| Sendedatum | 2009-01-08 10:05:09 |

|---|---|

| Ausgabe | 76 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Links: Blog und Digest

Inhaltsverzeichnis:

- LyondellBasell ist pleite

- 2008 Country Returns

- Oil Traders Seek Another 10 Supertankers for Storage

- Intel Business Deteriorates Rapidly

- The China Not-Investing Corporation

- Chinesischer Computerriese Lenovo streicht Tausende Stellen

- China: Housing Market a Drag on into 2009 and Beyond

- China warns of risks from "abnormal" cross-border capital flow

- Hong Kong: Immobilienverkaufszahlen in 2008

- Kong Hong: Einzelhandelsumsätze im November 2008

- China\'s Silicon Valley faces tough time in financial crisis

- China: Unternehmensgewinne im freien Fall

- German bond sale’s fate signals trouble ahead

- Der deutsche Export bricht ein (Länderdomino)

- Indien: Satyam Computer Services

- Spanien: Automarkt im Dezember 2008

- Spanien: Edward Hughes erwartet Krise bis 2010/11...

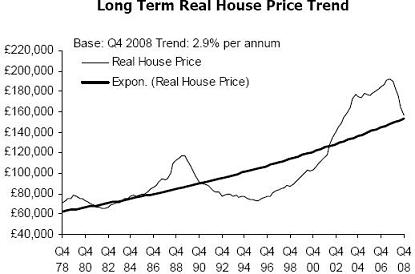

- UK house prices - nearly where they should be

- USA: Automarkt in 2008

- USA: Senkung der Kreditkartenlimits

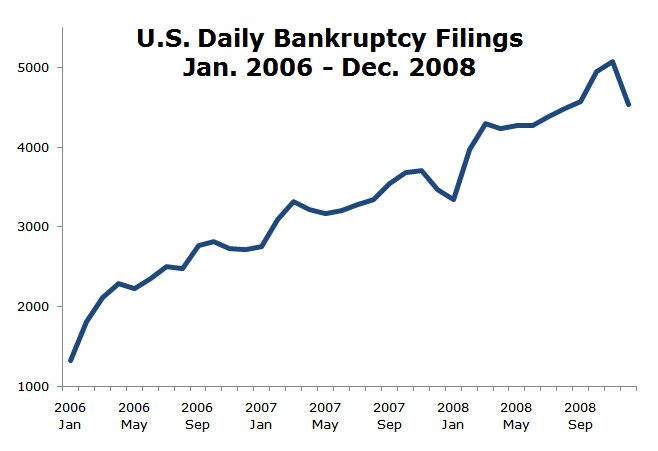

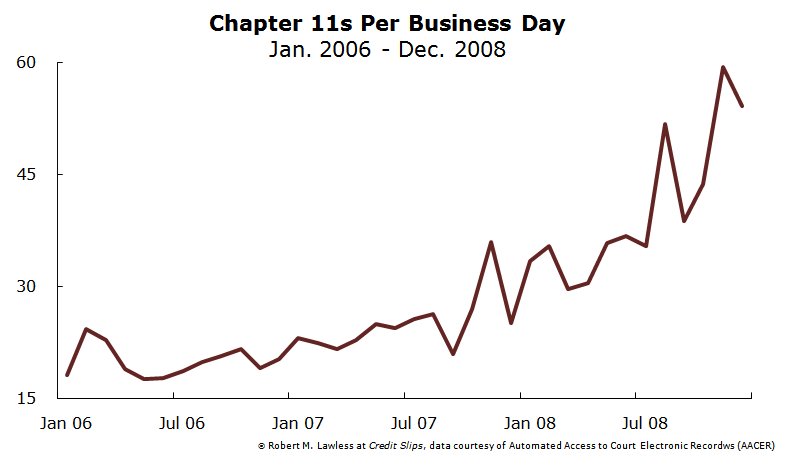

- USA: Bankrotte und Chapter 11, 2006 bis 2008.

- USA: State's jobless claims systems overwhelmed

- U.S. companies face $409 billion pension deficit: study

- Fed Fears Long Recession

Inhalt:

Betroffen sei neben den US-Konzernteilen auch die deutsche Holdinggesellschaft Basell Germany, teilte der weltweit drittgrößte Petrochemiekonzern am Dienstagabend mit. Insgesamt hätten sich rund 80 Tochtergesellschaften an dem Schritt beteiligt. Das Unternehmen leidet unter einer Schuldenlast von rund 26 Mrd. $. Am Sonntag war die Frist für eine Umschuldung abgelaufen.

