| Sendedatum | 2009-01-06 10:24:40 |

|---|---|

| Ausgabe | 75 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Beginnen will ich mit einem Rückblick auf das Jahr 2008:

Inhaltsverzeichnis:

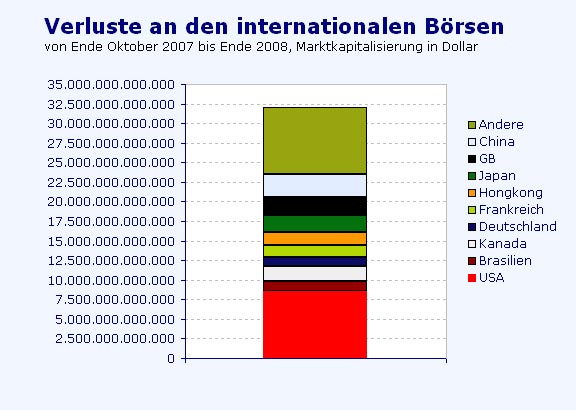

- Verluste an den internationalen Börsen - 2007-10 bis 2008-12

- The Aftermath of Financial Crises

- December’s JPMorgan Global PMI Shows Just How Far The Infection Has Spread

- Credit crunch hits Second Life

- Mutual funds suffer $320bn outflow

- Kunstmarkt 2009

- Global Semiconductor Sales Decline 9.8% in November

- Coral growth in decline at Great Barrier Reef

- Canada's forests, once huge help on greenhouse gases, now contribute to climate change

- Climate scientists: it's time for 'Plan B'

- Chinas Exporte in Yuan gerechnet.

- Dubai: IPO für Nakheel?

