| Sendedatum | 2009-02-18 09:32:44 |

|---|---|

| Ausgabe | 82 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Inhaltsverzeichnis:

- Burp of Arctic laughing gas is no joke

- Global warming 'changing balance' of marine life in polar seas

- UN crime chief says drug money flowed into banks

- Carbon Tax or Carbon Trading?

- U-Boot-Kollision

- A Glance At The Upcoming Eastern European Cataclysm

- Suez Canal traffic at five-year low as crisis bites

- China Record Loans Diverted to Stocks, Shenyin Says

- Hongkong: Cargo volume in record fall at airport

- Aareal Bank schlüpft unter den Schirm

- Borse Dubai to get $1 bln UAE federal bailout

- Made in Germany | Die Finanzkrise erreicht Dubai

- International sei verabredet...

- Ireland ‘could default on debt’

- Japans Wirtschaft schrumpft um 13 Prozent

- Japan’s Power Output Drops for Sixth Month as Recession Deepens

- Japan: Verkaufsförderung der anderen Art

- Korea Fails to Meet Target in Bond Sale for 2nd Month

- Tokyo Condo Inventory Falls as Developers Pare Output

- Indonesien

- Nigeria

- Poland prepared for currency intervention

- Russian Gas Crisis almost Froze Europe???

- Russland/China - Weckruf für Europa

- Russian industrial output falls 20%

- Russian stocks tumble, trading suspended

- Russia studying large oil inventory

- Der Schweiz droht der Bankrott

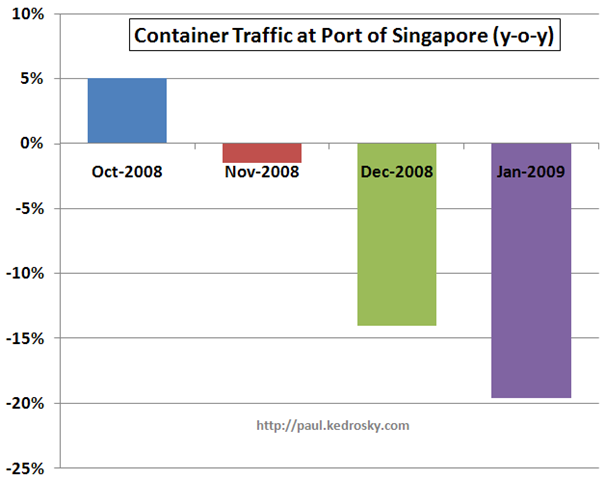

- January Port of Singapore Container Traffic

- Santander seeks to halt payouts

- UK: Government must help oil industry ... or lose $1,000,000,000,000 in tax

- UK: Pensions before dividends, says regulator

- UK: Immobiliensektor

- Just how big are the UK banks

- USA: Bank Leverage Stats, 12/31/08

- After Manhattan’s Office Boom, a Hard Fall

- Foreign money continues to pour into US

Inhalt:

Der Torf in der Tundra setzt Lachgas - ein Treibhausgas - frei:

During the snow-free season, they found the peat circles emitted 1.2 grams/m2 of N2O, which is just as much as tropical forests release in a year. The team reckons that a lack of plants decreases competition for the mineral nitrogen. This allows nitrate to accumulate in the soil which is then metabolised by bacteria to produce N2O.

Although this means N2O remains a small contributor to the greenhouse effect, compared with methane and carbon dioxide, the gas persists unaltered in the atmosphere for over 110 years, compared with around 10 years for methane – which is also periodically released by the tundra.

Unfortunately, global warming may promote churning, and expand bare areas. Since the flow of the gas from the peat circles is so high, even a small increase in bare surfaces would cause significant changes in N2O emissions, says Repo.

Der Klimawandel ändert die Verteilung, Zahl und Diversität der Arten in den Polarmeeren:

[...]

They say an increasing number of these species are extending their range towards the poles as previously cold waters between Norway and the North Pole become warmer and more hospitable.

[...]

The team also found that smaller species are replacing larger ones in some Arctic waters, a shift which could have profound implications further up the food chain.

"We are finding two smaller species of plankton. This difference in size is big enough to cause a problem for the breeding populations of birds and whales as they will be forced to eat smaller species that has less energy content."

[...]

"From an Arctic perspective it's not only about an increase in temperature, it's a complete change in the ecosystem - salinity, ice melt, flow, currents - all of these together will have an impact."

