 43853 Tonnen.

http://www.world-nuclear.com/info/inf75.html

Known Recoverable Resources of Uranium 2007: 5469000 Tonnen.

Reichweite bei derzeitigem Verbrauch: 80 Jahre.

Reichweite inkl. im Bau befindlicher Reaktoren: 70 Jahre.

Reichweite inkl. geplanter Reaktoren: 51 Jahre.

Reichweite inkl. "PROPOSED" Reaktoren: 31.5 Jahre.

Nun kann man sicherlich auf der Welt noch mehr Uran finden, aber das wird sicherlich teurer zu produzieren als die offensichtlichen, leicht erreichbaren Lager.

Davon ab gibt's sicherlich auch noch andere Abnehmer für Uran als nur die Reaktoren - irgendwann werden die Atommächte ihr friedensstiftendes Overkillpotential ja mal modernisieren wollen, oder so... und auch Flugzeugträger, U-Boote und Eisbrecher wollen gefüttert werden.

...

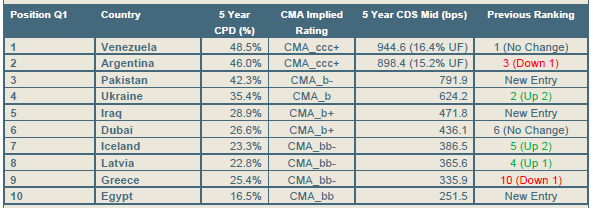

Und die Krise frisst sich gerade in die Fundamente deutscher Banken. Institute wie die HSH Nordbank, die Commerzbank, die Nord/LB, die KfW-Tochter Ipex und die DVB Bank sind die größten Schiffsfinanzierer der Welt (siehe Grafik). Beinahe 100 Milliarden Euro Schiffskredite stehen in ihren Büchern.

Nicht gut, das Verhältnis. Gar nicht gut...

Anleger zahlen dabei einen festen Betrag in einen gut verzinsten Lebensversicherungsvertrag ein, den sie kurzfristig und ohne Verluste kündigen dürfen. Diese Kapitalanlagen sind selbst in der Branche umstritten. Für die Versicherer sind sie entscheidend, um mehr Neukunden zu gewinnen. Kritiker monieren, dass damit die Gewinne der Bestandskunden sinken. Nur so könnten Versicherer höhere Zinsen als Banken anbieten. Bei einer langen Niedrigzinsphase könnten Versicherer nicht alle Zusagen erfüllen.

Am Wochenende meinte ich noch zu einer Bekannten, daß die Lebensversicherer in einer Krise stecken...

Etwas älter, aus dem Oktober 2009:

http://www.ftd.de/unternehmen/ [verkürzt] t-um-versicherer/50023022.html

Die BaFin befürchtet offenbar, dass einige Anbieter bei lang anhaltenden niedrigen Erträgen aus den Kapitalanlagen kaum in der Lage wären, diese Garantien dauerhaft zu bedienen. Dann käme mancher Lebensversicherer in eine Schieflage. In Japan führten Deflation und Niedrigzinsen in den 1990er-Jahren zu einer Reihe spektakulärer Zusammenbrüche von Lebensversicherern.

More than 1,300 single detached homes were sold in greater Vancouver last month, for a whopping total of $1.35 billion.

[...]

The $1-million average includes high-end homes. But the average price for a single, standard detached home in the city reached $800,341, the Real Estate Board of Greater Vancouver said Tuesday. That's up from $650,000 a year ago.

Nichts, was ich in den letzten Monaten über Kanada las, stimmte mich vorbehaltslos optimistisch. Dies auch nicht.

The ministry sold 15.81 billion yuan ($2.3 billion) of 273- day bills compared with the planned amount of 20 billion yuan and issued 14.25 billion yuan of the 91-day bills versus the target of 15 billion yuan, according to the traders at Bank of China Ltd. and BOC International Holdings Ltd., who declined to be identified before an official announcement.

Soso, China kann keine kurz laufenden Anleihen platzieren. China, nicht Griechenland.

Warum?

Einen Tag vorher gab's 3 Jahre laufende Anleihen.

A solitary man and an ox cart travel across an area where locals went fishing less than a year ago in Damoguzhen County, Yunnan

Today, it joins 310 reservoirs, 580 rivers and 3,600 pools that have been baked dry by a once-in-a-century drought that is evaporating drinking supplies, devastating crops and stirring up political tensions over dam construction, monoculture plantations and cross-border water management in south-east Asia. Linking specific weather events to human-caused climate change is impossible, but the drought is consistent with what climate scientists expect to see more of in future.

With its mighty rivers and steep gorges, south-west China is the world's biggest hydro-electric powerhouse, but reservoir levels have fallen so low this year that 60% of dams report a decline in electricity output. This forces industrial estates and cities to burn more coal and emit more carbon to make up the shortfall.

