| Sendedatum | 2009-08-16 17:08:34 |

|---|---|

| Ausgabe | 86 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

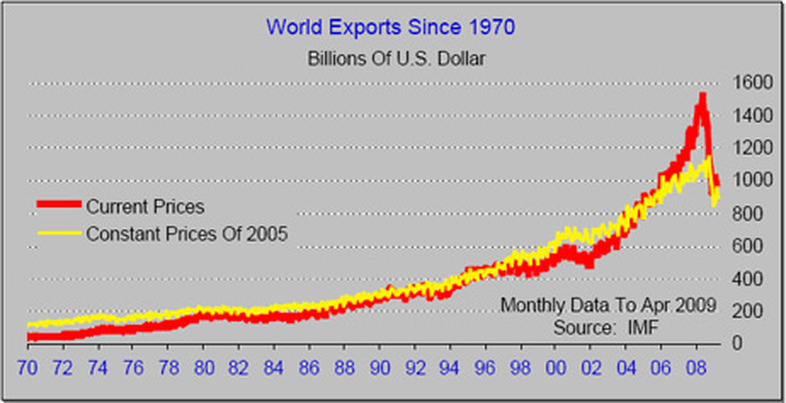

Als Einstimmung eine Darstellung des Welthandels seit 1970:

(Quelle)

Inhaltsverzeichnis:

- Antarctic glacier 'thinning fast'

- Second Warmest July on Record Globally, according to NASA

- Hunger hits Detroit's middle class

- The wildebeest river is running dry

- New El Niño threatens world with weather woe

- Sub-Arctic timebomb: warming speeds CO2 release from soil

- Climate fixes 'pose drought risk'

- Extinction hits 'whole families'

- Typische Bärenmarktrally?

- There's no quick fix to the global economy's excess capacity

- Eurozone GDP Upside Surprise

- The debt-inflation myth, debunked by UBS

- Proven oil reserves of OPEC go up to 1.02 trillion barrels in 2008

- Warning: Oil supplies are running out fast

- Oil contango boosts crude storage at sea-sources

- Shipping Industry Fights for Survival

- Gas flows through Ukraine tumble

- Beijing sets date for emissions cut

- China: Reich der Schönrechner

- China: Bogus Boom?

- China relaxes one-child rule to beat pension crisis

- China warns of 'grave' jobs situation

- China: SMEs' H1 Electricity Use Down 50%

- China’s July Power Use Rises 6% on Economic Recovery

- Germany's gold is in U.S. custody, Bundesbank confirms

- Viele Hotelzimmer bleiben leer

- Plague strikes French oysters

- India's water use 'unsustainable'

- Indian land 'seriously degraded'

- India plans to build 100 warships

- Iraq in throes of environmental catastrophe, experts say

- Japanese prices in record decline

- Global Demand Freefall Waning... Japanese Export Edition

- Kanada: Caisse de dépôt takes $5.7-billion hit

- Kenya to Spend 24 Billion Shillings to Counter Drought Threats

- Latvia’s Economy Contracted Record 19.6% Last Quarter

- Pemex Needs Oil at $70 a Barrel to Sustain Projects

- Analysts skeptical about Pemex's 2009 production forecast

- Mexican Drug Gangs Diversify Into Oil

- Polish Government Approves Asset Sales to Cover Swollen Deficit

- Russia's economy contracts 11pc as Putin model hits 'dead end'

- Spain's Economy Shrinks Again

- UK: Young jobless count climbs to 'crisis' point of 1 million

- Britain's energy crisis

- GM gets to dump its polluted sites

- GMAC: Das Leben geht weiter

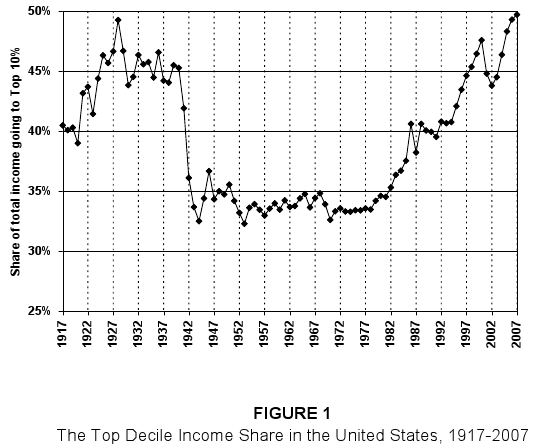

- Einkommensverteilung in den USA

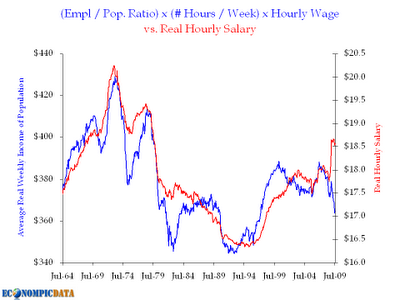

- USA: "Average" Real Income of the Population

- American Incomes Head Down, Threatening Recovery in Spending

- USA: Thank God For Government Spending

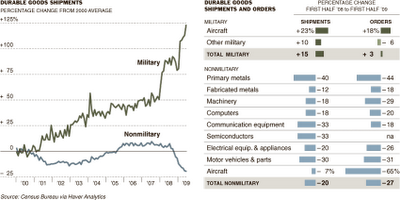

- Military vs. Non-Military Durable Goods in Pictures

- ‘Underwater’ Mortgages to Hit 48%, Deutsche Bank Says

- USA: Foreclosures: One Giant Wave, Still Building

- USA: Home foreclosures set another record in July

- USA: average number of weeks of unemployment

- Option ARM Defaults Shrink Recast Wave, Barclays Says

- ‘Lost Couple of Decades’ Looming for U.S. Economy

- How tiny striped molluscs are muscling in on America's water supply

- Post-Crash Dynamics

Inhalt:

A study of satellite measurements of Pine Island glacier in west Antarctica reveals the surface of the ice is now dropping at a rate of up to 16m a year.

Since 1994, the glacier has lowered by as much as 90m, which has serious implications for sea-level rise.

[...]

Calculations based on the rate of melting 15 years ago had suggested the glacier would last for 600 years. But the new data points to a lifespan for the vast ice stream of only another 100 years.

Im Grunde genommen nichts Neues: ein großer Gletscher in der Antarktis schmilzt. Kennt man ja...