- Hong Kong air pollution worst since records began: official data

- Indien: Exports decline close to 10 pc in November 2008

- Indien: Tata Motors December Sales Decline on Credit Squeeze

- India inks largest-ever defence deal with US

- The Irish Economy’s Rise Was Steep, and the Fall Was Fast

- Italian Pensions Sapped by Private Funds Bush Backed

- Japan auto sales plunge as young lose interest

- Mexikos Ölförderung, Addendum

- Mexican Peso Slides as Money Transfers From Workers Abroad Fall

- Nepal: Stromversorgung, Update

- Energiekrise in Pakistan

- Singapore Home Prices Post Steepest Drop in Decade

- Singapore's GDP slumps 12.5 percent

- South Korean exports drop 17.4%

- Letter from the Devil to Paulson

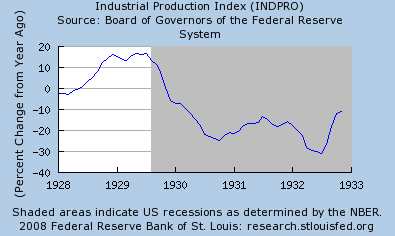

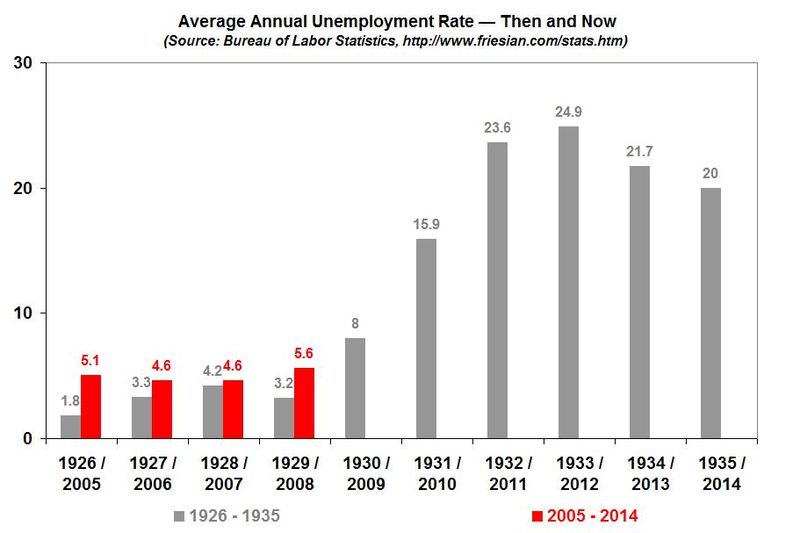

- USA: Arbeitslosigkeit 1926-1935 <->2005.. verglichen

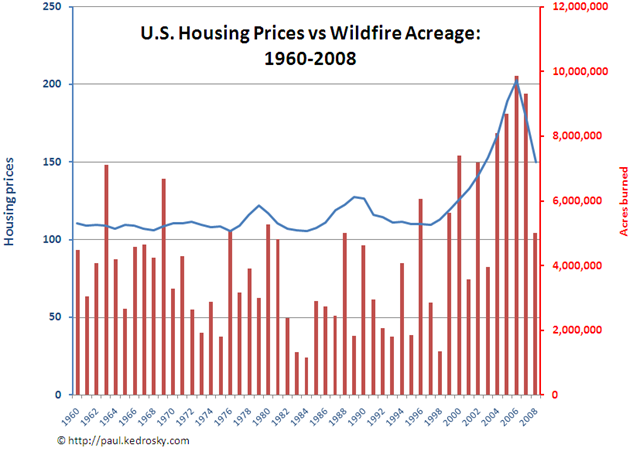

- USA: Housing Prices vs. Wildfire Acreage

- Auto dealers offer cash back, low rates, 2-for-1 sales

- USA: Onlineverkäufe während des Weihnachtsgeschäfts

- UK: Aussichten für den Einzelhandel 2009

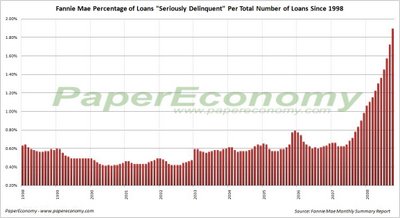

- USA: Zahlungsversäumnisse bei Fannie Mae

- USA: Der Ölschiefer in den Rocky Mountains

- USA: Staatliche Pensionsfonds

- U.S. governors seek $1 trillion federal assistance

- USA: Yale’s Swensen Sees ‘Extraordinary’ Opportunity to Snap Up Debt

- USA: The Disappearing Money Multiplier

- USA: Autoverkäufe im Dezember 2008

Inhalt:

Wenn ich das richtig lese, sind alleine in China mehr als 2500 Mrd. aufgelaufen.