[...]

"In many instances, drug money is currently the only liquid investment capital," Costa was quoted as saying by Profil. "In the second half of 2008, liquidity was the banking system's main problem and hence liquid capital became an important factor."

Vielleicht können wir die Banken ja wegen Verstoß gegen das Geldwäschegesetz schließen.

Korrekte Analyse.

Shit happens, Tarnung ist bei den Dingern ja groß geschrieben:

The Royal Navy’s HMS Vanguard and the French Navy’s Le Triomphant are both nuclear powered and were carrying nuke missiles.

ich erwarte ja schon gar keine hohe Professionalität vom Militär, aber ganz leicht enttäuscht bin ich ja schon. Soetwas verschweigt man doch...

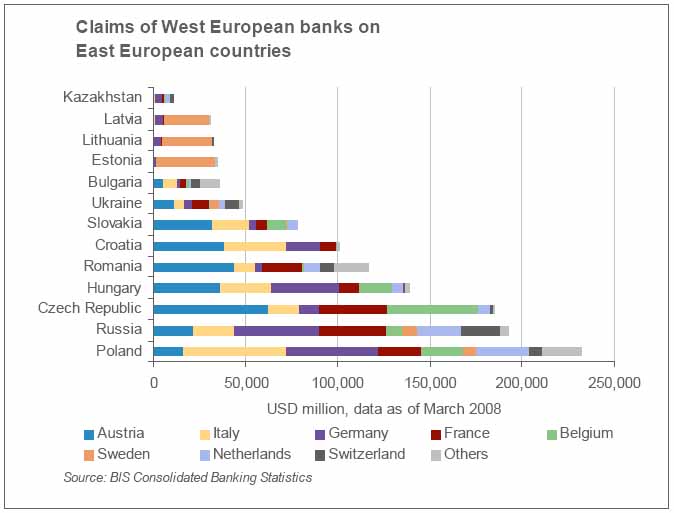

Wenn ich es richtig sehe, sind deutsche Banken mit >= 170 Mrd. involviert.

The number of boats passing through the narrow channel in January was 1,313 compared to 1,690 in January 2007, down 22 percent, the unnamed official said.

Revenues in the same month were down 19.5 percent from 414.2 million dollars in 2009 to 332.4 million in 2008.

Das ist zweifelsfrei nicht gut, aber eben auch nicht ansatzweise so schlimm wie verschiedene andere Zahlen.

Nunja, wer Waffen durch oder in den nahen und mittleren Osten verschifft...

Ja. Und 125 Mrd. beträgt das Bruttosozialprodukt Ägyptens ungefähr. Das heißt, alleine der Rückgang auf dem Suezkanal kostet mal eben so 0.8% vom BIP. Oder eben rund 2.5% vom Staatshaushalt (der chronisch defizitär ist).

Daneben kommen die Haupteinnahmen Ägyptens übrigens vom Tourismus...

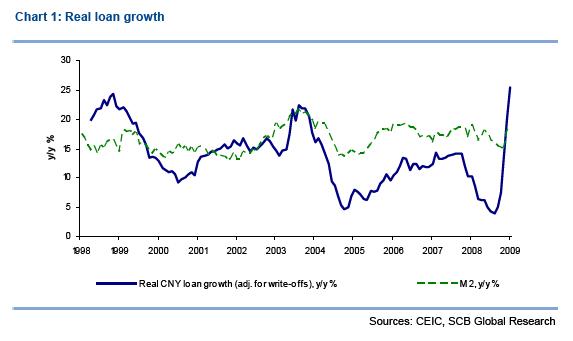

Chinas Banken verleihen gerade viel, viel Geld:

Quelle

Aber kommen die Kredite da an, wo sie ankommen sollten?

China’s banks lent a record 1.62 trillion yuan in January as part of a government drive to stimulate the world’s third- largest economy, while M2, the broadest measure of money supply, climbed 18.8 percent from a year earlier. The Shanghai Composite has surged 29 percent since the start of 2009, compared with a 10 percent decline in the MSCI World Index.

“Part of the liquidity flowing into the stock market could be from companies using borrowed funds to invest in the stock market instead of working requirements,” said Li.

He arrived at the 660 billion yuan figure by subtracting M1, which includes cash and demand deposits, from M2. The brokerage was voted the best in the country for research by the national pension fund, China’s largest investor.

