| Sendedatum | 2009-02-02 22:59:16 |

|---|---|

| Ausgabe | 80 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Lucy Kellaway von der FT schreibt:

In good times I used to delight in stories like these. Aren’t people silly, I used to think with a complacent air of superiority. But now my thinking is different: if banks’ response to the current crisis is to stick bits of paper on fake trees, then the only rational thing for the rest of us to do is to surrender ourselves to panic.

Ebenso gute Gründe für Panik wären das Gerate um Nutzen/Gefahr von Bad Banks, Stimuli, Protektion, Subventionen (-swettläufen) oder die Streiterei um Schuld und Unschuld an der Krise.

Inhaltsverzeichnis:

- Floating rubbish dump 'bigger than US'

- Acid oceans 'need urgent action'

- Somali piracy 'reduces tuna haul'

- Über die Bewertung von Assets

- YES WE CAN!! have a global depression if we really continue to work at it…

- Länderrisiken durch Banken

- Seehandel: Volle Häfen...

- IATA: Cargo Plummets 22.6% in December

- Verfall des Preises gebrauchter 737-800.

- Australien

- China: 20 Mio. Wanderarbeiter...

- China: Unzufriedenheit und Wiederherstellung der Zufriedenheit

- China birth defects 'up sharply'

- Deutschen Werften brechen Aufträge weg

- Shakeout in Dubai

- Central Europe’s Manufacturing And Consumers In A State Of Shock

- EU: Liste der von der EU-Kommission erlaubten Hilfen in der Finanzkrise

- Japan’s Factory Output Falls Record 9.6%

- Japan consumer prices see 0.2% rise in December, flat when energy prices stripped out

- ABP, Dutch funds post Q4 losses, cut equity risk

- Unruhen in Rußland

- Russia finance: Debt restructuring looms

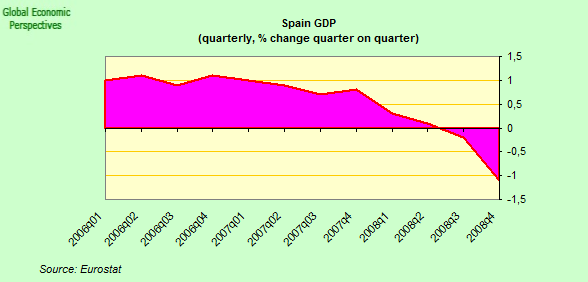

- Spain’s Recession Deepens

- Südkorea: Exporte -32.8%

- S Korea brings bourse under state control

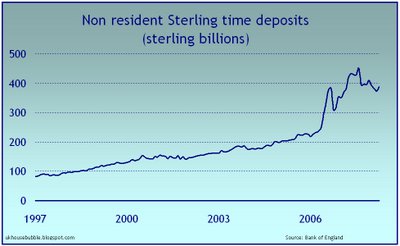

- UK: Auslandsanlagen in Sterling

- UK: bank lending to other financial institutions

- UK: Commercial property values plunge

- US college endowments

- US-Lebensmittelkonsum

- USA: Eisenbahntransporte / 3 Wochen im Januar 2009

- USA: Record Low New Homes Sales in December

- USA: Activity Declined in Every State in December

- USA: The Consumption Collapse Continues

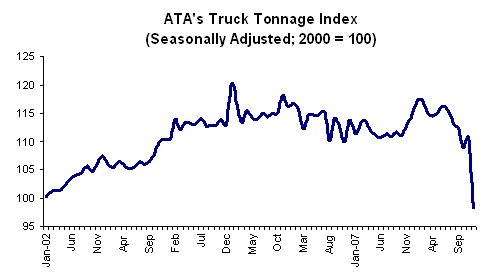

- USA: Truck Tonnage Index: Cliff Diving

- USA: January Economic Summary in Graphs

- Snow study shows California faces historic drought

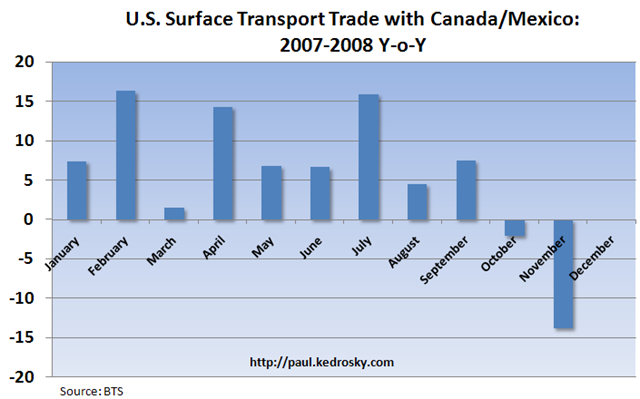

- surface transport trade data, Canada/US/Mexico

- Zimbabwe dollar sheds 12 zeros

- Zimbabwe's starving millions face halving of rations as UN cash dries up

Inhalt:

Im Pazifik schwimmt eine große Menge Plastikmüll - größer als die USA.

Moore, an oceanographer who has made the study of the patch his full-time occupation, believes there is about 100 million tonnes of plastic circulating in the northern Pacific - or about 2.5 per cent of all plastic items made since 1950.

About 20 per cent of the junk is thought to come from marine craft, while the rest originates from countries around the Pacific like Mexico and China.

Naja, was sind schon 100 Mio. Tonnen? In PET-Mehrweg-Literflaschen (70 Gramm pro Flasche, etwa 14000 Flaschen pro Tonne) umgerechnet:

Je Flasche 30cm: 100 Mio * 14000 * 0.3 = 100 Mio. * 4200 Meter.

Macht: 420 Mio Kilometer.

Damit könnten wir fast die halbe Erdumlaufbahn (um die Sonne, 940 Mio Kilometer) auslegen.

Oder, wenn wir typische nicht recyclebare Flaschen (25cm, 30 Gramm) nehmen, kommen wir damit schon 825 Mio Kilometer weit - das reicht von der Sonne bis hinter den Jupiter.

Ist also kein Problem von kosmischer Bedeutung - auf Alpha Centauri ist man sicher vor unserem Müll...

Instead the plastic slowly photodegrades, becoming brittle and disintegrating into smaller and smaller pieces which enter the food chain and end up in the stomachs of birds and other animals.

Yeah, und das ist das Hauptproblem: Das Zeug zersetzt sich nicht.

"It is not like going to a parking lot after a rugby match. It is not like a landfill," he says.

"The material is breaking down continually. It is photodegrading all the time. It is what I call a kaleidoscope or an alphabet soup. You won't see it from a satellite shot of the ocean. You only see it from the bows of ships," he says.

The Earth scientist James Lovelock, working with Chris Rapley of the Science Museum in London, devised a plan to put giant tubes into the seas to take surface water rich in dissolved CO2 to lower depths where it will not surface. The idea is to take CO2 out of the short-term carbon cycle, cutting the gas in the atmosphere. Critics say it may bring carbon locked away in the deep ocean to the surface.

... hat gewisse Risiken.

http://news.bbc.co.uk/2/hi/science/nature/7860350.stm

* This has lowered its pH by 0.1

* pH is the measure of acidity and alkalinity

* The vast majority of liquids lie between pH 0 (very acidic) and pH 14 (very alkaline); 7 is neutral

Seawater is mildly alkaline with a "natural" pH of about 8.2

Mögliche Folgen?

The also say that it could lead to substantial changes in commercial fish stocks, threatening food security for millions of people

Weniger oder vielleicht auch keine Korallenriffe mehr, und nicht nur dadurch auch Auswirkungen auf den Fischfang...

Piraterie ist gut für die Bewohner der Meere:

The head of the Indian Ocean Tuna Commission, Alejandro Anganuzzi, said catches fell by about 30% last year, seriously affecting the industry.

Und das kann man durchaus für eine positive Nachricht halten - die Thunfischbestände wachsen nämlich deutlich negativ.

Der Besitzer hat das Zeug zu 97% vom Nennwert in den Büchern.

S&P bewertet es mit 87% vom Nennwert unter den gegebenen Umständen, und mit 53% bei doppelt so hohen Ausfallraten.

Auf dem Markt wird es mit 38% gehandelt.

Grobanalyse: S&P ist von der Realität ein ganzes Stück weit weg, und irgendjemand hat einen fürchterlich hohen Abschreibungsbedarf.

Und was ist es:

Toxischer AAA-Hypothekenmüll der schlimmsten Sorte ("little or no money").