Und daß er (siehe URL) 3cm zum Meeresspiegel beitragen wird, und das Eis hinter ihm noch mal 20 bis 30cm, ist auch nicht _so_ neu.

dieser Gletscher hält sich nicht an die Vorhersagen, er wagt es schneller zu schmelzen (und insbesondere hat er die Frechheit, nicht linear, sondern exponentiell zu schmelzen).

anderswo (Arktis) sieht es ähnlich aus.

The global land-ocean temperature anomaly for July 2009 was +.60 Celsius or +1.08 F. Only July of 1998 (a strong el nino year) was warmer.

The image below shows the July 2009 anomalies across the globe (warm is red, cool is blue). Clearly the reds and oranges far outweigh the blues on this map.

Die restlichen Graphiken auf der Seite lohnen sich auch. Sie zeigen, daß sich die Pole durchaus stärker erwärmen als der Rest.

"We've seen about a third more people than before," said Jean Hagopian, a volunteer at the New Life food pantry, part of the New Life Assembly of God church in Roseville, a suburb some 20 miles northeast of Detroit.

Gleaners, an agency that distributes excess food donated from food processors, says their distribution is up 18% from last year. Michigan Department of Human Services, which handles federal food assistance like food stamps, WIC checks and such, has seen a 14% spike in applications since October. Calls to the United Way's help line have tripled in the last year.

Now it's middle class folks who lost their $60,000-a-year auto job, or home owners who got caught on the wrong side of the real estate bubble.

[...]

But this year there is something missing – the water. "This is the first year we've ever seen the river this low," says Will Deed, who works with the Mara Conservancy, a not-for-profit group which manages one third of this huge reserve.

"In parts there's just small channel, one or one-and-a-half feet deep." In the same stretches of the river last year the water was as deep as five feet and "the wildebeest and zebra were up to their chests or necks, or even swimming," he adds.

Ich weiß aber nicht, in wieweit das nur ein vorübergehendes Phänomen war - im Forum sind gerade ein paar anders aussehende Bilder gewesen. Z.b. dieses:

So, over the next few months, there may be increased drought in Africa, India and Australia, heavier rainfall in South America and increased extremes in Britain, of warm and cold. It may make 2010 one of the hottest years on record.

[...]

At present, forecasters do not expect this El Niño to equal that of 1998, but it may be the second-strongest, and concerned groups, from international insurance companies to commodity traders, to aid agencies such as Oxfam, have begun to follow its progress anxiously. Its potential for economic and social impact is considerable.

[...]

El Niño is a periodic warming of the normally cold waters of the eastern tropical Pacific, the ocean region westwards out from South America along the line of the equator. Since the Pacific is a heat reservoir which drives wind patterns around the world, the change in its temperature alters global weather. An El Niño is defined by ocean surface temperatures rising by more than 0.5C above the average.

This El Niño is well beyond that, says the Climate Prediction Center of the US National Weather Service. "Sea surface temperatures remain +0.5 to +1.5 above average across much of the equatorial Pacific Ocean," the centre reported last week. "Observations and dynamical model forecasts indicate El Niño conditions will continue to intensify and are expected to last through the northern hemisphere winter of 2009-10."

The last El Niño was in 2006-07 and, at its peak, sea surface temperatures averaged about 0.9 degrees above normal. But this is a stage which has already been reached by this one.

An increase of just 1.0 degree Celsius (1.8 degrees Fahrenheit) over current average temperatures would more than double the CO2 escaping from the peatlands.

Northern peatlands contain one-third of the planet's soil-bound organic carbon, the equivalent of half of all the CO2 in the atmosphere.

Peat is an accumulation of partially decayed vegetation found in wetlands or peatlands, which cover between two and three percent of the global land mass. While present in all climate zones, the vast majority of peatlands are found in sub-Arctic regions.

A team of European researchers led by Ellen Dorrepaal of the University of Amsterdam artificially warmed natural peatlands in Abisko, in northern Sweden, by 1.0 C over a period of eight years.

The experimental plots exhaled and extra 60 percent of CO2 in Spring and 52 percent in Summer over the entire period, reported the study, published in the British journal Nature.

Bis 2050 prognostiziert sind übrigens 2°, nicht ein lausiges Grad.

Anders gesagt: es wird dringend Zeit für eine andere Aufbewahrung des CO2s - der Torf mag nicht mehr...

Im Grunde genommen ist meine Reaktion "ach nee?", aber schön, daß das mal jemand sagt:

Methods put forward include reflecting solar radiation back into space using giant mirrors or aerosol particles.

But the authors warn that such attempts to control the climate could also cause major changes in precipitation.

They want the effect on rainfall to be assessed before any action is taken.

Gabriele Hegerl of the Grant Institute at University of Edinburgh and Susan Solomon of National Oceanic and Atmospheric Administration (NOAA) at Boulder, Colorado, write that "if geo-engineering studies focus too heavily on warming, critical risks associated with such possible "cures" will not be evaluated appropriately".

The finding is based on an examination of past extinctions, but could help current conservation efforts.

Researchers say that this phenomenon can result in the loss of an entire branch of the "tree of life".

Auch das rechtfertigt ein "Ach nee?", denn wer hätte schon gedacht, daß verwandte Arten verwandte Verwundbarkeiten haben könnten? Aber vielleicht bringt das irgendwen zum Nachdenken, wenn genug Menschenaffen ausgestorben sind...

![Die 4 Stadien einer typischen Bärenmarktrally]](/data/o/0/4339/ms.jpg)

Dies muß aber keine typische Bärenmarktrally sein...

Justin Lin, the World Bank’s chief economist, warned last month that half-empty factories risk setting off a “deflationary spiral”. We are moving into a phase where the “real economy crisis” bites deeper – meaning mass lay-offs and drastic falls in investment as firms retrench. “Unless we deal with excess capacity, it will wreak havoc on all countries,” he said.

Mr Lin said capacity use had fallen to 72pc in Germany, 69pc in the US, 65pc in Japan, and near 50pc in some poorer countries. These are post-War lows. Fresh data from the Federal Reserve is actually worse. Capacity use in US manufacturing fell to 65.4pc in July.

Da kann man dann wohl auf eine Pleitewelle gigantischem Ausmaßes wetten.