Ja, warum sollte man unsichere Kredite vergeben, wenn man doch mit Aktien spielen kann?

Der Shangai Composite Index:

Quelle

The airport handled 210,000 tonnes of cargo, down from 295,000 tonnes the same month last year, the authority said.

The slide in last month's cargo volume follows a 28.2 percent plunge in December, which at the time was an airport record. Total air traffic movements in January fell 2 percent to 24,245, down from 24,752 in the same period last year.

-28.2% November auf Dezember.

-28.9% Dezember auf Januar

-2% Januar 2008 auf Januar 2009.

Oder anders gesagt: November 2008 auf Januar 2009: -49%.

Zudem bekommt das Institut aus dem Bankenrettungsfonds Soffin bis zu 4 Mrd. Euro Garantien für die Emission von Anleihen. Mehrere Banken haben bislang Garantiezusagen erhalten, die es den Instituten ermöglichen, zu günstigeren Konditionen Anleihen herauszugeben, wie jetzt auch die Aareal Bank.

[...]

Neu ist, dass ein Geldinstitut die Hilfen in Anspruch nimmt, ohne akute Probleme zu haben. 2008 verdiente Aareal vor Steuern 117 Mio. Euro. Selbst im besonders schlechten vierten Quartal erzielte sie noch einen Gewinn von 11 Mio. Euro. Damit hat die Bank in jedem Quartal seit Ausbruch der Krise Mitte 2007 schwarze Zahlen geschrieben. Dass das Institut dennoch auf staatliche Hilfe zurückgreift, zeigt, wie dramatisch die Situation auf dem Kapitalmarkt ist.

Der Immobilienfinanzierer hat die Staatshilfe beantragt, um gegenüber Wettbewerbern mit entsprechenden Hilfen konkurrenzfähig zu bleiben.

Gut, das erklärt die Garantien, aber was ist mit der Kapitalzuführung (stille Einlage zu 9%)? Dafür sind 47 Mio. Zinsen pro Jahr zu Zahlen - warum wird die dann in Anspruch genommen?

Wafür zahlt ihr dann 47 Mio. pro Jahr?

Borse Dubai has been trying find funding to make repayment of the loan due at the end of this month, but bankers close to the deal have told Reuters it was falling short of the target in the midst of a global squeeze on credit.

Die Börse von Dubai mußte einen Kredit zurückzahlen, den sie zum Kauf der schwedischen OMX aufgenommen hatte - und hat niemanden gefunden, der ihr das Geld dafür leihen wollte, außer der Regierung der VAE.

Das sagt wenig Gutes über den Glauben an die Finanzkraft der Börse Dubai aus.

http://www.breakingviews.com/2009/02/17/Dubai.aspx?email

[...]

Banks are reluctant to increase their exposure to Dubai, which recently revealed it has a total of $80bn in sovereign and state-affiliated debt, equivalent to 1.5 times 2007 GDP. However, lenders also want to protect the value of their existing exposure to the region. Balancing these fears, lenders are reportedly offering to help Borse Dubai, but at an interest rate 430 basis points higher than Libor, well up from the 130 bps on the maturing loans.

Der Libor liegt bei 2%, damit hätte die Börse 6.3% zahlen müssen - immer noch weniger als die 9%, die die "kerngesunde" Aareal für die stille Einlage zahlt.

5:28 Minuten langer Film der deutschen Welle über Dubai.

In dem Film werden die Verluste der Immobilienbranche mit geschätzten 50 Mrd. Euro angegeben. Das läßt irgendwelche Rettungsmaßnahmen für die VAE-Finanzbranche (27 Mrd Dollar habe ich zuletzt gehört) unzureichend erscheinen.

Ist es eigentlich vorstellbar, daß ein Land, das vor 5 Jahren ganz ohne Wolkenkratzer ausgekommen ist, jetzt 200 davon hat?

Ich hoffe, das ehemalige Nachrichtenmagazin hat etwas falsch verstanden:

Seufz. Ich weiß gar nicht, gegen wieviele Punkte meines Rechts-, Staats- und Demokratieverständnisses es verstößt, daß die Bundesregierung international "Verabredungen" trifft, die erhebliche finanzielle Mittel erfordern und national nicht bekannt gemacht werden.

Wahrscheinlich gegen so ziemlich alle.

