| Sendedatum | 2009-01-29 10:25:58 |

|---|---|

| Ausgabe | 79 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Inhaltsverzeichnis:

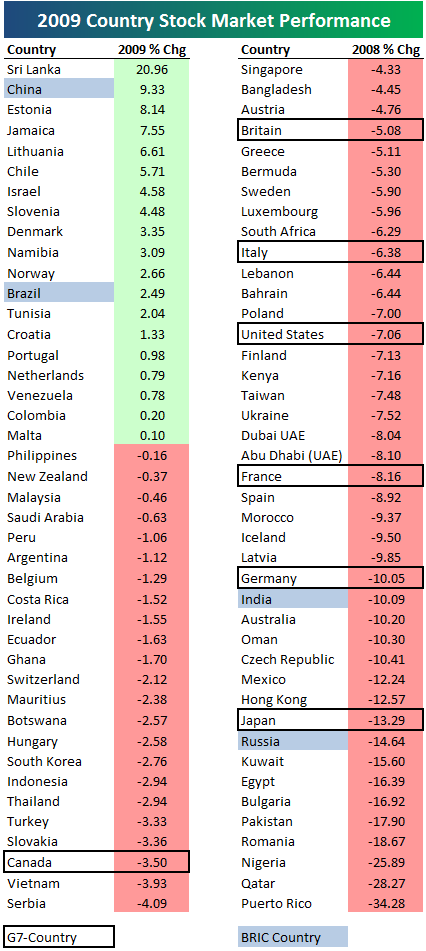

- 2009 COUNTRY STOCK MARKET PERFORMANCE -- THINGS ALREADY AREN'T PRETTY

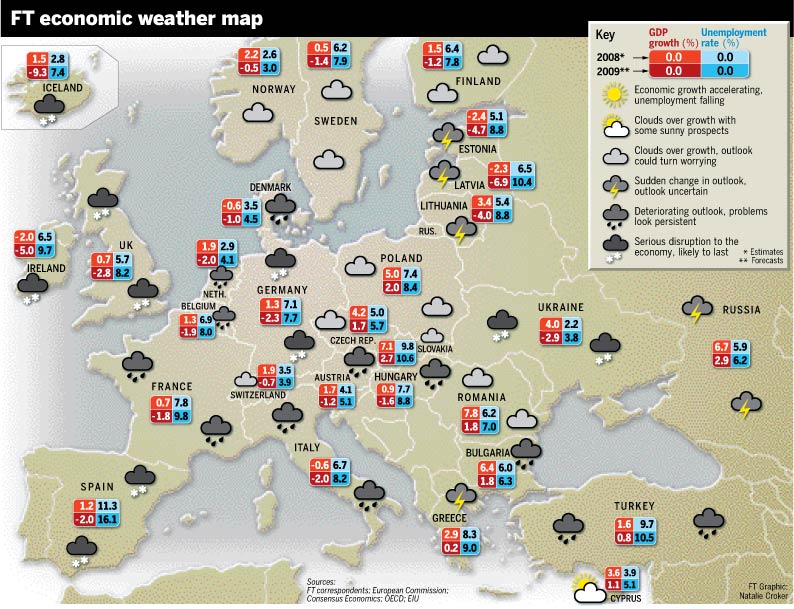

- Winter bites in EU but with some bright spots

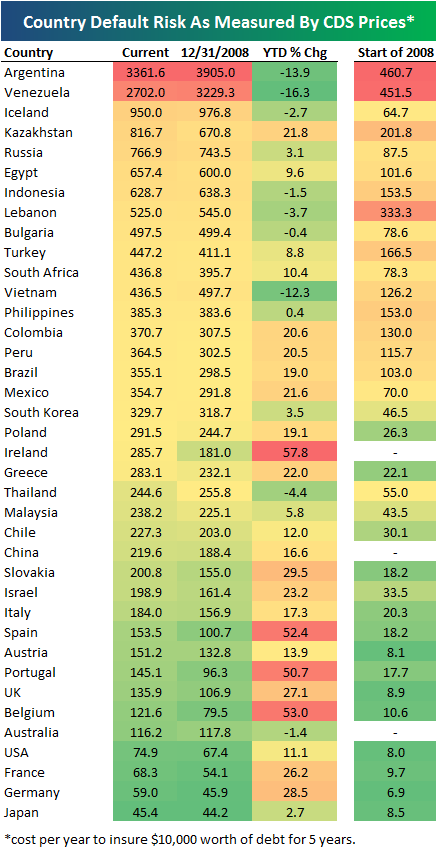

- Country Default Risk Continues to Rise

- Nations turn to barter deals to secure food

- Global pensions lose £3.6 trln in 2008

- Citigroups Pandit über Bankkapitalisierungsregeln

- Blackstone für mehr Hebelung

- Investcorp Ends S&P Contract After "Unjustified" Downgrade

- The Mega Containers Invade

- European capacity collapse: the preview

- Fortis Bank to report 2008 loss up to 19 bln euros

- Bolivia nationalizes energy firm Chaco

- Bhutan: Thimphu running out of fuel wood

- China: Thinking the unthinkable

- Still ruht das Drehkreuz

- Dänische Exporte: Einbruch

- India Bans Chinese Toys For 6 Months

- Price Waterhouse Auditors Arrested in Satyam Inquiry

- Island ruft Neuwahlen aus

- Israel: Coastal aquifer in danger of contamination, study finds

- Japan faces up to the prospect of ‘peak fish’

- Libya eyes nationalisation of oil firms

- E. European workers go home

- Energiekrise in Pakistan, Update

- Rußlands Öl- und Gasförderung

- Spanien: Finetuning.