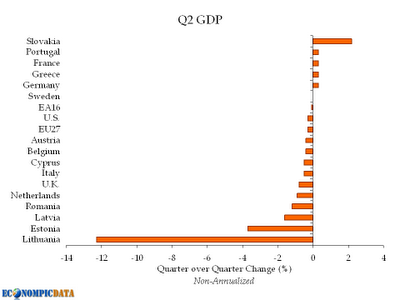

Bulgarien, Tschechei, Dänemark, Irland, Spanien, Luxemburg, Malta, Polen, Slowenien fehlen.

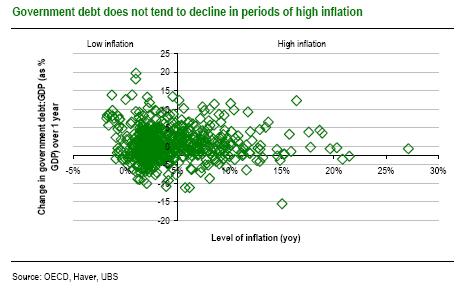

Die Idee, daß Regierungen ihren Weg aus der Verschuldung mit herausinflationieren können, ist laut UBS falsch - jedenfalls Inflation kleiner als Hyperinflation.

Die Graphik zeigt die Entwicklung der Staatsverschuldung (in % des BIP) nach Inflation.

Warum? Weil der Staat zwar inflationieren kann, aber eben auch eine Menge Altschulden rollen muß, und für die dann auch einen zusätzlichen Inflationszins zahlen muß.

Das heißt aber natürlich auch, daß von den vier möglichen Wegen zur Staatsentschuldung, nämlich Inflation, Hyperinflation, Währungsreform und Staatsbankrott, der Mildeste nicht gangbar ist (der theoretische Fünfte - nämlich vernünftiges wirtschaften - ist ja leider nur theoretisch).

Direkt aus Tausend und einer Nacht berichtet uns Arabnews:

In welchem Paralleluniversum produziert ihr denn so viel?

Ja, ich möchte auch so vieles. Manchmal 6 unmögliche Dinge vor dem Frühstück. Ok, falsches Märchen.

wenn man im Jahr nur so rund 30 Mrd. Barrel Öl verbraucht, aber 75 Mrd. findet, reicht das Öl für die Ewigkeit, bis zum Ende des Universums. Wenn. Und wenn man überhaupt welches gefunden hat.

Venezuela claims that at “$50 a barrel, a portion of the Orinoco tar sands becomes commercially viable; enough to bring the country’s proven reserves up to 312 billion barrels”.

Kinder, das Orinoco-Gebiet kann man nicht so relativ straflos in eine Mondlandschaft verwandeln wie es die Kanadier mit ihren Ölsand-Gebieten tun (und auch da bin ich mal auf die Gesamtbilanz gespannt). Der Orinoco ist eure Wasserversorgung.

Eine positive Nachricht: Die IEA kann zugeben, daß sie Fehler gemacht hat.

6.7% versus 3.7% ist eine ganze Menge.

Oil production has already peaked in non-Opec countries and the era of cheap oil has come to an end, it warned.

Hey, das böse Wort "Peak", das offizielle Stellen im Zusammenhang mit Öl bisher nicht kannten...

Daß das jetzt gebraucht wird heißt wohl, daß es demnächst lichterloh brennt, äh, dunkel und kalt wird (bei den Ärmeren jedenfalls).

Several industry sources estimated that there were 70 million barrels of oil being stored at sea. While the estimates vary from around 60 million to 100 million barrels, most sources agree offshore storage levels rose by around 10 million barrels in the last two weeks alone.

Irgendwie gefällt mir der Gedanke ja nicht, daß das Öl ausgerechnet im Hurricane-Gebiet in Tankern gelagert wird...

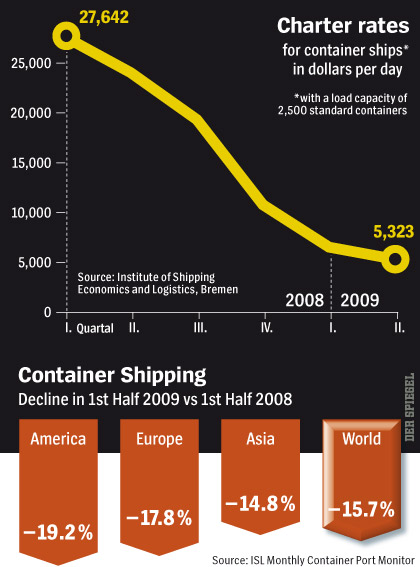

Der Spiegel hat eine wunderschöne Graphik über die Charterraten für Containerschiffe:

Year after year, new and ever more massive ships were built, ports were expanded and new scheduled service introduced. The cargo capacity of the world's combined container fleet increased from 4 million TEUs in 2000 to 12.5 million today.

2000: 4 Mio. TEU Transportkapazität Weltweit.

2009: 12.5 Mio.

2008: 500 Mio. TEU transportiert.

2000: rund die Hälfte.

Eine der beiden Zahlen hat sich von 2000 auf 2008 verdoppelt - die andere verdreifacht. Die Überkapazität war also bereits vor Ausbruch der Krise da...

Und wo wird das Problem wohl am meisten weh tun? In China? Den USA? Den Niederlanden? Japan? Singapur? Nein...

[... viel weiter unten ...]

Roughly 1,644 of the 4,619 container ships worldwide are German-owned.

Deutschland und dort insbesondere Hamburg.

Davon fallen dann 7 Mrd in Deutschland an. Hm...

Aber Vorsicht mit dem Mitleid - das scheint doch nicht hundertprozentig angebracht:

Vor einem Jahr noch hätten satte Gewinne von $700 pro Container anfallen sollen, die eigentlich locker ausreichen müßten, $300 Verlust pro Container für eine Weile abzufedern.

Wenn man das Geld denn noch hätte, klar.

Und ein Abschnitt zur HSH Nordbank aka Nordbundesland-Mordbank:

33 Mrd. Schiffsbaukredite ausstehend, Risikovorsorge nun 330 Mio. Das ist immerhin viel besser als vorher, aber immer noch rund 3 Mrd. zu niedrig...

Zur Zukunft:

But the real problems are still ahead for German shipping companies. The 1,550 new ships that were on order in mid-2008 are to be delivered in the next few years. The major Asian shipyards are unwilling to accept cancellations.