The cost of buying insurance against Irish government bonds rose to record highs on Friday, having almost tripled in a week. Debt-market investors now rank Ireland as the most troubled economy in Europe.

[...]

Pledges made by Ireland to support its banking sector amount to 220% of the country’s annual economic output. The total loans held in Irish banks are more than 11 times the size of the economy.

[...]

One possible solution would see Germany buy billions of euros of Irish government debt through a fund set up by the European Central Bank.

Klar doch, als würden wir die irische Depfa nicht schon längst unterstützen...

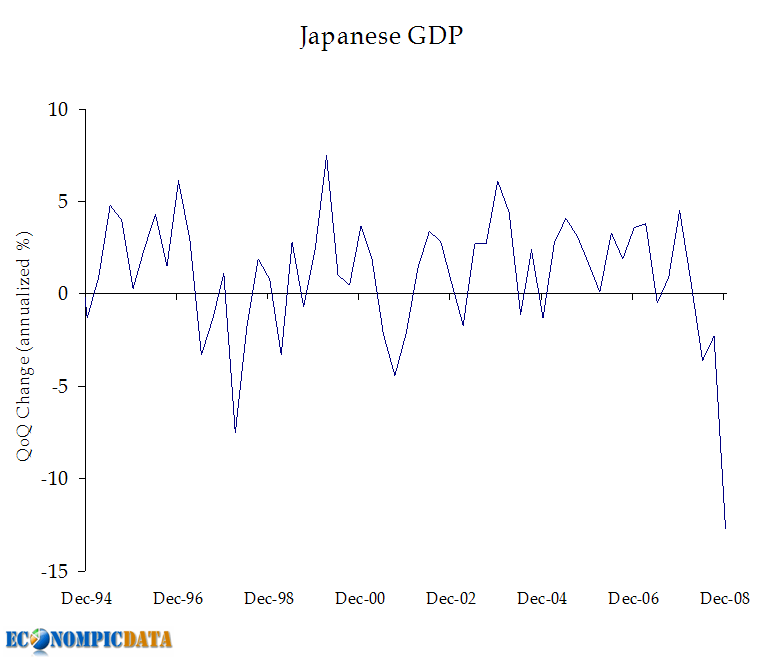

Wow.

Econompicdata hat das aufbereitet:

Japans Stromerzeugung:

------------------------------------------------------------

Month FY 2006 FY 2007 FY 2008

%Change %Change %Change

------------------------------------------------------------

April 73.67 3.7 75.05 1.9 75.39 0.5

May 72.87 3.6 74.62 2.4 75.78 1.5

June 77.38 -0.3 79.09 2.2 77.84 -1.6

July 87.30 1.2 85.96 -1.5 94.12 9.5

August 93.34 3.4 96.20 3.1 90.93 -5.5

September 79.48 -2.5 86.27 8.5 82.98 -3.8

October 76.22 2.2 78.22 2.6 77.55 -0.9

November 76.31 2.2 78.61 3.0 77.17 -1.8

December 85.65 -2.9 87.13 1.7 82.89 -4.9

January 86.18 -1.8 90.42 4.9 84.64 -6.4

February 78.24 -1.6 88.46 13.1

March 83.82 1.5 83.49 -0.4

-----------------------------------------------------------Full Year 971.3 0.7 10,034.9 3.3

----------------------------------------------------------

[...]

Toyota has already tacitly applauded a “voluntary” scheme in which 2,200 of its top brass decided to buy new Toyota cars, and the president of Fujitsu recently e-mailed 100,000 staff and gently pointed out how nice it would be if “employee ownership rates” of Fujitsu PCs and mobile phones were a little higher.

Ist das jetzt ein Weg, die Lager zu räumen, oder ein Weg, die Gehälter zu kürzen? Oder beides?

Südkorea gab eine 10jährige Staatsanleihe aus - und fand nicht richtig viele Abnehmer:

South Korea failed to meet its target at an auction of 10-year bonds for a second consecutive month on concern that the nation will increase debt sales to fund stimulus spending.

The government raised 584 billion won ($415 million) at today’s sale, less than the 800 billion won targeted, after investors offered to buy 604 billion won, the finance ministry said on its Web site. The securities were sold at an average yield of 5.2 percent, higher than the 5.1 percent the market expected, said Kim Do Sung, a futures trader with PB Futures Co. in Seoul.

[...]

