| Sendedatum | 2009-03-14 19:32:21 |

|---|---|

| Ausgabe | 84 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

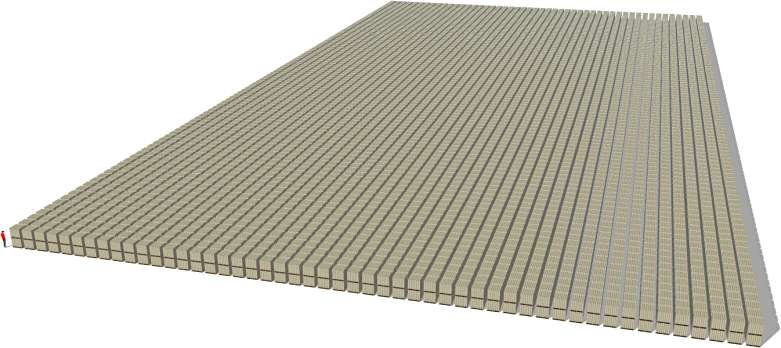

Zur Einstimmung ein Blick auf Dubai:

Inhaltsverzeichnis:

- A sinking feeling

- Amazon rainforest at risk of ecological 'catastrophe'

- Climate 'hitting Europe's birds'

- 'Coral lab' offers acidity insight

- Coral reefs may start dissolving when atmospheric CO2 doubles

- UN climate chief: US carbon cuts could spark 'revolution'

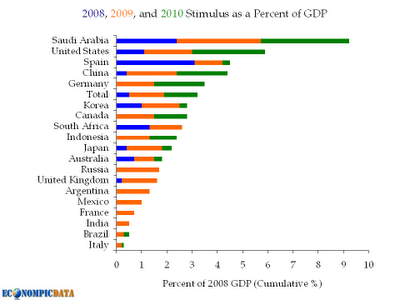

- Global Stimulus as a Percent of GDP

- 45 percent of world's wealth destroyed: Blackstone CEO

- Idle Box Fleet Reaches 1.35M TEUs

- Deutsche Bank analyzes oil production costs

- Japan reconsidered

- AFGHANISTAN: Tempted by a Taliban job offer

- In Parched Argentina, Worries Over Economy Grow

- China Trade Surplus Plunges as Exports Fall by Record

- Chinas Ölimporte im Februar 2009

- China’s Luxury Mall Calamity

- China Consumer Prices Fall for First Time Since 2002

- Sindelfingen droht Finanznot

- Qimonda stoppt Produktion in Dresden

- Politiker warnen vor Staatsbankrott in Schleswig-Holstein

- Tragfähiges Geschäftsmodell

- Sieben Mythen über Opel

- Thyssen stoppt Bau von vier Schiffen

- Dubai: Wohnimmobilien

- Dubai: Gewerbeimmobilien

- Dubai: Exodus

- Dubai: Leere

- Dubai lässt Rechnungen platzen

- Record for European corporate spreads

- Ghost Towns Dot Finland as Forestry Collapse Threatens Growth

- Tata: Autoverkäufe im Januar 2009

- Tata Motors says some vendor payments delayed

- Cathay Pacific Says Current Fares Are Unsustainable

- Japan’s fearless women speculators

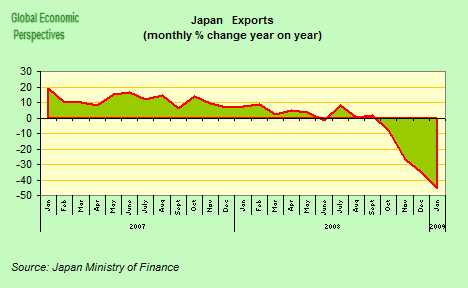

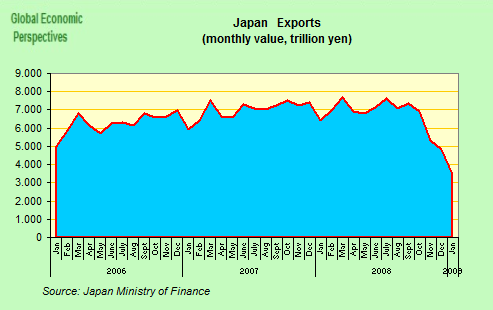

- Japan Exports Plummet 45.7%, Deficit Widens to Record

- Japan confirms sharp drop in GDP

- Japan’s Funding Crunch Deepening, State Lender Says

- Der Fluch des teuren Yen...

