| Sendedatum | 2009-09-29 16:14:26 |

|---|---|

| Ausgabe | 87 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Inhaltsverzeichnis:

- Climate Change in Alps to Leave Europe High and Dry

- Climate change may trigger earthquakes and volcanoes

- Unusual Arctic Warmth, Tropical Wetness Likely Cause for Methane Increase

- Four degrees of warming 'likely'

- World’s Oceans Were Warmest on Record in June Through August

- Science Report: Climate Change Speeding Toward Irreversible Tipping Points

- Pandas could be extinct in 2-3 generations

- World food aid at 20-year low, 1 billion hungry

- Baltic Dry Index Continues Leading The Stock Market

- Developing Nations May Reuse More Electronics Than Thought

- When will we hit peak oil? Try 2009

- Debt deflation laboratory of the Baltics

- Foreign Direct Investment in China Fell 35.7% in July

- Pleitewelle bei Zulieferern in Sicht

- German army stops wind turbines as security threat

- Iran's oil revenue plummets

- Winter gas shortage looms large for Iran

- Iraq's drought: Eden drying out

- Irland: Überblick

- Japan prices continue record fall

- Tuna Town in Japan Sees Falloff of Its Fish

- Oil and gas reforms announced after B.C. bombings

- Environmental Impacts of Oil Sands Development in Alberta

- Kenya's heart stops pumping

- Lithuania’s Economy May Start to Grow in 2010

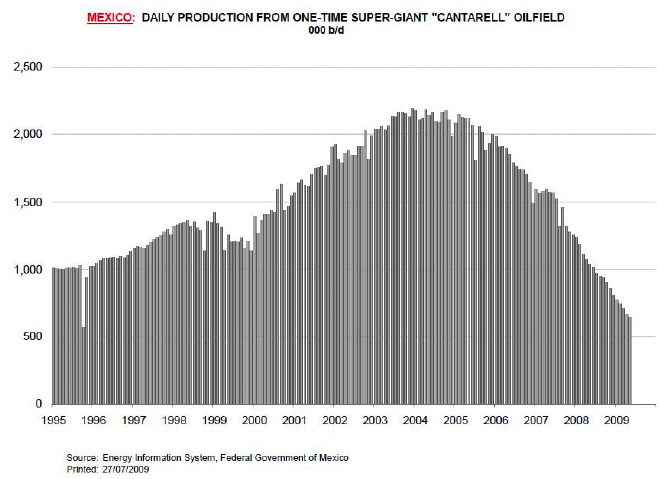

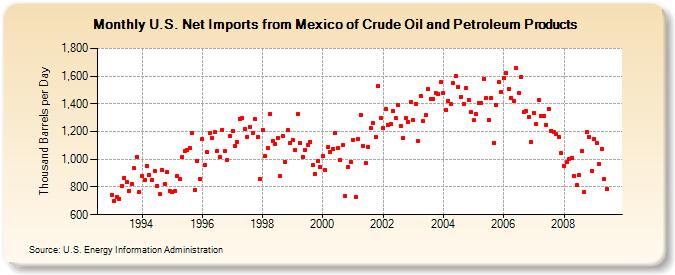

- Mexiko: Cantarell

- Mexiko: die anderen Ölfelder

- Pemex’s Export Revenues Down 55.5 Percent

- Mexico's Cantarell oil field may be stablizing

- Nepal feels heat of climate change

- Saudi not in favour of high prices

- Three Million Unsold Properties In Spain?

- Three Million Unsold Properties In Spain - Update

- Ukraine seeks new natural gas suppliers

- Detroit: The Death — and Possible Life — of a Great City

- The Quick Buck Just Got Quicker

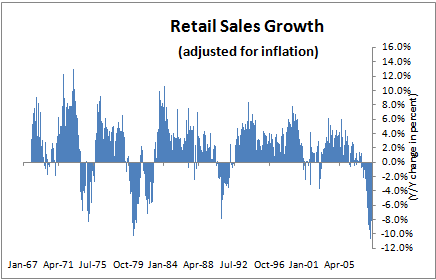

- US-Einzelhandelsumsätze

- Forty percent of U.S. junk bonds to default by 2013: BofA

- Hotel RevPAR off 18.3 Percent

- USA: Layoff Massacres Persist

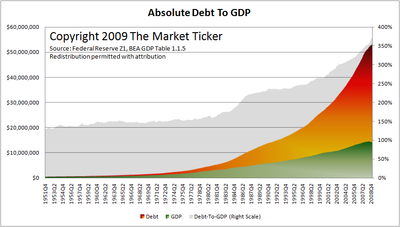

- WARNING: Deflationary Collapse Dead Ahead

- S&P cuts MBIA, MBIA Insurance as losses continue

- USA: Commercial Real Estate Sales 2009

- USA: If Housing Were Priced in Gold

- Luxury Hotels Risk Default as $850 Rooms Remain Empty

- Pork Drops 30% in Futures as Flu Cuts Chinese Imports

Inhalt:

Europe's Water Supply Threatened

As the changing global climate affects precipitation and snow-cover patterns in the Alps, it also impacts the amount of water these "water towers of Europe" can provide to millions of people in lowland areas. The vulnerable region is home to most of the headwaters of major rivers, including the Danube, Rhine, Po, and Rhone, and its glaciers provide 40 percent of Europe's fresh water.