Some ship financiers have already decided to forfeit down payments already paid to the shipyards, which can amount to up to 40 percent of the total price, because they lack the additional millions needed to take delivery of the ships on order. Most others are trying to negotiate with the shipyards to at least delay construction, in the hope that the situation will improve significantly in a few years.

The orders for new container ships now on the shipyards' books represent a total capacity of 5.3 million TEUs, or about 50 percent more than current worldwide container fleet capacity. Even if global trade recovers by next year, this glut of new ships will create enough excess capacity to depress shipping prices.

[... viel weiter unten ...]

Lucien Wong, the chairman of the Maritime and Port Authority of Singapore, reported in April that roughly 450 container ships are now idle worldwide -- about 10 percent of the global fleet.

Wollen wir mal festhalten: rund 10% der weltweiten Containerschiffe sind derzeit mangels Nachfrage stillgelegt. Gleichzeitig kommen in den nächsten paar Jahren mehr als 50% der noch in Betrieb befindlichen Kapazität hinzu.

Welche Auswirkungen könnte das, nach dem Gesetz von Angebot und Nachfrage, wohl haben? Steigende Frachtraten, vielleicht?

The State Statistics Committee did not give figures for the volume of gas transported through Ukrainian territory but according to last year's statistics, 74 billion cubic metres of gas was sent through Ukraine.

In the full year of 2008, some 120 billion cubic metres of gas was transited through Ukraine. Russia sends 80% of its gas exports to Europe through its southern neighbour.

Hm, müßten nach einem relativ harten Winter nicht einige Reserven wieder aufgefüllt werden? Verstehe ich da irgendetwas falsch?

Aber das kann nicht 37% ausmachen - oder? Die Heizungen waren doch eher stärker gefordert als in 2008.

2050.

Der Zweifel wird Mainstreamthema...

Auf 7,1 Prozent beläuft sich laut Statistikamt das BIP-Wachstum, doch bis auf sieben Provinzen meldeten alle Regionen höhere Werte.

übrigens beträgt der Unterschied zwischen den beiden Milliardenzahlen ziemlich genau 10%. Das beschreibt die Unsicherheit der chinesischen Wirtschaftszahlen schon recht gut: zwischen 8% Wachstum und -2% Wachstum ist alles drin.

Aus irgendeinem Grund erfüllt mich das nicht mit großer Zuversicht für China.

Also, 13% ist durchaus glaubhaft. Die ganzen billigen Jobs fallen weg, und die gut bezahlten Jobs in Regierung und KP fallen mehr ins Gewicht

Eines meiner Lieblingsthemen in der letzten Zeit ist China. Und zwar nicht etwa wegen gehobenem Interesse an China, und noch nicht mal wegen China selbst - was mich richtiggehend fasziniert ist die Bereitschaft der Welt, die chinesischen Zahlen und Behauptungen zu glauben. Ich meine, wir wissen eigentlich alle, wie sehr die Zahlen in der westlichen Welt getürkt sind - und im Grunde genommen weiß auch jeder, daß man Zahlenwerken aus Ländern, in denen eine noch geringere Bereitschaft zur Offenlegung von Zahlen und Verhältnissen herrscht, erst recht nicht trauen darf - aber aus irgendeinem Grund wird den Zahlen geglaubt.

Hm.

Once China had announced its 8 percent growth target, it began to disburse funds directed at a sharp increase in public works spending. It is important to understand that the disbursal of funds is recorded as GDP growth. So the government can easily control the pace of growth by the pace at which it releases funds that have already been allocated in the stimulus package to the creation of higher production or growth numbers. Funds disbursed for fixed-asset investment bx state-owned enterprises or provincial governments are counted as having been spent when they are disbursed. In fact, the funds go out to the state-owned enterprises and provincial governments and may be held until actual projects are identified and undertaken.

In Kurzform: die BIP-Zahlen Chinas werden nicht errechnet, sondern entschieden. Sobald der Staat Geld zahlt (an Staatsunternehmen überweist), wird der Betrag dem BIP angerechnet - unabhängig davon, ob und wann der Empfänger damit irgendetwas tut.

Und so sieht das beim Konsum-Anteil des BIPs aus: der errechnet sich nicht aus den Verkäufen der Händler, sondern aus deren Einkäufen.

Many couples will be excluded from the new diktat, but if both parents were an only child, like most newly-weds in the city, they will be encouraged to conceive again, in an effort to ensure that the city's workforce is not outnumbered by its pensioners.

Ob das noch rechtzeitig kommt?

[...]

Wang said around 147 million migrant workers had moved to cities for jobs by June but more than four million had yet to find one.

Moreover, three million university graduates, including those who had left last year, were still unemployed, he said.

China's urban registered unemployment rate stood at 4.3 percent in the second quarter, unchanged from the first three months and up from 4.2 percent at the end of 2008, Wang said.

[...]

However, the actual jobless figure may be much bigger than the official rate, which does not include migrant workers and university graduates.

Man beachte: das ist die Arbeitslosenquote in den städtischen Regionen, und schließt Universitätsabgänger und Wanderarbeiter aus.

» First-half electricity use by small and medium-sized enterprises fell almost 50 percent year-on-year, as these companies were more exposed to the economic downturn, the National Bureau of Statistics said on August 3.

» SMEs saw power consumption plunge 48.9 percent year-on-year, against a 5.9 percent industry-wide drop.

» UBS Securities chief economist Wang Tao said SMEs were the first to be hit with falling orders when the global economy began to slide, causing them to cut output more sharply than larger enterprises.

In der ersten Jahreshälfte haben kleine und mittlere Unternehmen in Chinas 48.9% weniger Strom verbraucht als im gleichen Zeitraum des Vorjahres.

Dagegen sind insgesamt in der Industrie 5.9% weniger Strom verbraucht worden.

Da dürfte es nun eine Menge Arbeitsplätze in kleinen und mittleren Unternehmen nicht mehr geben.

Power consumption rose to 342 billion kilowatt-hours last month, the National Energy Administration and the China Electricity Council said separate statements today. Power demand between January and July fell 0.9 percent to 2 trillion kilowatt-hours.

Industrial production climbed 10.8 percent in July after a 10.7 percent advance in June, the statistics bureau said earlier this week. Power production expanded for the second month in July as China recovered from the economic slowdown helped by the government’s 4 trillion-yuan ($585 billion) spending, according to the statistics bureau.