- Norway pension fund loses 71.5 bln euros

- Poland searching for investment partners for Euro 2012

- Kreml will 100 Mitarbeiter entlassen

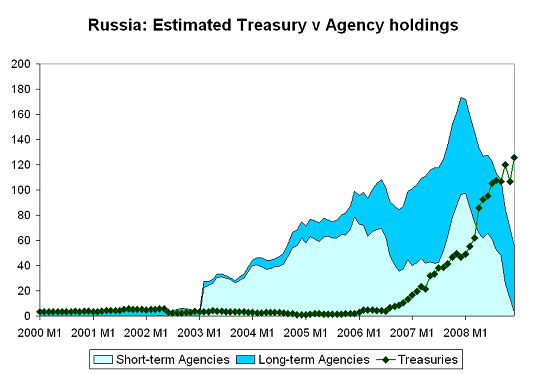

- Russia bans Nat'l Wealth Fund investment in agencies

- St. Petersburg TEU Traffic Plunges

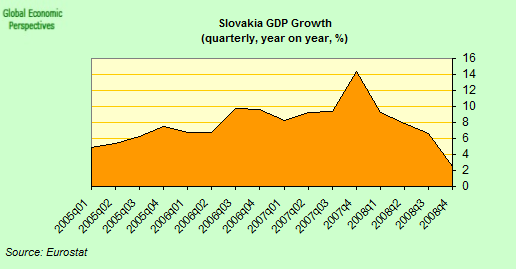

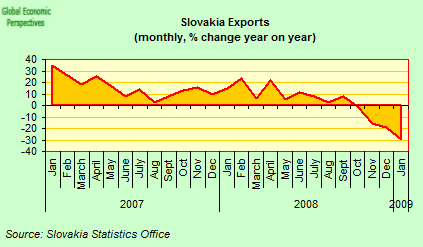

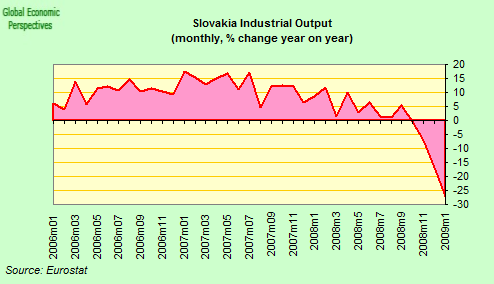

- Slovakia Slides Into Recession

- Slovenia’s Economy Falls Off The Roof

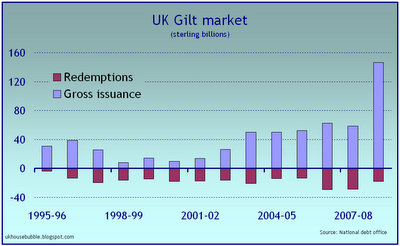

- UK: The gilt market explosion

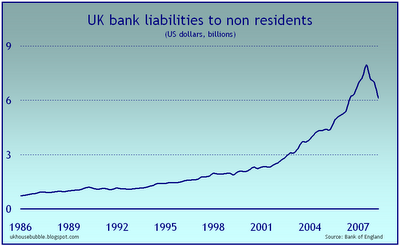

- UK: Foreign investors racing towards the exit

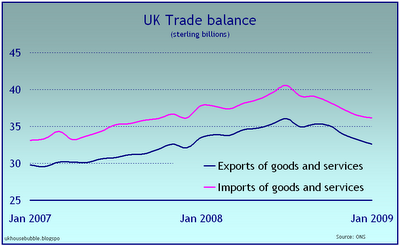

- UK trade data - exports down, imports down; trade deficit remains the same

- House prices 'could drop another 55%' and leave Britain bankrupt

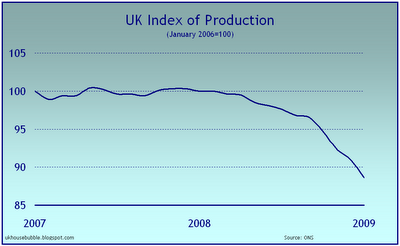

- UK - diving head first into a depression

- USA: Keepin' It Real Estate: Foreclosure Wheel Keeps on Turning

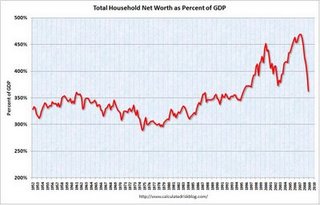

- USA: Household net worth

- USA: Einzelhandelsumsätze

- USA: Importe und Exporte im Januar 2009

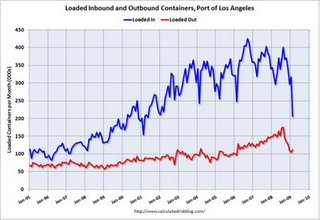

- LA Port Import Traffic Collapses in February

- USA: Rail Freight Traffic

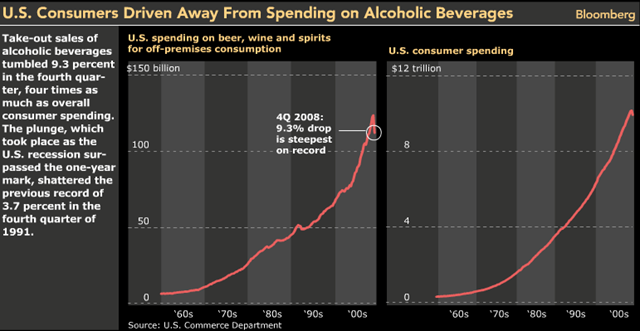

- USA: Weniger Alkoholverkäufe

- Cumulative high yield defaults could hit 50%, says Goldman Sachs

- Budget deficit widens 10% as receipts fall to 14-year low

- Harvard: the Inside Story of Its Finance Meltdown

- To the victor go the spoils: who answers the phone in the US Treasury?

- AmEx paying card holders to close their accounts

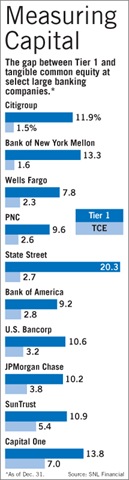

- USA: Comparing Bank TCE and Tier 1 Capital Ratios

- U.S. Pension Plan Funding Plunged by More than $300 Billion in 2008

- Pensions Experience $33 Billion Decline in Funded Status in February

- Freddie needs $31bn capital injection

- In hard times, more U.S. women try to sell their eggs

- Drought to Cut Off Federal Water to CA Farms

- Schutz der Armen: Chávez enteignet US-Reisfabrik

Inhalt:

The reason for the rapid change in the predicted rise in sea levels is a rapid increase in the information available. In 2007, when the Intergovernmental Panel on Climate Change convened by the UN made its prediction that sea levels would rise by between 18cm and 59cm by 2100, a lack of knowledge about how the polar ice caps were behaving was behind much of the uncertainty. Since then they have been closely monitored, and the results are disturbing. Both the Greenland and the Antarctic caps have been melting at an accelerating rate. It is this melting ice that is raising sea levels much faster than had been expected. Indeed, scientists now reckon that sea levels will rise by between 50cm and 100cm by 2100, unless action is taken to curb climate change.

Das Thema wird sogar USA-tauglich.

Even small rises in temperature could destroy large swathes of the jungle, they believe.

Changing rainfall patterns already under way could leave up to three quarters of the forest dry and withered by the middle of the next century.

The result would not only be an ecological "catastrophe" but could also turn the global weather system on its head, the researchers said.

The findings were presented to the climate summit in Copenhagen by scientists at the Met Office’s Hadley Centre in Exeter, which specialises in climate prediction and research.

The team has calculated that if, as widely anticipated, the world’s average temperature rises by 2 degrees Celsius (3.6 degrees Fahrenheit) from the pre-industrial levels of around 14C (57F) by the middle of the century, then between 20 and 40 per cent of the Amazon’s trees will disappear.

If the more pessimistic predictions of a 3 degree C rise are correct, then as much as 75 per cent of the forest will be destroyed by 2150.

Climate change is already having an impact on European bird species, according to British scientists.

[...]

"Overall, the trend is towards net loss," said a spokesman for the Royal Society for the Protection of Birds (RSPB), which contributed to the study.

[...]

The researchers found birds that are expected to do well as temperatures rise had indeed increased in number since the 1980s.

But some 75% of species studied by the researchers had declined in the same period.

The study compared the change in population numbers of bird species over the last two decades with the projected change in their ranges and found a strong link.

These shifts in species territory are thought to be associated with climate change.

Of the 122 species included in the study (out of 526 species that nest in Europe), 30 are projected to increase their range, while the remaining 92 species are anticipated to experience a contraction in their territory.

Dr Carol Turley from Plymouth Marine Laboratory says it is impossible to know how marine life will cope, but she fears many species will not survive.

Since the Industrial Revolution, CO2 emissions have already turned the sea about 30% more acidic, say researchers.

It is more acidic now than it has been for at least 500,000 years, they add.

...

Laboratory tests suggest starfish may be wiped out before the end of the century if current emissions trends continue.

Scientists fear mussels may not be able to cope, either. Oysters may be less vulnerable, and farmed oysters may fare better than wild oysters.

besuchen Sie die Korallenriffe, so lange sie noch stehen.

Die Realitäten in der Politik:

Obama has said the US will work to reduce its greenhouse gas emissions to 1990 levels by 2020. Europe has pledged to cut them by 20-30% on 1990 levels by 2020. The IPCC says developed nations should aim for 25-40% cuts by then to avoid dangerous climate change.

Speaking on the fringes of a high-level scientific conference on climate change in Copenhagen, Pachauri told the Guardian: "He [Obama] is not going to say by 2020 I'm going to reduce emissions by 30%. He'll have a revolution on his hands. He has to do it step by step."

"Between 40 and 45 percent of the world's wealth has been destroyed in little less than a year and a half," Schwarzman told an audience at the Japan Society. "This is absolutely unprecedented in our lifetime."

"45% sind weg, und unsere Kunden durften sogar daran teilhaben". Ob das Blackstones Kunden und Aktionären wenigstens ein gutes Gefühl verschafft?

Andererseits habe ich keinen Zweifel daran, daß Blackstones Aktionäre sowieso Idioten etwas anders gestrickt sind...

Internationale Containerschiffahrt:

The jobless figure, up from 392 vessels of 1.1 million TEUs two weeks ago, is equivalent to 10.7 percent of the world cellular container ship fleet in capacity terms, according to AXS-Alphaliner, the Paris-based consultant.

This is the highest unemployment rate in the history of container shipping and is three times the 3.5 percent jobless figure in the depth of the 2002 bear market.

The idled fleet has nearly tripled since the beginning of the year when it stood at 210 ships of 550,000 TEUs. In late October the jobless fleet totaled 70 ships of 150,000 TEUs.