[...]

The Alps, which traverse Austria, France, Germany, Italy, Liechtenstein, Slovenia, and Switzerland, host at least 4,500 plant species, more than a third of the flora recorded in Europe, including ferns, conifers, and flowering plants and almost 400 endemic species. According to the EEA, "the tree line is projected to shift upward by several hundred meters... restrict[ing] the alpine zone to higher elevations, severely threatening the alpine flora." Cold-water fish species including greyling, brown trout, perch, and Danube salmon are also already showing signs of stress from warmer water temperatures.

The team is confident that the two are linked. El Niño raises the local sea level by a few tens of centimetres, and they believe the extra water weight may increase the pressure of fluids in the pores of the rock beneath the seabed. This might be enough to counteract the frictional force that holds the slabs of rock in place, making it easier for faults to slip. "The changes in sea level are tiny," says Day. "A small additional perturbation can have a substantial effect."

Klingt widersprüchlich? Ist es aber nicht.

NOAA scientists and their colleagues analyzed measurements from 1983 to 2008 from air samples collected weekly at 46 surface locations around the world. Their findings will appear in the September 28 print edition of the American Geophysical Union’s Geophysical Research Letters and are available online now.

“At least three factors likely contributed to the methane increase,” said Ed Dlugokencky, a methane expert at NOAA’s Earth System Research Laboratory in Boulder, Colo. “It was very warm in the Arctic, there was some tropical forest burning, and there was increased rain in Indonesia and the Amazon.”

[...]

The finding was presented at an Oxford University conference exploring the implications of a 4C rise.

The results show a "best estimate" of 4C being reached by 2070, with a possibility that it will come as early as 2060.

4° bis 2060.

Alles wird warm.

The summer ocean surface temperature was 62.5 degrees Fahrenheit (16.95 Celsius), which is 1.04 degrees Fahrenheit above the 20th century average, the agency said today in a statement. The combined land and ocean surface temperature for the period was 61.2 degrees Fahrenheit, the third-warmest on record.

Eigentlich kann man den Artikel ganz zitieren, lesenswert ist jedes einzelne Wort:

This new analysis of the latest, peer-reviewed science indicates that many predictions at the upper end of the Intergovernmental Panel of Climate Change's forecasts are becoming more likely. Some events thought likely to occur in the long-term are already happening or will happen far sooner than had previously thought, the report shows.

[...]

The growth in carbon dioxide emissions from energy and industry has exceeded even the most fossil-fuel intensive scenario developed by the IPCC at the end of the 1990s. Global emissions were growing by 1.1 percent each year from 1990-1999 and this accelerated to 3.5 percent per year from 2000-2007.

Yet the scientists documented in the Compendium suggest that it may still be possible to avoid the most catastrophic impacts of climate change, but only if there is immediate, cohesive and decisive action to both cut emissions and assist vulnerable countries to adapt.

[...]

The observed increase in greenhouse gas concentrations is raising concern among some scientists that warming of between 1.4 and 4.3 degrees Celsius above pre-industrial surface temperatures could occur.

This exceeds the range of between one and three degrees perceived as the threshold for many "tipping points," including the end of summer Arctic sea ice, and the eventual melting of Himalayan glaciers and the Greenland ice sheet.

[...]

The report indicates losses of tropical and temperate mountain glaciers affecting from 20 to 25 percent of the world's population in terms of drinking water, irrigation and hydro-power.

[...]

Management alternatives suggested include large-scale translocation or assisted colonization of species; eco-agriculture, in which landscapes are managed to sustain a range of ecosystem services, including food production; and the use of biochar, biologically-derived charcoal that is mixed in soils, increasing fertility and potentially locking up carbon for centuries.

Experts increasingly agree that active protection of tropical forests is a cost-effective means of cutting global emissions. An international mechanism of reducing emissions from deforestation and forest degradation, REDD, is likely to emerge as a central component of a new agreement in Copenhagen.

The problem is that the pandas' habitat is being split up into ever smaller patches, preventing the animals from roaming freely for mating partners and in turn endangering their gene pool, the Global Times reported.

"If the panda cannot mate with those from other habitats, it may face extinction within two to three generations," said Fan Zhiyong, Beijing-based species programme director for WWF. "We have to act now."

The risk of inbreeding is increasing, threatening to reduce the panda's resistance to diseases and lowering its ability to reproduce, the paper said.

[...]