Da hatte die Gerüchteküche recht - und schnell kam das Ende außerdem.

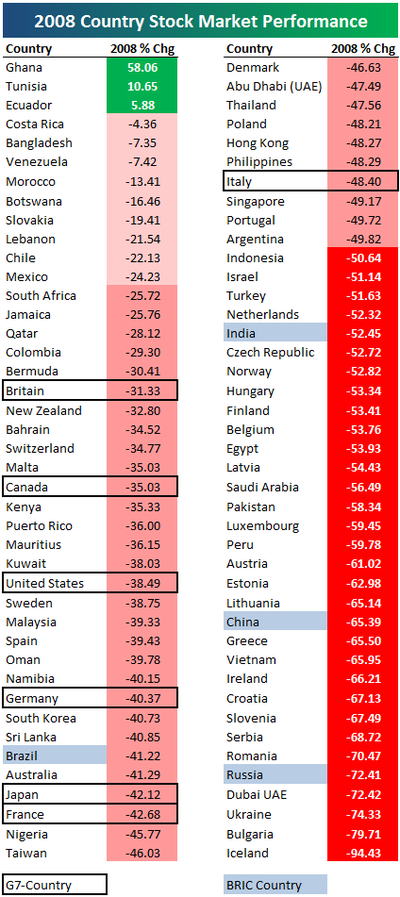

Man kann nicht sagen, daß in 2008 alle Aktienmärkte abgestürzt sind, aber... fast alle.

About 25 of the carriers, each able to hold about 2 million barrels of crude, were already hired for storage. There are enquiries for 5 to 10 more, Jens Martin Jensen, Singapore-based interim chief executive officer of the company’s management unit, said by phone today. Traders are storing crude to take advantage of higher prices for supply in the future.

Thirty-five supertankers represent about 7 percent of the global fleet of very large crude carriers, according to data from London-based Drewry Shipping Consultants Ltd. Storing oil in tankers may buoy rental rates that fell by a record 78 percent last year as slower economic growth sapped demand for energy.

Ist das nun eine Wette auf Contango oder die Bildung einer kriminellen Vereinigung zum Hochtreiben der Ölpreise?

Ansonsten habe ich eben noch einen Tankerindex bei Bloomberg "entdeckt":

http://www.bloomberg.com/apps/cbuilder?ticker1=TANKER%3AIND

On Oct 14th, Intel projected revenue for Q4 2008:

[margin=0 0 0 2]Revenue: Between $10.1 billion and $10.9 billion.[/margin]

Then Intel warned on November 12th and lowered their revenue projection to $8.7 billion to $9.3 billion:

[margin=0 0 0 2]Intel Corporation today announced that fourth-quarter business will be below the company's previous outlook. The company now expects fourth-quarter revenue to be $9 billion, plus or minus $300 million, lower than the previous expectation of between $10.1 billion and $10.9 billion. Revenue is being affected by significantly weaker than expected demand in all geographies and market segments. In addition, the PC supply chain is aggressively reducing component inventories.[/margin]

And now today Intel reported a significant miss: Intel Announces Preliminary Fourth-Quarter Financial Information

[margin=0 0 0 2]Intel Corporation today announced preliminary fourth-quarter financial information with revenue of approximately $8.2 billion, down 20 percent sequentially and down 23 percent year over year. Revenue will be lower than the company's previous expectation, provided on Nov. 12, 2008, as a result of further weakness in end demand and inventory reductions by its customers in the global PC supply chain.[/margin]

This is a pretty significant decline in revenues and suggests much lower business investment in equipment and software in Q4 2008.

23% weniger Einnahmen gegenüber dem Vorjahr. Das ist beeindruckend.

Ein wunderschöner Artikeltitel...

Welche feine Selbstironie

Dies entspricht elf Prozent aller Stellen im Konzern.Das Unternehmen teilte am Donnerstag mit, auf diese Weise sollten rund 300 Millionen Dollar eingespart werden.

Grund für den Sparkurs seien sinkende Verkaufszahlen weltweit – vor allem aber in der Volksrepublik. Lenovo ist der viertgrößte PC-Hersteller weltweit.