- Tschechien

- UAE: Banks are hereby required not to be in a hurry to publish their audited annual accounts

- Britain is facing return of three-day week

- UK car production plunges by nearly 50pc

- UK: Durchschnittliche Bankhebelung

- UK: ‘Accidental landlords’ face shrinking rents

- UK: Immobilienpreisverfall in verschiedenen Währungen

- USA: Liquidation risk grows as finance dries up

- USA: Venture Capital Fell 33% Last Quarter to Lowest Level Since ’05

- The US placed about $1.3 trillion of Treasuries with non-Chinese investors in 2008

- USA: Pensionsfonds verliert $61.4 Mrd.

- Long-Term Charts Of The Financial Sector

- GE: "2009 to be extremely difficult"

- Hamptons Prices Fall as Recession Hits Wall Street

- Stuyvesant Town and Peter Cooper Village apartments

- TARP-Linked NASDAQ Government Relief Index: Not Looking Good…

- Wall St bonuses down 44 percent in 2008-NY State

- Vietnam: Export -24%

Inhalt:

Israel ist übrigens im grünen Bereich, alle anderen Länder in der Gegend im roten... es scheint so, als wäre ein bischen "Krieg" gut für die Börse.

[...]

With policymakers struggling to keep pace with the downturn’s ferocity, the European Commission on Monday rushed out revised economic forecasts showing European Union gross domestic product would contract by 1.8 per cent this year – faster than in the US. The gloom was pretty universal. Spain and Ireland – previously among the eurozone’s best performers – would contract by 2 per cent and 5 per cent. German GDP was expected to fall by 2.3 per cent in 2009; UK GDP by 2.8 per cent.

[...]

There are some other possible bright spots. Eastern European economies such as Poland, the Czech Republic and Slovakia were still expected to see their economies growing this year – as was the Mediterranean island of Cyprus.

Die FT hat einen unerfreulichen Ausblick für Deutschland - gleichauf mit Großbritannien und Spanien, knapp besser als die Ukraine. Ich habe leichte Zweifel an dieser Sichtweise.

Aber insgesamt ist das eine gute Erinnerung daran, daß es lichterloh und überall brennt.

Der Rückschritt des internationalen Handels - zurück in die Zeit vor der Erfindung international operierender Banken - beschleunigt sich. Ein weiteres Anzeichen, daß das Banksystem seine Funktion nicht mehr erfüllt.

The study said that over 2008, global pension assets fell to $20 trillion from $25 trillion, a fall of 19 percent which took assets below 2005 levels.

Weltweit fielen die Pensionsfonds von 25000 Mrd. Dollar auf 20000 Mrd. Dollar. Mal eben 20% weg.

Einziger Lichtblick:

Ein besonderes Beispiel für Realitätsverzerrung liefert der Chef der Citigroup:

Banken sind also gut kapitalisiert, und \"tangible common equity\" ist der falsche Maßstab für die Liquidität einer Bank.

FT Alphaville hat an dem Standpunkt einige Kritik;

Und ich habe noch einen anderen Kritikpunkt: Was Pandit da macht, ist die Aufhebung aller Regularien zu fordern, die eine Bank zur Vorhaltung einer Kapitalreserve zwingen.

Ein Zuhörer: Was wäre denn ein bessere Maßstab für die Kapitalisierung einer Bank als \"tangible common equity\"?

Pandit: ein besserer Maßstab - das ist der heilige Gral.

Ah, ja.

Insgesamt ließt sich das für mich wie der Versuch, die Pleite dadurch abzuwenden, laxere Regeln zu bekommen.

Und das kann weder funktionieren noch langfristig erwünscht sein.

Auch Blackstones Boss wirbt für laxere Regeln:

Mr. Schwarzman argued that banks should be allowed lower capital ratios, freeing money normally laid away against losses for new lending. He also called for the end of accounting rules that forced lower and lower asset valuations. And, oh yes, the government should guarantee securitizations to help the market get moving.

Da bin ich ja mal gespannt, ob sich die Idee, einen Brand durch mehr Brennstoff zu löschen, durchsetzen wird.

Wenn eine Ratingagentur mal downgraded, muß das nicht unbedingt gut für sie sein:

Standard and Poor's said earlier Wednesday it lowered the long and short-term credit ratings on Investcorp to BB+/B from BBB/A-2.

Was mir bei der Gelegenheit auffällt:

a) die Ratingagenturen sind immer noch am Markt

b) die Besitzer der Ratingagenturen haben immer noch nicht für den Schaden bezahlt.

c) die systematischen Probleme des Ratingsystems sind immer noch unverändert.

Das ist eigentlich nicht nur ein kleines bischen erschreckend...

In Seehandel: Containermarkt in den kommenden Jahren schrieb ich, über die Kapazitätszunahme im Seehandel:

Das Wall Street Journal schreibt zu dem Thema:

With overcapacity and a drop in trade, the bottom recently fell out on shipping rates. The rate for shipping a container from Asia to Europe, the world's busiest trade lane, has fallen to around $300, one-tenth the cost of a year ago, even as some shippers cancel regular runs. Some ships have gone so far as to take containers free. The only cost to the shipper is roughly $500 in fuel and transit fees, which are assessed on all containers.

According to the most recent data available, the U.S., Japan, China and the European Union all suffered 10% declines in exports in November, auguring a bitter 2009 for global trade. Yet shipping companies aren't expected to cancel any orders for new ships, allowing the global fleet to increase by over 12% -- way ahead of expected demand.

ok, die Wachstumsrate beträgt vielleicht nicht 13, sondern nur 12% - aber der Einbruch auch nicht 0.7%, sondern momentan mindestens 10%. Und die Frachtraten sind mittlerweile nicht mehr kalkulierbar...