To date the WFP has confirmed $2.6 billion in funding for its 2009 budget of $6.7 billion.

Ja, kein Wunder, wir mußten ja hungrige Bankster retten.

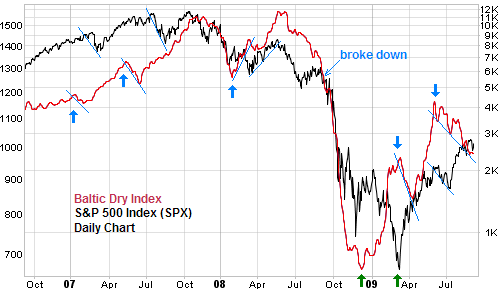

I hinted towards this early in the year when it looked like it had put in a significant bottom and I wondered if the Baltic Dry Index would lead the stock market higher. Of course, we now know it certainly did.

The index measuring international shipping rates around the world bottomed in early December 2008 three months ahead of the stock market (green arrows):

Korrelation?

Also from the article, written by Kellyn S. Betts:

The researchers determined that once the computers entered the country, they were generally handled in a very efficient way by the country's reuse and recycling sector in a "reverse supply chain". In the metropolitan capital Lima, the team documented that informal and formal businesses act together to generate a "highly dynamic flow [that] reuses and recycles almost every part and material found in a computer," Williams says.

Das könnte man für vorbildlich halten.

"This is our view -- capacity has pretty much peaked in the sense that declines equal new resources," Iain Reid, head of European oil and gas research at Macquarie, told Reuters.

http://blogs.ft.com/energy-source/2009/09/18/not-your-average-peak-oil-theory-from-macquarie/

Here’s the most alarming graph:

Property prices in Estonia's Hanseatic capital of Tallinn have fallen by 59pc from their peak in the Baltic boom, a remarkable state of affairs for an EU country nestled against Russia on the most dangerous fault line in Europe.

Cost per sq.m has dropped from €1,611 (£1,455) to €669 since April 2007, according to Ober-Haus Real Estate Advisors. Swedbank says up to 30pc of its mortgages in Estonia are in negative equity. Recent loans are in euros – not the local kroon.

[...]

The economy will contract by 14.5pc this year, twice as bad as Iceland (OECD forecasts). Industrial production has fallen 28pc. The unemployed receive half their former pay for a few months, then benefits fall to £12 a week. The shock awaits this winter. Chief victims will be ethnic Russians on the lower rungs of industry.

Investment declined 35.7 percent from a year earlier to $5.36 billion, the Commerce Ministry said at a briefing in Beijing today. That compared with a 6.76 percent drop in June.

The situation for foreign direct investment in China remains “severe” even as “positive signs” have emerged in the past two months, Vice Commerce Minister Fu Ziying said last week. Japan emerged from its worst postwar recession in the second quarter, the Cabinet Office said today in Tokyo, and a Bloomberg survey of users shows confidence in the world economy surged to a 22-month high in August.

"Bei rund 750 mittelständischen Automobilzuliefern sind 170 Unternehmen in Deutschland in die Kategorie 'akut insolvenzgefährdet' einzuordnen", schreibt Professor Ferdinand Dudenhöffer, Direktor des Center Automotive Research an der Universität Duisburg-Essen, in einer Gemeinschaftsstudie mit der Unternehmensberatung Struktur Management Partner.

Das unter anderem vom deutschen Branchenverband VDA erhoffte Ende der Talfahrt in der Autoindustrie sei nicht in Sicht, lautet das Fazit der Untersuchung. "330 Unternehmen oder 44 Prozent aller Zulieferer sind nach Einschätzung der Banker 'gefährdet, aber rettbar' - und nur ein Drittel aller Zulieferer, also 250 Unternehmen, sind aus Bankersicht problemlos", heißt es in der Studie.

67 Prozent sind also gefährdet, und davon ist ein Drittel hin.

Hey, das klingt ja wie, äh, dieses Gespenst mit D am Anfang... dieses Wort, was man nicht kennt in D-Land...

Auf dem Weltmarkt für Autos sehe es ebenfalls düster aus. Allein China weise ein stabiles Wachstumsmuster auf - aber das Land steht derzeit nur für 13 Prozent der weltweit verkauften Autos. Audi beispielsweise teilte am Montag mit, im September ein zweites Werk in China mit seinem dortigen Partner First Automobile Works zu eröffnen.

Die übrigen Fahrzeugmärkte seien dagegen fragil, schreibt der Auto-Experte. Die Pkw-Verkäufe in Europa - einschließlich der EU-Erweiterungsstaaten und Ost-Europa mit Russland - dürften 2010 auf rund 15,3 Millionen sinken.

In Westeuropa würden 2010 seit langer Zeit mit 11,9 Millionen Pkw-Verkäufen weniger als 12 Millionen Pkw zugelassen. "Unter Ende der Talfahrt stellt man sich eigentlich etwas anderes vor", lautet das Fazit.