Juni auf Juli: +6% = +342 Mrd. KWh.

Januar auf Juli: -0.9%.

Das wäre mal eine gute Entwicklung. Alleine, mir fehlt irgendwie der rechte Glaube.

GATA ist nicht wirklich eine seriöse Quelle, aber:

Bundesweit verbuchten die Hotels und Pensionen nach Angaben des Statistischen Bundesamtes im ersten Halbjahr einen Rückgang um zwei Prozent bei den Übernachtungen. Besonders betroffen sind, so der Hotelverband Deutschland, Flughafenhotels, 5-Sternehotels und die Regionen, die vor allem Geschäftsreisende empfangen. Denn viele Firmen streichen wegen der Krise Tagungen, Kongresse, Feiern und Ausflüge.

Zwar waren die deutschen Hotels insgesamt im Juni sogar besser besucht als im Vorjahr, weil die Deutschen wieder mehr Urlaub im eigenen Land machen, etwa an der Ostsee. Aber eine Sprecherin des Hotelverbands warnt: „Wir haben noch einen sehr steinigen Weg vor uns. Selbst die beste Reisesaison kann die Ausfälle bei den Geschäftsreisen nicht ausgleichen.” Deswegen rechnet sie für die Gesamtbranche aufs Jahr gesehen mit fünf Prozent weniger Umsatz und „erhöhtem Preiswettbewerb”, wenn auch nicht mit einem Preiskrieg.

[...]

The deaths have come in two waves. The first, in May, hit the Mediterranean - including Corsica and the Etang de Thau, a salt-water lake near Montpellier – and also the west coast in the bay of Arcachon. The second struck oyster farmers all the way as far as Normandy.

"This year is different, as it has come in two waves," said Sebastien Chantereau, from the national shellfish producers' body, the Comité National de la Conchyliculture. "Although each was less violent than the one that struck last July, together the damage is roughly the same. If we have one more wave between now and September it will be a total catastrophe," he told the Daily Telegraph.

The Grace mission discovered that in the country's north-west - including Delhi - the water table is falling by about 4cm (1.6 inches) per year.

Writing in the journal Nature, they say rainfall has not changed, and water use is too high, mainly for farming.

But weather and climatic factors are not responsible for water depletion in the northwestern states of Rajasthan, Haryana and Punjab, according to the Nasa study.

"We looked at the rainfall record and during this decade, it's relatively steady - there have been some up and down years but generally there's no drought situation, there's no major trend in rainfall," said Matt Rodell, a hydrologist at Nasa's Goddard Space Flight Center near Washington DC.

"So naturally we would expect the groundwater level to stay where it is unless there is an excessive stress due to people pumping too much water, which is what we believe is happening."

The northwest of India is heavily irrigated; and the Indian government's State of the Environment report, published on Tuesday, noted that irrigation increased rice yields seven-fold in some regions compared to rain-fed fields.

It blames deforestation, over grazing, forest fires and the indiscriminate use of agro-chemicals.

The report also warns of a potential water crisis in the country, pointing out that in the past, a combination of rainfall and surface and groundwater supplies were sufficient for the population.

But now it says that rainfall has become more erratic, groundwater supplies are becoming more depleted and surface water is becoming more polluted.

Captain Alok Bhatnagar, director of naval plans at India’s ministry of defence, said on Thursday that 32 warships and submarines were under construction in the country’s shipyards. Work on 75 more ships, including aircraft carriers, destroyers, frigates and amphibious vessels, would begin over 10 years.

Ohne Worte.

Falling agricultural production means that Iraq, once a food exporter, will this year have to import nearly 80% of its food, spending money that is urgently needed for reconstruction projects.

[...]

This summer and last have seen more than twice as many dusty days as the previous four, he said. And 35% of the time, dust is reducing visibility to less than three miles, the point at which it is normally considered unsafe to fly. On many of those days, visibility was zero, delaying flights, disrupting military operations and sending thousands of people to hospitals with breathing problems.

"The lack of available water is a huge issue and it's having a huge effect on Iraqi society," said Silverman, social science advisor for strategic communications with the Army's Human Terrain System, a program that links social scientists and anthropologists with combat brigades. He emphasized that he was not speaking on behalf of the military.

Weak demand during the downturn and the fall in the price of oil have put downward pressure on prices.

[...]

Recent data showed consumer prices had fallen by a record 1.7% in the year to the end of June.

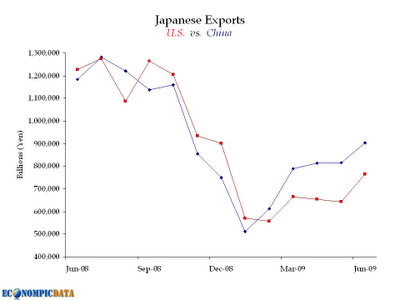

http://www.google.com/hostedne [verkürzt] ERLcfGYFHR3q1grHfn_kAD99K2JSG2

Hach, dieser Optimismus... "so wenig gefallen sind die japanischen Exporte schon seit 6 Monaten nicht mehr".

The Caisse took the unprecedented move of announcing interim financial results Tuesday – indicating that an overall writedown of $5.7-billion on real estate and other investments completely wiped out gains on stocks in the first half of the year – in part to quell growing rumours about trouble in its property portfolio.

The Caisse, which manages the assets of 25 provincial funds including the Quebec Pension Plan, was stung by criticism last fall that it was too secretive, when it continuously rejected calls to reveal the extent of the damage it suffered as a result of October's stock market meltdown.

[...]

The Caisse was badly bruised in 2008 by its oversized position in currency and futures contracts and third-party asset-backed commercial paper holdings, posting a $40-billion loss last year, equal to a return of minus 25 per cent.

[...]

The writedowns this year erased the 5-per-cent return that the Caisse had earned on other investments to June 30, leaving it with “neutral” overall performance, Mr. Sabia said. “No one here thinks that neutral returns is what we should be aiming for,” he told reporters on a conference call. “There's a lot of work to do in repositioning the Caisse and changing our strategies, and we're going to continue to do that.”

Die Abschreibungen (im Wesentlichen auf Immobilien) in Höhe von 5.7 Mrd. Dollar (kanadische, vermute ich) haben die ganzen sonstigen Gewinne des ersten Halbjahres ausgeglichen.