For those who have worked in the Beijing real estate industry over the past 10 years, 2008 has been the worst. Latest figures revealed by the Beijing Bureau of Statistics show that housing sales area between January and November totaled 7.389 million square meters, a drop of 52.4% over the same period of 2007.

A 50+% decrease in sales leaves much new housing vacant. By the end of December, 2008, the number of salable houses and apartments under construction in Beijing reached 188,031, while finished but unsold houses and apartments totaled 174,290, leaving over 360,000 units on the market. If they are sold at 120,000 a year, the rate in 2007, it will take at least 3 years to sell them all, and that’s if no more are built.

Peking: Der Vorrat an Häusern - ob fertiggestellt oder im Bau - reicht für 3 Jahre. In den USA ist's knapp ein Jahr - bei den derzeitigen Verkaufszahlen, nicht denen vom letzten Jahr.

Das scheint zwar der schlimmste Überhang in China zu sein, aber anderswo sieht's nur saumieserabel statt katastrophal aus:

Tja, was wird die Verkaufszahl in 2009 wohl sein?

Such capital movement, resulting from the world economic slowdown and financial crisis, will bring with it potential risks, said Hu Xiaolian, head of the State Administration of Foreign Exchange (SAFE).

China has cut interest rates and seen its economy slowing down since the global financial crisis hit the country's exporters. That could reduce its attraction to foreign investors and lead to capital outflows.

More money flowing out of the border could increase the risk of liquidity strain in the country, which is especially dangerous amid the global financial crisis.

Ausländisches spekulatives Geld - nach China geflossen wegen der Hoffnung auf langsame Aufwertung des Yuan - fließt ab. Und das kann Folgen für die Liquiditätsversorgung im Land haben (Übersetzung: Es führt zu mehr Unternehmensinsolvenzen).

Oder vielleicht auch nicht, wenn ich das mal frei als "wir werden euch daran hindern, euer Geld abzuziehen" interpretiere.

The Land Registry recorded 5,437 registration of flat sale and purchase agreements in December, up 43.6 percent from November but still down 65.1 percent from the same period in 2007.

Using a 12-month moving average, the figure for December, however, represented an 8.2 percent drop on November and a 22.2 percent dip on December 2007.

http://news.xinhuanet.com/english/2009-01/06/content_10614435.htm

The figure is down 22.2 percent on 2007 but up 14.3 percent on 2006.

The total consideration involved in these agreements was 413.11billion HK dollars (53.34 billion U.S. dollars), down 21.4 percent on 2007 but up 31.1 percent on 2006.

Verkaufszahlen -22.2% ggü. 2007 und +14.3% ggü. 2006.

Umsatz -21.4% ggü. 2007 und +31.1% ggü. 2006. Das müßte man noch um die Inflation bereinigen, dann wird die 2008er-Zahl noch etwas schlimmer.

There were 162,912 assignments of building units lodged for registration in 2008, up 2.9 percent on 2007 and 29.3 percent on 2006.

Baugenehmigungen oder Anträge auf selbige: _Zunehmend_. Oops. Ist das der Versuch, einen fallenden Markt durch mehr Überangebot zu stabilisieren?

http://news.xinhuanet.com/english/2009-01/02/content_10591181.htm

Umsatz: +1.1%.

http://news.xinhuanet.com/english/2009-01/02/content_10595196.htm

Inflationsbereinigt: -2.8%.

Wenn man unterstellt, daß Hong Kong etwas stabilere Verhältnisse als China hat, dann muß es in China noch deutlich schlimmer sein (und ich habe nicht einen Bericht gefunden, der dagegen gesprochen hätte) - und wie in aller Welt die dann in Q4/2008 um eine technische Rezession herumgekommen sein könnten, erschließt sich mir nicht.

Einzelberichte über den chinesischen EDV-Binnenmarkt:

-40% weniger Notebooks.

Oktober->November: -30% Umsatz.

November->Dezember: -15% Umsatz.

Zusammen: -40%.

Ich dachte, die Binnenkonjuktur sollte den Exportausfall ausgleichen und nicht verschlimmern?

Those companies' profits grew 19.4 percent year-on-year in the first eight months of last year and 36.7 percent in 2007, so the 4.9-percent growth rate indicated a freefall-style collapse, in line with the recent sharp declines in industrial output and export growth.