Mir ist ja nicht ganz klar, warum Opel gerettet werden muß. Um irgendwoanders Produktionskapazitäten stillegen zu müssen, in einem Konzern, der nicht sowieso schon wackelt?

The Bundeswehr has launched an investigation into the impact of the wind turbines planned for northern Germany's coastal area amid concerns they could compromise air defense -- because they could in theory provide a shield for enemy aircraft.

vielleicht müßte man der Bundeswehr mal den Saft abstellen, damit die Leute dort verstehen, wofür man Windparks baut...

Hamid Hosseini, who heads the Iranian Oil Product Exporters Union, said revenue from the export of Iranian oil products was $1.57 billion for the first five months of the Iranian year, down from $3.26 billion in the same reporting period in 2008, state-funded broadcaster Press TV reports.

Ergo: circa 300 Mio. pro Monat.

http://www.upi.com/Energy_Reso [verkürzt] screpancies/UPI-38201253740655/

[...]

The newspaper reported that the $25 billion shortfall in official statistics inside the government widened following the publication of statistics by the Central Bank about Iran's imports and exports during the last few years, highlighting that the statistical difference by the Central Bank and the Oil Ministry during the four-year period of Iran's ninth government is over $27 billion.

Huh?

4 Jahre a 12 Monate a 300 Mio. macht laut meiner Rechnung... 14.4 Mrd.

Wie in aller Welt können davon 27 Mrd. fehlen?

Iran has bought its first diesel cargoes for six months in September to supplement gas it is burning in power plants.

The country sits on the world's second-largest gas reserves but has failed to develop them fast enough to meet domestic demand.

[...]

"It seems because of the protective (subsidy) policies, in all fields, waste is prevalent ... Growth in gas consumption in the first half of the current year exceeded average consumption in the corresponding period last year by 30%."

Earlier this year, Iranian officials were so confident gas supplies would be sufficient to meet demand that they allocated no money from the federal budget for diesel imports.

Then, officials said increased output from the world's largest pure gas field at South Pars would be enough to meet demand.

Mirkazemi said Iran's gas industry was lacking around $16 billion in funding.

[...]

At the National Centre for Water Management in Baghdad, senior engineer Zuhair Hassan Ahmed showed me graphs recording the levels of the two rivers over the past 10 years.

The "water year" starts in October. The hand-drawn lines for 2008 and 2009, for the Tigris and the Euphrates, confirm that their levels are well below the mean.

And Mr Ahmed explains that drought in Iraq is only part of the problem. The shortage of water for each river, he tells me, is caused mainly by lack of rain and snowmelt in the mountains of Turkey where the rivers rise.

Another factor is a series of dams on the Euphrates in Turkey and Syria, reducing flow before the river enters Iraq.

http://www.finfacts.ie/irishfinancenews/article_1017971.shtml

http://www.finfacts.ie/irishfinancenews/article_1017950.shtml

http://www.finfacts.ie/irishfinancenews/article_1017949.shtml

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aqeTAJ5shNg0

[...]

In what may be the biggest financial gamble in 87 years as a sovereign state, the government will spend about 28 percent of the country’s gross domestic product for 2008 to become the owner of loans for property developments that are plunging in value. Ireland is suffering the worst economic slump of any developed nation since the Great Depression, according to the Economic & Social Research Institute in Dublin.

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aDNRNO_7POaI

“We are familiar with the specter of the ghost village that have seven or eight housing developments but hardly a house sold,” said Joan Burton, finance spokeswoman of the opposition Labor Party. “All of us have been in NAMA-land.”

In absoluter Kurzform: In Irland ist alles so, wie es vor dem Boom war, nur mit mehr Leerstand und mehr miesen auf den Konten.

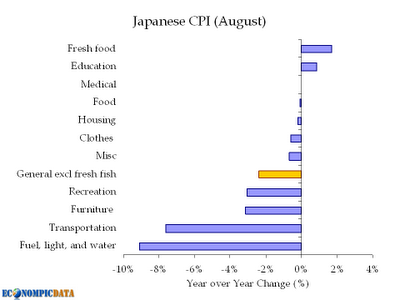

Official figures showed core prices, which exclude those of volatile fresh food, fell for a sixth month in a row.

The record fall for August was due to lower petrol and other energy costs as well as weak domestic demand.

http://econompicdata.blogspot.com/2009/09/deflationary-spiral-in-japan.html

Econompicdata hat dazu dies:

Ein Rückgang um 90%.

Und wer ist Schuld?

Und was wird dagegen getan?

Nichts.

Warum sollte man auch etwas gegen die Vernichtung der Umwelt tun? Wenn man es nicht selber macht, würden es ja Andere tun.

There have been six explosions targeting EnCana Corp. gas projects in northeastern B.C. since October last year, when an anonymous letter was sent to the Dawson Creek newspaper, warning EnCana to stop drilling and leave the area, about 600 kilometres northwest of Edmonton.