Interessant, daß zwei Jahre nach Beginn der Krise der Manager von 25 kanadischen Fonds immer noch massiv in Sachen investiert ist, die einen hohen Abschreibungsbedarf haben. Ob das Zeug ist, das zwei Jahre lang niemand haben wollte? Also ganz wertlos ist?

Kenya’s corn production may fall 65 percent below consumption this year, putting 10 million Kenyans at risk of hunger or food insecurity, said Odinga.

Drought has cut hydropower generation by 46 percent, leading to the start of scheduled power-rationing last week as generation dropped to 900 megawatts. This is 200 megawatts below peak demand, he said.

Kenya will maintain load-shedding until at least mid- October when 222 megawatts of new generating capacity will be added to the grid and the short rains start, he said.

The contraction, the worst since quarterly records began in the Baltic nation in 1995, gathered pace after gross domestic product shrank 18 percent in the first quarter, the central statistics office in Riga said today, citing preliminary figures. The median estimate in a Bloomberg survey of eight economists was for a 22 percent decline. The final report will be released on Sept. 8.

“The steepest decline is behind us,” said Andris Vilks at SEB AB’s Latvian unit, who had estimated an 18 percent contraction for the second quarter. “The third and fourth quarters may see a decline of about 12 percent to 15 percent.”

Q1: -18%

Q2: -19.6%

Vorhersage Q3+4: -12% bis -15%

Aua.

[...]

Latin America’s largest oil producer plans to spend a record amount this year and $20 billion annually next year through 2012 to fund exploration in waters deeper than 500 meters (1,640 feet) and at its Chicontepec development. Output is slumping as production at Cantarell, the company’s largest field, drops at a rate twice as fast as Pemex forecast after last year falling the most since 1942.

"to fund exploration" ist nur leider nicht gleichbedeutend damit, daß sich die Exploration auch auszahlt.

National production averaged 2.59 million b/d in the second quarter of the year and 2.67 million b/d in the first quarter.

[...]

Even before Pemex revised its outlook to 2.65 million b/d for 2009, consultancy IPD Latin America was expecting the company to be producing less than 2.5 million b/d going into next year, managing director John Padilla told BNamericas.

George Baker, director of Houston-based consultancy Baker & Associates, said Pemex would be following statistical trends if it finished the year with production of 2.5 million b/d.

Naja, wenn schon die Opec Märchen erzählt, darf Mexiko das doch auch, oder?

The Mexican state-owned oil monopoly Petróleos Mexicanos, or Pemex, estimates some $720 million worth of oil products were stolen from it in 2008, slightly higher than 2007. The robberies have sapped the oil behemoth--the second-largest exporter to the U.S.--for years. But the number of discovered clandestine taps into national pipelines has steadily climbed in recent years, adding to frustrations over falling production at its prize field Cantarell.

Ich halte eine enge Verbindung von Öl und Kriminalität für überhaupt nicht überraschend - insbesondere in Anbetracht der Gewinne der Ölunternehmen...

An und für sich nichts Besonders: Polen verkauft Anteile an Staatsunternehmen, um den Staatshaushalt nicht ganz so schnell zu ruinieren.

“The plan acknowledges the need to speed up privatization,” said Prime Minister Donald Tusk at a press conference in Warsaw today. The budget “requires a cash injection to cover basic spending.”

Aber die Begründung ist interessant:

[...]

“The legislative route is virtually impossible for the government, so privatization is the only way out,” Gomulka said by phone. “Union protests have been a big factor in the lack of privatization in recent years -- but the situation has got so bad now this constraint might have been lifted.”

Wer regiert da eigentlich? Der noch nicht abgesägte Kaczynski mit dem schon Abgesägten?

President Dmitry Medvedev blamed the country's reliance on energy and commodity exports, saying the economy "crumbled" as the global crisis hit.

"We can't develop like this any further. It's a dead end," he told party leaders. "We're hovering in place, and the crisis brought this home. We will have to make decisions on changing the structure of the economy. Otherwise our economy has no future. The situation is outrageous and has been for a long time. We continue to ship raw timber for export, and processing isn't being developed."

The slump has played havoc with state finances. The Kremlin's war chest is vanishing fast as the budget deficit rises to 9.4pc this year. While there are still funds to cover $80bn (£48bn) of stimulus measures, the picture could turn ugly if there is a second leg to the global downturn. The World Bank says unemployment may reach 13pc this year as household spending "collapses".

Nein, auch in Rußland sind die Aussichten nicht gut.

Gross domestic product declined 1 percent from the previous quarter, when it shrank 1.9 percent, the Madrid-based National Statistics Institute said in a preliminary estimate. From a year earlier, G.D.P. contracted 4.1 percent.

The statistics stood in contrast to data Thursday showing stronger-than-expected performances by the French and German economies, each of which grew 0.3 percent in the second quarter from the first quarter.

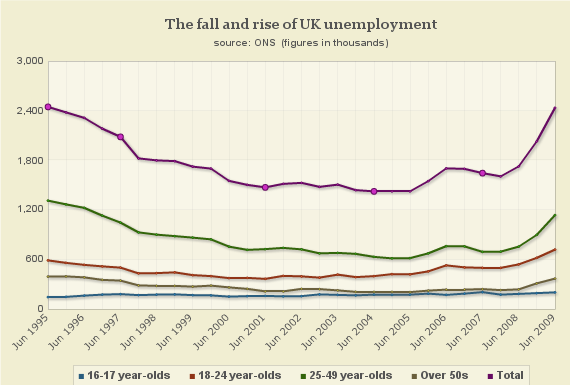

Official data revealed that youth unemployment has soared, with more than 700,000 18 to 24-year-olds and 206,000 16 to 17-year-olds jobless.

In the three months to June, the number of 16 to 17-year-olds in work dropped to only 28.6 per cent, from 34 per cent a year earlier. The employment rate for people aged 18 to 24 dropped to 59.8 per cent, from 64.1 per cent.

The figures formed part of what economists described as a "ghastly" set of employment data, which showed that the jobless total had hit a 14-year high of 2.44 million and that the jobless rate had reached a 13-year-high of 7.8 per cent.

[...]

The number employed fell by a record 271,000.

[...]