Nachtrag:

http://www.calculatedriskblog.com/2009/02/ny-times-example-of-toxic-asset.html

Calculated Risk schreibt dazu:

To be worth even 38 cents on the dollar, this must be a senior tranche. The lower tranches have absorbed most of the losses so far, and that is why S&P is currently valuing the bond at 87 cents on the dollar, but any higher default assumptions, and the value of this bond will plummet. I'm amazed, given that these are no money down 2nds that the loss severity is only 40 percent.

But this illustrates the problem. If the bank marks the bond to market (38 cents), they will have to take huge losses. But if the government even pays the current S&P estimated value, the bank will have to write the bond down further, and the taxpayers will probably take huge losses too. Unless a bank has been very aggressive with their write downs, buying the toxic assets doesn't help - or is a gift from taxpayers to shareholders.

Das wäre übrigens ein Grund für die Deutsche Bank, mit ihren Abschreibungen möglichst lange zu warten: Eine Bad Bank würde eventuell für nicht abgeschriebene Sachen mehr zahlen...

Willem Buiter wird pessimistisch - in einem relativ langem Artikel.

Das Warum, in Auszügen:

Ich teile das grundlegende Gefühl dahinter: Zunehmende nationale Alleingänge, zunehmender Protektionismus und Gegenprotektionismus, und insgesamt gesehen diverse im Grunde vollkommen widersinnige "Problemlösungen", die Zeit herausschinden um den Preis, erst mal Schwächere in den Abgrund zu treiben.

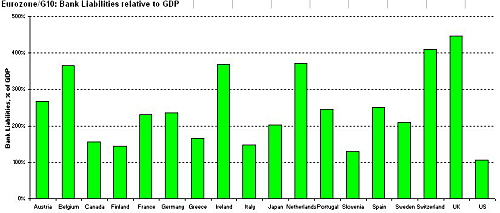

Bankverbindlichkeiten der Eurozonen/G10-Länder, im Vergleich zum jeweiligen BIP, laut Dresdener:

Das kann einen schon etwas ins Grübeln bringen.

Die Häfen in Großbritannien füllen sich:

The lay-up area at King Harry Ferry on the River Fal is already so full of dormant ships that Carrick harbourmaster Andy Brigden has had to reject a request to accommodate a further fleet of seven vessels. Southampton, meanwhile, has become the temporary home of four large ships totalling over 300,000 tonnes, and it is reported that additional moorings will be laid to accommodate further arrivals.

Und das wird noch mehr werden:

http://www.seatradeasia-online.com/News/3626.html

Worse is to come. Alphaliner estimates that new build deliveries in 2009 will represent 14% of the current fleet. Another 12% will join in 2010. Despite continued scrapping, the weak demand trends will fall well short of absorbing this net new capacity. Compounding the problem, as pointed out by Alphaliner, is that current bunker prices are reaching the point where the popular coping practice of "slow steaming" becomes uneconomical. In short, the idle fleet will expand considerably.

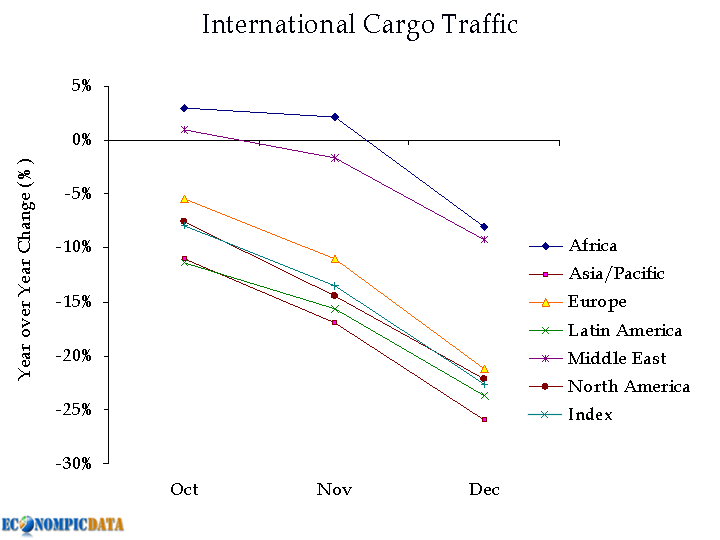

Die IATA hat die Zahlen zum Luftverkehr 2008 veröffentlicht - und sie sind schlecht.