In the wake of six bombings targeting natural-gas pipelines on the B.C.-Alberta border, the B.C. government announced Friday a package of reforms aimed at improving relations between the oil and gas industry and residents.

Siehe auch Re: Alles wird gut!!!55! - Kanada: Angriff auf Gasproduktion.

renaturisiert wird, aber anders...

[...]

There are currently over 720 billion litres of toxic tailings on the landscape in the Athabasca oil sands area. These ponds cover an area of more than 130 square kilometres. By 2040 these tailings are expected to occupy 310 square kilometres, an area nearly the size of Vancouver. No tailings ponds have been reclaimed to date.

[...]

A dominant plan for reclaiming liquid tailings at mine closure is to deposit them in end pit lakes. Tailings would be dumped into old mine pits and capped with water from the Athabasca River. This method is unproven. The concern is that the water and tailings layers will mix and there is also some fear that the end pit lakes will be unable to sustain aquatic life. However, many mining projects to date have been approved based on dealing with tailings in this manner. A fully realized end pit lake has not yet been constructed.

Endlagerung auf kanadisch, genauso überlegt wie anderswo.

In Kenia hat der Kahlschlag der Wälder verheerende Folgen. Mit der Abholzung der Bäume blieb der Regen aus. Die Region um den Mau-Wald war einst die grüne Lunge Kenias. Jetzt ist sie zum größten ökologischen Problem des Landes geworden.

[...]

Luftaufnahmen zeigen, dass etwa ein Drittel der Bäume im Mau-Wald verschwunden ist. Über ihren Wipfeln hatte sich sonst kühle Luft gebildet. Die stieß mit warmer Luft vom einigen hundert Kilometer entfernten Victoria-See zusammen. Die Folge: Regen. Aber jetzt gibt es keine kühlen Luftmassen und folglich auch keinen Regen mehr. Die zwölf Flüsse, die im Mau-Wald entspringen, führen kaum noch Wasser. Dadurch können sie auch die Seen der Umgebung nicht versorgen.

[...]

Die Versorgung von mehr als fünf Millionen Menschen mit Wasser ist gefährdet.

[...]

Und auch die kenianischen Wildparks sind bedroht. Die legendäre Tierwanderung in der Maasai Mara, ein Schauspiel, das jedes Jahr Tausende Touristen lockt, wird diesmal wohl ausfallen. Der Fluss, den Gnus und andere Wildtiere alljährlich überqueren, führt kein Wasser. In vielen Regionen des Parks überleben die Elefanten, Zebras und Gazellen nur, weil Wildhüter sie mit Wasser versorgen, sagt Anne Kahiya von der Parkbehörde. Doch selbst das ist nicht ganz einfach. "Wir nutzen unsere Bohrlöcher. Aber auch von denen sind viele schon ausgetrocknet. Wir pumpen für eine kurze Zeit Wasser herauf, aber dann kommt nichts mehr und wir müssen warten, bis sie sich wieder auffüllen." Bald könnte das Wasser auch dort endgültig versiegen, befürchtet Kahiya. Dann werden die Tiere Zuflucht in anderen Parks suchen - oder sterben.

Auch die BBC hat etwas darüber:

http://news.bbc.co.uk/2/hi/africa/8057316.stm

http://news.bbc.co.uk/2/hi/africa/8055553.stm

Und natürlich hat sie auch Bilder. Das hier war mal ein See:

Die Bauern werden nun umgesiedelt, aber sind sie die Schuldigen? Oder viel mehr weitere Opfer?

http://www.survival-international.de/nachrichten/308

Obwohl das Volk der Ogiek den Wald immer schonend genutzt hat, behauptet Kenias Regierung, er müsse vor diesen Jägern und Sammlern geschützt werden. Inzwischen hat die Regierung fast 60.000 ha des betroffenen Waldes für die private Nutzung frei gegeben. Nicht die Ogiek, sondern vor allem Unternehmer wie Teeplantagenbesitzer und Holzfäller sowie Siedler aus anderen Gegenden des Landes werden davon profitieren. Drei einflussreiche Holzfällerunternehmen – Pan African Paper Mills, Raiply Timber und Timsales Ltd. – haben ihre Arbeit bereits aufgenommen.

Mich dünkt, die Ogiek haben verloren, die Holzfäller gewonnen, und alles wird gut.

Immerhin, so lernt die Welt vielleicht, wie man Urwälder regeneriert...

“Under positive external conditions, a recovery, even if at very low growth rates, may begin next year,” Sarkinas said in an interview in Vilnius yesterday.

The government of Prime Minister Andrius Kubilius expects the economy to contract 4.3 percent next year as the Baltic state adapts to tough austerity measures needed to comply with euro adoption terms. Lithuania, like neighboring Latvia and Estonia, pegs its currency to the euro inside the exchange rate mechanism, obliging the government to deflate the economy to stay competitive instead of relying on a weak litas.