Die Gewinne der Unternehmen mit mindestens 5 Mio. Yuan Jahresumsatz:

2007: +36.7%

2008, Januar bis August: +19.4%

2008 insgesamt: +4.9%.

Das ist ein massiver Einbruch - rein rechnerisch müssen die letzten 4 Monate, auf ein Jahr hochgerechnet, bei -14% gelegen haben.

Daneben hat der Artikel noch einen Hinweis zur Binnennachfrage in China:

Heute war die erste Staatsanleihenausgabe der Eurozone in 2009, und was passierte?

It is the first eurozone bond auction of the year and an ominous sign of potential trouble ahead for governments around the world, with an estimated $3,000bn expected to be issued in sovereign debt this year – three times more than in 2008.

The auction of 10-year bonds failed to attract enough bids to reach the €6bn the government wanted to raise. Although a number of German bond auctions failed last year, it was almost unheard of before the credit crisis.

Versteigert wurden 6 Mrd, geboten wurden 5,237 Mrd, und zugeteilt 4,058 Mrd.

Das schließt sich nahtlos an die Versteigerung 10jähriger im November an (siehe Deutsche Staatsanleihen).

Das beantwortet, wenn auch spät, meine Frage aus Economists über Chinas Zahlen: "und der Exportweltmeister?", die ich mir gestellt hatte, als die chinesischen Exporte (in demselben November) und 2.4% eingebrochen waren.

Dem Statistischen Bundesamt zufolge wurden Waren im Wert von 67,4 Milliarden Euro eingeführt – 5,6 Prozent weniger als im Vormonat und 0,9 Prozent weniger als im Vorjahresmonat.

Tja, aber was tun, wenn der Rest der Welt unsere Waren nicht will?

btw: Diese Nachricht wird jeglichen Verstand in Regierung und Opposition ausschalten und für richtig Geldverschwendung sorgen. Und ich wette, alle Maßnahmen gehen am eigentlichen Problem "Binnennachfrage" vorbei.

Satyam Computer - Nummer vier unter den indischen Softwareherstellern - hat über Jahre die Bücher frisiert... und das nicht um ganz kleine Summen.

Vergangene Woche war der Konzern mit dem Plan gescheitert, zwei größere Firmen, die nicht aus dem IT-Sektor stammten, zu übernehmen. Raja räumte heute ein, dass diese Transaktion der letzte Versuch gewesen sei, die Bilanz mit fingierten Vermögenswerten aufzublähen. Im Gegenzug habe er aus fremden Quellen 12,3 Milliarden Rupien aufgetrieben und in das Unternehmen geschleust, um Satyam operativ am Laufen zu halten.

Das Verhältnis Rupie:Dollar ist etwa 50:1.

btw: Die 12.3 Mrd. könnte ein Übersetzungsfehler sein, das sind wahrscheinlich eher 1.23 Mrd.

Zurück zu Alphaville und einem Auszug aus dem Geständnis:

"Niemand außer mir hat irgendetwas gewußt"?

Naja, dann entläßt man die genannten eben nicht wegen Bilanzfälschung, sondern Unfähigkeit.

Satyam scheint sowieso ein unheimlich sauberes Unternehmen zu sein:

http://economictimes.indiatimes.com/Infotech/Software/Old_client_files_forgery_lawsuit_against_Satyam/articleshow/3041117.cms

haunt the billion-dollar technology services firm. The innovator firm, Upaid, has filed a lawsuit in a Texas court alleging that Satyam provided forged documents to Upaid in patents filing that eventually resulted in the company losing its patents infringement case against telecom giants Qualcomm and Verizon.

Fälschung von Dokumenten, die in Patentschriften eingingen.

http://economictimes.indiatimes.com/Infotech/World_Bank_bans_Satyam_for_8_years/articleshow/3882667.cms

World Bank on Tuesday confirmed an earlier report that it has barred Satyam Computer Services from doing business with it for eight years, starting September this year, due to data theft and paying bribes to its staff.

Datendiebstahl und Bestechung bei der Weltbank.

Aber auf der positiven Seite steht das zu Buche:

http://www.goldenpeacockawards.com/GPA_RESULTS_ANNOUNCEMENT_2008.pdf

[blockquite]GOLDEN PEACOCK GLOBAL AWARD FOR EXCELLENCE IN CORPORATE GOVERNANCE – 2008

4. Satyam Computer Services : Under Risk Management and Compliance Issues

Ja, so ein Unternehmen verdient auch einen Preis für Risikomanangement und Compliance.