For the full-year 2008, international cargo traffic was down 4.0%, passenger traffic showed a modest increase of 1.6%, and the international load factor stood at 75.9%.

Frachtverkehr 2008: -4.0%

Frachtverkehr 2008-12: -22.6%

Personenverkehr 2008: +1.6%

Personenverkehr 2008-12: -4.6%

Freier Fall, in der Tat.

http://econompicdata.blogspot.com/2009/01/cargo-plane-traffic-crash.html

Econompicdata hat das graphisch umgesetzt:

Proceeds from sales of Boeing 737-800 in Q3 2008 - €26.5m each. (Five aircraft sold for roughly €132.6m)

Proceeds from sales of Boeing 737-800 in Q3 2009 - €21.2m each. (Eight aircraft sold for roughly €169.6m).

20% weniger pro Maschine.

The performance of manufacturing index rose 2.9 points to 36.6 from December, the Australian Industry Group and PricewaterhouseCoopers said in a report released in Canberra today. A reading below 50 signals manufacturing is shrinking.

36.6 ist sicherlich besser als 33.7, aber "contracted for an eigth month" ist der entscheidende Satz.

sicherlich auch wegen des Rohstoffsektors.

By the start of the Chinese new year festival on January 25, 15.3 per cent of China’s 130m migrant workers had lost their jobs and left coastal manufacturing centres to return home, said officials quoting a survey from the agriculture ministry.

Mehr als 20 Mio. chinesische Wanderarbeiter haben ihre Jobs verloren und sind in ihre Heimat zurückgekehrt... und das ist noch nicht alles:

denn diese 20 Mio. enthielten nicht diejenigen, die zwar ihren Job verloren haben, aber am Ort geblieben sind um einen Neuen zu suchen.

Man könnte auf den Gedanken kommen, daß die Krise bisher _mindestens_ die Jobs vernichtet hat, die in drei Jahren geschaffen worden.

Das ist, gelinde gesagt, katastrophal.

The research was conducted for The Sunday Times over the last two months in three provinces vital to Chinese trade – Guangdong, Zhejiang and Jiangsu. It found that the global economic crisis has scythed through exports and set off dozens of protests that are never mentioned by the state media.

Eines ist mir ja etwas unklar: Ein Unterdrückungsregime wie das in China müßte doch eigentlich wissen, daß man solche Forschungen nicht durchführen läßt, oder?

Der Artikel zählt ein halbes Dutzend (kleinerer) Unruhen auf, und zeigt dann noch auf, daß die Regierung den Sinn für Prioritäten nicht ganz verloren hat, und sich um einen Rechtsanwalt von Migranten kümmert, wie man das erwarten würde:

On January 9, Xiao said, 14 security officers from the local labour bureau broke into his office, confiscated 600 legal case files, 160 law books, his computer, his photocopier, his television set and 100,000 yuan in cash.

“That evening I was ambushed near the office by five strangers who forced a black bag over my head and then threw me into a shallow polluted canal,” he said. His landlord has since given him notice to quit his rented home.

Xiao said he was defying bribery and threats to speak to the foreign media because he wants international businesses to know what is really happening in “the workshop of the world”.

Unter dem Eindruck wachsender Unzufriedenheit in der Bevölkerung hat China sein Militär zu absolutem Gehorsam gegenüber der Kommunistischen Partei aufgefordert. Die Forderung wurde bei einem Treffen der zentralen Militärkommission unter Leitung von Präsident Hu Jintao formuliert. Nach einem Bericht der amtlichen Nachrichtenagentur Xinhua trifft die chinesische Verteidigungspolitik auf "komplizierte Veränderungen im internationalen und heimischen Umfeld."

Die Frage ist jetzt nur noch, wann das Regime die Maske endgültig fallen läßt.

[...]

The coal-mining heartland of Shanxi province had the biggest problem.

[...]

A 2007 commission report said the rate of defects had risen 40% since 2001, from 104.9 per 10,000 births to 145.5 in 2006.

Officials blame emissions from Shanxi's large coal and chemical industry for the problems there.

Na, wer hätte das erwartet?

Mit 172 (Vorjahr: 239) Aufträgen im Wert von 13,3 (15,4) Mrd. Euro sei die Beschäftigung der Werften rechnerisch nur noch für weniger als drei Jahre gesichert, teilte der Verband mit. Hinzu komme, dass wegen der Krise die Finanzierung von 29 Schiffen aus dem Auftragsbestand wackelt.

