| Sendedatum | 2009-08-02 14:32:25 |

|---|---|

| Ausgabe | 85 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Inhaltsverzeichnis:

- Chernobyl 'shows insect decline'

- Scientists sound Oceania extinction warning

- Fresh hope for world's fisheries

- World will warm faster than predicted in next five years, study warns

- Europe: COMMERCIAL VEHICLES: Registrations decline by 35.6% in first quarter 2009

- Deleveraging then and now

- Cruel windfall: How wars, plagues, and urban disease propelled Europe’s rise to riches

- Michael Pettis über China

- China property prices ‘likely to halve’

- China: Real Estate Developers, Strapped for Cash, Resort to "Irregular" Tactics

- China: Steuereinnahmen

- China: Squeezing out the exporters

- Notes on a real estate trip in China

- Flood of money buoys Beijing property bubble

- Deutsche Bad Bank: Befreiungsschlag Fehlanzeige

- Omas Häuschen verliert drastisch an Wert

- Consumer prices fall in Germany

- At least 40 shops damaged in Greek riots

- India to Resist U.S. Pressure on Carbon Emission Caps

- Irland: 17000 Stellen streichen?

- Japan jobless rate up amid record deflation

- Japan Retail Sales Fall for 10th Month on Job Losses

- Kanada: Federal pension plan books 22.7% loss

- Alberta seniors' need for welfare soaring

- Pemex Output Goal ‘Uphill Battle,’ Forces Borrowing

- Poland-Russia gas deal hits road block

- Drunken Nation: Russia’s Depopulation Bomb

- S Korea July exports down less than forecast

- UK: Alterung

- British pensioners among the poorest in Europe

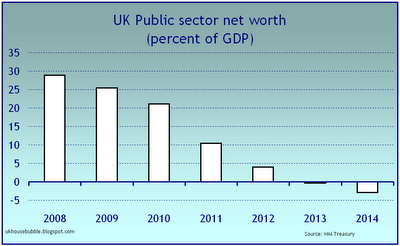

- UK: public sector net worth

- UK: Recession forces a million to work part-time

- UK house prices up strongly for third month

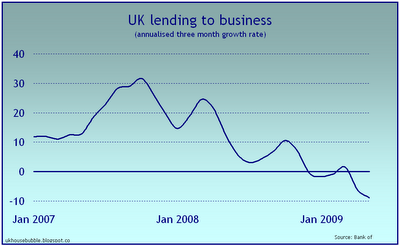

- UK: Bank lending to business down 8 percent

- Bank of China offers UK mortgages

- US-Treasuries: Real Yields Highest Since 1994 Aid Record Debt Sales

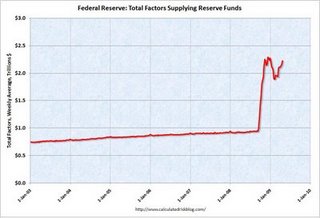

- Federal Reserve Assets Continue to Increase

- GSEs Unlikely to Repay U.S. in Full

- After Rescue, New Weakness Seen at A.I.G.

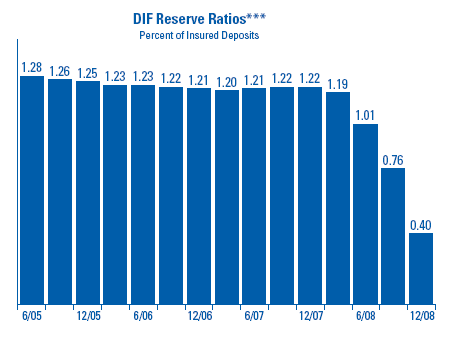

- FDIC Woefully Underfunded; Problem Institutions Soar

- Mass. pension fund posts big loss

- Bank 'walkaways' from foreclosed homes are a growing, troubling trend

- Banks Fail to Make Adequate Loan-Loss Provisions, Moody’s Says

- January’s TIC data …

- Ukraine's Naftogaz has over $4 billion in debts

Inhalt:

According to researchers working in the exclusion zone surrounding Chernobyl, there is a "strong signal of decline associated with the contamination".

The team found that bumblebees, butterflies, grasshoppers, dragonflies and spiders were affected.

[...]

The two researchers previously published findings that low-level radiation in the area has a negative impact on bird populations.

Es gibt natürlich auch eine Gegenmeinung:

"Wildlife really thrives in Chernobyl area - due to the low level of [human] influence," Dr Gashchak told BBC News.

Über das Artensterben im Bereich Ozeanien:

[...]

"They are certainly a lot higher than the background rates of extinction that you would see in the evolutionary record.

"Maybe 1,000 to perhaps 10,000 times that rate and that is occurring right across all organisms.

[...]

"Whether you look at the land biodiversity, the freshwater biodiversity, or the marine ecosystems, we are in some way having a major impact on all of those."

Dasselbe Thema wie in Stock-Market Strategy Halts Fishing Collapse:

They said that efforts introduced to halt overfishing in five of the 10 large marine ecosystems they examined were showing signs of success.