In a Jan. 19 auction, the Korean government sold 426 billion won of similar-maturity debt, failing to raise a planned 800 billion won.

Langjährig laufende südkoreanische Staatsanleihen sind out. 1600 Mrd. seit Anfang des Jahres angeboten, 1010 abgenommen.

Und auch bei anderen asiatischen Ländern sieht's nicht optimal oder sogar richtig schlecht aus:

[...]

India, the Philippines, Thailand, Korea and Malaysia were scheduled to sell at least $3.8 billion of local-currency bonds maturing in 10 to 30 years in February.

Unsold inventory fell 6 percent to 11,679 units last month from 12,427 units in December. The figure represented a 9.2 percent increase versus a year earlier. Developers added 1,760 new units to the market, 24 percent fewer than in January last year, the 17th consecutive month of declines, the Tokyo-based institute said in a report released through the Ministry of Land, Infrastructure, Transport and Tourism

- im Januar wurden 24% weniger Eigentumswohnungen auf den Markt gebracht als ein Jahr vorher.

- die Zahl der neu auf den Markt gebrachten Eigentumswohnungen fällt seit 17 Monaten.

- die Zahl der Wohnungen auf dem Markt ist auf dem tiefsten Punkt in 24 Jahren.

Ich weiß, Japan hat keine Häuserblase mehr, aber... einen gesunden Immobilienmarkt hat es in den letzten anderthalb Jahren auch nicht gehabt. Und -24% ist heftig.

Indonesien Handelsminister erwartet einen Exportrückgang - Öl- und Gasprodukte ausgenommen - von 20 bis 30% für 2009.

Autoexporte: -27% von Dezember auf Januar.

Dezember 2008: -20.6% weniger Exporte als Dezember 2007.

Große Ölunternehmen planen Entlassungen:

The plan is said to have been hatched at the headquarters of the major oil companies overseas after a meeting of their top executives, worried by the great fall in oil prices from its peak of $147 a barrel in July 2008, to $35 a barrel as at Friday. The great fall in oil prices has left the oil companies with far more lower incomes than in the recent past. Shell recorded its first quarterly loss in a decade of $2.8 billion. BP Plc had its first loss, in seven years, of $3.3 billion. France's Total SA had a quarterly loss of 794 million Euros. Also Exxon Mobil net income has tumbled.

Und so erreicht der Ölpreisverfall auch die nigerianischen Ölarbeiter.

Some analysts, in the oil sector expressed dismay at the plans by Shell and other unidentified oil companies to halt recruitments and slash workforce. The oil companies reaped huge profits when oil prices where at their peak last year.

http://allafrica.com/stories/200902170977.html

"China muß die Beziehungen zu Nigeria stärken":

[...]

According to him, there was also the need for Chinese government to strengthen its bilateral relation with Nigeria in Commerce and Trade.

Da braucht wohl jemand Geld.

http://allafrica.com/stories/200902170274.html

Die Führungsspitze der nigerianischen Börse tritt zurück:

She said they have agreed to voluntary retire from service in order to inject new blood into the management of the troubled market, whose woes have worsened with the global economic meltdown.

[...]

Market capitalisation which determines the equities value in the market had dropped by 137.7 per cent from all time high of N12.6 trillion in mid March 2008 to N5.286 trillion as at last Friday.

Aha, die alte Spitze hat die Kurse wohl nicht genug manipuliert

Der Preis für die saumäßigste PR des Tages geht an...

Polens Wirtschaftsminister Waldemar Pawlak.

Diese "Transaktionen" sind Optionsgeschäfte, die polnische Firmen eingegangen sind, um damit auf den Sloty zu wetten. Die Annulierung der Verträge dürfte sich auf die Bereitschaft des Auslands, mit Polen Geschäfte zu machen, nicht besonders positiv auswirken.

Der von mir sonst geschätzte Matthew Simmons ist hier hoffentlich einer Ente aufgesessen:

- On January 1, 2009 a bitter Arctic blast froze Russia.

- Putin had a tough decision as high amount of their gas was committed to Europe (at high prices).

- Russia did not have enough gas for peak winter in Russia and Europe, let alone Ukraine.

- So, they closed their taps and Europe almost froze.

- This problem was not political. It was mature Siberian giant gas fields in steep decline.

Angeblich hatte Rußland im Januar einfach nicht genug Gas, um die Lieferverträge mit Europa einzuhalten, und hat die Pipelines deshalb still gelegt.