Zusammenfassung der stillgelegten Containerschiffkapazitäten:

[in]

Spätoktober 2008: 70 Schiffe, 150000 TEUs (Container).

Anfang 2009: 210 Schiffe, 550000 TEUs.

Vor zwei Wochen: 392 Schiffe, 1100000 TEUs.

Jetzt: 453 Schiffe, 1350000 TEUs.

[/in]

Kann der Ölpreis weiter fallen? Ja, er kann...

Second, the analysis found that lower oil prices would shut in much oil production. Looking at the marginal cash cost curves within these mature regions, a modest 700,000 b/d of production would be cash negative with an oil price of $30/bbl, including 400,000 b/d of oil sands production. However, at a $20/bbl WTI oil price this rises towards a more substantial 3.5 million b/d.

The third observation is that decline rates could curtail supply quickly. Past oil-price collapses have been associated with a sharp increase in the decline rates observed in mature basins. Using past production curves as a proxy, Deutsche Bank estimates that as much as 1.5 million b/d of supply could be lost to accelerated decline over the next 2 years within the US onshore, Alaska, Canada, UK, Norway, and Russia.

Finally, the analysts see that new supply projects are being postponed. Within the growth regions, the rise in costs and taxes in recent years suggests that the average oil price necessary to achieve a 15% rate of return is now $68/bbl in Angola, $62/bbl in the US Gulf of Mexico, $60/bbl in deepwater Nigeria, and around $60/bbl in Brazil, although this depends heavily on the scale of the development considered.

Das eigentliche Problem ist also, daß der derzeitige Preis nicht ausreicht, neue Felder zu erschließen.

Auf der positiven Seite aber lohnt sich ein Preisdumping für niemanden - so viele derzeitige Wettbewerber bekäme man auch mit $20 nicht aus dem Markt gedrängt.

Krugman über Japan bzw. die USA:

Well, I’m sure I’m not the only person to notice this: Japan doesn’t look so bad these days.

For one thing, the famed sluggishness of Japanese policy — the refusal to face up to banking system losses and pour in the funds needed to recapitalize the system, the refusal to let zombie banks die, the stop-go nature of fiscal policy, with concerns about rising debt warring with concerns about the economy — all of that seems entirely comprehensible now, doesn’t it? Even with the knowledge of what happened to Japan to motivate us, so far we’re following exactly the same path.

And given what the next couple of years are likely to look like, Japan’s lost decade — yes, growth was slow, but there wasn’t mass unemployment or mass suffering — is actually starting to look pretty good. We may or may not be about to face our own lost decade, but the sheer misery millions of Americans will face in the near future probably exceeds anything that happened in Japan during the 90s.

I still hope we can do better than the Japanese did, but it’s not at all obvious that we will.

[...]

Shakir was deported from Iran three times in 2006-2008 and his efforts to find a job in his home district of Pushtroad have been unsuccessful. “I cannot marry and start a family because I have no money… Wherever I go [for work] I return empty-handed,” he said.

“The Taliban pay 500-1,000 Afghanis [$10-20] for a day of action against government and American forces,” said Lutfullah, 23, from Helmand Province.

By contrast, government employees get less than $2 a day.

Für die Regierung zu arbeiten bringt 2$ am Tag, gegen sie zu arbeiten 10 bis 20. Mich dünkt, der Verlierer zahlt schlechter.

Wie dämlich muß man eigentlich sein, um glauben zu können, daß man unter diesen Umständen gewinnen kann?

Argentina’s worst drought in more than 50 years is magnifying the country’s chances of suffering another economic crisis, and the lost farming revenue will complicate the government’s efforts to meet more than $18 billion in debt obligations this year, economists said.

[...]

Argentine ranchers have lost an estimated 1.5 million head of cattle, said Ernesto Ambrosetti, the chief economist at the Institute of Economic Studies at the Argentine Rural Society. Ricardo Theill, a dairy farmer in Ceres, in Santa Fe Province, told a radio station last week that he lost 106 cows in three hours when they abandoned their parched pasture, gorged on soybean plants and died from indigestion.

[...]

The United States Department of Agriculture last week dropped its estimate of Argentina’s corn crop to 13.5 million tons, down 35 percent from the department’s estimate last year.

Argentinien: Kornernte -35%, Rinderzahl -1.5 Millionen.

Und dann sind da noch die Staatsfinanzen:

Though most economists say they believe the government can squeak by and avoid another crippling default on its debts, sidestepping a major devaluation of the currency, the peso, will be a more delicate dance.

For now, the Kirchner government appears committed to gradually devaluing the peso to avoid stoking a widespread panic.

With the cash that the government seized from private pension funds and other instruments, it can shave down a $10 billion financing gap this year to a more manageable $2 billion, said Esteban Medrano, an economic adviser at LatinSource, a consulting firm.

He said a steep drop in production could be offset somewhat by millions of tons of grains that farmers stored last year when they were battling the government.

The trade gap narrowed to $4.8 billion, about an eighth of the amount in the previous month, the customs bureau said in a statement. Exports tumbled 25.7 percent from a year earlier. Imports fell 24.1 percent.

Plus:

Alleine 2 Mio. Jobs gingen in der Provinz Guangdong seit Oktober verloren.

third-largest economy has taken a harder-than-expected hit from the deepening

global economic downturn.

According to preliminary figures released by the Chinese customs Wednesday, the country imported 11.73 million mt (3.08 million b/d) of crude oil last month.

The volume was the lowest since the Chinese customs tallied 11.56 million mt of crude imports in December 2006.

China's February crude imports represented a 17.9% decline from 14.29 million mt recorded in the same month in 2008. The volume was also 8.5% less than January's 12.82 million mt.

In the first two months of 2009, the country imported 24.55 million mt (3.06 million b/d) of crude, falling 13% on the year.

Ich weiß, ich rede permanent die Dinge schlecht, aber wie in aller Welt China ein Wirtschaftswachstum bei rückläufigem Ölimport hinbekommen haben will, erschließt sich mir nicht. Es ist ja nicht so, daß China plötzlich zur Dienstleistungsgesellschaft mutiert wäre...

Einkaufszentren in Peking:

The Place is around the corner from my office, and this was my first trip back in about two months, I was shocked at what I saw. Fifty percent of the eateries in the basement were boarded up. The cheap food court, too, was gone, covered up with ugly blue boarding, making the basement especially grim and dreary. The two good restaurants there, Ganges and Master Kong Chef’s, were still thriving. The few others that remained seemed to be just hanging on.

That same night I went by The Village, which seemed so cool when it first arrived and now seems so unnecessary aside from the Apple store and a couple of restaurants. Same thing as The Place: lonely clerks looking plaintively out the store windows, eyes begging you to come in and buy something. But no one does. There is simply too much stuff, too many stores, and no buyers. Do you have to be a rocket scientist to conclude this is unsustainable? And to top it off, they are now finishing the second Village mall down the street, across from the Poppa Bear of all disaster malls, 3.3. All I can say is, WTF??

I’m predicting The Place and many of its sister ghost malls, shunned by customers overwhelmed by so many malls to choose from, each selling the same crap that no one can afford nowadays, are going to experience a catastrophe, if they haven’t already, and will ultimately become burnt-out, boarded-up shells. In turn, this is going to throw a lot of fuel on China’s current financial crisis. Real estate will be further cheapened, and the general misery unique to times of deflation will set in. Brother, can you spare a dime?

Ähnlich erfolgreich wie das South China Mall...

Ich hab' eben locker und leicht 20 Minuten nach Bildern von "The Place" und "The Village" gesucht, und abgesehen von diversen interessanten Nachtaufnahmen nicht viel Interessantes gefunden - aber was ich gefunden habe, zeigte wenige bis keine Menschen.