Ein kleines Update zu Länderdomino: Ecuador (Ecuador ist in finanziellen Schwierigkeiten) und Texaco Toxic Past Haunts Chevron as Judgment Looms (Ecuador möchte 27 Mrd. Dollar von Chevron für Umweltschäden aus Texacozeiten):

The report, made public yesterday, adds another twist to a 17-year-old case brought on behalf of indigenous peoples for polluting the Ecuadorean jungle near where they live. Damages could be as much as $27 billion, and a ruling on the case from the court in Ecuador is due this year. The original defendant in the case, Texaco, merged with Chevron in 2001.

Diego Borja, one of the two men who secretly videotaped an Ecuadorean judge in the case during a discussion of bribes, now receives a monthly sum from Chevron and lives near its headquarters in San Ramon, California, according to Santiago Escobar, who says he has known Borja for 15 years.

Womit ich ja Schwierigkeiten habe ist dieses "secretly videotaped"... ein Unternehmen wie Chevron sollte niemanden auf Bestechungstour in einem solch vielbeachteten Prozess schicken, der so blöde ist, das nicht zu vermeiden.

Griechenland als "emerging country". Can't make this up...

Griechenland erinnert mich aber weniger an ein auftauchendes U-Boot als ein Absaufendes...

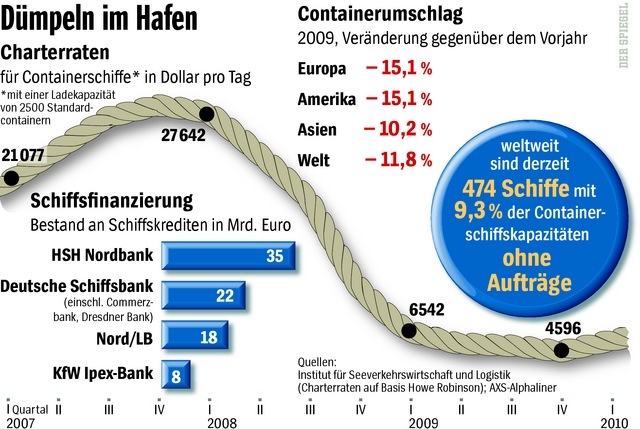

Quelle: Atlanta FED, http://www.frbatlanta.org/docu [verkürzt] ts/finhighlights/FH_040710.pdf

Warum die es für sinnvoll halten, .uk mit einzuschließen?

The figure represents 7.5pc of a Bloxham Stockbrokers estimate of a total of €533bn of lending outstanding by the six state-guaranteed banks and the country's five main foreign-owned lenders.

Und diese Summe von 40 Mrd EUR sind nur 7.5% der ausstehenden Kredite der 11 Institute. Wow.

Der das Zitat einleitende Satz ist wunderschön, besser kann man das gar nicht ausdrücken.

Aber worum geht es?

Riga, die lettische Stadt, wollte eine Brücke bauen. Der Staat sagte "nein, ihr dürft keinen Credit aufnehmen". Die Deutsche Bank eilte zu Hilfe, zu äußerst großzügigen Konditionen, lieh dem Bauunternehmen das nötige Geld und schloß mit Riga ein CDS ab - Riga garantierte also den Kredit.

Daß das dann irgendwann aufflog, und Eurostat und/oder Rechnungshof das für einen Kredit an Riga hielten, naja, Schwamm drüber.

Aber der wirklich interessante Aspekt ist der: Die Deutsche Bank contrived to collect a whopping 46% of the total expense of the bridge in Riga as interest payments. 46% der Gesamtausgaben bekam die Deutsche als Zinsen...

The Sui Northern Gas Pipelines Ltd (SNGPL) has initially scrutinised a list of about 6,000 domestic consumers who are ‘illegally’ using gas for standby power generation. The authorities will start checking of illegal gas-powered generators during house-to-house search and will cut connection on the spot. The SNGPL has warned that users of gas generators should register with gas authorities if they want to avoid action.

"Illegale" Stromerzeugung aus Gasgeneratoren... Warum bloß?

Im Grunde ist das die logische Fortsetzung von Energiekrise in Pakistan, Update: 11000 Megawatt Bedarf, 7000 Erzeugung.

http://www.thenews.com.pk/print1.asp?id=232480

According to the official figures, there was not even a single day during the last week when the power shortfall came down from 5,000MW, rather sometimes, it went above 6,000MW. It showed that one the temperature of the City abnormally went high as compared to the previous years while the generation of the National Grid of Pepco was standing where it was in the last year. Another reason, which Pepco gave, was the low hydel generation in comparison with the last year, which Wapda authorities kept on denying.