- Russia's three top gas fields produce 65% - 70% of its gas.

- All have peaked.

- Urengoy is the "Ghawar" of global gas:

- It peaked in the mid-1990s at 305 bcm/year

- By 2000, Urengoy's production was 145 bcm/year

- By 2015, production is estimated to fall to 70 bcm/year

- Yamburg's decline is close behind.

- Zapolyarnoye came on stream one year ago and is just starting to decline.

So sieht das Resultat das Gasstreits laut russischen Zahlen aus:

http://en.rian.ru/business/20090216/120159860.html

Primary crude processing decreased 2.8% against January 2008 to 19.3 million tons and declined 0.3% against December 2008.

Natural gas production in January declined 4% against December.

Also hat Rußland im Januar 4% weniger Gas als im Dezember und 10.5% weniger Gas als im Januar 2008 produziert.

Aber die Gasexporte fielen um 74.1%? Dann müssen die aber relativ leere Lager gehabt haben - nicht beinahe volle, wie man zu Winterbeginn annehmen würde.

Nicht daß ich Simmons' Verschwörungstheorie glaube, aber passen zu den Fakten tut sie doch.

Ich zitiere mal fast vollständig:

Moskaus rüdes Auftreten im Georgienkrieg im Sommer hat die Europäer vor ein Dilemma gestellt: Sie konnten dem Aggressor nur mit gedämpftem Selbstbewusstsein entgegentreten, da dieser zugleich Europas Hauptlieferant für Erdgas ist. Darauf, wie es sich anfühlen könnte, wenn Russland den Hahn einmal zudreht, lieferte dann Anfang des Jahres die erneute Auflage des russisch-ukrainischen Gasstreits einen Vorgeschmack.

Sowohl im Georgienkrieg als auch beim Gasstreit wurde gern darauf verwiesen, dass Russlands Erpressungspotenzial begrenzt sei: Schließlich beruhe die Abhängigkeit auf Gegenseitigkeit, weil Russland auf Europa als Gaskunde ebenso angewiesen sei wie Europa auf Russland als Verkäufer. Bislang trifft dieser Einwand zu.

Umso größer muss das Unbehagen der Europäer sein, wenn Russland nun mit der Wirtschaftsgroßmacht China seine Kundenbasis erheblich ausweitet und Pipelines nach Fernost baut. Zwar geht es bei dem am Dienstag geschlossenen Energie-Kreditabkommen zunächst nur um Öl, Gas kann aber leicht folgen. Mit Staaten wie Libyen und dem Iran kooperiert Russland ohnehin längst.

The decline was its largest month to month drop since records began seven years ago.

"The horrendous industrial production data in January have left no doubt that the economy has come to a screeching halt," said Ivan Tchakarov, chief Russia economist for Nomura, the investment bank. "This indicates that the combined effect of the credit squeeze in the banking sector and falling global and domestic demand has filtered through to the real economy."

[...]

Igor Yurgens, an adviser to Mr Medvedev, said the government was mapping out scenarios for growth to fall from 6.3 per cent in 2008 to anywhere between zero and minus 10 per cent this year depending on whether the oil price falls further, whether international credit markets reopen and on how sharply the global recession hits China.

[...]

Economists linked the sharp fall in January output to the virtual paralysis of the financial system as the government sped up a rouble devaluation that created a lucrative one-way bet for anyone to change roubles for dollars, rather than lend them to the real economy.

Bankers say non-payments spiralled during the devaluation and rouble liquidity dried up. The banking system is still frozen with most second and third tier borrowers unable to find funds. However, the rouble appears to have stabilised, at least temporarily, and authorities are hoping the banks will begin lending again.

Rußland könnte vor einem ganz ernsthaften Problem stehen.

Rußland plant, Öl einzulagern in Zeiten niedriger Preise:

Deputy Prime Minister Igor Sechin, who oversees the oil and gas sector, said the move could help the Organisation of Petroleum Producing Countries (OPEC) stabilise oil prices.

[...]

Russia produces around 9.7 million bpd, or 485 million tonnes of oil, per year. Purchases of 16 million tonnes of oil per year into the reserve would represent over 3 percent of Russia's annual oil production.