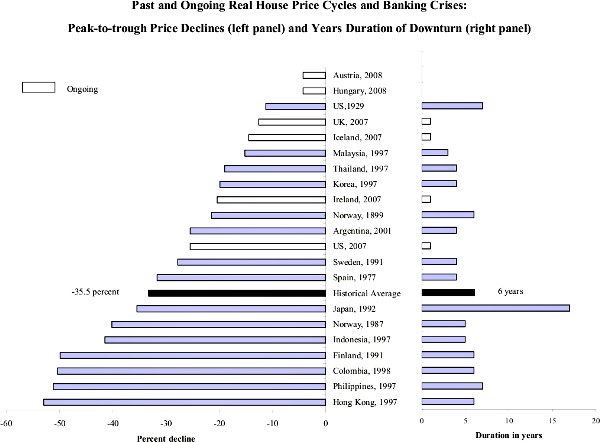

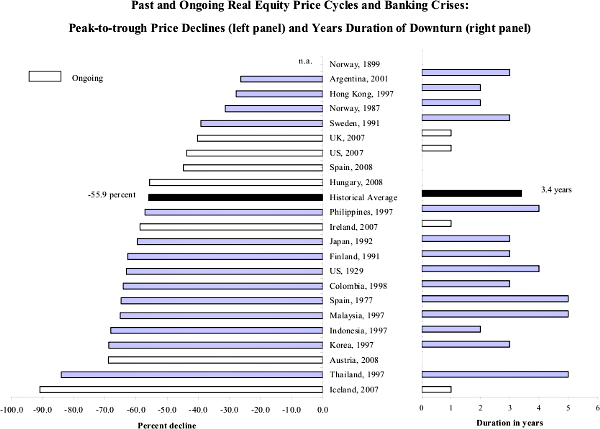

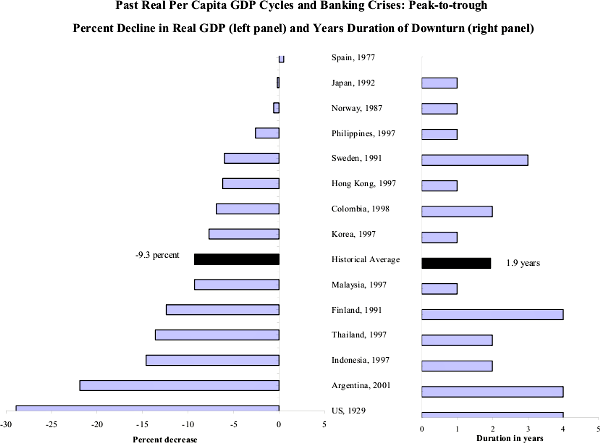

Carmen M. Reinhart und Kenneth S. Rogoff über Auswirkungen und Dauer von Finanzkrisen (zwecks Lesbarkeit umgebrochen):

First, asset market collapses are deep and prolonged. Real housing price declines average 35 percent stretched out over six years, while equity price collapses average 55 percent over a downturn of about three and a half years.

Im Gefolge von Finanzkrisen sinken Hauspreise durchschnittliche 35% über 6 Jahre, und Aktien 55% über 3.5 Jahre.

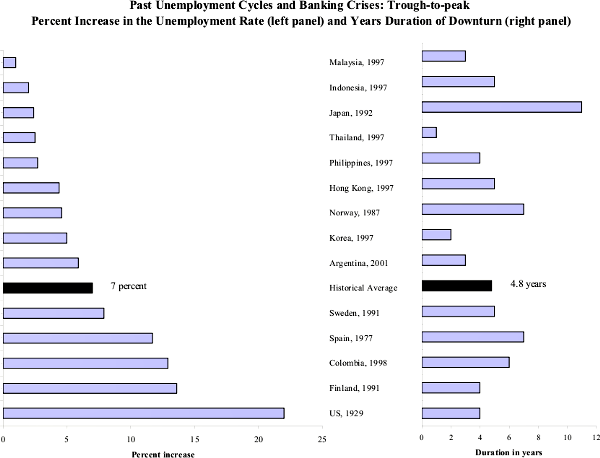

associated with profound declines in output and employment. The unemployment rate

rises an average of 7 percentage points over the down phase of the cycle, which lasts on

average over four years. Output falls (from peak to trough) an average of over 9 percent,

although the duration of the downturn, averaging roughly two years, is considerably

shorter than for unemployment.

Die Arbeitslosigkeit steigt im Durchschnitt um 7% (nicht auf, sondern um) in der Abschwungphase des Zyklas, der durchschnittliche 4 Jahre dauert. "Output" (BSP?) fällt durchschnittlich um 9% - für rund 2 Jahre.

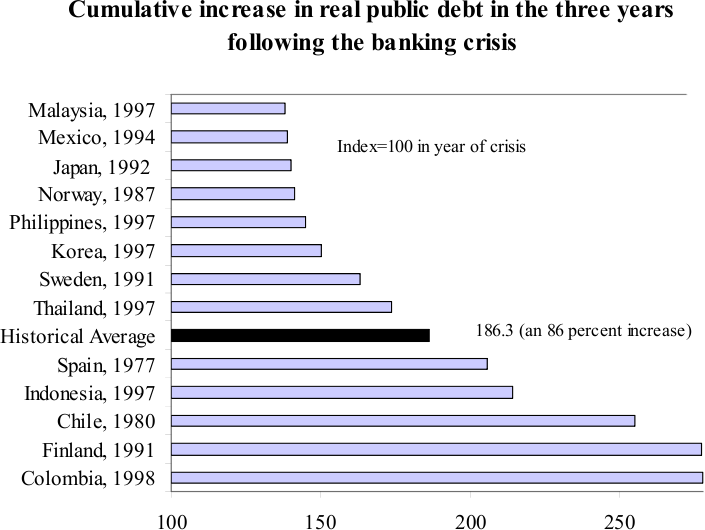

Third, the real value of government debt tends to

explode, rising an average of 86 percent in the major post–World War II episodes.

Interestingly, the main cause of debt explosions is not the widely cited costs of bailing

out and recapitalizing the banking system. Admittedly, bailout costs are difficult to

measure, and there is considerable divergence among estimates from competing studies.