A combination of measures - such as catch quotas, no-take zones, and selective fishing gear - had helped fish stocks recover, they added.

Details of the two-year study by 21 marine scientists appear in Science.

As solar activity picks up again in the coming years, the research suggests, temperatures will shoot up at 150% of the rate predicted by the UN's Intergovernmental Panel on Climate Change.

Nein, wer hätte denn das gedacht? Das IPCC irrt sich? Nein, soetwas...

Uwe Ohse, 2009-04-24

Hey, die Krise ist wirklich vorbei...

LKW/Transporter/Bus-Verkäufe in Prozent gegenüber Vorjahresquartal:

März Q1

UK -41.7 -43.8

D-Land -15.6 -25.4

Spanien -46.1 -53.8

EU-Alt -31.3 -34.8 Alte EU-Staaten

Westeuropa -31.1 -34.5

Europa -32.9 -35.6

Estland -70.3 -71.8

Litauen -82.8 -80.9

Lettland -69.4 -76.5

Bulgarien -74.6 -68.3

EU-Neu -48.7 -44.2 Neumitglieder

EU-Gesamt -33.1 -35.8

Wenn man die Geschwindigkeit des Schuldenabbaus Australiens 1890 und 1930 auf heute überträgt, erhält man

diese wenig lustige Graphik:

Oops.

Detail:

Uwe Ohse, 2009-08-02

Der Ausbruch aus der Bevölkerungsfalle:

At the same time, there are good reasons to think that it is not entirely accidental that the countries (and regions) that were ahead in per capita income terms in 1700 were also the first to industrialise. How the world could escape the Malthusian trap at all has become a matter of intense interest to economists in recent years (Galor and Weil, 2000, Jones, 2001, Hansen and Prescott, 2002). In a related paper, we calibrate a simple growth model to show why high per capita income at an early stage may have been key for Europe’s rise after 1800 (Voigtländer and Voth, 2006).

In the “Three Horsemen of Riches”, we ask how Europe got to be rich in the first place. Our answer is best summarised by the smuggler Harry Lime, played by Orson Welles in the 1948 classic “The Third Man“:

"In Italy, for thirty years under the Borgias, they had warfare, terror, murder, bloodshed, but they produced Michelangelo, Leonardo da Vinci and the Renaissance. In Switzerland, they had brotherly love; they had 500 years of democracy and peace – and what did that produce? The cuckoo clock."

We argue that a similar logic held in economic terms before the Industrial Revolution. Europe’s exceptional rise to early riches owed much to forces of destruction – war, aided by frequent disease outbreaks and deadly cities.

Why? Because besides valuation changes and interest income there are two reasons for the increase in the reserves – the very high trade surplus and net capital inflows into China. Take the second reason first. If money flows into China for investment purposes, it must flow out of somewhere else, and that somewhere else for the most part means the global pool of dollar savings which would anyway have been available to fund the US fiscal deficit directly or indirectly.

In that sense China is acting as kind of upside-down bank that takes risk-seeking money and intermediates it into low-risk assets – as an aside almost the opposite of what the US does, and whereas the US profits from this intermediation, China runs a significant negative carry. Of course the fact of intermediating risk money into low-risk assets will have some impact on US Treasury rates, but the impact is minimal (technically risk-free rates will decline a tiny bit and credit spreads will increase by the same amount).

Kurz gesagt: Die Tatsache, daß viel ausländisches Geld nach China fließt, heißt auch, daß die Geldgeber keine amerikanischen Staatsanleihen kaufen können - und daß das Geld fließt, heißt auch, daß China als sicheres Investment gesehen wird.

Was China’s “surprisingly” high GDP growth numbers a big surprise? Not really. I have argued several times since last year that in fact China can achieve very high growth numbers by throwing a huge amount of resources into achieving short-term growth, but the real question is whether these policies are sustainable and whether the kind of growth they achieve is in China’s best interest.

Er hat Recht - auch Verschwendung ist positiv für's BIP.

Seufz.

von welchen positiven Daten redet die FT da bloß? Den überaus glaubwürdigen Regierungsdaten?

Aber eine solche Ankündigung aus regierungsnahen Kreisen ist eine echtes Alarmsignal.

Cao Jianhai, professor at the Chinese Academy of Social Sciences, a leading government think tank, said an apparent rebound in the property market was unsustainable over the medium term and being driven by a flood of liquidity and fraudulent activity rather than real demand.

Wer hätte das nur gedacht? Die Blase ist geplatzt, und schon stellt man fest, daß sie nur aufgrund von übermässig billigem Geld und Betrug zustande gekommen ist.

Ich hoffe, er hat recht - denn meine Einschätzung ist, daß die Verhältnisse in China noch verheerender sind.

Soso, _gute Zeiten_ haben über 30% Stornierungen?