Warum Lager bauen und nicht einfach in der Erde lassen? Deshalb:

3% ist allerdings gar nicht so viel - im Jahre 2009. Wäre es da nicht effizienter gewesen, in unempfindlichere Technik zu investieren? Oder ist die Situation in Rußland so, daß dafür kein Geld mehr da ist? Oder sind die Restmengen in den Ölfeldern so gering, daß sich das nicht rechnet?

[...]

In Ungarn sind 31 Prozent aller Kredite in der Schweizer Währung ausgestellt, bei den privaten Haushaltskrediten sind es fast 60 Prozent.

Nun hat die Finanzkrise die Ära der günstigen Kredite beendet: Die Ostwährungen sacken ab. Ende September musste man für 100 polnische Zloty noch 46 Franken bezahlen, heute sind es 30 Franken. Das heisst: Immer mehr Kreditnehmer kriegen Probleme mit den Zinsen und bei der Abzahlung.

[...]

Nun ist dieses System ins Wanken gekommen.

So haben der ungarische Forint und der polnische Zloty in den letzten Wochen gegenüber dem Franken über ein Drittel an Wert verloren. Wegen der Abwertungen der Landeswährungen haben sich die Schulden gegenüber der Schweiz um mehr als einen Drittel gesteigert. Viele der osteuropäischen Länder haben ernste Zahlungsschwierigkeiten und stehen quasi vor dem Staatsbankrott.

Was bedeutet das für die Schweiz?

Es ist anzunehmen, dass ein beträchtlicher Teil der insgesamt 200 Milliarden Dollar Osteuropa-Kredite in Schweizer Franken ausgestellt wurden. Gemäss einem Bericht der Bank für Internationalen Zahlungsausgleich sind weltweit Franken-Kredite im Gegenwert von rund 675 Milliarden Dollar im Umlauf – davon wurden etwa 150 Milliarden direkt von der Schweiz, 80 Milliarden von Grossbritannien sowie rund 430 Milliarden Dollar über Offshore-Finanzzentren vergeben. Wieviele dieser Kredite faul sind, ist nicht bekannt. Doch schon wenn die Ausfallrate 20 Prozent beträgt, würden die Banken viel Geld verlieren.

[...]

Nun müssen die möglichen Verluste durch diese Kredite auf den Tisch; vor allem müssen alle möglichen osteuropäischen Risiken lückenlos offengelegt werden. Zusammen mit den Kreditausfällen von UBS und Credit Suisse könnte der gesamte Abschreibungsbedarf für die Schweiz die Grössenordnung des Schweizer Bruttosozialprodukt übersteigen.

blockquote=Fazit]Der Schweiz droht wie Island der mögliche Staatsbankrott.

80% wollen auf ein mal daraus? Warum, und was wissen oder ahnen die, was ich nicht weiß?

http://fistfulofeuros.net/afoe/economics-and-demography/santanders-banif-fund-suspends-payments/

Banif, which is described in its prospectus as “low risk,” produced a yield of 1.37 percent last year, down from 5.87 percent in 2007, according to the fourth-quarter report, while assets under management fell 4.2 percent in January, according to data published by Inverco, the Spanish asset management association.

Zusammenfassung: Banif - der Fond, um den es geht - ist hauptsächlich in Wohnimmobilien investiert, hat 15% des Wertes "zwischen dritten und viertem Quartal" verloren, und liefert nur noch 1.37% statt 5.87% Rendite. Deshalb wohl die plötzliche Einstufung als Sondermüll durch die Investoren.

Das Betteln nach dem Geld der Bürger wird immer peinlicher. Die schottische Öl- und Gasindustrie verlangt es nach Stütze:

Sir Ian Wood, chairman of Wood Group, also predicted that failure to act now could undermine the UK economy's overall recovery when the upturn comes, and could cost the Treasury around $1 trillion (£700 billion) in lost tax revenue.

Es drohen Steuerausfälle in Höhe von $1000 Mrd., was sogar in der heutigen Zeit kein Kleingeld mehr ist.

Bloß: Wo sind eigentlich die Gelder aus den Rekordgewinnen von 2008 geblieben?

The regulator will signal that it is prepared to stretch out payment periods for companies to restore pension schemes. This would reduce the size of annual contributions for companies that are cash-strapped and at risk of failure due to the burden of retirement costs.

Wieso jetzt erst?

Heavyweights, Hammerson are Land Securites fell 9% and 8.5% respectively, while second liners Brixton and Segro dropped 28% and 18%.