Die Deflation ist in China eingezogen:

Consumer prices dropped 1.6 percent in February from a year earlier, when they reached an 11-year high, the statistics bureau said today. The median estimate in a Bloomberg News survey of 10 economists was for a 1 percent decline. Producer prices fell 4.5 percent, the most in a decade.

Da stellt sich glatt die Frage, ob das eine kurzfristige Korrektur oder ein Jahre währender Trend wird.

Der Sindelfinger Haushaltsentwurf sei nur noch "ein Werk für den Papierkorb", teilte die Stadt am Mittwoch mit. Der Etat sei nicht genehmigungsfähig, es gelte ab sofort eine Haushalts- und Stellenbesetzungssperre.

Ähnliches wird man noch von anderen Städten zu hören bekommen: Unter anderem Eisenach, München, Dingolfing, Rüsselsheim, Bochum, Köln, Saarlouis, Wolfsburg, Stuttgart/Sindelfingen und Dresden.

Qimonda geht's wirklich nicht gut:

Der vorläufige Produktionsstopp soll ab 1. April gelten. Allerdings werde eine Rumpfmannschaft eine mögliche Wiederaufnahme der Fertigung gewährleisten, teilte die Infineon-Tochter am Freitag mit.

An Qimonda hätten "verschiedene Investoren Interesse bekundet; verbindliche Angebote liegen jedoch noch nicht vor. Es steht erwartungsgemäß fest, dass es bis Ende März keine abschließende Lösung geben kann", sagte Insolvenzverwalter Michael Jaffé nach einer Sitzung des Gläubigerausschusses.

Auch der FDP-Fraktionsvorsitzende im Kieler Landtag, Wolfgang Kubicki, erklärte, mit den Milliardenhilfen für die HSH übernehme sich Schleswig-Holstein. "Dem Land droht die politische Handlungsunfähigkeit. Das käme einem politischen Bankrott wie in Island gleich", sagte Kubicki laut der Zeitung. Der FDP-Politiker erwartet dem Bericht zufolge, dass die HSH Ende 2009 bereits weiteres Eigenkapital von mindestens drei Milliarden Euro benötigt.

Da stellt sich die Frage: Hinken unsere Politiker der Entwicklung einfach nur weit hinterher, oder sind sie Gegenindikatoren?

Wenn das Geschäftsmodell darin besteht, Bundesländer in die Pleite zu treiben...

Zwar heißt es oft, Opel stehe gut da. Doch das kann nicht sein. Im europäischen GM-Geschäft sind allein im dritten Quartal 2008 Verluste in Höhe von rund einer Milliarde Euro angefallen - und Opel ist für etwa 80 Prozent des GM-Geschäfts in Europa verantwortlich.

Ich weiß nicht, ob ich den GM-Zahlen überhaupt irgendwie glauben möchte (ich habe halt ein tief sitzendes Mißtrauen Zahlen aus dem Hause GM), und das dritte Quartal 2008 ist sicherlich kein Gutes gewesen, aber an dem Argument ist etwas dran.

Opel ist alles andere als unabhängig. Opel ist integraler Bestandteil des General-Motors-Konzerns - und das schon seit dem Jahr 1929. Damals wurde Opel ein 100-prozentiges Tochterunternehmen von GM. Die Verflechtungen sind über Jahrzehnte gewachsen und deshalb eng.

das sind immerhin 80 Jahre... und wer weiß, an wie vielen Stellen Opel auf GM angewiesen ist? Wieviele technische Abhängigkeiten? Wieviele Knebelverträge? Und wieviele wirtschaftliche Abhängigkeiten?

Um das Geflecht aufzulösen, und zwar so, daß GM und Nachfolgeunternehmen wirklich draußen sind, könnte eine Insolvenz durchaus das richtige Mittel sein.

(Image) Weder bei den älteren Kunden, die sich erinnern, dass es lange Zeit an der Qualität haperte. Noch bei den Jungen. Der Autoexperte Stefan Bratzel von der Fachhochschule Bergisch Gladbach hat herausgefunden, dass die 18- bis 25- Jährigen die Marke Opel nicht schätzen: In einer Studie heißt es, dass Opel eine "besonders uninteressante Marke" sei.

So ungerne ich das auch sage, aber der letzte Opel mit Mythoscharakter war der Manta.

Keine Frage, der neue Opel Insignia ist ein guter Wagen, wenn man der Auszeichnung "Auto des Jahres 2009" glauben darf. Doch selbst wenn Opel davon viele Fahrzeuge verkauft: Für die nähere Zukunft wird das dem Unternehmen wenig bringen. In der Autoindustrie zählt Volumen, also eine hohe Produktionszahl, damit die Stückkosten sinken. Und dies wird Opel mit dem Insignia nicht erreichen können. Zwar könnten Marken wie Corsa und der Astra für mehr Auslastung in den Fabriken sorgen - besonders weil solche Modelle wegen der Abwrackprämie derzeit sehr gefragt sind. Doch gerade in diesem Modellsegment ist die Opel-Konkurrenz meist besser aufgestellt. So hat etwa VW mit dem neuen Golf ein aktuelleres Produkt im Markt. Und der neue Astra von Opel lässt auf sich warten.

Zumal man die Marktverzerrung durch die Abwrackprämie besser heraus rechnen sollte: Da scheint an Kleinwagen verkauft zu werden, was überhaupt noch lieferbar ist.

krisengeplagte Unternehmen durch Staatseingriff zu stützen hat selten funktioniert. Greift der Staat ein, wird der Niedergang der Unternehmen häufig nur hinausgezögert, jedoch nicht verhindert.

Absolut richtig.

Im vergangenen Jahr verkaufte Opel gemeinsam mit der Schwestermarke Vauxhall 1,5 Millionen Autos. Das ist im Vergleich zur Konkurrenz zu wenig. Opel ist zu klein. Dabei ist gerade der europäische Automarkt besonders hart umkämpft. Ohne Kooperationen mit anderen Herstellern, die helfen, die Kosten zu senken und die Auslastung zu sichern, kann Opel nicht überleben. Bei einer Trennung von GM und Opel stellt sich die Frage, wie Opel weitermachen will: Zwar hat das Unternehmen auch Vorteile gegenüber GM, zum Beispiel ist es gut bei der Entwicklung umweltfreundlicher Fahrzeuge, doch GM hat bisher mit seinen Aufträgen dafür gesorgt, dass Opel in den Bereichen Forschung und Entwicklung und in der Produktion viele Aufträge erhält. Das würde bei einer Trennung von GM entfallen. Und neue Arbeit ist nicht in Sicht.

Ich weiß nicht recht, ob das stimmt, 1.5 Millionen sollten eigentlich reichen - bei Fiat hieß es damals, die Grenze wäre bei einer oder 1.2 Mio.