Oops, statt einer Verbesserung gab's eine Verschlechterung... wer hätte das gedacht?

With the start of the year 2010, the Pepco authorities again started claiming that loadshedding would end soon by the induction of 1,500-2,000MW power but that too did not happen. By the end of March 2010, the Engro Power (225MW) was inducted in the national grid but it was just peanuts vis-a-vis the current demand of around 16,000MW. Moreover, with the induction of Engro, there was not at all any decrease in loadshedding duration; rather it crossed the duration of 12 hours a day.

The shortfall between the demand and supply of Pepco’s national grid was still standing around 5,000MW on Saturday evening and loadshedding of over 12 hours was still being observed in Lahore negating the Pepco officials’ claims of nine and 11 hours of loadshedding in the urban and rural areas of the City.

Seufz.

An einen von der Binnennachfrage getriebenen britischen Aufschwung mag ich nicht glauben.

A damning report by the Confederation of British Industry calls on ministers to tackle the huge bill to look after millions of state employees in old age, which works out at a staggering £40,400 for every household in the UK.

40.400 Pfund pro Haushalt betragen die ungedeckten Pensionslasten der britischen Staatsangestellten. Das ist beeindruckend.

To compound the problem, the state workforce has grown by almost a million over the past decade to hit 6.1 million, or one in five workers. The depth of the funding crisis was underlined by a separate study revealing that local authority deficits have soared to almost £60billion.

[...]

Public sector pensions currently cost the taxpayer £14.93billion a year, a rise of 38 per cent in a decade. But more than five million people, including civil servants, teachers, NHS staff and members of the Armed Forces, are in schemes for which no money has been set aside.

Das kommt jetzt offenbar aus der Abteilung für Neusprech:

[...]

Ukraine will pay $330 per 1,000 cubic meters in the second quarter for Russian gas, up from $305.68 in the first quarter, Interfax-Ukraine news agency reported today. Oleksandr Kolodiy, a spokesman for the Fuel and Energy Ministry, declined to immediately comment.

Wenn man aus dem Stand heraus den höchsten Gang einlegt, ist garantiert, daß man nicht schnellstmöglich fertig wird...

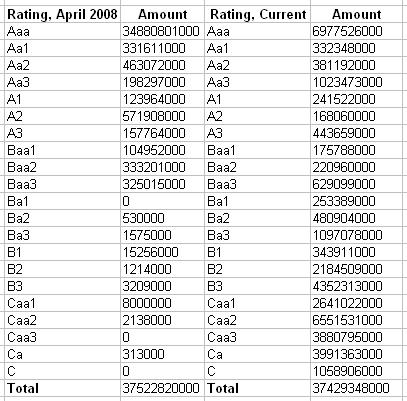

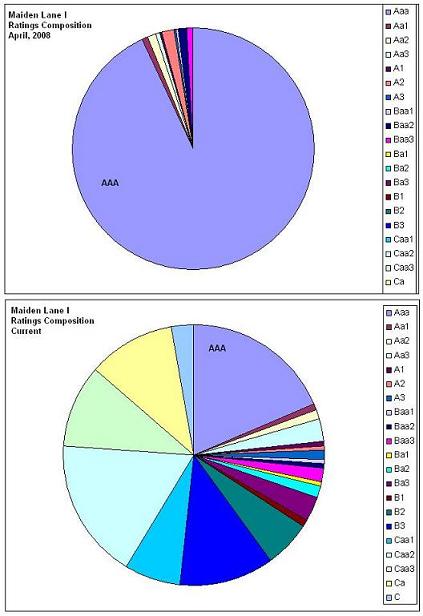

For simplicity’s sake we’ve translated long-term credit ratings from Standard & Poor’s and Fitch, into Moody’s ones, using a table along these lines. You can see a detailed definition of Moody’s ratings here, but suffice to say that anything below the Baa3 level is deemed non-investment grade.

Why focus on non-investment grade?

Because Federal Reserve chairman Ben Bernanke was very clear in April 2008, in his testimony to the US Congress, that the assets taken from Bear Stearns to collateralise the Fed’s $29bn loan were “entirely investment grade, entirely current and performing.” Taxpayers were not getting junk.

After a brief glance at a few bonds, we now know that’s not true.

Based on ratings data for the 1,000-or-so CUSIPS, we’ve found 10 bonds that were sub-investment grade when Bernanke made that statement. Admittedly, it’s not a lot out of 1,000, but it also means Bernanke’s statement wasn’t true. It either was all investment grade, or it wasn’t. Clearly, it wasn’t.

Nach meiner Lesart ist der von Bear Stearns übernommene Müll damit noch deutlich schlechter als der von AIG Übernommene.

[...]