Moody's über Dubai:

Also, erstens ist Dubais Diversifizierung in der derzeitigen Krise nichts wert (zyklische und gekoppelte Branchen). Zweitens kann der Staat nicht großartig helfen.

Und sogar eine unserer Ratingagenturen hat Zweifel an die Liquidität der Dubaischen Auslandsanlagen. Was ja, nach den bisherigen Erfahrungen, ein Hinweis auf einen Totalausfall sein kann.

Edward Hugh ist wieder für Depressionen gut:

Q-o-Q Y-o-Y

Hungary -1.0% -4%

Poland -0.7% -3%

Czech Republic -1.0% -4%

Geschätzte Januar-BIPs von Polen, Tschechien und Ungarn, auf Basis der Einkaufsmanagerindizes.

Warum macht er sich die Mühe zu schätzen?

Im Klartext: Er vermutet einen steilen Fall.

Auf der Seite listet die EU-Kommission auf, welche Hilfen sie in letzter Zeit bewilligt hat.

Japanische Industrieproduktion -9.6% im Dezember, nach -8.5% im November.

The drop eclipsed the previous record of 8.5 percent decline set in November, the Trade Ministry said today in Tokyo. Economists predicted a month-on-month decrease of 8.9 percent.

Uwe Ohse, 2009-02-02

According to data released today by the Ministry of Internal Affairs and Communications, Japan’s “core” consumer prices rose just 0.2% in December as declining oil prices continue to add deflationary pressure. December was the fifteenth month in which core consumer prices rose.

[...]

* December general nationwide consumer price index: +0.4% (+1.0% in November)

* December general nationwide consumer price index (excluding rent): +0.4% (+1.2% in November)

* December nationwide core CPI (excluding fresh food): +0.2% (+1.0% in November)

* December nationwide consumer price index (excluding fresh food and energy): 0.0 (+0.0% in November)

Mich dünkt, Japan sammelt sehr bald weitere Erfahrungen im Umgang mit Deflation. Naja, einzelne Branchen dürfen schon:

* Fuel, light and water charges +1.8% (Previous: +4.8%)

* Food +3.6% (+3.7%)

* Education +0.7% (+0.7%)

* Clothes and footwear +0.5% (+0.5%)

* Furniture and household utensils +0.2% (+0.2%)

* Housing +0.1% (+0.2%)

* Miscellaneous +0.0% (+0.2%)

* Medical care -0.4% (-0.5%)

* Reading and recreation -0.4% (-0.5%)

* Transportation and communication -5.1% (-2.3%)

-11.6% in einem Quartal - nicht gut.

Dutch pension funds, which in total managed 736 billion euros in September, usually buy extra stocks when equity markets go down to keep up the weight of share investments relative to other asset classes, Dutch central bank data has shown.

But metal workers fund PME, which managed 18.7 billion euros at the end of December, will keep its weight for stocks at 20 percent of total assets for 2009 from a 38 percent target in 2008.

Den Aktienanteil nicht zu erhöhen ist nicht unbedingt ein Zeichen für Vertrauen in den Aktienmarkt.

The marches, complete with Soviet-style red flags and banners, pose a challenge to a government which has faced little threat from the fragmented opposition and politically apathetic population during the boom years fuelled by oil.

Der Artikel ist ein durchaus ein klein wenig reißerisch - aber daß Tausende gegen Putin auf die Straße gehen, ist neu:

Mitte 2008 hatte Rußlands Zentralbank Währungsreserven von ungefähr $600 Mrd, und Rußlands gesamte Auslandsverschuldung betrug $527 Mrd.

Januar 2009: Währungsreserven knapp $400 Mrd, Auslandsverschuldung $467 Mrd.

Ergo: Reserven -200, Verschuldung -60 Mrd. Oops.

Ausblick:

The defaulted Russian loan was only a small fraction of RBS’s mounting problems, and the size of the total Russian debt pales in comparison to the size of the subprime residential mortgage mess in the US, for example. Still, if Russia now initiates a process of international debt restructuring, it is likely to shake the already troubled global financial system further.

Mehr Probleme...

Das ist, auf ein Jahr gerechnet, -4.4%.