Most of the new big ships were ordered before the economic bust in anticipation that the China-fueled boom in global trade would continue. But instead of canceling orders, shippers now see an opportunity to force a shakeout in what has long been a fragmented industry of family-led carriers.

Wir blähen also Überkapazitäten bewußt auf, um die kleineren Konkurrenten aus dem Geschäft zu drängen.

Eine riskante Strategie: Zwar sind Schiffe, die 13000 Container transportieren können, sicherlich effizienter als Kleinere, aber schuldenfinanzierte Giganten müssen nicht notwenigerweise gegen abbezahlte kleinere Konkurrenz gewinnen - insbesondere wenn die niedrigen Leitzinsen nicht weitergereicht werden.

Naja, in jedem Fall: Die nächsten Jahr kann man für 500$ seine komplette Wohnungseinrichtung nach Asien schiffen, wenn man denn möchte.

Den Artikeltitel finde ich (leider) einfach nur passend.

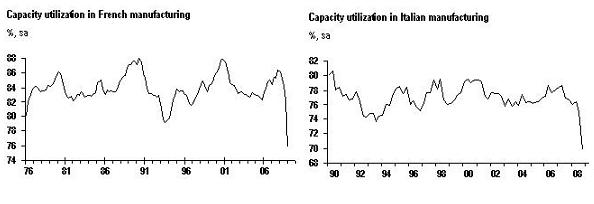

Die Quartalszahlen zur italienischen und französischen Kapazitätsauslastung sind da:

In Italy there was also a significant decline, to 69.9 in January, from 74.4 in October.

Das sind in der Tat Vorboten ganz, ganz schlechter Zahlen.

The company, formed from the carve-up of listed Fortis (FOR.BR) (FOR.AS) by the Belgian, Dutch and Luxembourg governments at the end of October, said it made an underlying profit of 1.2 billion euros in the first nine months.

However, a net loss resulted due to a 12.5 billion euro hit linked to the divestment of ABN AMRO and the carve-up transactions and 3.6 billion euros from the deterioration of its credit portfolio.

-14 Mrd in den ersten 9 Monaten 2008, und wahrscheinlich noch mal 4 bis 5 Mrd. im letzten Quartal.

Aber alles ist gut: im Kerngeschäft machte man +1.2 Mrd in den ersten drei Quartalen, die Verluste sind ja nur wegen des Kaufs von ABN AMRO und der Verschlechterung des Kreditportfolios. Kein Grund zur Beunruhigung.

Nun wüßte ich noch ganz gerne, ob das der Verluste der belgischen Fortis oder der Gesamtverlust von Benelux war...

"With this decree today, we nationalize all the shares of oil company Chaco. (They belong) to Bolivians now," Morales said during a speech given in one of Chaco's natural gas fields located in the central Cochabamba region.

Morales ordered Pan American Energy last year to transfer part of its 51 percent stake in Chaco to the Bolivian government so that state-run energy company YPFB, which at the time held a 49 percent stake, could become majority holder.

But talks over the transfer of shares had broken down, prompting the government to take control of the whole company.

Pan American Energy is controlled by oil giant BP Plc.

Die Spitzenpolitiker der linken Länder Südamerikas arbeiten hart daran, das internationale Vertrauen auf den absoluten Nullpunkt zu bringen.

Der Bezirk Bhutans, der rund um die Hauptstadt liegt, hat einen Mangel an Brennholz:

At such a rate, the FMUs are used up faster than they can be replenished.

For this year, the Natural Resources Development Corporation Limited (NRDCL), the institution responsible for handling firewood orders, has submitted a request for 10,830 cubic metres or 1,354 truckloads of firewood from the DFS. According to the Divisional Forest Officer (DFO), Lobzang Dorji, this will not happen, “it will be difficult to meet even one third this year”, he said.

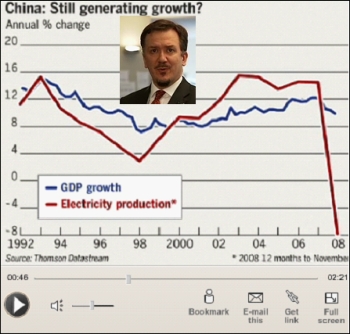

However, various measures of economic activity suggest that an outright contraction in the Chinese economy is now at least thinkable. To take one widely discussed example, electricity production in November was down 7.8 per cent from a year earlier. This was the sharpest decline on record. Typically, electricity production has grown at more than 10 per cent.

Chinese imports in December were down 21.3 per cent from a year earlier. Falling commodity prices explain some of this. China may also be cutting its reliance on importing parts from other countries in favour of building and assembling everything itself. This might explain the torrid decline in exports for Korea and Taiwan. But it still looks as though China is suffering a significant fall in domestic demand.

China im Januar 2009: Immer mehr Leute sehen die Möglichkeit einer echten Rezession...

Ein paar Hundert Meter weiter auf der Fläche vor dem Rollfeld warten zwei Jumbos und acht MD-11-Frachtflieger. Eigentlich sollten sie voll beladen in der Luft sein. Doch nur um ein Flugzeug stehen Paletten mit Kartons im Kreis. Arbeiter in neongelb leuchtenden Westen laden sie in den Bauch der Maschine.

Die anderen Flieger müssen warten. Und das kann dauern. Denn dem Carrier brechen die Aufträge im Sturzflug weg. Allein im Dezember transportierte er gut ein Fünftel weniger Güter als im Vorjahresmonat. "Das war einer der schlechtesten Monate in unserer Firmengeschichte", gibt Haupt zu.