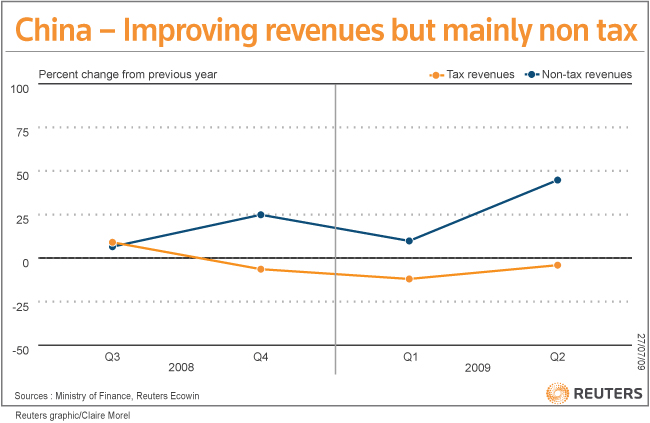

Diese Graphik sagt eigentlich schon eine ganze Menge aus. Chinas schafft es, um 8% zu wachsen, obwohl die Steuereinnahmen um 2.4% fallen, statt, wie wohl gewünscht, zu steigen.

Ansonsten verbreitet der Artikel allerlei Unfreundliches über China:

The trouble is that excludes local government borrowing, the current surge in loans backstopped by Beijing and bad assets cleared from the banking system but still floating about.

When all are thrown into the pot, analysts estimate that China's debt may be closer to 60 percent of GDP, putting it in virtually the same league as the United States, which was at 70 percent at the end of 2008 before it launched its massive economic stimulus programme.

So ist das halt mit Zahlen: Man kann schöne Spiele mit ihnen veranstalten...

Tax intakes are, of course, closely tied to economic activity, so China's upturn should deliver cash to government coffers. But improvement in June came mainly from land sales, a one-off revenue source that masks the difficult road ahead.

Until recently investment’s share of GDP growth peaked at around 65% in 2003 – a very high share by any standard – and going back the full thirty years of China’s reform period achieved an historical high astonishing of 81% in 1985. From 2005 to 2008 the investment share of GDP growth averaged around 40% – still high – and then in the first half of this year accounted for a mind-boggling 88% of this years GDP growth.

nun kommen 88% des chinesischen BIP-Wachstums aus Investitionen...

Oder anders gesagt, 7 der 8 Prozentpunkte, um die das BIP gewachsen ist, stammen aus Investitionen. Der Exportanteil am Wachstum ist massiv rückläufig (keine Überraschung).

Was heißt das wohl?

China produziert also schon mal die Lager voll... positiv gesehen sind die damit für den kommenden Superaufschwung bestens gerüstet.

Oder ist das nur eine gewaltige Fehlallokation von Resourcen?

Immobilien in China:

Of course Guiyang has a quarter the population and probably a quarter the per capita income of Shenzhen. They built sprawling new government buildings about a 20-minute drive north of town. And then the residential high rise projects started going up. From driving around the area, Tom and I figured well over 100 20+ storey buildings.

[...]

The only buildings that were occupied were six-storey towers built to accommodate the peasants who had been displaced by the construction.

Fehlallokation? Ach, was. Wer hätte je davon gehört, daß es Immobilien schadet, leer zu stehen?

This flood of money has buoyed asset prices: the Shanghai stockmarket is up 69% since the start of the year, while investors are now returning to the property market after the government clamped down on an emerging bubble there in 2007. Today, "long queues increasingly form whenever new apartments go on sale" in cities such as Shanghai and Shenzhen.

Als Maßnahme gegen das Platzen einer Blase tun wir was? Wir blasen den nächsten Ballon in derselben Farbe auf. Das ist in der Tat eine ganz neue Idee...

Aber was kann schon schlimm daran sein, Fehlallokation fortzusetzen?

Ok, ich weiß, Moody's ist nicht unbedingt das, was man glaubwürdig nennt, aber so lange - aus mir vollständig unverständlichen Gründen - deren "Ratings" (das ist ein Euphemismus) noch Gehör finden...

Wenn ich mich nicht ganz falsch erinnere, war es der Zweck des Bad Bank Gesetzes, die Banken vor dem Müll zu schützen, den sie mal für wertvoll hielten. Moody's - die den Müll selbst mit Preisschildern versehen haben - scheint das Gesetz im Wesentlichen für nutzlos zu halten.

Hat Moody's mal einen Anflug von Realitätssinn?

... was sich aber langfristig als Vorteil für die Staatsfinanzen erweisen könnte.

Naja, Moody's hat trotzdem Recht. Was nützen die etwas weniger ruinierten Staatsfinanzen langfristig schon? Außer als Reserve für Wahlgeschenke, natürlich...