"Even if the economy does return to growth in the third quarter, we suspect unemployment will rise for the rest of this year and much, if not all, of 2010."

Europas neues Armenhaus.

Ich bin mir nicht sicher, in wieweit ich dem Artikel glauben soll, aber...

North Sea gas has served Britain well, but supply peaked in 1999. Since then the flow has fallen by half; by 2015 it will have dropped by two-thirds. By 2015 four of Britain’s ten nuclear stations will have shut and no new ones could be ready for years after that. As for coal, it is fiendishly dirty: Britain will be breaking just about every green promise it has ever made if it is using anything like as much as it does today. Renewable energy sources will help, but even if the wind and waves can be harnessed (and Britain has plenty of both), these on-off forces cannot easily replace more predictable gas, nuclear and coal power. There will be a shortfall—perhaps of as much as 20GW—which, if nothing radical is done, will have to be met from imported gas. A large chunk of it may come from Vladimir Putin’s deeply unreliable and corrupt Russia.

wenn das stimmt, produziert Großbritannien 26.5 Gigawatt aus Gas, und wird 2015 17.7 Gigawatt weniger aus eigenem Gas produzieren können.

=> Mehr Strom aus Kohle, mehr Gasimporte.

GM’s unusual, government-engineered bankruptcy allowed the Detroit automaker to emerge as a new company — and to shed billions in liabilities, including claims that governments had against GM for polluting.

Environmental liabilities estimated at $530 million were left with the old GM, which has only $1.2 billion to wind down.

Administrative fees and other claims will soak up that money, and state and local officials told the Free Press they fear the cleanups will be shortchanged.

[...]

GM said the issue rested with Motors Liquidation Co. — what’s left of the old GM — which declined to comment.

... wie gehabt:

In the year-ago period, the company posted a loss of $2.48 billion.

Revenue during the quarter fell 28 percent to $1.27 billion from $1.76 billion.

The bulk of the latest quarterly loss stems from a $1.6 billion charge related to the company's mortgage business. GMAC also incurred a $1.2 billion tax charge on its conversion from a partnership, or LLC, to a privately held corporation. The company remains a preferred lender to General Motors Co.

Excluding those charges, GMAC said its second-quarter loss was about $400 million.

Inkl. aller Abschreibungen: -3.9 Mrd. Dollar

Darunter: 1,6 Mrd. Abschreibungen (Hypotheken) und 1.2 Mrd. Abschreibungen (Steuer).

Exklusive solcher Sondereffekte: 400 Mio Verlust, bei Einnahmen von 1270 Mio.

Das sind ja grundsolide Zahlen...

Aber keine Sorge, die gehen so schnell nicht pleite:

Die FDIC - selbst nicht gerade reich mit Kapital gesegnet - garantiert für bis zu 7.4 Mrd. Dollar Anleihen von GMAC. Oder war's der Steuerzahlen, der den Kopf hinhält?

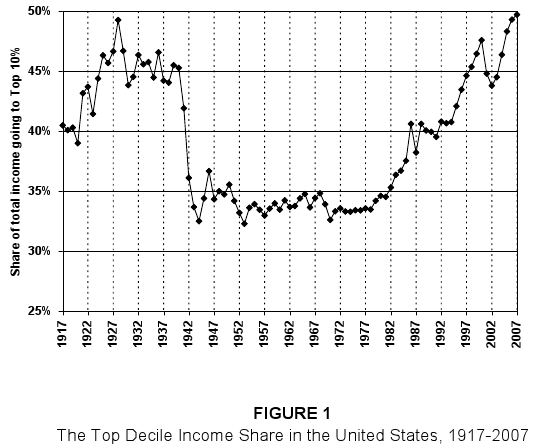

Der Anteil der oberen 10% am Einkommen der USA hat 2007 das Niveau von 1929 wohl knapp übertroffen.

Und das ist der Anteil der oberen 0.01%.

Durchschnittliches Wocheneinkommen in den USA, im Verhältnis zur Lohnentwicklung, inflationsbereinigt und auf die Gesamtbevölkerung bezogen.

Wo wir gerade bei den steigenden chinesischen Löhnen waren:

[...]

Wages and salaries, which drive recoveries in spending, fell 4.7 percent in the 12 months through June, the biggest drop since records began in 1960, according to Commerce Department figures released yesterday. The Obama administration’s tax cuts, extended jobless benefits and a one-time Social Security bonus have helped mask the damage done by the worst employment slump since the Great Depression.

Personal incomes, which include interest income, dividends, rents and other payments as well as wages, tumbled 1.3 percent in June, more than forecast and the biggest drop in four years, yesterday’s Commerce report showed. Excluding the effects of the stimulus plan, June incomes would have dropped 0.1 percent after no change in May, according to the report. In May, one-time additional payments to Social Security recipients boosted incomes 1.3 percent.

[...]

The savings rate in June fell to 4.6 percent as incomes dropped, yesterday’s Commerce Department report showed. The rate, which reached a 14-year high of 6.2 percent the previous month, is likely to keep climbing, Rosenberg said. A rate as high as 15 percent can’t be ruled out, he said.

Löhne und Gehälter: -4.7% (über ein Jahr gerechnet)

Einkommen insgesamt: -1.3%.

Sparquote: gefallen.

Ja, der amerikanische Konsument...

Gallup hat eine schöne Graphik über den Konsum:

31.7.2008: um die 100$

31.7.2009: um die 60$

Das ist als Tendenzanzeige durchaus brauchbar.

und trotz der 11% Mehrausgaben der Regierung fällt das BIP der USA...

Anders gesagt: Ohne gewaltige Fehlallokation von Resourcen zum Militär hin ginge es den USA-Zahlen noch schlechter...

Ob es eine kluge Idee ist, daß ein überexpandiertes Beinahe-Imperium mit gravierenden inneren Problemen noch mehr Geld in das schwarze Loch "Militärmaschinerie" steckt?

The percentage of “underwater” loans may rise to 48 percent, or 25 million homes, as prices drop through the first quarter of 2011, Karen Weaver and Ying Shen, analysts in New York at Deutsche Bank, wrote in a report today.

As of March 31, the share of homes mortgaged for more than their value was 26 percent, or about 14 million properties, according to Deutsche Bank. Further deterioration will depress consumer spending and boost defaults by borrowers who face unemployment, divorce, disability or other financial challenges, the securitization analysts said.