Year Principal $K Percentage

2000 503 0.0%

2001 1,657 0.0%

2002 690 0.0%

2003 112,273 0.3%

2004 747,871 2.2%

2005 5,630,124 16.3%

2006 17,635,093 51.0%

2007 10,251,954 29.7%

2009 168,547 0.5%

Total 34,548,712

The average vintage is mid-2006, which is lousy for any debt portfolio on residential real estate in the US. I would expect bad performance from a portfolio with these characteristics.

Compared to ML III, ML II has better collateral, but worse vintage years. Both are messes. I am not saying that the Fed will necessarily lose money on either one, but I question the valuations on the assets.

Maiden Lane II: Müll, den die Fed AIG abgenommen hat.

- The average rating on the bonds in the portfolio is B-, with 61% rated CCC or lower. (Composite rating of Moody’s, S&P, and Fitch.)

- 98.3% of the portfolios are some type of CDO.

- On average, the deals owned were originated in 2006, with 73% between 2005 and 2007, and 96% between 2004 and 2008.

Maiden Lane III - der Müll, den die Fed AIG abgenommen hat - ist in der Tat Müll: 61% der Anleihen sind CCC oder schlechter geraten.

http://www.fns.usda.gov/pd/snapmain.htm

Zusammengetragen aus den verschiedenen Tabellen dort:

SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM: AVERAGE MONTHLY PARTICIPATION (PERSONS)

(Data as of March 30, 2010)

FY 2005 FY 2006 FY 2007 FY 2008 FY 2009 2005..2009

Personen 25,717,830 26,672,294 26,468,563 28,409,880 33,722,293 +31%

Haushalte 11,197,377 11,734,491 11,789,594 12,728,981 15,232,105 +36%

$/Person+Monat 92.57 94.32 95.63 101.52 124.45 +34%

33 Mio. von 309 Mio. Amerikanern erhalten also Ernährungsbeihilfen... und das Programm kostete 2009 insgesamt 76% mehr als 2005. Das ist mal eine beeindruckend wachsende Industrie...

This suggests the long post-Volcker period of declining yields has finally ended. [...] And, as the Greeks are discovering, rising bond yields add to the problems of a government with a weak economy and huge deficit.

Aber das Deleveraging ist ganz bestimmt vorbei!11!!

Diese Marktverzerrung nähert sich also dem Ende.

10200 Mw - durchaus beeindruckend.

Mit anderen Worten, Venezuela kann ab Ende Mai ein echtes Problem mit der Stromerzeugung der Wasserkraftwerke bekommen.

Nun gut, aber Venezuela hat viel Öl, und kann sicherlich ein bissel mehr Öl verstromen?

Nein, offensichtlich nicht: Dieser Musterstaat des modernen Sozialismus hat keine Reserven [footnote]was auf alle Musterstaaten des Sozialismus zutraf, soweit ich weiß.[/footnote]

Wie der Ölpreis reagieren wird, wenn Chavez wegen Wahlen mehr Öl im Inland verbrauchen läßt?

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=atnu8kBn2P3g

The Planta Centro power plant, which has total generating capacity of 2,000 megawatts, has been completely offline for three days, the national grid operator said today on its Web site. The plant is conducting maintenance work and will restart a 350-megawatt turbine tomorrow morning, with another turbine coming online April 15, Electricity Minister Ali Rodriguez said.

Chavez declared an electricity crisis in February and ordered companies and residences to cut power use by 20 percent to avert a collapse of the grid after a drought drained water from hydroelectric reservoirs. Venezuela depends on hydropower for more than two-thirds of its energy needs.

“We’re going to extend the presidential electricity emergency decree, probably for another six months,” Rodriguez said today at a press conference in Caracas. “We’ll progressively reduce rationing, but I can’t say when.”

Und dabei ist Venezuela ein _so_ reiches Land.

In the fourth quarter of 2009, the price of the Venezuelan oil basket averaged USD 70.20, thus leaving far behind a decline due the global financial crisis. However, the Gross Domestic Product fell by 5.8 percent.

The statistics show that in the fourth quarter of 2009, private consumption declined 6.7 percent, investment plummeted 19.6 percent, government spending slightly increased by 2.1 percent, although it was the smallest increase in the past seven years. The only positive data was the surge of Venezuelan oil exports (56.2 percent), due to the rebound in oil prices.

Den Daten fehlt natürlich das letzte bischen Genauigkeit - und hoffentlich sind sie bereits annualisiert...

Laut US Department of State (http://www.state.gov/r/pa/ei/bgn/35766.htm) hat Venezuelas BIP 2009 insgesamt 2.9% verloren, laut http://www.eluniversal.com/201 [verkürzt] ia-venezolana_02A3517091.shtml rund 3.3%.

Wollen Sie den Digest abbestellen?