Nach dem allgemeinen Hypoport-Index, der die tatsächlich erzielten Verkaufspreise für Gebäude umfasst, haben Ein- und Zweifamilienhäuser im Bestand seit Jahresbeginn durchschnittlich neun Prozent an Wert verloren. Seit Dezember verbilligten sich diese Objekte demnach im Bundesschnitt von 185.000 Euro auf nur noch 168.375 Euro Ende März. Es handelt sich um den stärksten Preisrückgang binnen einem Quartal seit Beginn der Indexberechnung im Januar 2005. Damals kosteten Häuser im Bestand im Schnitt noch 204.856 Euro. Seither haben existierende Eigenheime den Indexdaten zufolge im Schnitt rund 18 Prozent an Wert verloren. Einzig Immobilien in Innenstadtlagen erweisen sich als wertstabil.

Das ist eine Katastrophe.

Prices fell 0.6% in July from a year earlier - the first fall since March 1987, when they declined by 0.3%.

The decline was largely due to falls in energy prices, which peaked in summer 2008, and analysts said Germany was unlikely to see a deflationary spiral.

An der Argumentation mit dem Ölpreis ist etwas dran, aber technische Argumente helfen gegen das psychologische Phänomen Preisverfall nicht unbedingt.

Gelebte Demokratie und Zivilisation in Griechenland:

About 150 hooded youths, armed with sledgehammers and steel bars, entered the Kolonaki district in central Athens on Friday afternoon, smashing shop windows and cars. The attackers fled after police used tear gas, scattering leaflets identifying them as members of anarchist groups.

No casualties have been reported, and no arrests were made.

Greece has seen regular street violence since last December's worst riots in decades, sparked by the killing of a teenager by police. Last week a home-made explosive device went off outside a Citibank branch in Athens.

Nur damit nicht in Vergessenheit gerät, daß Griechenland immer noch brennt...

“There is simply no case for the pressure that we, who have been among the lowest emissions per capita, face to actually reduce emissions,” Jairam Ramesh said at a meeting today with Clinton in Gurgaon near New Delhi, according to a statement he issued to reporters. “And as if this pressure was not enough, we also face the threat of carbon tariffs on our exports to countries such as yours.”

Indien will sich von den USA nicht unter Druck setzen lassen,den CO2-Ausstoß zu reduzieren.

Vielleicht würde es helfen, wenn die USA mal mit gutem Beispiel voran gingen?

[Update, 2.8.2009]

http://www.ft.com/cms/s/0/80a9200e-7dfe-11de-8f8d-00144feabdc0.html?nclick_check=1

“In 2020, it’s conceivable that we might look at a limited target. But in 2009, no way,” said Mr Ramesh.

17000 entspricht, auf die USA hochgerechnet, locker einer Million Stellen.

Und 13000 von diesen 17000 Stellen im den Bereichen Kinder, Gesundheit und Ausbildung einzusparen, ist eine langfristig sehr, sehr schlechte Sache.

Aber hey, irgendetwas auf der Welt muß ja wachsen - warum nicht die Zahl der Armenhäuser?

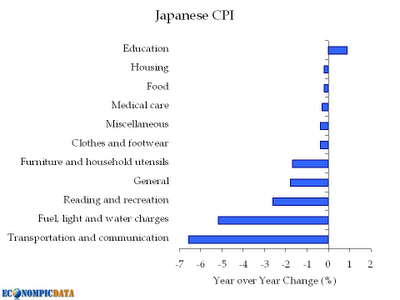

The 1.7 per cent year-on-year fall in consumer prices, excluding fresh food, and the 5.4 per cent jobless rate highlight the continuing troubles of the world’s second-largest economy, despite a sharp rebound in industrial output over the past four months.

While the falling energy prices that have been the main driver behind the decline are no bad thing for resource-poor Japan, analysts increasingly worry that deepening deflation – fuelled by job insecurity and massive manufacturing over-capacity – could undermine economic recovery.

The fall in “core-core” consumer prices, excluding food and energy, accelerated to 0.7 per cent in June. More recent July price data for urban areas of Tokyo showed a fall of 1.1 per cent.

http://econompicdata.blogspot.com/2009/07/full-blown-deflation-hits-japan.html

Econompicdata hat den Preisverfall mal aufgeschlüsselt.

Sales slid 3 percent from a year earlier, the Trade Ministry said today in Tokyo. Economists surveyed by Bloomberg News predicted a 2.5 percent drop.

Kanadischer Pensionsfonds meldet große Erfolge:

The Public Sector Pension Investment Board reported Thursday it was buffeted by the financial crisis that began last year, seeing its assets fall by $5.1-billion to $33.8-billion as of March 31, 2009, down from $38.9-billion a year earlier.

-22%!

Das muß doch ein Erfolg sein, denn sonst würden doch keine Boni gezahlt...

His pay included a $485,000 base salary, an annual bonus of $189,122, a deferred incentive plan payment of $611,100, benefits and other compensation worth $35,876, and accrued pension benefits worth $98,500.