Ich möchte auch die Buchprüfungsgesellschaft für einen Sonderpreis vorschlagen (nein, ich weiß nicht, wer das ist - aber egal wer's war: schließen).

Dezember: halbiert gegenüber dem Vorjahr (anderswo habe ich -49.9% gelesen).

2008 insgesamt: -28.1%.

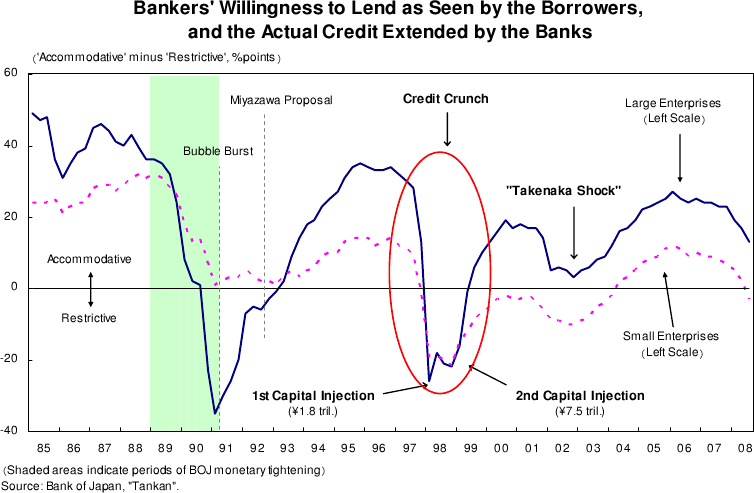

Ich frage mich allerdings, wie der spanische Staat das hinbekommen will - vor dem verlorenen Jahrzehnt und soundsovielen Rettungsaktionen war der japanische Staat finanziell gesund, und die Verbraucher waren es sowieso.

Spanien hat da ganz andere Voraussetzungen.

http://fistfulofeuros.net/afoe/economics-and-demography/why-spains-economic-crisis-is-something-more-than-a-housing-slump/

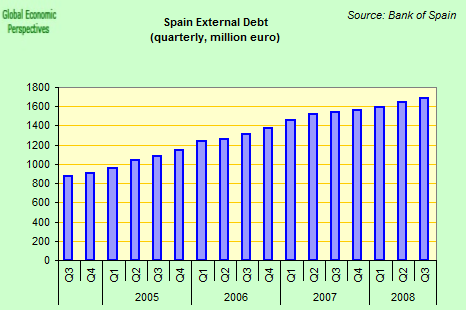

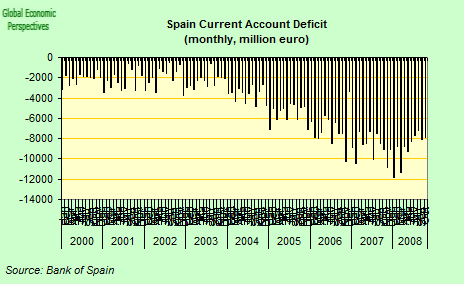

Edward Hughes schreibt über Spanien... und wieder nichts, was eine tolle Zukunft verheißt.

Außenhandelsdefizit: um die 8%.

Die Importe fallen, daher fällt es mit, aber die Zinszahlungen überschreiten die Einnahmen aus Anlagen, und das Verhältnis wird schlimmer.

Der Grund dafür? Auslandsschulden - gestiegen von 870 Mrd. Euro (Q3 2004, = 90% des BSP) auf 1686 Mrd. Euro (Q3 2008, = 155% des BSP).

FT Alphaville hat diese schöne Graphik:

und schließt daraus

daß die Hauspreise fast den halben Sturz hinter sich haben.

Ich möchte das um eine Kleinigkeit ergänzen: Demnächst fällt auch die Trendlinie wieder - der Sturz wird noch ein kleines bischen länger dauern.

Und er ist jetzt schon nicht ohne...

Year-over-year change in monthly sales

Category Nov 2008 Dec 2008

domestic cars -39.9% -33.9%

domestic trucks -36.9% -38.8%

imported cars -29.5% -31.9%

imported trucks -35.8% -31.4%

all vehicles -36.7% -35.6%

Das heißt, Importeure schneiden immer noch besser, wenn auch fürchterlich schlecht ab.