Aber ob Opel auf die 1.5 Millionen käme, ist eine andere Frage. Laut GM-Zahlen sah's 2007 in Europa so aus:

[in]

Country* Opel/Vxh Chevrolet Saab[/in]

Units Units Units

United Kingdom 384,372 18,356 23,642

Germany 299,239 25,590 4,168

Russia 66,329 189,492 757

Italy 187,128 44,925 4,362

Spain 136,153 28,503 5,361

France 112,337 8,819 3,368

Netherlands 56,303 9,022 3,064

Belgium & Luxembourg 56,980 5,728 3,202

Ukraine 13,574 46,519 14

Sweden 13,366 2,712 24,913

Turkey 33,220 4,963 98

Poland 29,211 5,204 490

Portugal 30,787 3,073 257

Romania 19,684 13,090 157

Greece 24,056 7,009 1,107

Austria 25,706 3,191 372

Hungary 21,430 7,235 322

Switzerland 22,295 3,613 2,202

Ireland 18,353 1,587 1,087

Denmark 15,435 3,199 1,433

Croatia 12,850 2,530 13

Norway 9,976 675 2,515

Finland 6,397 1,779 1,546

Czech Republic 5,651 3,150 82

Slovenia 6,837 1,170 12

Serbia-Montenegro 5,102 2,492 19

Bulgaria 4,316 2,684 40

Slovakia 3,565 1,076 18

Macedonia 1,018 1,709 -

Latvia 1,637 693 85

Estonia 1,517 450 127

Lithuania 1,834 175 81

Bosnia-Hercegovina 569 349 -

Albania 78 53 -

Misc. Other Europe 3,124 1,302 138

Other FSU 401 5,017 -

Total Europe 1,630,830 457,134 85,052

*Sorted by Total GM units.

So rund 600000 Verkäufe fanden in Ländern statt, die derzeit ökonomische Todeszone sind, und deren Erholung eine Weile dauern wird (Großbritannien, Rußland, Spanien, Ukraine), und darüber hinaus sind noch etliche andere Namen in der Liste stabiler oder gar steigender Umsatzzahlen vollkommen unverdächtig.

Gerne wird behauptet, die Krise habe die schlechte Lage von Opel erst verursacht. Das ist nicht richtig. Zwar stimmt es, dass Opel allein im Januar dieses Jahres 23 Prozent weniger Autos als im Vorjahreszeitraum verkauft hat. Doch Opel schwächelt schon seit Jahren. Das Grundproblem ist, dass die Zulassungen in Deutschland seit langem zurückgehen und der Automarkt gesättigt ist. Diese Probleme der Autohersteller wurden durch die Finanzkrise zwar verschärft, doch die Überkapazitäten, das rückläufige Branchenwachstum und die verfehlte Modellpolitik haben mit der Finanzkrise nichts zu tun.

Laut dem Kraftfahrtbundesamt (eine meiner Meinung nach fürchterlich schlecht gemachte Seite) sind das die Opelverkaufszahlen der letzten Jahre

[in]

[/in]

2007 285267 9,01 %

2006 334479 9,65 %

2005 347960 10,41 %

2004 334491 10,24 %

2003 332781 10,28 %

2002 337535 10,38 %

2001 396214 11,86 %

2000 411193 12,17 %

Und wenn man mal davon ausgeht, daß der deutsche Verbraucher nicht plötzlich die Autos, der er jahrelang nicht wollte, doch zu mögen beginnt, dann ist auch nicht anzunehmen, daß Opel in Zukunft nennenswert steigende Marktanteile haben wird.

Daneben ist da noch das Problem der Überkapazitäten auf dem Markt.

Gruss, Uwe

Die Auftraggeber hätten keine Finanzierungszusagen von Banken. Nach FTD-Informationen aus Schifffahrtskreisen wurden die Schiffe von Buxpower in Auftrag gegeben, einer Investmenttochter des deutschen Reedereiriesen NSB Niederelbe aus Buxtehude. NSB war für eine Stellungnahme nicht zu erreichen. TKMS wollte auf Anfrage nicht sagen, wer die Schiffe bestellt hatte.

Zeit wird's ja.

und das sind noch zu wenige Projektabbrüche.

However, Jones Lang LaSalle estimates that this will now be reduced to 90,000 units.

Diese 90000 zusätzlichen Wohneinheiten sind 90000 mehr Gründe, warum die Preise weiter verfallen werden.

Und verfallen tun sie, wobei der Mirror nicht ganz die Nachrichtenquelle ist, der ich äußerste Genauigkeit bei der Recherche unterstellen würde:

http://www.mirror.co.uk/news/top-stories/2009/03/08/celebs-losing-80k-a-week-on-their-dubai-mansions-115875-21180367/

Das ist schon ein beachtlicher Wertverfall - 50% in weniger als 6 Monaten.

Jack Whisker, of luxury agents Dream Property Dubai, said: "The Dubai market has fallen off a cliff.

"The credit crunch hit us suddenly because all the foreign investors lost confidence.

"It has hit the higher-value properties the hardest. Fourbedroom villas worth £3million a couple of months ago are now being sold for £1.5million."

Mit starkem Verfall der Preise hatte ich ja gerechnet, aber das ist mehr als stark.

2008-07: 7% Leerstand.

2009-03: 16% Leerstand.

Und dank der fortschrittlich geregelten Aufenthaltserlaubnisse in Dubai (erlauben Aufenthalt für einen Monat nach Jobverlust) und dem dadurch bedingten Einsetzen der Massenflucht von Ausländern wird das nicht viel besser werden...

1500 pro Woche = 78000 pro Jahr = rund 3.5% der Bevölkerung.

Plus Angehörige. Plus all diejenigen, die so gehen. Oops.

Sind das vielleicht die Leute, für die gerade Wohnungen auf den Markt kommen?

A short stroll from the beach into the main shopping strip near JBR confirmed the difficult realities facing Dubai. In the middle of the day, I walked around the new Saks Fifth Avenue store in the complex for 15 minutes without anyone else in there - it was like I was P.Diddy for a minute - on my own private shopping spree (with prices slashed up to 70%).

Leere Einkaufszentren auch dort. Naja, warum auch nicht...

Und dann ist da noch dieses Goldstück in der Bilderserie im Artikel:

daher weise ich darauf hin, daß alles gut werden wird in Dubai. Nur wann?

[...]Im vergangenen Jahr hatten deutsche Lieferungen in den Golfstaat noch einen Wachstumsschub von 40 Prozent verzeichnet. Außerhalb Europas war die arabische Halbinsel mit einem Gesamtvolumen von 17,8 Mrd. Dollar der viertgrößte Exportmarkt für Deutschland nach den USA, China und Russland.

Schön war's, so lange die Musik noch spielte...

Nach Einschätzung von Oliver Parche von der Außenhandelskammer in Dubai hat sich die Zahlungsmoral in der Glitzer-Metropole seit Oktober letzten Jahres dramatisch verschlechtert. [...] Kaum ein Firmenchef möchte sich jedoch namentlich dazu äußern - aus Sorge, künftig bei öffentlichen Aufträgen in Dubai nicht zum Zuge zu kommen.

Fachleute rechnen nun mit heftigen Entlassungswellen. Nach Informationen aus dem indischen Generalkonsulat werden Vorbereitungen getroffen, um 300 000 Bauarbeiter aus Dubai abzuziehen. Mehr als 50 Prozent der 1,6 Millionen Einwohner zählenden Stadt besteht aus Indern, die zum großen Teil im Bausektor tätig sind.

The main index of European investment grade corporate bonds saw spreads hit the highest levels on Tuesday, reaching 478bp, driven mainly by further investor aversion from financial companies, especially their more junior bonds.

Um das mal in ein Verhältnis zu setzen: Die Spreads für "investment grade" Unternehmensanleihen aus der Eurozone sind nun doppelt so hoch wie die Spreads für "High Yield" Junkanleihen Ende Juni 2007 gewesen sind (241 Basispunkte, laut

Quelle).

[...]

“When jobs vanish, it’s certain that those who want to work will move away,” said Timo Tyrvaeinen, chief economist at Aktia Bank Oyj in Helsinki. “We have ghost towns, lost villages -- lots of them -- throughout the country.”

The forest industry’s share of Finland’s economy has halved in three decades to 3.8 percent as exports fell to 15 percent of total shipments from 42 percent. In January, production slumped 35 percent from the same month a year earlier, the most on record, Finland’s statistics agency said March 10.