Ein Land, auf das das Motto dieser Artikelserie - nämlich "Alles wird gut" - nicht zutreffen wird, ist Mexiko. Ich möchte nicht, wie [a href=http://www.theoildrum.com/user/jeffvail]jeffvail in Mexico: A Collapse Update[/a], so weit gehen, daß Mexiko zusammen- und auseinanderbrechen wird, denn vielleicht passiert ja noch ein Wunder - und sei es nur, daß die USA mal aufwachen -, aber nach Happy End sieht es in Mexiko nicht aus.

Pemex, which hasn’t increased production in 3 years, needs to raise output by at least 1.6 percent in the final six months of 2009 to reach a goal of 2.65 million barrels a day, according to data compiled by Bloomberg. Mexico City-based Pemex lowered its forecast yesterday on an earnings conference call.

[...]

Pemex says it will seek $10 billion in bank loans and bonds this year to finance its $19.5 billion capital budget.

The company plans to spend $19.9 billion annually from 2010 through 2012. Oil producers including ConocoPhillips, the third- largest U.S. oil company, slashed their budgets amid plunging energy prices because of the recession. ConocoPhillips cut its capital budget 37 percent to $12.5 billion this year.

[...]

This year will be the first time Pemex raises total debt levels since 2006. Total debt as of June 30 was $47 billion. The company has also agreed to borrow as much $900 million from the U.S. Export-Import Bank this year.

Mexico’s Energy Ministry has set a goal of having production rebound to 3 million to 3.1 million barrels a day by the end of President Felipe Calderon’s term in 2012. The estimate is based on the incorporation of new fields and mature fields like Ku-Maloob-Zaap reaching their peaks.

Ich glaube nicht, daß das klappt.

[...]

Poland, which imports about two-thirds of the gas it uses from Russia, would be short of some 2.5 billion metres annually starting from 2010 with Russia the only supplier capable of filling the gap.

Poland receives gas from Russia through the Yamal pipeline, which is capable of carrying about 30 billion cubic metres of gas annually to Europe, but the government wants to diversify from its dependence by building a liquefied natural gas terminal.

Über die Bevölkerungszahl in Rußland:

Rußland hat dieses Problem bereits mehrfach gehabt, aber diesmal ist es anders:

Russia has faced this problem at other times during the last century. The first bout of depopulation lasted from 1917 to 1923, and was caused by the upheavals that transformed the Russian Empire into the Soviet Union. The next drop took place between 1933 and 1934, when the country’s population fell by nearly 2 million—or almost 2 percent—as a result of Stalin’s war against the “kulaks” in his forced collectivization of Soviet agriculture. And then, between 1941 and 1946, Russia’s population plummeted by more than 13 million through the cataclysms and catastrophes of World War II.

The current Russian depopulation—which began in 1992 and shows no signs of abating—was, like the previous episodes, also precipitated by events of momentous political significance: the final dissolution of the Soviet Union and the end of Communist Party rule. But it differs in three important respects. First, it is by far the longest period of population decline in modern Russian history, having persisted for over twice as long as the decline that followed the Bolshevik Revolution, and well over three times as long as the terrifying depopulation Russia experienced during and immediately after World War II.

17 Jahre sind ein übel langer Zeitraum - und da es keine externen Ursachen gab, muß jedwede Veränderung von innen kommen. Die ersten Putinjahre lassen nicht erkennen, daß es sie gegeben hat...

A comparison dramatizes what is happening in Russia. Between 1976 and 1991, the last sixteen years of Soviet power, the country recorded 36 million births. In the sixteen post-Communist years of 1992–2007, there were just 22.3 million, a drop in childbearing of nearly 40 percent from one era to the next. On the other side of the life cycle, a total of 24.6 million deaths were recorded between 1976 and 1991, while in the first sixteen years of the post-Communist period the Russian Federation tallied 34.7 million deaths, a rise of just over 40 percent. The symmetry is striking: in the last sixteen years of the Communist era, births exceeded deaths in Russia by 11.4 million; in the first sixteen years of the post-Soviet era, deaths exceeded births by 12.4 million.

1976-1991: 36 Mio. Geburten, 24.6 Mio Sterbefälle, zusammen +11.4 Mio.

1992-2007: 22.3 Mio. Geburten, 34.7 Mio. Sterbefälle, zusammen -12.4 Mio.

A consortium headed by the World Health Organization estimated that for 2005 a woman’s risk of death in childbirth in Russia was over six times higher than in Germany or Switzerland. Moreover, mortality levels for women in their twenties (the decade in which childbearing is concentrated in contemporary Russia) have been rising, not falling, in recent decades.

=> Auf dem Weg in die dritte Welt.

Das ist aber gar nicht das Hauptproblem:

But Russia’s low fertility patterns are not due to any extraordinary inability of Russian women to conceive, but rather to the strong and growing tendency among childbearing women to have no more than two children—and perhaps increasingly not more than one. The new evident limits on family size in Russia, in turn, suggest a sea change in the country’s norms concerning family formation.

denn _das_ ist das Problem: Verzicht auf Kinder.