Urks.

Und Spaniens Staatsausgaben haben das BIP schon massiv gestützt...

Financial authorities last year declared the Korea Exchange (KRX) an illegal monopoly and said the National Board of Audit and Inspection should supervise its accounts and management. However, this recommendation could not come into force until the finance ministry's ruling yesterday.

Südkoreanische Börse nun unter Staatskontrolle - weil sie ein "illegales Monopol" ist.

Was das bringen soll?

"Turning the KRX into a public institution is apparently seen as a way for the current government to keep a tight rein on personnel, a move that will ultimately lead to a shake-up and 'parachute staff', dropped from the top into their jobs," Yu Heung-ryol, KRX union chief, told the Yonhap news agency.

The move to class KRX, which is mainly owned by Korean securities firms, as "quasi-governmental" comes at a tough time for an exchange which is looking to expand its foreign listings and itself expand abroad into smaller markets.

Nicht, außer mehr Einfluß für den Staat?

Aber interessant ist folgendes:

Nach südkoreanischem Recht hat ein Unternehmen ein Monopol, wenn es mehr als 50% des Umsatzes des ganzen Sektors macht.

Das schreit ja geradezu nach Verstaatlichung von Bahn AG, Telekom, Post, ...

Das ist die Menge Geld, die nicht in Großbritannien Lebende in Großbritannien angelegt haben. Alice Cook (ukhousingbubble) argumentiert, daß die Leute ihr Geld da wegen attraktiver Zinsen angelegt haben, und ein weiteres Senken des Zinssatzes zum Abziehen dieses Geldes und weiteren Verfall des Pfundes führen könnte.

Die Argumentation ist natürlich nicht von der Hand zu weisen, aber eventuell sind diese Investoren hauptsächlich scharf auf Schmerzen und weniger auf Rendite... aber wenn ich damit unrecht haben sollte, wären die Folgen gravierend:

The amount of cash held in these accounts is huge. In December 2008, it was an amount equal to 30 percent of UK GDP. The growth of these deposits is even more shocking. Between September 1997 and April 2008, they increased by 450 percent.

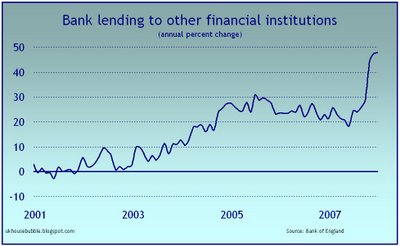

In Großbritannien gibt's eine Kreditklemme? Nicht für jeden... insbesondere nicht für das Schattenbankensystem.

Wobei sich hier die Frage stellt: Wird dem SBS das Geld geliehen, weil man es nur so vor dem Zusammenbruch bewahren kann, oder bekommt es das Geld nach dem Motto "alles auf die 17" eines verzweifelten Spielers?

Britische Gewerbeimmobilien:

Its UK Quarterly Property Index showed commercial properties lost 26.4% of their value last year - the most since records began in 1987.

-26.4% in einem Jahr - _viel_ schlimmer als erwartet.

The funds shed $94.5 billion in asset value in the five months ended Nov. 30, according to a study released today by Commonfund and the National Association of College and University Business Officers. The loss, the biggest in 35 years, compares with a 29 percent decline in the same period by the Standard & Poor’s 500 Index, including reinvested dividends.

Die US-Collegefonds, haben von Juli bis November 22.5% verloren - und die Verluste werden wohl steigen, sobald die Ergebnisse von Immobilien und private equity berechnet sind.

Oh, und Harvard und Dartmouth sind noch gar nicht eingerechnet.

Die Amerikaner schnallen buchstäblich ihre Gürtel enger. Im vierten Quartal ist der reale private Verbrauch von Nahrungsmitteln saisonbereinigt mit einer Jahresrate von 13,8 Prozent gefallen, nach einem Minus von 7,3 Prozent im dritten Quartal. Derlei hat es seit Beginn des vierteljährlichen US-BIP-Ausweises 1947 nicht gegeben.

Urks.