Naja, dann wünsche ich euch mal sehr positive externe Bedingungen, aber ganz ehrlich: ich glaube nicht, daß sie kommen, und ich glaube nicht, daß eine schwache Erholung für einen so fürchterlich gebeutelten Staat sich anders anfühlt wie eine Fortsetzung der Depression.

Und die Auswirkungen auf den großen Nachbarn?

Ein Gutes hat das ja: Wenn mehr Öl aus weiter Ferne herbei geschafft werden muß, liegen weniger Tanker still herum

KMZ: "before declining ... next year". Oops - Peak auch da.

Most Chicontepec crude is heavy, some as heavy as 18° gravity. The reservoir is highly fractured and at low pressure, and the region lacks infrastructure for large-scale development. Low permeability makes extraction difficult. On top of that, some analysts suggest Pemex systematically exaggerates the recoverable oil in the basin.

30000 b/d jetzt, 700000 in 2017, in einem extrem schwierigen Gebiet. Naja, für mich klingt das, als bräuchte Mexiko hohe Ölpreise um nur alleine die Förderkosten herein zuz bekommen.

Was für eine schlechte Ausgangsbasis: Mexiko hat drei Waren für den Export: Arbeitskraft (momentan in den USA nicht benötigt), Drogen/Kriminalität (nicht gewünscht) und Öl (davon immer weniger), und verbraucht gleichzeitig immer mehr Öl selbst.

Um es auf den Punkt zu bringen: Der Export von Menschen und Drogen wird massiv zunehmen.

Mexico pumped 2.542 million bpd in August, a decline of 7.9 percent on a year ago but production at Cantarell edged higher for the first time in more than two years.

[...]

The Cantarell unit, which includes the giant field along with several nearby satellite reservoirs, produced 650,154 bpd in August, up from 646,557 bpd in July, according to the energy ministry. Output at Cantarell was 34 percent below what it yielded in August 2008.

Cantarell auf dem Weg der "Besserung", aber...

keine gute Nachricht aus Mexiko ohne eine Schlechte dabei.

However, this time it is so hot that there is no such preparation so far.

[...]

In several places, farmers have cut down the apple orchards since the fruit they produced were invested with larva. Now, they are trying to grow vegetables and corn -- crops usually associated with lower altitudes and warm temperatures.

Winter snowfall, once a regular feature, has now become a rare event, leading to the decline of snow deposits, and exposing the black rocks of high mountains where permanent snow cover used to be a key feature.

[...]

To the worry of the local people, water sources are drying up and livestock, particularly goats, are dying in large numbers due to diseases linked to unusually dry and warmer weather.

Ali Al Naimi also said $75 a barrel was a fair price for oil and he saw no need for Opec to change production levels ahead of the group's next meeting in December, according to a transcript of an interview with a US television channel.

Hm, ja, 75 Dollar sind ein fairer Preis. Jedenfalls fair insofern, daß es sich nicht lohnt, in der Tiefsee zu bohren...

- At end of 2008 the supply of property for sale or under construction was 1,623,042, of which roughly 580,000 were resales, 500,000 newly built but unsold, and 470,000 under construction and nearing completion.

- Annual demand estimated as follows: 233,000 in 2008, and 218,000 in 2009.

- That means there are some 1,6 million homes on the market, whilst demand in the next few years is expected to run at around 220,000 homes. At current levels of demand it will take 6 to 7 years for the real estate sector to recover. So it could take until 2016 for the market to digest the current property glut.

- The only way developers and banks will get rid of the glut of property in the medium term is selling at a loss.

- After falling 1.83% in 2008, overall prices will fall 9.55% in 2009, 9.32% in 2010, and 4.81% in 2011, a cumulative fall of just under 25.5% in nominal terms.

- Thanks to long lead times in the construction business, the full economic impact of the collapse in residential construction is yet to be felt. The darkest hour for the Spanish economy will come in the second half of 2010, when unemployment could reach 25%.

- Developers will go out of business in greatest numbers during 2010 and 2011. “It gets increasingly harder for developers to refinance with assets they either can’t sell or which are already mortgaged, and are increasingly devalued,” said Fernando Rodríguez y Rodríguez de Acuña, who predicts that 75% of developers will be wiped out in the next 5 years by a combination of too much debt, the market slump, and “bad management”.

http://fistfulofeuros.net/afoe [verkürzt] ion-unsold-properties-in-spain/

Edward Hugh fügt dazu:

Personally I would only add two further points of my own.

Firstly the estimate of 25% unemployment by the end of next year contained in the report may well be on the low side, especially if the Spanish government is running out of funding for the stimulus programmes. Spanish INEM employment department officials have already leaked estimates that if the Plan E type projects are not renewed, then we could see something like 700,000 additional unemployed in October and November of this year alone. If these warnings turn out to be realistic then my feeling is that we will hit 25% unemployment around Easter, and then start heading up towards 30%. We should break through the 30% level around the turn of 2010/11 or by the spring of 2011, depending on a lot of factors which are still hard to see at this point.