Was natürlich nicht heißen soll, daß Rußland sonst keine Probleme hat:

These losses were recovered during the Gorbachev period, but even at its pinnacle in 1986 and 1987, overall life expectancy for Russia was only marginally higher than it had been in 1964, never actually managing to cross the symbolic 70-year threshold. With the end of Communism, moreover, life expectancy went into erratic decline, plummeting a frightful four years between 1992 and 1994, recovering somewhat through 1998, but then again spiraling downward. In 2006—the most recent year for which we have such data—overall Russian life expectancy at birth was over three years lower than it had been in 1964.

Allgemein steht es schlecht um die Gesundheit dort, und die Lebenserwartung:

Das heißt wohl in der Praxis, daß die Lebenserwartung russischer Männer kleiner als 60 Jahre sein könnte.

Aids, Drogen und TB. Nichts davon verheißt eine glorreiche Zukunft.

Herz/Kreislaufbedingte Todesfälle: 3.8 mal so hoch wie hier.

Verletzungen und Vergiftungen: 5.3 mal so viele Todesfälle wie hier.

=> Dritte Welt auch in Punkto gewaltbedingte Tode.

Und dann ist da der Suff:

Yet even these numbers may substantially understate hard spirit use in Russia, since the WHO figures follow only the retail sale of hard liquor. But samogon—home-brew, or “moonshine”—is, according to some Russian researchers, a huge component of the country’s overall intake. Professor Alexander Nemstov, perhaps Russia’s leading specialist in this area, argues that Russia’s adult population—women as well as men—puts down the equivalent of a bottle of vodka per week.

Putin’s Kremlin made a fateful bet that natural resources—oil, gas, and other extractive saleable commodities—would be the springboard for the restoration of Moscow’s influence as a great power on the world stage. In this gamble, Russian authorities have mainly ignored the nation’s human resource crisis. During the boom years—Russia’s per capita income roughly doubled between 1998 and 2007—the country’s death rate barely budged. Very much worse may lie ahead. How Russia’s still-unfolding demographic disaster will affect the country’s domestic political situation—and its international security posture—are questions that remain to be answered.

die werden nie wieder Supermacht.

[...]

Exports in July slid 20.1 per cent from a year ago, the Ministry of Knowledge Economy said, slightly better than a forecast of a 20.6 per cent drop and after a revised 12.4 per cent fall in June.

Licht am Ende des Tunnels: Nur 20.1% der Wirtschaft tot, nicht 20.6%.

Das ist ganz, ganz schlecht für ein Land, dessen Reichtum lange vorher im Nichts aufgeht.

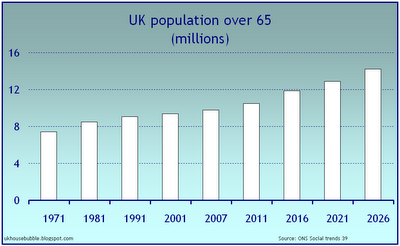

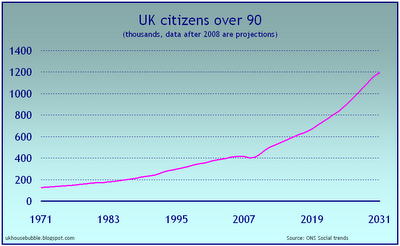

http://ukhousebubble.blogspot.com/2009/04/ageing-britain.html

Take for example, citizens over 90; there has been a three-fold increase since 1971. The number is likely to triple again by 2031. Over-90s incur major medical costs. While we might be able to delay the retirement age by a couple of years, the typical 90 year-old is extremely unlikely to be a financially self-supporting member of the community.

The over 65’s in Britain are, on average, worse off than their counterparts in Romania, Poland and France.

The research, which compared relative poverty in the 27 member states, showed nearly one in three UK over-65s were at risk of poverty - the same proportion as in Lithuania (30 per cent).

Only pensioners in Cyprus (51 per cent), Latvia (33 per cent), and Estonia (33 per cent) came out worse. The EU average was 19 per cent.

Seufz. Mitteleuropas kommendes Armenhaus.

Das sind absolut keine guten Aussichten für .UK: 2014 wird der Staat weniger Besitz als Schulden haben.

In the past year more than 250,000 extra people who would like to be in full-time employment have found themselves working four days a week or fewer, according to the Office for National Statistics.

This is an increase of more than a third on the previous year, and illustrates the extent to which companies are trying to cope with the downturn by reducing staff hours, rather than just laying them off.

"Wachstumbranche": +33% Teilzeitarbeit.

Schade bloß, daß die Leute das nicht freiwillig tun.

[...]

I should also note that mortgage applications have been increasing strongly, evidence that first time home buyers are coming back to the market. This underlying demand may be buoying prices.

Overall, the data cannot be seen as anything but bullish.