The tendency is clear - with the exception of Germany, Danish exports to these countries have fallen dramatically from 2007 to 2008.

The drop in exports to Sweden, for example, between November 2007 and November 2008 was at 22 percent. The corresponding figure for the U.S. was a drop of 32 percent.

[...]

The worst prospects are said to be for the United Kingdom. Exports to the U.K. have dropped 12 percent over the past year and the council expects negative British GDP in both 2009 and 2010. The Confederation of Danish Industries (DI) expects Germany, which is Denmark's largest export market, to be even harder hit than Britain.

Dänemark -> USA: -32%. Wow.

Was die Welt in einer Weltwirtschaftskrise wirklich nicht braucht: Protektionistischen Blödsinn unter den Billigproduzenten...

The ban, notified by the Directorate General of Foreign Trade, will remain valid for six months.

While the government notification did not cite the reason for the ban, sources said it was concerned over a rise in imports of toys.

A concern had also been raised over the safety of children playing with the Chinese toys, which were found to be toxic.

Most of the varieties, including wheeled toys, dolls, stuffed toys, toyguns, wooden and metal toys, musical instruments, electric trains and puzzles are covered under the ban.

[...]

However, trade expert Arun Goyal said, "The ban would encourage smuggling of toys through Nepal borders. That would be more dangerous... It is bad, especially for the slum children, who an afford the cheap Chinese toys only."

und wahrscheinlich trifft's sowieso die Falschen.

Der Satyam-Fall zieht nun PricewaterhouseCoopers mit sich:

Srinivas Talluri and S. Gopalakrishnan were remanded to judicial custody on charges of “conspiracy and co- participation,” A. Shivanarayana, a police spokesman in Andhra Pradesh state, said from the province’s capital Hyderabad, where Satyam is based. Price Waterhouse said in an e-mailed statement it didn’t know why two partners were detained.

Seven years after the implosion of Enron Corp. led to the dissolution of accounting firm Arthur Andersen LLP, the Satyam case has put PricewaterhouseCoopers in the spotlight. Indian police, fraud squad, markets regulator and accounting body have started investigations after Satyam founder Ramalinga Raju said Jan. 7 that he had fabricated $1 billion of assets.

[...]

PricewaterhouseCoopers LLP may also face scrutiny in the U.S. after Satyam’s New York-listed equities lost 82 percent of their market value in two weeks. The U.S. Securities and Exchange Commission is investigating whether Satyam misled investors and officials from the SEC plan to coordinate inquiries with counterparts in India.

Haarde hatte sich zunächst für Wahlen gegen Jahresende ausgesprochen. Eine Abstimmung in der gegenwärtigen Notlage seien unverantwortlich, hatte der Regierungschef argumentiert. Gísladóttir forderte jedoch rasche Neuwahlen.

[...]

Seit Wochen fordern Demonstranten den Rücktritt der Regierung. Tausende Isländer hatten mehr als eine Woche lang jeden Tag bis in die Nacht hinein vor Parlament, Ministerien und Parteibüros protestiert. Dabei kam es auch zu gewaltsamen Auseinandersetzungen mit der Polizei - was sehr ungewöhnlich ist in Island.

Was ist eigentlich mit der isländischen Bankenaufsicht und den verantwortlichen Bankiers? Lernen die jetzt im Januar ohne Neopren im Atlantik zu schwimmen, oder bleiben die Hauptschuldigen ungestraft?

Der küstennahe Grundwasserleiter/tank liefert zwischen 25 und 33% des Trinkwassers in Israel.

The Water Authority divides the aquifer into area cells, and according to the available data, the cells in the south, about half of the total, are running low on stored water. However, the report says that the quality of the water they contain is good overall.

Rund die Hälfte des Bereichs hat wenig Wasser übrig, aber die Wasserqualität dort ist in Ordnung.

Die andere Hälfte jedoch hat verhältnismäßig viele Wasserreserven von schlechter Qualität.

Ich frage mich aber, wie Israel das hinbekommen soll...

Each year, about 100m tonnes of fish, 5 per cent of the 2bn tonnes of seafood biomass, are hauled from the oceans, according to a recent study published in Science. Many conservationists espouse “peak fish” theories, suggesting that catches have reached a limit, or gone beyond.

Naja, das eigentliche Problem ist nicht, daß 5% der Biomasse weggefischt werden (das alleine wäre wahrscheinlich unproblematisch), sondern daß große, erwachsene, fortpflanzungsfähige Tiere weggefangen werden. Und das ist halt ein sehr wirksamer Beitrag zur Unterbrechung der Fortpflanzungskette.

That may not be true for all species. But for some it is undeniable. In November, the International Commission for the Conservation of Atlantic Tunas, which includes Japan, sliced the 2009 blue-fin quota by a fifth. Japan gobbles 90 per cent of all blue-fin. Some scientists say the quota must be halved to let stocks recover.

Äh, Kinder... Quoten für _teuren_ Fisch machen keinen Sinn, denn es ist einfach zu lohnenswert, den illegal zu fangen, und die Fischindustrie insgesamt ist nicht gerade leicht kontrollierbar.

Gerade bei dem teuren Zeug helfen nur Verbote.

Japan’s fishing industry faces crisis. The number of fishermen has sunk to 200,000 from a peak of 1m. That is still too many, compared with 10,000 in Norway. Too many boats chasing too few fish have devastated fish resources. By 2006, according to the Japan Economic and Social Research Institute, more than half of Japan’s fishing grounds had dangerously low stocks.

was dann im wesentlichen heißt: die kleinen Fischer gehen vor die Hunde, und die großen bauen größere Schiffe und fischen anderswo.