[...]

My second observation is merely anecdotal, but the Acuña & Asociados report places a lot of emphasis on the coastal situation, which has, to some extent, already been “factored in” by most participants, however quite by chance I have talked with a number of people in recent days who have stressed with me just how serious the situation is in the satellite towns around Madrid, built as they have been for Ecuadorians who never arrived, or Romanians who have already left. I think this element is yet awaiting a proper accounting, and the cost is unlikely to be small.

Ich kann da keine Spur einer positiven Nachricht drin entdecken.

Update zu Three Million Unsold Properties In Spain?:

Oops - ein Preissturz mehr als 30% von 2007-12 bis 2009-09.

Wenn ich mir die Liste auf http://www.idealista.com/news/archivo/2009/09/17/0102112-gobierno-destapa-22-puntos-negros-precio-vivienda-nueva-ha-desplomado ansehe, glaube ich eher nicht, daß die offiziellen 8% Immobilienpreisverfall irgendetwas mit der Realität zu tun haben...

Ukraine currently imports all of its natural gas from Russia, and in the last several years has been involved in pricing disputes with Moscow.

Urging his colleagues to look beyond the present arrangement to diversify Ukraine's natural gas supplies Sokolovsky said, "Russia and Ukraine have the intergovernmental agreement of Oct. 4, 2001, which includes an item on transit of Russia's gas via Ukraine. This document is effective in the period up to 2013," an arrangement which he said causes "discomfort" for Ukraine as it constrains its supply options.

Spätestens 2013 wird die Frage der europäischen Gasversorgung wieder interessant - falls die Ukraine nicht zwischendurch wieder einen Anfall von Pleite bekommt. Und warum sollte sie nicht?

But a study of changes made in pay practices by 191 of the nation’s largest companies this year shows that where pay is concerned, enlightenment remains a long way off. In other words, meet the new pay, same as the old.

[...]

The biggest shock? Instead of seeing a greater reliance on long-term incentive programs, the Reda report found that changes in these companies’ plans made short-term incentive pay a bigger part of the compensation pie. Let me say that again: The plans — despite the calamities that short-term profiteering has visited on our economy — made short-term incentives a bigger component of compensation.

[...]

Mr. Reda said he suspected that the increased reliance on short-term incentive pay that he found was a result of the precipitous declines in many of these companies’ share prices. Indeed, he found that the greater the drop in a company’s stock price, the more likely that its pay program was changed.

There were a variety of changes made to incentive pay that wound up skewing companies’ total packages toward short-term performance. First were the adjustments made to long-term incentive grants, like decreasing the value of awards or dispensing the same number of shares regardless of a decline in their value.

Among short-term incentive programs, some companies moved to discretionary plans, widened payout ranges or lowered performance hurdles.

The end result was a greater reliance over all on short-term incentive pay. And that invites riskier behavior among executives, Mr. Reda said.

Change we can believe in, indeed.

Ich bleib' derweil mal bei meiner Prognose, daß Preissteigerungen in der nächsten Zeit kein Problem sind.

By contrast, the cumulative five-year default rate was about 30 percent in the last two default cycles, Bank of America said in a report.

Überraschung: Junk bonds sind nicht die beste Investition in schlechten Zeiten.

Hotelertrag pro Raum in den USA:

Und hier die Hotelauslastung:

Warum das wichtig ist?

After Labor Day business travel becomes far more important for the hotel industry than leisure travel, and so far there is no evidence that business travel is recovering significantly

Wir wissen ja, das Schlimmste ist vorbei, aber...

Karl Denninger, sowieso selten durch Zurückhaltung auffallend, hat sie hier ganz aufgegeben.

Not "might collapse."

Not "might get bad."

WILL COLLAPSE.

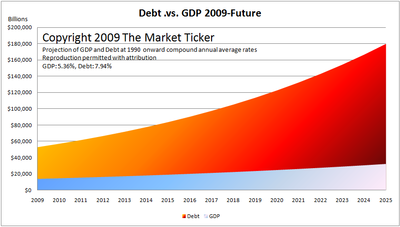

Er garniert das mit der folgenden Graphik über das US-BIP im Verhältnis zu den Gesamtschulden der USA:

Do you really believe that those interest payments can be made?

http://market-ticker.org/archi [verkürzt] lationary-Collapse-Ticker.html

In diesem (im gleichen Stil geschriebenen) Text geht er dann auf diverse Kritik ein, die das so nicht glauben wollte:

Oh yes it is.

In fact, I was being rather reasonable, in that I was using time periods going all the way back to the 1950s.

But - let's focus in on "closer to today", specifically, 1990 forward.