“Borrowers may also ‘ruthlessly’ or strategically default even without such life events,” they wrote.

Mir scheint, bei der Deutschen Bank hat sich noch nicht herumgesprochen, daß sich die Lage stabilisiert

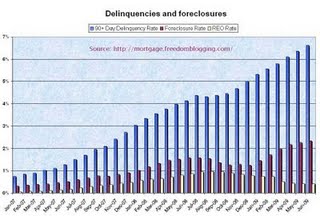

Nur für den Fall, daß meine Leserschaft glauben sollte, die Probleme auf dem US-Hausmarkt seien Geschichte:

Foreclosure Rate is actual foreclosures in process: "Everything with NOD and Trustee's Sale filing."

REO Rate: "Everything foreclosed but still held by bank or servicer. This category is separate from other two."

Ja, ich hab' mitbekommen daß die US-Hauspreise sich stabilisieren. Schön.

Bloß, was heißt das? Um es kurz und knapp zu sagen: Wenig.

- eine Schwalbe macht noch keinen Sommer.

- Die Hauspreise in Detroit _können_ im unteren Preissegment ($1500) nicht mehr nennenswert fallen. Nein, wirklich nicht. Ja, Detroit ist im Case-Shiller-Index enthalten. Und ja, das stabilisiert den Gesamtindex etwas - bloß nicht die anderen Städte.

- Steigende Arbeitslosigkeit führt ausgesprochen selten zu mehr Hauskäufen.

- Wenn man sich obige Graphik ansieht, könnte man auf den Gedanken kommen, daß eigentlich viel mehr Häuser im Stadium "Foreclosure" sein müßten. Richtig, dem ist auch so. Sie müßten - das wird oft deshalb nicht gemacht, um die Hauspreise nicht weiter zu destabilisieren. Aber _irgendwann_ kommen auch diese Häuser wieder auf den Markt. Und so lange hübschen sie die Statistik auf (nicht die Realität, aber die Statistik).

Foreclosure activity jumped 7 percent in July from June and 32 percent from a year earlier as one in every 355 households with a loan got a foreclosure filing, RealtyTrac said on Thursday.

Filings -- including notices of default, auction and bank repossession -- have escalated with unemployment.

"July marks the third time in the last five months where we've seen a new record set for foreclosure activity," James J. Saccacio, RealtyTrac's chief executive, said in a statement.

Erst waren es Rekordpreise, jetzt sind es Rekordzwangsversteigerungen. Naja, Hauptsache Rekord...

Zum einen ist das natürlich ein neuer Rekord, und ein Beweis mehr, daß der Jobmarkt in den USA längst nicht die Talsohle dieser Krisr erreicht hat.

Zum Anderen zeigt diese Graphik aber auch, daß sich die Dinge auf dem Arbeitsmarkt der USA schon lange schlechter entwickeln: Die mittlere Länge der Arbeitslosigkeit nimmt seit den späten 60ern zu.

Die restlichen Graphiken im Artikel müßten auch zur Dämpfung verfrühten Optimismus beitragen.

Das Problem der Option-ARM-Resets wird nicht so groß wie befürchtet (Re: Alles wird gut!!!51! - Hypothekenresets):

[...]

About 40 percent of borrowers with option ARMs are already delinquent, and “many” of the others will start missing payments before their obligations change, the Barclays mortgage- bond analysts wrote in a July 24 report. Recasts of securitized option ARMs will peak at about $6 billion a month in mid-2011 and include “volumes lower than feared” overall, they said.

Bis 2011 sind die längst mehrheitlich Pleite...

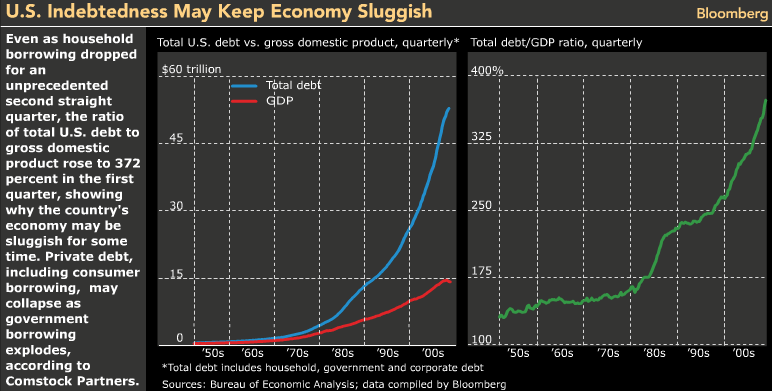

Bloomberg ist etwas pessimistisch:

Stimulus programs and a surging money supply aren’t likely to “solve a problem of excess debt generation that resulted from greed and living way beyond our means,” the firm wrote yesterday in an unsigned report on its Web site. “We could wind up with a lost couple of decades.”

The CHART OF THE DAY shows U.S. total debt and gross domestic product since 1952, along with the ratio between them, based on data compiled by Bloomberg. The ratio rose in the first quarter to 372 percent even as household borrowing dropped for a second straight quarter, an unprecedented streak.

Nicht jeder erfolgreiche Einwanderer ist in den USA gerne gesehen:

The quagga mussels first came to America in the ballast of ships from Ukraine and other parts of Eastern Europe in the 1980s. It was not until recently, however, when the molluscs turned up in Lake Mead, which supplies drinking water to Las Vegas and other large desert cities, that the catastrophic scale of the invasion became clear.

[...]

There are now believed to be at least three trillion of them in Lake Mead, and scientists say it is only a matter of time before they spread throughout the West’s vast network of reservoirs and aqueducts, causing damage estimated at billions of dollars.

At the Hoover Dam there are sometimes 55,000 mussels per square foot in the intake towers, hampering the facility’s electricity-generating equipment.

[...]

Apart from their ability to reproduce at an astonishing rate — a female quagga mussel can produce as many as one million eggs a year — the molluscs can attach themselves to almost anything, clogging drains and pipes and ruining boat engines.

They also feast on phytoplankton, which is an important food source for zooplankton, and so can radically change the ecosystem within a lake.

The mucus-wrapped excretion of the mussels can eventually turn a lake more acidic. Emergency measures already in place include the decontamination or quarantine of boats travelling in infested areas, and the use of sniffer dogs that can identify mussels.

Wollen Sie den Digest abbestellen?