[...]

By contrast, the current problems for the auto sector resulted from the broad collapse in overall consumer spending. With the aggregate picture as bleak as it is, consumers seem reluctant to buy any kind of car, regardless of the price of gasoline.

Früh in 2008 war das Problem der US-Hersteller der Spritpreis - daher sind die Verkäufe von SUV eingebrochen während gleichzeitig die Importe von Kleinwagen stiegen. Das derzeitige Problem ist, daß Käufer grundsätzlich zögern, Geld auszugeben.

Das und die Graphiken im Artikel bestätigen meine Vermutungen.

A spokeswoman for J.P. Morgan Chase & Co. said "we will lower credit lines for customers who are showing signs of increased risk or inactivity."

Seufz. Mit anderen Worten: immer einen Cent Schulden auf der Kreditkarte lassen, wenn man sie denn behalten will.

Aber die Sache hat noch ganz andere Nebenwirkungen:

Wenn so eine Kreditkartenfirma das Limit auf der Karte senkt, kann das zu einer Verschlechterung der Risikobewertung führen (und, so stelle ich mir vor, in der nächsten Runde dann zu einer weiteren Senkung des Limits

This can also have a negative impact on your credit score by increasing the ratio of outstanding debt to available credit. A loss of a long-standing credit card may also shorten your credit history.

Ist dieses System marode...

http://www.creditslips.org/creditslips/2009/01/bankruptcy-filings-rise-32-in-2008.html

Zunahme in 2008: 32%.

http://www.creditslips.org/creditslips/2009/01/chapter-11s-rise-62-in-2008.html

Zunahme in 2008: 61.5%.

The Ohio Department of Job and Family Services says callers have been unable to get through this week.

Spokesman Brian Harter said Tuesday the section of the state's web site that enables people to make claims online is down.

Harter said the telephone hot line generally receives about 7,500 calls a day, but has been getting about 80,000 each of the past two days.

Die Telefonleitungen und die Webseiten des "Department of Job and Family Services" in Ohio sind hoffnungslos überlastet - und das wohl weniger, weil Unternehmen gerade massiv einstellen...

Auf der anderen Seite stellt das Arbeitsamt jetzt - temporär (vielleicht) - Leute ein.

Eine weitere Bestätigung:

http://abcnews.go.com/US/wireStory?id=6586680

Ähnlich ist es in North Carolina:

http://www.huffingtonpost.com/2009/01/06/north-carolina-jobless-cl_n_155786.html

Once the system was back up, the state set one-day records both for the amount of unemployment benefits paid and for the number of transactions, officials said Tuesday.

The number of people trying to sign up online for new or continuing benefits was as much as triple pre-recession levels Sunday and Monday, the Employment Security Commission said. That volume, together with a phone line problem, overwhelmed the agency's computers and prevented some people from filing claims.

Rekorde der negativen Sorte.

The phone line problem was fixed Sunday, when 74,000 people tried to access the system, and the ESC thought the overload problem had been handled as well. But the system failed again Monday when about 55,000 people tried to file.

Hm.

Also eigentlich schreit das ja geradezu danach, sehr viel Geld auf die EDV zu werfen.

As of December 31, pension plans among members of the Standard & Poor's 1500 had $1.21 trillion of assets and $1.62 trillion of liabilities, Mercer said in a report released on Wednesday. At the end of 2007, pension plan assets totaled $1.66 trillion and liabilities totaled about $1.6 trillion, Mercer said.

Mercer estimated pension expenses will increase to about $70 billion this year from $10 billion in 2008, reducing overall profitability by about 8 percent.

2007: Pensionsverpflichtungen: 1600 Mrd., Anlagewert: 1660 Mrd.

2008: Pensionsverpflichtungen: 1620 Mrd., Anlagewert: 1210 Mrd.

-28%...

Kerninflation sinkt deutlich in 2009 und wird 2010 weiter fallen => Deflation.

"disinflationary effects ..." => Deflation.

Bruttosozialprodukt wird in ganz 2009 fallen, und in 2010 wieder steigen.

Mich dünkt, da ist ein Anflug von Realismus zu bemerken.

Wollen Sie den Digest abbestellen?