There was no specific news flow driving prices lower, just a feeling that those developers who have not raised fresh equity might struggle to do so in the wake of the rights issues from Hammerson (£584m) and British Land (£740m) and the £750m call being readied by Land Securities.

Hm, beginnender Erdrutsch im Immobiliensektor?

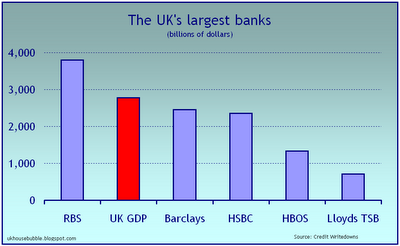

In terms of assets, the largest bank - RBS - is significantly larger than UK GDP. The next two banks; Barclays and HSBC, are almost as large as GDP. Moreover, the fourth bank - HBOS - is about to merge with the fifth largest bank - Lloyds. When the merger is complete, that bank too will be almost as large as UK GDP. In short, the UK's four largest financial institutions are each as large as the UK economy.

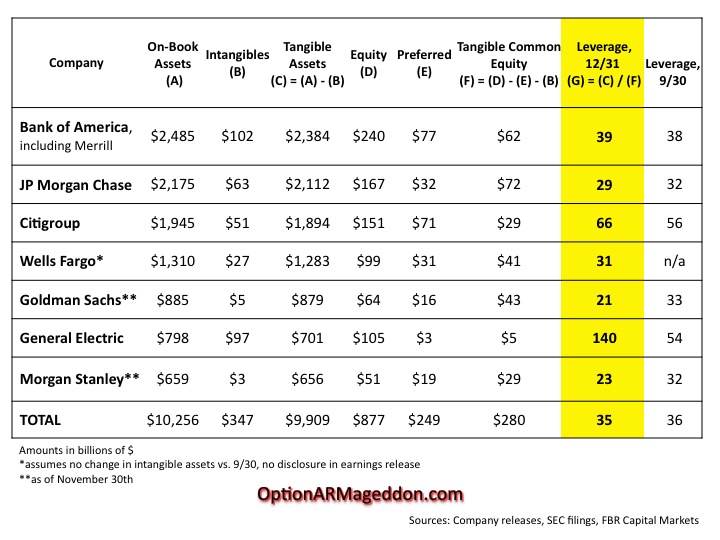

Die Hebelung amerikanischer Großbanken:

[...]

One BIG caveat with this calculation is that these companies carry “other assets” on the balance sheet, some of which might be intangible in nature. Also, each has significant risk exposure via off-balance sheet entities. The point is, even though these leverage calculations seem high, they actually understate the risks facing common shareholders…

Die weitere Verschlechterung von Citi und GE ist nicht wirklich beruhigend.

So what are Manhattan office buildings worth today? Since no substantial transactions have taken place in recent months, no one knows for sure. But some real estate specialists are willing to hazard estimates.

Robert Von Ancken, the senior appraiser for Grubb & Ellis in New York, estimated that prime Midtown buildings were now worth $425 a square foot, on average, while lesser buildings had a value of $350 a square foot, down from $500 to $600 a square foot two years ago. Mr. Von Ancken said he could not estimate how far values in Lower Manhattan had declined until more was known about the prospects for the financial services companies that occupy so much downtown space.

Das ist katastrophal - und damit kann man wohl davon ausgehen, daß die Mehrzahl der Immobilieninvestoren, die da investiert haben, noch pleite gehen werden.

I

und der freie Fall hält an.

Der Dollar als Krisenwährung?

The latest monthly Treasury International Capital (Tic) data show that foreign purchases of US securities grew to $74bn in December, up from $61.3bn the month before. Inflows for purchases of long-term securities were $34.8bn, compared with outflows of $25.6bn in November.

December marked a rebound for sales of long-term Treasury debt, which saw foreigners buy $15bn after selling off $25.8bn the month before. Corporate debt was also in greater demand, as purchases reached $41bn after months of selling.

[...]

Meanwhile, foreign investors spurned debt from companies backed by government agencies. Sales of debt issued by agency-backed companies such as Fannie Mae and Freddie Mac totalled $37.5bn in December. “A lot of things are being guaranteed by the government and the yield differential is considerable,” said Joshua Shapiro, chief US economist at MFR, referring to the flight from agency debt to corporate bonds.

Wollen Sie den Digest abbestellen?