Tja, nicht nur in Japan, und nicht nur bei Fisch. Das ist ein Problem, was sich wirklich global durch den Umgang mit Naturresourcen zieht.

Fish resources are devilishly difficult to manage internationally. Many fish species migrate wantonly across territorial waters. Indonesians have an economic incentive to grab juvenile tuna in their waters before they head for the high seas to be snagged – more rationally – as mature adults by stronger fishing nations. The idea of a war over fish is no more preposterous than that of a conflict over water or petroleum.

"There have been calls for the nationalisation of the oil and gas industry," he said at a dinner on Friday night for visiting King Juan Carlos of Spain.

"We hope this will not happen. We hope oil prices will rise to a reasonable level," he said. "A price which stabilises at around 100 dollars ... is a reasonable target price."

Libyen könnte Ölfirmen verstaatlichen, wenn die Ölpreise nicht auf 100 Dollar pro Barrel steigen. "Wir hoffen daß dies nicht passieren wird. Wir hoffen, die Ölpreise steigen auf ein vernünftiges Niveau". Irre ich mich oder klingt das ein wenig nach Erpressung?

Nicht nur Dubai wird von seinen Gastarbeitern verlassen (siehe Indians Flee Dubai as Dreams Crash - Fall out of Economic Crisis):

Although Eastern Europeans tend to work for lower wages than their Danish construction colleagues, they also appear to be at the top of the list when layoffs have to be chosen as a result of the current recession.

According to figures from the Labour Market Board, the number of Eastern Europeans with an active working permit in Denmark has fallen from 12,784 to 8,814 – despite the fact that it has become much easier for companies to import foreign workers.

rund ein Drittel ist eine eindruckvolle Quote.

Das Thema aus Energiekrise in Pakistan ist noch nicht beendet: In Pakistan wird weiterhin regelmäßig der Strom abgeschaltet.

According to reports, 10 to 12 hours of power cuts are being observed in various cities of Sindh, including Sukkur, Rohri, Panu Aqil, Sangrar and Khairpur.

Meanwhile, eight to 10 hours of loadshedding is being witnessed in urban areas of Hyderabad, Matli, Tandobago, Tando Muhammad Khan, Jamshoro, Badin, Nawabshah, Mirpurkhas, Umar Kot, Tharparkar, Ghotki and Obaro. However, rural areas bear prolonged power cuts of around 14 hours a day.

People held a protest demonstration against 16-hours of power outage in Thatta. The protestors staged a sit-in on the National Highway, causing a huge traffic jam.

In Faisalabad, domestic consumers of urban areas are bearing 10 to 12 hours of power cuts while in rural areas, this duration exceeds further.

Similarly, 14 to 16 hours of electricity loadshedding is being observed in various cities of Southern Punjab, including Multan, Muzaffargarh, Rahimyar Khan and Bahawalpur.

Das kann natürlich nicht wirklich überraschen, wo zu wenig ist, ist halt zu wenig: Strombedarf: 11000 MW, Verfügbar: 7000.

Aber Besserung ist in Sicht:

http://www.onlinenews.com.pk/details.php?id=139595

Ein Kernkraftwerk mit 300MW Leistung geht an's Netz. Damit steht es dann 7300:11000.

Ok, das lohnt sich dann in 5 Jahren.

Und bald geht auch ein zweiter Reaktor ans Netz - naja, "bald" wie in "2011". Es bleibt also 7300:11000.

0.7% weniger ist nicht viel, aber eben trotz Rekordölpreisen weniger als zuvor.

Während in den Vereinigten Arabischen Emeraten die Banken angehalten sind, ihre Ergebnisse nicht schnell zu veröffentlichen (siehe UAE: Banks are hereby required not to be in a hurry to publish their audited annual accounts), diskutieren spanische Banken mit der Zentralbank ...

nein, nicht etwa über schnellere Veröffentlichung, sondern über Bilanztuning zur Vermeidung von katastrophalen Abschreibungen.

Auch das ist nur bedingt vertrauensbildend.

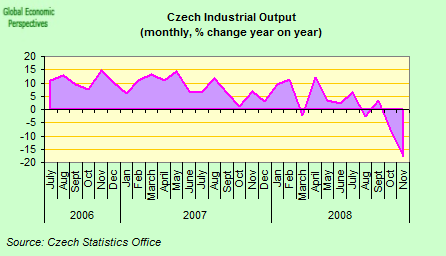

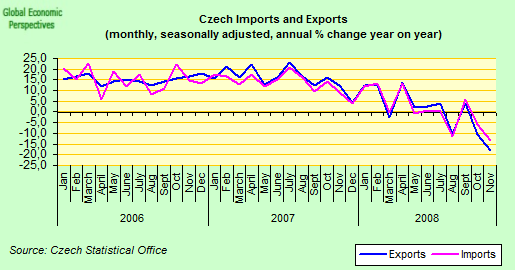

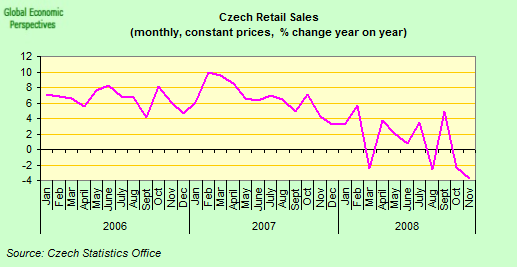

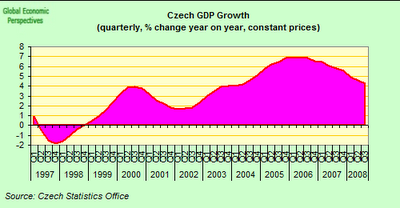

Czech industrial production fell in November at the fastest rate since at least 2000, dropping by 17.4 percent year on year, following a decline of 7.6 percent in October.