Forstwirtschaft: -35%, und das alleine wird 1.3% des finnischen BIPs fressen.

Nicht ansatzweise so schlimm wie im Dezember:

Im Dezember wurden insgesamt 25219 Autos verkauft, im Januar 36931. Schon besser, wenn auch immer noch schlecht:

Januar 2008: 4147 Autos exportiert, Dezember 2008 1325, Januar 2009 1227.

The Economic Times newspaper had earlier reported on Thursday that Tata Motors owed more than 12 billion rupees ($245 million) in delayed payments to vendors. [ID:nBOM135248]

"That is not a correct number," managing director Ravi Kant told reporters at a news conference.

"Yes, there is a delay... there would be a delay. I'm telling you we are in a difficult situation... the whole industry is," he said, but declined to say what amount of payments were delayed.

"There is a liquidity problem, banks are not lending."

Tata Motors zahlt Rechnungen verspätet. Nein, nicht weil sie insolvent wären, nur weil die Banken nichts leihen. Aha.

[...]

“A lot of companies have been cutting down on travel,” said Jim Wong, an analyst at Nomura International Ltd. in Hong Kong. “The situation is deteriorating very rapidly.”

Cathay Pacific and its Hong Kong Dragon Airlines Ltd. unit carried 1.8 million passengers last month, a decline of 7.4 percent from a year earlier, it said yesterday. Freight volume dropped 17 percent.

-7.4% trotzt niedrigerer Preise - da kann man nur hoffen, daß die Situation nicht wirklich "deteriorating very rapidly" ist.

Ein Update zu Re: Alles wird gut!!!53! - Hebelung japanischer Privatinvestoren:

Anlagen japanischer Haushalte in Fremdwährungen verfielen zwischen 2008-07 und 2008-10 um 23%.

Wenn die in Re: Alles wird gut!!!53! - Hebelung japanischer Privatinvestoren erwähnten 20fach gehebelten Investoren dabei waren: Prost Mahlzeit.

Nach -26.7% im November und -35% im Dezember habe ich es für wahrscheinlich gehalten, daß sich die japanischen Exporte noch etwas verschlechtern - aber daß die Fallgeschwindigkeit dermaßen konstant bleibt, hatte ich für unwahrscheinlich gehalten...

[...]

Exports to the U.S. tumbled an unprecedented 52.9 percent from a year earlier, and shipments to Asia and Europe also posted the largest-ever declines as the global recession deepened. The collapse is likely to force Japanese companies to keep firing workers and closing factories, worsening an economy that shrank the most in 34 years last quarter.

[...]

Shipments to Europe slid 47.4 percent in January from a year earlier, the Finance Ministry said. Exports to China fell 45.1 percent and those to Asia dropped 46.7 percent.

Oh, oh, oh - wenn man daran denkt, wie ähnlich sich die Bedingungen für die deutsche und japanische Wirtschaft sind, dann...

http://fistfulofeuros.net/afoe/economics-and-demography/japans-exports-collapse-in-january/

Edward Hugh hat das graphisch umgesetzt:

und:

und schließt:

The fall in gross domestic product (GDP) for the October-December quarter in real, price-adjusted terms was slightly smaller than economists’ forecasts for a 3.3 per cent contraction, which was the same as the initial estimate.

3.2% wären gut, auf das Jahr gerechnet. Aber...

[...]

The euro zone economy shrank 1.5 per cent in the same period while the United States contracted an annualised 6.2 per cent.

12.1% annualisiert ist alles andere als gut.

“Not just automakers, but electrical and chip companies, and also other manufacturers, are coming to us in large numbers,” Hiroshi Watanabe, chief executive officer of the Tokyo-based Japan Bank for International Cooperation, said in a March 10 interview. As part of a government program, the bank is lending to “essentially blue-chip firms that are having trouble with cash flow.”

The bank, known as JBIC, has received requests for emergency loans totaling as much as $40 billion since the end of 2008, almost four times its original budget for the fiscal year that ends March 31, Watanabe said. Companies are struggling with a shortage of foreign-currency funding, he said.

Seoul has always been a favorite destination for Japanese leisure travelers hunting for a handy weekend trip but cheap Korean won is drawing Japanese visitors in droves to Seoul this winter.

Korean won has dropped to 1,600 won per one 100 yen recently, about 50 percent cheaper than a year ago. Won has unanimously depreciated against US dollar and other major currencies in the wake of global financial crisis but the drop was particularly dramatic against Japanese Yen.

Dank gesunkenem Won und gestiegenem Yen kaufen die Japaner wo? In Korea, anderthalb Flugstunden von zuhause.

The central bank said the fund's holdings tumbled 633 billion kroner (71.5 billion euros, 90.5 billion dollars) in value last year as the global financial crisis took a heavy toll.

The negative return of 23.3 percent is the worst result since the fund was created in the early 1990s and wiped out almost all the gains it made in the past decade.

10 Jahre Gewinne, weg in einem Jahr...

Polen

In an interview with KUNA on the sidelines of his visit, the minister said, "We (Poland) are not looking for funds, but for true partners with whom to implement specific infrastructure development projects in major Polish cities in preparation for hosting the Euro 2012 Football Championship." As to the aim of his visit, he said that it was to boost tourism exchange between the two countries, but "most importantly" to assist in preparations for hosting the championship in 2012 alongside the Ukraine, for which 25 billion euro had been allocated on the Polish side.

Moskau - Bis Anfang März solle jede Abteilung Vorschläge machen, wo Posten gestrichen und noch weiter gespart werden könne, sagte Natalja Timakowa, Sprecherin von Kremlchef Dmitrij Medwedew, am Dienstag nach Angaben der Agentur Interfax. 100 der insgesamt 1500 Stellen, so die Anweisung des Präsidenten, müsse die Präsidialverwaltung streichen. Bis 2011 sollten zudem die Ausgaben reduziert werden. Genauere Angaben zu den Sparplänen machte die Sprecherin jedoch nicht.

Wie ... antizyklisch?

The ministry said earlier on Thursday it had also banned investment of its $136.3 billion Reserve Fund in foreign government agencies' bonds.

http://blogs.cfr.org/setser/2009/03/06/russia-says-no-to-the-agencies/

Auch Brad Setser hat etwas dazu geschrieben:

That isn’t exactly news. Those who follow the TIC data closely had little doubt that Russia was reducing its Agency portfolio.

But the fact that Russia explicitly indicated its sovereign fund would shy away from illiquid Agencies is news. It underscores that most sovereign investors — sovereign funds as well as central banks — are shifting into the Treasury market. And it also highlights just how amorphous the distinction between sovereign wealth funds and central bank reserves really is.

And while Russia is no doubt an extreme case, it is by no means atypical.

The terminal handled 61,301 TEUs in February, taking volume for the first two months of the year to 124,608 TEUs, a drop of 24.7 percent on the same period in 2008.

The decline “is a direct result of the unfolding economic downturn which is affecting Russian importers in every possible way,” said Egor Govorukhin, vice president sales and marketing at National Container Co., the terminal’s owner.

Aber das sind reichlich gute Zahlen, um Vergleich zu dieser hier:

Allerdings ist das möglicherweise nicht das ganze Ausmaß der Probleme, denn:

Und damit wären die noch gut bedient, wo doch Exporte um 30% gefallen sind und die Produktion ebenfalls um 30% eingebrochen ist...

Part of the problem is the drop in export demand for Slovakia’s car driven economy, and the country posted a trade deficit in January, as drop in demand was made worse by the suspension of gas deliveries from Russia. Exports slumped 29.9 percent on the year in January, the fourth consecutive monthly decline, and the biggest drop at least since 2006 when the statistics office began compiling data under the current methodology. Imports were down 22.4 percent.