I think we can all agree that the 1990s were tremendously good times for GDP, and were not nearly so destructive for debt, right?

Ok.

Well, I hate people telling me they think I'm being unrealistically "doom and gloomish", so I "de-theoreticalized" that chart a bit, and picked on more-recent times where the growth rates were pretty darn good and some of the really-expansive debt periods, particularly from the 70s, were not included.

Here are the ugly facts - not conjecture, not assumptions, not going back 50 years data, current and unassailable facts.

During the period from 1990 onward, GDP grew at a compound annual rate of 5.361%1. Debt during the same period, nearly 20 years, grew at a compound annual rate of 7.9401%.

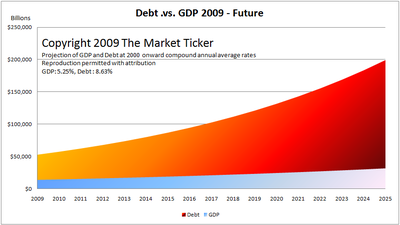

It is worse if you look at 2000 onward - there GDP growth was 5.25% on an average annual basis, while debt growth was 8.6279%.

I thus have "recast" the 20-year forward graph for you in two forms - one assuming we can maintain the 1990 onward rates (which are more favorable) and the second assuming that the 2000 onward rates are what we face going forward.

Zuerst die optimistischere Vorhersage (USA wächst und verschuldet mit den Werten der 90er Jahre):

Und dann die weniger positive (die Zahlen der 2000er):

S&P cut MBIA Insurance two notches to BB-plus, one step below investment grade, from BBB. MBIA Inc was also cut one notch to BB-minus, three steps below investment grade, from BB.

The outlook for both companies is negative, indicating additional downgrades may be likely over the next one-to-two years.

S&P ist schnell wie immer.

2007-Q2: $114 Mrd.

2008-Q2: $30 Mrd.

2009-Q2: $5 Mrd.

Wenn diese Tendenz anhält, kann man an dieser Stelle nächstes Jahr "Mio." schreiben.

Ahem, wie paßt das eigentlich zur Inflationsgefahr?

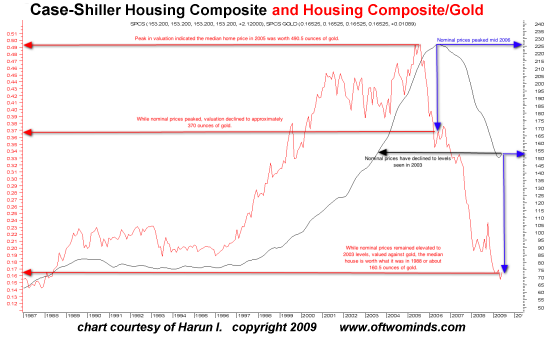

Eine interessante Betrachtung der Entwicklung der US-Immobilienpreise:

Loans secured by more than 1,500 hotels with a total outstanding balance of $24.5 billion may be in danger of default, according to Realpoint LLC, a credit rating company that tracks commercial mortgage-backed securities. Some of the biggest loans, put on the company’s watch list because of late payments, decreasing occupancies or cash flow, were made to luxury properties where rooms can cost more than $850 a night.

“All segments are showing signs of distress but the luxury segment carries much higher loan balances and is more clearly affected,” Frank Innaurato, managing director of CMBS analytical services at Horsham, Pennsylvania-based Realpoint, said in a telephone interview.

Wer hätte das gedacht? Luxushotels in Schwierigkeiten, weil die Räume für 850 Dollar pro Nacht leer bleiben?

Hinweis: Hog=Schwein.

Swine flu will contribute to an 11 percent drop in global pork trade this year, even after scientists said the meat is safe to eat, United Nations data show. Slumping exports, the global recession and improvements in breeding methods left U.S. inventories in June at a record high level for the month.

“What do we do with all these hogs?” said David Kruse, a commodity trading adviser at CommStock Investments Inc. in Royal, Iowa. “The industry is just not structured to modify production in response to reduced demand. The industry is basically structured to go broke. It will produce hogs until it runs out of money.”

[...]

Farmers are losing $30 to $35 on every pig they sell this month and may not make money until May, Grimes said. Producers have been unprofitable for 20 of the 22 months through July, and more than 5,000 of them may need to exit the business, he said. Only then would the breeding herd shrink by the 10 percent needed to spark a turnaround, he said.

[...]

Total U.S. shipments sank 20 percent through June from a year earlier to 1.985 billion pounds, the government said Aug. 13. Wholesale pork plunged 44 percent to 52.52 cents a pound since prices set a record of 94.41 cents in August 2008. Only natural gas performed worse than hogs this year on the Reuters/Jefferies CRB Index of 19 raw materials, dropping 42 percent.

Aus irgendeinem Grund überrascht mich das nur wenig.

Wollen Sie den Digest abbestellen?