Well, in trying to determine the future path of Czech GDP, the first thing we need to bear in mind - looking at the GDP chart above - is that the economy has been losing momentum since late 2006, that is the “stellar” catch-up growth component has been waning, and for some time. The second thing we need to bear in mind is that this is not necessarily a bad thing, since it means that the CR’s economy (unlike many others across the CEE) is certainly not on a boom bust cycle. The slowdown in quarter on quarter growth is also evident in the chart below. In fact in Q3 2008, Czech GDP grew by 1.0% in comparison to Q2 2008 and by 4.7% in comparison to Q3 2007.

Also: Aussichten schlecht, aber nicht so schlecht wie anderswo.

Wobei die große Unbekannte die Entwicklung bei Skoda ist - 2008 war ein Rekordjahr, 2009 wird definitiv keines (geplante Produktionskürzung in der ersten Hälfte 2009: 20%). Und Skoda alleine, ohne Zulieferer, hat einen Anteil vom tschechischen BIP von 4.5%.

Uwe Ohse, 2009-01-27

Banken in den vereinigten arabischen Emiraten sind von ihrer Zentralbank aufgefordert worden, sich nicht mit der Veröffentlichung ihrer Ergebnisse zu beeilen:

Ich bin sicher, daß dieser Schritt nur der Stärkung des Investorenvertrauens dienen kann. Es würde ja niemals Mißtrauen verursachen, wenn alle Banken einer Volkswirtschaft ihre Ergebnisse möglichst spät veröffentlichen.

Und ein weiteres Mosaiksteinchen:

Es scheint, als hätte Dubai zu viele Hotels.

[...]

Major firms such as JCB have already downed tools for one day a week and are considering moving to a three-day week, with state help, if the recession gets worse. The firm's chief executive, Matthew Taylor, said that he is pressing Lord Mandelson, the Secretary of State for Business, to introduce compensation for workers if their hours are reduced. Some of the jobs earmarked for redundancy, he said, could be saved if the move is introduced by April.

[...]

Figures from the British Chambers of Commerce, which represent 100,000 firms, show that 39 per cent of businesses are planning to cut hours.

Ich dachte bisher, so Sachen wie 35 Stunden Wochen wären nicht mehr in, und nun kommen ausgerechnet die Briten mit 24 Stunden Wochen?

A total of 53,823 cars were manufactured in the UK in December, a fall of 47.5pc from a year earlier, meaning 1.45m were manufactured in 2008 as a whole, a decline of 5.7pc.

Autoproduktion in Großbritannien:

2008-12: -47.5% gegenüber 2007-12.

2008: -5.7% gegenüber 2007.

However, the fact that 76pc of all vehicles produced in the UK are for exports to more than 100 markets shows the strength and importance of the sector, he added.[/blockquote

Bei -47% noch von Stärke zu reden beweist, daß derjenige den Bodenkontakt verloren hat.

As a result, the government is too small to help, in trying to bail out the banks, is in danger of chucking not just good money after bad but the entire economy after the banks.

Durchschnittliche Hebelung britischer Banken: 30.

Homeowners who let out their properties last year rather than sell them for a cut price are being forced to reduce rents or risk losing their tenants as the market rapidly sours.

Letting agents saw a rush of so-called “accidental landlords” into the market last year, as falling house prices convinced property vendors to delay their sales.

Accidental landlords sind Hauseigentümer, die nicht zu niedrigen Preisen verkaufen wollten und daher die Häuser/Wohnungen vermietet haben.

Mit der logischen Folge, daß die Mieten um 20% bis 30% eingebrochen sind...

blockquote=none]The plus side for high-end London estate agents being that there are now plenty of foreign - particularly Middle Eastern - buyers looking to snap up some London property bargains. Full FT Weekend article here.

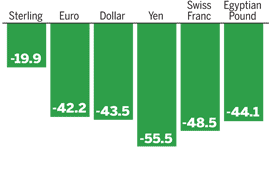

Das finde ich mal ausgesprochen eindrucksvoll.

Das Geld für die Finanzierung von "Chapter 11"-Pleiten ist ausgetrocknet, und man befürchtet zunehmende Zahlen von "Chapter 7"-Liquidationen.

In the US, companies on the verge of insolvency can restructure themselves under a Chapter 11 bankruptcy protection process, sometimes taking years.

But the credit crunch has severely limited the availability of so-called ‘debtor in possession’ financing that is vital to give them this second chance.

With previous big providers of DIP financing, such as GE Capital, shying away from the market, companies may have to rely on their existing lenders, says Standard & Poor’s, the rating agency.

It said on Friday there had been no substantial increase in DIP volumes in 2008, in spite of a jump in the number of bankruptcies, highlighting the reluctance of banks and investors to finance companies in bankruptcy.

[...]

Debtors also face the highest rates yet for DIP financing. The risk premium a debtor has to pay on the loan has more than doubled since 2001-2002, the height of the last downturn, according to Dealogic.

In 2001 the spread over Libor was 429bp versus 900bp now.

Uwe Ohse, 2009-01-25

Brad Setser über die Käufer von US-Staatsanleihen:

In 2008, my best estimate** is that China bought $374.6 billion of the $1684.8 billion increase in the outstanding stock of marketable Treasuries not held by the Fed. China absorbed 22.2% of net issuance. Foreign central banks share of the total outstanding stock of marketable Treasuries not in the hands of the Fed also went down, falling from 47.2% at the end of 2007 to 44.5% at the end of 2008.***

Demnach ist China zwar ein wichtiger Abnehmer von US-Staatsanleihen, aber längst nicht so wichtig wie angenommen. Und insgesamt nehmen Zentralbanken "nur" 44.5% der US-Staatsanleihen auf.