The trade deficit totalled 279.5 million euros ($361 million), following a revised deficit of 341.6 million euros in December. Slovakia posted a trade surplus of 42.3 million euros in January 2008.

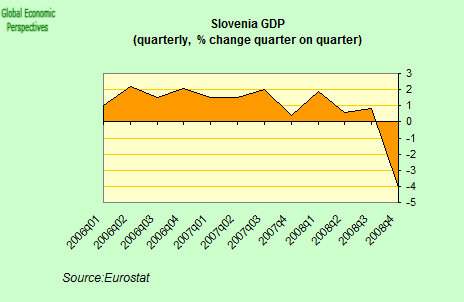

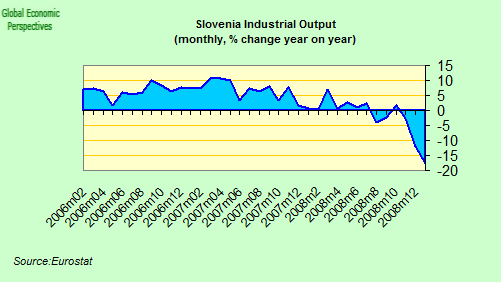

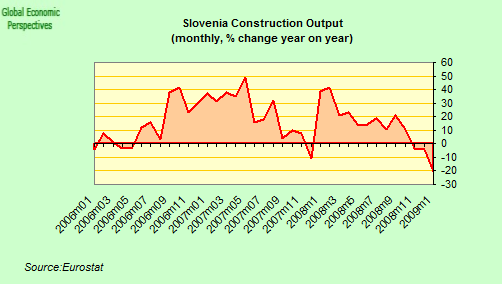

Slovenia’s economy contracted for the first time in more than 15 years in the fourth quarter of 2008, and is almost certainly heading for quite a deep recession as a construction boom came to an end while demand dropped for exports to other economies in the European Union. Gross domestic product shrank 0.8 percent year on year following a revised 3.9 percent expansion in the previous quarter. More astonishingly, quarter on quarter GDP contracted a seasonally adjusted 4.1 percent. Only Estonia and Latvia contracted at a faster rate.

Annualisiert ist das ein gewaltiger Absturz um 16%.

Oder: Kapitalflucht aus Großbritannien...

Imports are also down by around 10 percent. Ominously, the UK is doing its bit to reduce Chinese exports.

Interestingly, the UK deficit in goods and services remains broadly unchanged.

It also predicts a deep recession lasting throughout next year and a 'very real probability' that Britain will go bankrupt.

The report leaked yesterday from financial analysts Numis Securities says that the collapse in house prices is not 'anywhere near over'.

They have already fallen 21 per cent from their peak, but the report says they will slump further by up to 55 per cent if the over-correction in prices is as bad as in the early 1990s.

Liebe Briten: Die Rezession der frühen 90er war nichts im Vergleich zu der, die ihr in den nächsten Jahren durchmachen werdet.

'The bankruptcy of the UK is a very real probability as the UK government is trying to stimulate a greater debt burden in a grossly over-indebted economy,' it says.

In fact, Rick Sharga, executive vice president at RealtyTrac, told Bloomberg he believes the country’s biggest lenders have yet to list over 700,000 bank-owned homes.

http://online.wsj.com/article/SB123672707657288607.html

Or consider Pulte Homes Inc.'s predicament in Henderson, Nev., near Las Vegas. The builder is trying to sell a new, four-bedroom house for $214,990, while a home owner is trying to dump a similar house, which Pulte built two years ago, for $149,999. That price is less than the owner's mortgage under a "short sale" approved by the lender.

In many markets, "we are no longer competing with other builders. We are competing with foreclosures," said Steve Ruffner, president of the Southern California division of KB Home.

http://news.yahoo.com/s/ap/20090312/ap_on_bi_ge/foreclosure_rates_3

Um die 300000 mal ins richtige Licht zu rücken:

Nationwide, nearly 291,000 homes received at least one foreclosure-related notice last month, up 6 percent from January, according to the Irvine, Calif-based company. While foreclosures are highly concentrated in the Western states and Florida, the problem is spreading to states like Idaho, Illinois and Oregon as the U.S. economy worsens.

Die Nettowerte der US-Haushalte im freien Fall:

CR hat noch ein paar "schöne" Graphiken auf dieser Seite, die zu betrachten sich lohnen könnte: Den Anteil des Eigenkapitals an den hyoothekenbelasteten Häusern, und die Entwicklung der Hauswerte und Hypothekenschulden.

Inbound traffic was 35% below last February and 35% below last month.

The Port of Los Angeles put up a special message explaining the collapse:

[in]

Contributing factors:

- Continued worldwide economic crisis contributing to a decline in trade volumes.

- Consumer sales are down due to high unemployment rates.

- 15 less vessel calls this February due to this decline and the consolidation of services in order to fill up the existing services.

- Chinese factories closed for an extended periods of time (beyond the normal time period) for Chinese New Year.

- Due to the lack of volume and Chinese New Year, Maersk 6700 TEU/week vessel did not make any calls in LA during the month of February (which is traditionally a low volume month).

- Anticipate this year’s volumes will continue to be below last year’s volumes because sales are still slow with most economists predicting there will not be any recovery before the second half of the year.

[/in]

We have to be careful because of the impact of the Chinese New Year on trade, but it does appear trade collapsed in February.

U.S. rail carload traffic in February 2009 fell 14.5 percent (188,487 carloads) compared to February 2008 to 1,109,035 carloads, the AAR said. U.S. rail intermodal traffic (which is not included in carloads) fell 18.7 percent (167,608 trailers and containers) to 726,343 units in February.

http://www.aar.org/NewsAndEvents/PressReleases/2009/03_WTR/031209_Traffic.aspx

U.S carload freight totaled 275,105 cars, down 15.0 percent from the comparison week in 2008, with loadings down 11.9 percent in the West and 19.5 percent in the East.

Intermodal volume of 180,047 trailers or containers was off 12.7 percent from last year, with container volume falling 6.0 percent and trailer volume dropping 34.0 percent.

2009-02: -14.5% bzw. -18.7% gegenüber 2008-02.

2009-03-W1: -15,0% bzw. -12.7% gegenüber 2008-03-W1.

Bodenbildung bei -15%? Jedenfalls sieht das schon deutlich positiver aus als USA: Eisenbahntransporte / 3 Wochen im Januar 2009.

Den Amerikanern geht's so schlecht, daß sie noch nicht mal Geld für Alkohol haben:

Goldman Sachs über den Junk-Markt:

However, the analysts add that a deeper recession could push annual defaults to 17% and the cumulative five-year default rate to 50.8%.

Goldman expects recovery rates to fall to 12.5% by the end of 2009, implying five-year cumulative losses of 37%, or as much as 44.7% in the firm's deep recession scenario.

Goldman Sachs sagt also klar und deutlich "Finger weg von Schrottanleihen" (warum denke ich gerade an Infineon?).

Wenn ich richtig verstehe, was in dem Fall einfach nicht sein darf, haben die USA im Februar Steuereinnahmen von 87.3 Mrd. Dollar gehabt und 280 Mrd ausgegeben.

Forbes hat eine Geschichte über den Absturz des Harvard-Fonds:

It would have been nice to have cash on hand to meet margin calls, but Harvard had next to none. That was because these supremely self-confident money managers were more than fully invested. Ss of June 30 they had, thanks to the fancy derivatives, a 105% long position in risky assets. The effect is akin to putting every last dollar of your portfolio to work and then borrowing another 5% to buy more stocks.