But even upper-bound estimates pale next to actual measured rises in public debt. In

fact, the big drivers of debt increases are the inevitable collapse in tax revenues that

governments suffer in the wake of deep and prolonged output contractions, as well as

often ambitious countercyclical fiscal policies aimed at mitigating the downturn.

Die Regierungsschulden steigen um Schnitt um 86% - und zwar weniger wegen der Bankenbailouts, sondern wegen ausbleibender Steuern und den Kosten von Konjunkturprogrammen.

Diese Graphik zeigt die durchschnittliche Tiefe des Verfalls der Hauspreise und die Dauer.

six years. Even excluding the extraordinary experience of Japan (with its 17 consecutive

years of price declines), the average remains over five years.

Die zweite Graphik zeigt den Aktienpreisverfall:

Die dritte Graphik zeigt die Auswirkungen auf den Arbeitsmarkt:

Im Prinzip sagt diese Graphik: Je schwächer das soziale Netz, desto geringer die Arbeitslosigkeit nach Finanzkrisen.

Die vierte Graphik zeigt die Wirkung auf das Bruttosozialprodukt:

Und dann noch die Staatsschulden:

Ob diejenigen, die an einen schnellen Aufschwung glauben, recht behalten?

Ob der Markt das alles schon eingepreist hat?

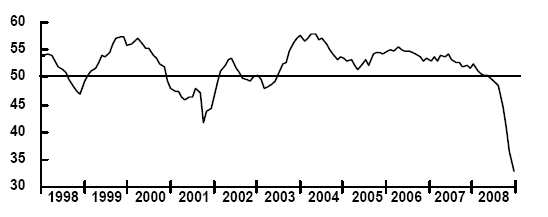

Edward Hughes weiß den Tag wirklich zu verschönern:

Die Situation wird immer noch schlechter... es ist nicht ausgeschlossen, daß wir eine 20%-Rate für den Global PMI im ersten Quartal erreichen werden.

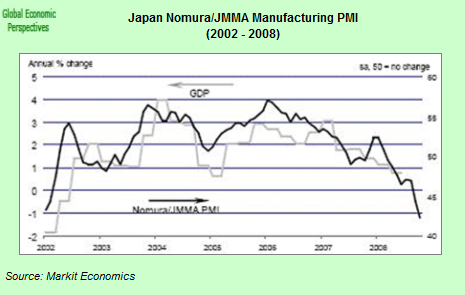

Wie gut der PMI das BSP/GDP vorhersagen kann, zeigt dies:

Auch das JPMorgan-PDF zeigt das deutlich.

http://www.ism.ws/files/ISMReport/JPMorgan/JPMorganMfg010209.pdf

Employment fell for the fifth successive month in December, and to the greatest extent in survey history. All of the national manufacturing sectors recorded a drop in staffing levels, most at series-record rates including all of the Eurozone nations, China and the UK. The sharpest falls in employment were signalled for Denmark, Spain, the US, Russia and the UK.

Das Gesamtbild ist auch nicht schön:

Global Manufacturing PMI Summary

50 = no change on previous month.

Nov Dec Summary

Global PMI 36.5 33.2 Index at series-record low

Output 33.1 28.8 Index at series-record low

New Orders 29.8 25.3 Index at series-record low

Input Prices 36.2 31.3 Index at series-record low

Employment 39.6 36.7 Index at series-record low

The average price of cyber land has dropped from 12.06 Linden dollars (seven cents) a square metre at its peak in January 2007 to 1.98 Linden dollars (1 cent) last month. While The Sun-Herald obtained price comparisons from net archives, Linden Lab chief Mark Kingdon boasted last week of a record currency trade, saying, "There's no credit crunch in Second Life."

[...]

Premium Second Life accounts, where members pay for extra services, were down globally 16 per cent, from a peak of 94,607 in June 2007 to 79,721 last month.

[...]

But the Second Life headquarters of 20 international brands were reduced to "ghost towns" this year, says PhD student Kim MacKenzie.

Nicht daß ich Second Life je verstanden hätte, aber interessant ist das allemale.

The move out of what were previously regarded as safe and stable investments followed a record year of investor inflows in 2007.