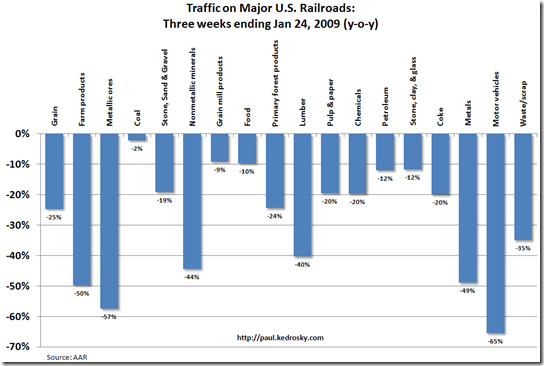

US-Eisenbahngütertransport über drei Wochen, endend 2009-01-24:

Autotransport: -65%.

Erz: -57%

Farmprodukte: -50%

Metall: -49%

Mineralien: -44%

Holz: -40%

Jeweils gegenüber dem Vorjahr gerechnet.

Auch hier gilt: Bald ist weitere Verschlechterung nicht mehr möglich.

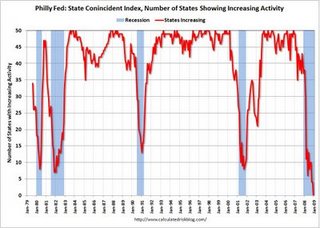

Here is the Philadelphia Fed state coincident index release for December.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for all 50 states for December 2008. The indexes decreased in all 50 states for the month (a one-month diffusion index of -100). For the past three months, the indexes increased in three states, Louisiana, North Dakota, and Wyoming, and remained unchanged in one state, Alaska.

Im Dezember ist der "Philadelphia Fed state coincident index" zum ersten mal in allen 50 US-Bundesstaaten gefallen. Der setzt sich so zusammen:

Each of the regional indexes is computed using data on employment, real earnings, the unemployment rate and average weekly hours worked in manufacturing. Each index is then retrended so its long-term growth rate matched the corresponding growth rate of real earnings. (Quelle)

Und damit hat die Krise dann auch offiziell auch all die Bundesstaaten voll erfaßt, die mit der Immobilienblase nichts zu tun hatten.

Wie CR so schön schrieb: a new record that will never be broken Schlimmer als 50 von 50 kann's nicht mehr kommen.

Rot: Haltbare Güter. Niveau: 1980.

Compared with December 2007, the index declined 14.1 percent, the biggest year-over-year decrease since February 1996. During the fourth quarter, tonnage was down 6.0 percent from the same quarter in 2007.

CR hat eine Zusammenfassung der Januarnachrichten über Ökonomie und Immobilienbranche der USA gemacht. Das sind 20 Graphiken, von denen nicht eine positiv ist.

The snowpack on California's mountains is carrying only 61 percent of the water of normal years, according to the survey by the state Department of Water Resources. Last year the snowpack held 111 percent of the normal amount of water, but spring was the driest ever recorded.

[...]

December through January tend to be the wettest months but thus far the Sierra has only received one third of its expected annual snowfall.

"A third of normal is devastating," said Elissa Lynn, a meteorologist with the state. "January is the biggest month for precipitation in the Sierra."

Die Chancen für eine massive Trockenheit in Kalifornien werden immer besser.

In Kalifornien kommt wirklich alles zusammen, was ein Land für ein abgrundtief schlechtes Jahr braucht: Finanzkrise, Trockenheit und Wasserrationierung, Wirtschaftskrise. Und brennen wird es sicher auch wieder genug.

Aber keine Sorge, es kann noch schlimmer kommen - das große Erdbeben fehlt noch.

The country's central bank is introducing seven new notes in an effort to stave off economic collapse.

Der Zentralbankchef hat aber Humor:

Ein erstes Mißtrauensvotum hat die BBC schon:

John Robertson

Harare-based economist

In jedem Fall kann man jedoch feststellen, daß 12 Nullen nicht ausreichen - die Zahl der Nullen in der Regierung ist deutlich größer.

The WFP says it has cut the ration to meet increased demand and cope with a shortfall in donations. It says it requires another $65m to keep feeding Zimbabweans until the end of March. But donors are reluctant to put more resources into the beleaguered African state and what aid there is has been partly diverted to the cholera crisis that has claimed 3,000 lives.

Noch ein Beweis der Überlegenheit der europäischen Zivilisation: Bei uns verbrennt eine einzelne Bank ja mehr pro Monat als 7 Mio. Simbabwer...

Wollen Sie den Digest abbestellen?