And it also implies that non-Chinese investors bought an (even more stunning) $892 billion of Treasuries in the second half of 2008.

Obviously, it would be a big deal if China stopped buying and started selling.**** But it would be much bigger deal if private investors lost their appetite for Treasuries.

Die alles entscheidende Frage ist: Verlieren die privaten Investoren ihren Appetit auf US-Staatsanleihen? Und wenn ja: verlieren sie ihn ganz oder treibt das nur die Zinssätze nach oben?

Apropos "private Investoren": das heißt in dem Kontext "alles außer Zentralbanken und deren direkten Ablegern".

Ein anderer Punkt zum Nachdenken: Setser schreibt China bought $374.6 billion ... of marketable Treasuries.

Laut http://www.census.gov/foreign-trade/Press-Release/current_press_release/exh14.txt hatte China in den ersten 11 Monaten 2008 einen Handelsüberschuß zur USA von $246 Mrd. Das heißt, China kauft grob 50% mehr US-Staatsanleihen als es müßte, um den Handelsüberschuß loszuwerden, und das heißt, China investiert auch Gelder aus dem Handel mit anderen Ländern in den USA.

Was im Klartext heißt: China sieht US-Staatsanleihen als bessere Investition als die Staatsanleihen diverser anderer Handelspartner - und die Annahme, daß China langsam aus dem Dollar herausdiversifiziert, ist im Wesentlichen falsch - wie auch die Annahme, daß China viel Geld in Sachwerte investiert.

It invests an additional $25.3-billion for more than 800 school districts and state and local government entities to, among other things, pay police and teachers, buy books and health care for children and help hurricane victims.

But in audit after audit over the past eight years, the supposedly low-risk agency was warned again and again about making risky, complex investments, without proper controls.

Now, with the economy tanking, the overexposure to risk highlighted in those audits has come back to haunt the SBA. In the past 18 months, one-third of the agency's assets — $61.4-billion — have been wiped out.

Es ist schon eine bemerkenswerte Leistung für einen Pensionsfond - von dem man annehmen würde, daß Sicherheit der Anlagen allererste Priorität hat - rund ein Drittel des Wertes zu verlieren, oder?

Nicht ganz so schnell - wenn man natürlich über 8 Jahre sämtliche Empfehlungen und Warnungen, die in verschiedenen Audits geäußert wurden, in den Wind schlägt, ist der Verlust nicht mehr so bemerkenswert...

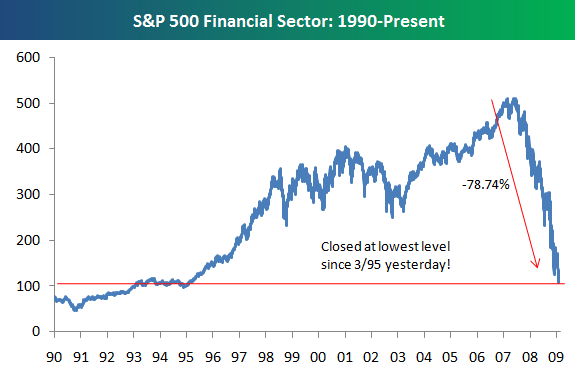

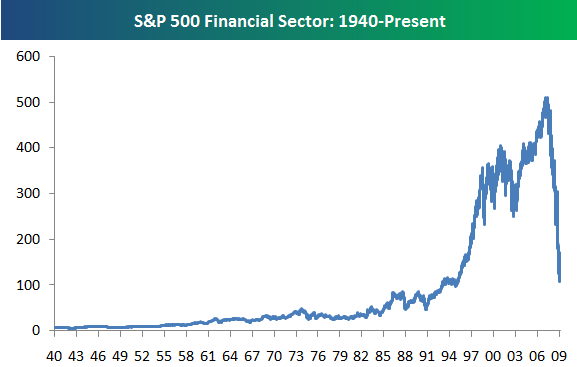

Aus der zweiten Graphik kann man entnehmen, daß der Finanzsektor noch längst nicht das Niveau erreicht hat, daß er vor dem Ausbruch der Finanzalchemie in den 80ern hatte.

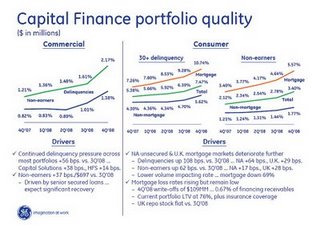

Calculated Risk hat das hier aus der Investor Presentation von General Electric herausgefischt:

The median price in Long Island’s Hamptons and the North Fork slid to $690,000 from $800,000 a year earlier, appraiser Miller Samuel Inc. and broker Prudential Douglas Elliman Real Estate said in a report today. The number of sales dropped 41 percent and the inventory of properties rose 19 percent.

was möglicherweise bedeutet, daß viel Zeug gar nicht mehr auf den Markt kommt, weil der Verkauf zu einem guten Preis eh' unmöglich ist.

Allerdings gehen die Preise der noch teureren Immobilien nach oben.

Many properties are also sitting on the market because sellers haven’t yet cut their price to reflect the economy’s decline, Miller said. On average, homes sold for 15.4 percent less than their asking price, compared with 8.1 percent a year ago.

“I have never seen sellers so disconnected from the market and my rough approximation is that they are about a year behind,” said Miller. “You had seven go-go years. That’s ingrained in the markets’ psyche.”