Investmentfonds in Jahre 2008: $320 Mrd Kapitalabflüsse.

Im Dezember allerdings scheint sich der Geldfluß umgedreht zu haben.

The data include both retail and institutional investors. The total outflow of $320bn does not include money market funds.

Aktienfonds: -$233 Mrd, Anleihenfonds: -$58.2 Mrd, Gemischte: -$28 Mrd.

Geldmarktfonds sind nicht enthalten - in die floß das Geld nämlich:

Madoff wird Konsequenzen im Kunstmarkt haben.

Dabei ist es ja nicht so, als wäre der Kunstmarkt momentan besonders gesund...

Die 40% könnten glatt noch überboten werden. Ich weiß ja nicht, wie gut die finanzielle Aussstattung der Kunstgalerien ist, aber wenn es nicht so ist, daß die alle super gesund sind, werden irgendwann die ersten in Schwierigkeiten gerade und für Schleuderpreise verkaufen müssen.

15%? Lächerlich.

Total sales fell to $20.8 billion from $23.1 billion a year earlier, the Semiconductor Industry Association said in a Business Wire statement today. In the first 11 months of 2008, sales rose 0.2 percent to $232.7 billion from a year earlier. In October global chip sales declined 2.4 percent.

Weltweite Halbleiterproduktion:

Oktober -2.4%

November -9.8%

Researchers with the Australian Institute of Marine Science looked at the skeletal records of porites corals collected over the years at 69 reefs along the 1,600-mile-long Great Barrier Reef. Those corals, some 400 years old, showed that calcification declined by 13 percent between 1990 and 2005.

Vielleicht sollte ich doch mal etwas stärker zum Klimawandel beitragen und da Urlaub machen...

Aus dem Artikel, von Jurgen Freund / Freund Factory

That, they wrote, left "two most likely" factors, both tied to carbon dioxide emissions: warming sea temperatures and more acidic oceans as CO2 raises the pH levels of the seas.

Uwe Ohse, 2009-01-04

Das ist eine wichtige Grenze überschritten worden: Kanadas Wälder, die bisher große Mengen Kohlendioxid aufgenommen haben, beginnen nun netto CO2 abzugeben.

But not anymore.

In an alarming yet little-noticed series of recent studies, scientists have concluded that Canada's precious forests, stressed from damage caused by global warming, insect infestations and persistent fires, have crossed an ominous line and are now pumping out more climate-changing carbon dioxide than they are sequestering.

Das ist, natürlich, eine große Überraschung: Die Gesundheit der kanadischen Wälder nimmt ab. Das ist ja völlig unvorstellbar, denn Wälder sind ja unverletzlich und absolut unempfindlich gegen Klimawandel - so wie sie es auch für den sauren Regen waren.

[/sarkasmus]

"We are seeing a significant distortion of the natural trend," said Werner Kurz, senior research scientist at the Canadian Forest Service and the leading expert on carbon cycles in the nation's forests. "Since 1999, and especially in the last five years, the forests have shifted from being a carbon sink to a carbon source."

Ich frage mich allerdings, wieso es 10 Jahre dauert, bis die Erkenntnis kommt. Oder vielleicht auch nicht: Bush und Cheney: möget ihr nie vergessen werden.

Higher temperatures also are accelerating the spread of a deadly pest known as the mountain pine beetle, which has devastated pine forests across British Columbia and is threatening vital timber in the neighboring province of Alberta. More than 50,000 square miles of British Columbia's pine forest have been stricken so far with the telltale markers of death: needles that turn bright red before falling off the tree.

Bitter cold Canadian winters used to kill off much of the pine beetle population each year, naturally keeping it in check. But the milder winters of recent years have allowed the insect to proliferate.

Höhere Temperaturen => mehr Waldbrände.

Mildere Winter => mehr schädliche Insekten. Und 4.x% der kanadischen Wälder sind deshalb praktisch tot.

"Plan B"? Wo war "Plan A"? Nein, Kyoto zählt nicht.

Geoengineering - bewußte Manipulation des Weltklimas. Der Zauberlehrling läßt grüßen.