Kinder, Kinder. Eine Schwalbe macht noch keinen Sommer. Und bei rund 2% Inflation und 2% Wertverlust des Pfunds in den letzten 3 Monaten bin ich mir noch nicht mal sicher, daß das, was da zu sehen ist, eine Schwalbe und keine Fata Morgana ist...

Ja, vielleicht ist das der Tiefpunkt. Aber mir ist nicht klar, warum man deshalb bullish sein sollte.

Vielleicht erholt sich der UK-Immobilienmarkt ja tatsächlich - eine neuer Hypothekengeber tritt auf.

Mortgages from the Chinese bank are offered via four brokers, starting at 2.5% above the base rate.

Bank of China previously focussed on lending to Chinese communities in the UK, but is now widening its scope.

Treasuries are the cheapest relative to inflation since 1994 after consumer prices fell 1.4 percent in June from a year earlier. The real yield, or the difference between rates on government securities and inflation, for 10-year notes was 5.10 percent today, compared with an average of 2.74 percent over the past 20 years.

aus irgendeinem Grund müssen die USA - Hort der finanziellen Solidität - an die Abnehmer ihrer Staatsanleihen mehr Zahlen als sonst je seit 1993.

Zweifelsfrei ist die Krise besiegt...

Daß Fannie und Freddie dem US-Steuerzahler nicht alles werden zurückzahlen können, was der zur Rettung der beiden Unternehmen "geliehen" hat, kommt nun nicht wirklich überraschend.

The Treasury has agreed to pump $200 billion into each company in order to keep them solvent. In exchange, the government receives senior preferred stock that pays a 10% dividend. So far, it has injected $85 billion in total into the companies, but Lockhart said that figure was likely to rise in the coming months.

Einige der Verluste werden also nicht zurückgezahlt werden können.

Hmmm....

Mr. Lockhart said Fannie and Freddie would likely see their reserves continue to decline next year, but could return to strong profits in two to three years. But he cautioned that the companies' thin capital and huge exposure to the mortgage market make it unlikely they will be able to repay the government in full.

Ich bin sicher, es gibt irgendeinen Fachbegriff für "starke Gewinne" von Unternehmen, die ihre Schulden nicht zurückzahlen können. Aber momentan wollen mir nur "Milchmädchenrechnung" und "Insolvenz" einfallen.

Mr. Lockhart said Fannie and Freddie aren't likely to burn through all $400 billion of government capital available under their agreement with the government. He cited stress tests that showed the total draws would remain below that level.

Naja, maximal 400 Mrd. Da geht's uns mit HRE ja noch gut...

In the months since A.I.G. received its $182 billion rescue from the Treasury and the Federal Reserve, state insurance regulators have said repeatedly that its core insurance operations were sound — that the financial disaster was caused primarily by a small unit that dealt in exotic derivatives.

Aber was wissen wir schon sicher, jedenfalls bei Unternehmen, die der Bilanzierungspflicht unterliegen?

AIG hat also schon mal recht eigenwillige Geschäfte zwischen den Geschäftsbereichen getätigt, zum Beispiel Garantien ausgesprochen, selbst wenn ein Geschäftsbereich wußte, daß er das gar nicht konnte.

Naja, nichts Neues auf der Welt, das macht der Staat ja ständig...

The companies’ weaknesses emerge in their filings with state insurance regulators — particularly when several are reviewed together. But that appears not to happen often, because there are so many. A.I.G. has more than 4,000 units in more than 100 countries.

Ok, 4000 Geschäftseinheiten... wer würde je gedacht haben, daß da irgendwelche Risiken verschleiert werden könnten?

Beispiel:

In addition, American Home has “unconditionally” guaranteed the obligations of 16 other A.I.G. subsidiaries, bringing the total it might have to pay to $140.6 billion.

26 Mrd. Assets, 140 Mrd. Garantien.

The latest Quarterly Banking Profile shows something most of us inherently knew: The FDIC is ill prepared for more bank failures.

- The DIF Balance Declines by $16 Billion, and Insured Deposits Grow by 4.6 Percent in the Fourth Quarter

- DIF Reserve Ratio Declines to 0.40 Percent

- Twenty-Five Insured Institutions Fail During the Year; Another Five Insured Institutions under the Same Holding Company Receive Assistance

Die DIF Reserve Ratio ist das Verhältnis der Reserven des Deposit Insurance Funds zu den versicherten Einlagen. Es ist nun so niedrig, dass auf jeden Investierten Dollar 0.4 Cent Sicherheit kommen... Oh, und noch ein Quartal, und der DIF ist leer.

Ich zitiere mal ein paar Headlines aus http://www.fdic.gov/bank/analytical/quarterly/2009_vol3_1/Quarterly_Vol3No1_entire_issue_FINAL.pdf:

Industry Reports First Quarterly Loss Since 1990

Provisions for Loan Losses Are More than Double Year-Earlier Total

Full-Year Earnings Fall to Lowest Level in 19 Years

Reserve Coverage Ratio Slips to 16-Year Low

Failures and Assistance Transactions Rose to 15-Year High in 2008

Ganz sicher ist die Krise vorbei oder wenigstens das Schlimmste überstanden!!!