Der Pensionsfonds aus USA: Pensionsfonds verliert $61.4 Mrd. hat hier investiert:

The fund for the Stuyvesant Town and Peter Cooper Village apartments has declined to $127.7 million as of Jan. 15, from $400 million when it was established. Property cash flow is not expected to improve from 2008 based on the borrower’s restated budget for 2009, the ratings company said.

Die haben also noch 127 Mio, und das soll für 6 Monate reichen -> Cash Burn Rate: 20 Mio. pro Monat.

Was bringt den Laden um? Die Schulden. Naja, nicht ungewöhnlich in der Branche...

5.4 Mrd für einen Appartmentkomplex in Manhattan? Naja, sportlich.

Aber 5.4 Mrd für 11200 Einheiten bedeutet, daß der Preis pro Appartment bei 480000 EUR gelegen haben muß. Das macht die Sache durchaus mehr sportlich.

Noch sportlicher wird die Sache dadurch, daß die meisten Appartments Mietobergrenzen von 2000 Dollar pro Monat hatten.

Nehmen wir mal an, die 3 Mrd Schulden müßten zu 5% Zins finanziert werden, dann würde das alleine 150 Mio. im Jahr kosten - bei 11200 Einheiten a 2000 Dollar pro Monat kommen aber meiner Rechnung nach nur 67 Mio im Jahr herein...

Was haben die Käufer geraucht? Wollten die wirklich allen Ernstes für die 9600 gebundenen Appartments 57 Mio. einnehmen, und für die 1600 anderen 100 Mio im Jahr = 5200 im Monat pro Appartment?

Und das wären nur die 5% für die 3 Mrd. schwere Anleihe...

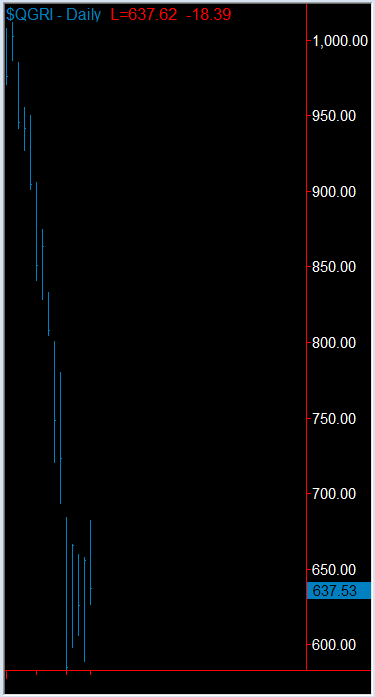

Diese wunderschön steile Graphik zeigt den NASDAQ TARP Index, der hier so beschrieben wird:

Eine naheliegende Deutung ist, daß die betroffenen "securities" seit Anfang Januar um 35% gefallen sind...

Bonuses fell to $18.4 billion from $32.9 billion in 2007, the largest decline ever and the biggest percentage drop in more than 30 years, Comptroller Thomas DiNapoli said. The size of the bonus pool is the sixth-largest on record, he said.

Wir wollen mal festhalten: Das Jahr war für die die Boni vergebenden Unternehmen so desaströs wie kein anderes, die Verluste astronomisch, die Vernichtung des Kapitals der Besitzer unerreicht - und die Angestellten erhalten Boni. WOW.

Auf der "positiven" Seite: Das Handelsdefizit sinkt...

‘Terrible Christmas’

Garment shipments tumbled 33% to $550 million, while footwear exports slumped 26% to $350 million.

“Lots of orders from the U.S. and Europe were canceled in November, and those would have gone out now,” said John Marron, managing director of Midas Clothing Ltd. in Ho Chi Minh City. “Buyers were expecting a terrible Christmas season, and wanted to see how much inventory and cash they would have afterward before placing any new orders.”

Aber, um beim positiven Grundtenor meiner Artikelserie zu bleiben: Alles wird gut.

http://www.vnbusinessnews.com/2009/01/grasp-opportunities-beat-recession.html

Viet Nam has the potential to grow despite the global recession if it can grasp its opportunities, Minister of Planning and Investment Vo Hong Phuc told Sai Gon Giai Phong.

It depends on the global economic recovery. The crisis is forecast to last rather long. The US can recover from the crisis no earlier than the fourth quarter of this year.

However, the impact (on Viet Nam) will be lower than on other countries since agriculture still plays a major role in Viet Nam.

Though the crisis is present worldwide, it has mostly affected developed countries. Vietnam is a developing country, so it will not be affected much and will keep growing at a moderate rate.

The Asian Development Bank (ADB) has forecast Vietnam’s growth rate will be 6.3% this year while the World Bank said 6.5%.

[...]

I think if Vietnamese enterprises understand how to make the most of their opportunities, they can overcome all difficulties.

Warum habe ich Zweifel daran? Vielleicht weil 6.5% Wachstum nur durch die Landwirtschaft doch ein wenig unrealistisch klingt, und weil die Exporte nicht wieder wachsen werden, bevor die Abnehmerländer sich erholen?

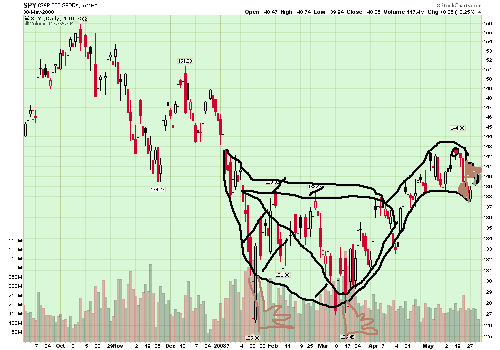

The very rare black swan formation - note both feet and neck are complete and the rare vampire tooth variation is in place.

This is very bad. Very very bad.

Gruß, Uwe

Wollen Sie den Digest abbestellen?