Desperate for cash, Harvard Management went to outside money managers begging for a return of money it had expected to keep parked away for a long time. It tried to sell off illiquid stakes in private equity partnerships but couldn't get a decent price. It unloaded two-thirds of a $2.9 billion stock portfolio into a falling market. And now, in the last phase of the cash-raising panic, the university is borrowing money, much like a homeowner who takes out a second mortgage in order to pay off credit card bills. Since December Harvard has raised $2.5 billion by selling IOUs in the bond market. Roughly a third of these Harvard bonds are tax exempt and carry interest rates of 3.2% to 5.8%. The rest are taxable, with rates of 5% to 6.5%.

It doesn't feel good to be borrowing at 6% while holding assets with negative returns. Harvard has oversize positions in emerging market stocks and private equity partnerships, both disaster areas in the past eight months. The one category that has done well since last June is conventional Treasury bonds, and Harvard appears to have owned little of these. As of its last public disclosure on this score, it had a modest 16% allocation to fixed income, consisting of 7% in inflation-indexed bonds, 4% in corporates and the rest in high-yield and foreign debt.

Die sind in nahezu jede Falle gegangen, die es gegeben hat.

Und dann war da noch das Personal: Der Chef des Fonds verließ den Laden 2005:

Meyer formed his own hedge fund, Convexity Capital, which seems to have held up well in the current market. He took with him the Harvard heads of domestic and international fixed income, and both their staffs, as well as the chief risk officer, chief technology officer and chief operating officer. The survivors were demoralized. "You walked onto the trading floor, and it was just 10% full," says someone who was there at the time. "There was a sense that if you were good, you left."

und nahm reichlich viele Leute in Leitungspositionen mit.

Der nächste kam:

[...]He talked of the "structural advantages" of investing a big endowment backed by an AAA-rated university, such as allowing you to borrow at low rates when making leveraged bets. The former Pimco emerging market superstar also believed that the developing countries offered big profits to smart investors like HMC because they had become less risky thanks to ample dollar reserves and a growing middle class.

So El-Erian upped HMC's exposure to emerging market stocks, which rose from 6% of assets when Meyer left to 11% two years later. He also used total return swaps to bet on developed world stocks and commodities on the cheap, freeing up money for other investments. Tapping former Stanford endowment staffer Mark Taborsky (an "important hire," El-Erian would later write in a book), El-Erian also took money from hedge funds he didn't like and redirected it to ones he thought were winners, putting hundreds of millions into funds in Latin America, Asia and the Middle East.

It's unclear how much of the results--good or otherwise--were El-Erian's doing. He left at the end of 2007, six months before the results came in[...]

Und dann dauerte es 6 Monate bis zur Nachfolgerin:

By the time Jane Mendillo walked into HMC's offices in July 2008, she figured some changes needed to be made. A former consultant who worked for years at HMC under Meyer, Mendillo got the HMC gig partly as a result of Meyer's recommendation. She had spent the last six years running the $1.6 billion Wellesley College endowment, which was completely outsourced to external managers. Her detractors say that she was ill prepared for Harvard's liquidity crisis and slow to take cognizance of the swap exposure. But they concede that the crisis came fast on the heels of her arrival.

Interessantes Timing: die neue Chefin kommt nach einem halben führungslosen Jahr _mitten während der Krise_.

Willem Buiter über den derzeitgen Zustand der US-Regierung:

It is a system designed to produce protracted policy paralysis. Often this does not matter much. It may even be helpful to the greater good at times - “That government is best which governs least.” - but in times of war and deep economic crisis, when the world we thought we knew may be falling apart, it is not a bad idea to have a government that can both think and act. The current US administration neither thinks nor acts much, judging from the results.

Oder anders gesagt: Fast 2 Monate nach der Regierungsübernahme sind die USA noch nicht handlungsfähig.

B

Erst konnten sie nicht genug Kunden haben... und jetzt wollen sie sie loswerden:

Card holders have until the end of February to accept the offer and must close their accounts in March or April. Each card holder will receive a $300 pre-paid American Express card.

Ich würde ja vermuten, daß die Leute, die man loswerden will, ausgerechnet die sind, die es sich nicht leisten können, eine Kreditkarte abzugeben...

Tier1 und "tangible common equity" für US-Banken - zwei Arten, die Eigenkapitalquote zu messen:

Und damit sind die Pensionen nur noch zu 79% gedeckt.

Wodurch das zustande kam? Aktieninvestitionen:

Werden die US-Pensionsfonds vorsichtiger werden?

allocations at year end were much lower. For the 83 companies that provided

data, the average target equity allocation is 55 percent for 2009, compared

with 58 percent for 2008. However, actual equity allocations fell over the

year, to 48 percent at the end of 2008 from 59 percent the year before. Rather

than a strategy shift, this reallocation was mostly due to the significant

drop in the stock market -- bonds significantly outperformed equities, thereby

automatically shifting funds' asset distribution. It remains to be seen

whether plans will redress this imbalance.

Vielleicht...

Februar 2009: US-Pensionsfonds verlieren weiter.

Laut http://www.milliman.com/expertise/employee-benefits/products-tools/pension-funding-study/pdfs/PFI-02-12-09.pdf sind auch im Januar Verlust von 49 Mrd. Dollar angefallen.

Warum bekommt eigentlich AIG mittlerweile bessere Konditionen als Freddie Mac?

Freddie said yesterday it was likely to record "significant losses" in future periods, which would lead it to require additional funds from the Treasury amid deteriorating economic conditions.

"Nettowert unter Null". Zukunft nicht besser.

[...]

Fertility organizations across the country said there had been a growing interest. The Center for Egg Options in Illinois has seen a 40 percent increase in egg donor inquiries since the start of 2008.

New York City's Northeast Assisted Fertility Group said interest had doubled and the Colorado Center for Reproductive Medicine said it had received 10 percent more inquiries

Im November war das Wachstum der Eispenden noch bei etwa 30% (Baby business).

Die kalifornischen Farmen, die am Wasserversorgungssystem des Bundes hängen, werden demnächst für mindestens 2 Wochen kein Wasser bekommen:

U.S. Bureau of Reclamation officials said parched reservoirs and patchy rainfall this year were forcing them to completely stop surface water deliveries for at least a two-week period beginning March 1. Authorities said they haven't had to take such a drastic move for more than 15 years.

Naja, wozu braucht man im März schon Wasser? Wer würde da etwas anpflanzen wollen?

Besser geht's den Farmen, die vom kalifornischen Staat Wasser bekommen:

Die bekommen immerhin noch eine Tasse Wasser für jeden Liter, den sie sonst bekommen hätte - was wohl de fakto heißt, daß sie wenigstens noch genug Wasser bekommen, um Tränen vergießen zu können.

[...]

Präsident Chávez hat für eine Reihe von Grundnahrungsmitteln Festpreise und ein Quotensystem eingeführt. Damit sollen die Lebenshaltungskosten angesichts der steigenden Inflationsrate begrenzt werden. Wegen der sich zuspitzenden Versorgungslage in Venezuela hatte Chávez am vergangenen Wochenende die Besetzung von privaten Reisfabriken durch die Streitkräfte angeordnet. Zur Begründung gab er an, das Volk und vor allem die Armen schützen zu wollen.

Die Verordnung der Festpreise hab' ich wohl übersehen gehabt. Aber wieso eine solche Maßnahme gegen Inflation helfen sollte und nicht einfach dem Schwarzmarkt, erschließt sich mir eh' nicht.

Gruß, Uwe

Wollen Sie den Digest abbestellen?