The fund lost 23.6 percent, or $12.8 billion, in the fiscal year that ended June 30, according to Michael Travaglini, executive director of the Massachusetts Public Reserves Investment Management Board, which runs the state pension fund. Assets are now down to $37.8 billion.

Worse, the long-vacant rental home had been vandalized and she faced a raft of housing code violations. Since then, she has been saddled with debts of about $12,000 to pay for demolition and back taxes.

"I thought I had nothing else to do with that home," said Atterberry. "I was so embarrassed and humiliated by this."

Da wird man aus dem Haus geworfen, und bekommt 5 Jahre später eine Rechnung, weil man noch Hauseigentümer ist?

[...]

"It's a growing issue. It's all over the state. It's not just Cleveland," said State Rep. Mike Foley. "That kind of lack of respect for communities that banks have made a ton of money off of in the past is infuriating."

U.S. banks may incur about $470 billion of losses and writedowns by the end of 2010, which may cause the banks to be unprofitable in the period, the ratings company said in a report published today.

Soso, 470 Mrd. Verluste und Abschreibung bis Ende 2010 läßt die Banken unprofitabel werden?

Wie wäre es statt dessen mit dem Wort insolvent.

btw: Die Summe dürfte einige der ganz, ganz großen Banken umfassen.

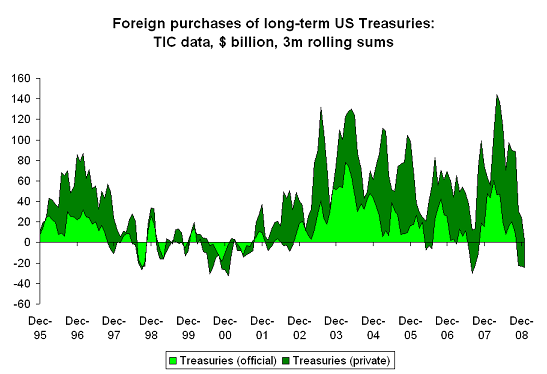

[TIC ist "Treasury International Capital" - Geldströmungsstatistik der US Treasury]

Interessant ist der Gegensatz zwischen den aktuellen Daten und den einen Monat älteren (Foreign money continues to pour into US).

Wenn ich Setser richtig interpretiere, beginnt die Flucht aus dem Dollar:

2) Banks stopped piling into US assets. In October — at the peak of the crisis — private investors abroad bought $64 billion US t-bills and increased their dollar deposits by $196 billion (see line 29 of the TIC data; “change in banks own (net) dollar-denominated liabilities). In January, credit conditions eased a bit, and private investors reduced their t-bill holds by $44 billion and the banks reduced their (net) dollar deposits by $119 billion.

Russia also, interestingly, added to its holdings of short-term Treasury bills. The Gulf reduced its dollar deposits (now at $114.3b, down from a peak of $125.5b in November) whether to support its domestic banks or to cover stretched budgets. The Gulf (and Brazil) also bought a decent number of long-term Treasuries. Most official buying, though, came at the short-end. In aggregate, the official sector sold $1.9 billion of long-term Treasuries while adding $29 billion to its short-term bills.

Interessant ist diese (nicht unerwartete) Feststellung:

wir erinnern uns: So mancher Bank wurde zum Verhängnis, daß sie sich nicht mehr kurzfristig refinanzieren konnte... nun sind Staaten etwas anderes als Banken, aber ein richtiger Vertrauensbeweis ist das nicht.

http://blogs.cfr.org/setser/2009/03/18/a-bit-more-to-worry-about-foreign-demand-for-long-term-treasuries-has-faded/#more-4981

Über den Kauf von US-Staatsanleihen durch Ausländer sagt diese Graphik genug...

The “quality” of the financial flows into the US consequently bears watching. A modest revival in foreign demand for longer-dated US assets would be a positive sign. To date, the sale of US assets abroad and a scramble for liquid dollar assets has provided the US with more than enough financing to sustain its deficit. Those flows though may not continue.

And if — as seems likely — foreign demand for Treasuries fades long before the US fiscal deficit, the US Treasury will need to sell an awful lot of Treasuries to American investors. For the past several years I have argued that it was almost impossible to overstate the impact of central bank demand on the Treasury market.

That may no longer be the case going forward.

The world is changing. Global reserves aren’t growing. The echo from their past peak that we observe in the current Treasury data will fade.

The Russian-language newspaper Delo, which is published in Ukraine, said that Ukraine's largest state company has to repay loans of over 25 billion hryvna ($3 billion) in 2009, with another 4 billion hryvna (about $500 million) due in interest payments.

Irgendwie beschleicht mich das Gefühl, daß die Ukraine derzeit eine sehr, sehr schwierige Zeit durchläuft.

Wollen Sie den Digest abbestellen?