Volcanic eruptions release huge amounts of sulphate particles into the upper atmosphere, where they reflect sunlight. After Mount Pinatubo erupted in 1991, sulphates reflected enough sunlight to cool the Earth by 0.5C for a year or two. The Nobel Laureate Paul Crutzen suggested in 2006 that it may be possible to inject artificial sulphate particles into the upper atmosphere – the stratosphere. However, the idea does not address ocean acidification caused by rising CO2 levels. There may be side-effects such as acid rain and adverse effects on agriculture.

Das ist Plan S - S wie Sinnlos. Saurer Regen => zusätzliche Waldschäden => mehr CO2-Freisetzung. Und Auswirkungen auf die Nahrungskette sind auch da. Und wenn zufällig dann, wenn der Schwefel in der Atmosphäre gelandet ist, gerade ein Vulkan explodiert, könnte sich das als ein paar Grade zuviel erweisen.

Another variation on the theme of increasing the Earth's albedo, or reflectivity to sunlight, is to pump water vapour into the air to stimulate cloud formation over the sea. John Latham of the United States National Centre for Atmospheric Research in Boulder, Colorado is working with Stephen Salter of Edinburgh University and Mike Smith at Leeds to atomise seawater to produce tiny droplets to form low-level maritime clouds that cover part of the oceanic surface. The only raw material is seawater and the process can be quickly turned off. The cloud cover would only affect the oceans, but still lower global temperatures.

Energieintensiv ohne Ende.

This idea arises from the fact that the limiting factor in the multiplication of phytoplankton – tiny marine plants – is the lack of iron salts in the sea. When scientists add iron to "dead" areas of the sea, the result is a phytoplankton bloom which absorbs CO2. The hope is that carbon taken up by the microscopic plants will sink to deep layers of the ocean, and be taken out of circulation. Experiments support the idea, but blooms may be eaten by animals so carbon returns to the atmosphere as CO2.

Nette Idee, dürfte aber massive Nebenwirkungen haben. Das führt zur Erwärmung der obersten paar Meter Wasser, und Abkühlung der Schicht darunter, und eventuell Strömungsänderungen; und außerdem ist das ein massiver Eingriff in die Nahrungskette - den man wegen der Strömungsänderungen auch nicht lokal begrenzt halten kann.

The Earth scientist James Lovelock, working with Chris Rapley of the Science Museum in London, devised a plan to put giant tubes into the seas to take surface water rich in dissolved CO2 to lower depths where it will not surface. The idea is to take CO2 out of the short-term carbon cycle, cutting the gas in the atmosphere. Critics say it may bring carbon locked away in the deep ocean to the surface.

Urks. Noch weniger kalkulierbar. Mal abgesehen davon: Das ändert nicht an der Notwendigkeit einer anderen langfristigen Lösung.

Some scientists suggest it would be possible to deflect sunlight with a giant mirror or a fleet of small mirrors between the Earth and the Sun. The scheme would be costly and prompt debate over who controls it. Many scientists see it as contrary to the idea of working with the Earth's systems.

Ja, klar, wir können mit Müh' und Not eine einzelne kleine Raumstation knapp über der Erde aufrecht erhalten, und wollen gigantische Spiegel tief im Weltraum unterbringen.

Nein, ich habe überhaupt keinen Zweifel daran, daß solche Spiegel möglich sind - aber bei der Geschwindigkeit, mit der sich unsere Weltraumtechnik in den letzten 30 Jahren weiterentwickelt hat, sind wir im Jahr 3000 so weit. Ja, ich bin, was die Weltraumfahrt betrifft, romantischer Optimist.

Convert the export figures into China's own currency, a much better measure of the effect on the Chinese economy, and exports plunged 9.6 percent in November. Factor in inflation over the past year and the plunge was 11.4 percent.

Chinas Exporte sind im November um 2.2% (oder 2.4%) gefallen - auf Dollarbasis. In Yuan gerechnet sind es 9.6% (incl. Inflation 11.4%).

Ein anderes Thema:

Geschätzt wird, daß 10000 von den 60000 chinesischen Fabriken mit Besitzern in Hong Kong geschlossen worden sind oder in den nächsten Monaten geschlossen werden. Die Quote könnte unter den in chinesischem Besitz befindlichen Fabriken noch höher sein, weil die kleiner sind und weniger Kapital haben.

Das wird sicherlich ein interessanter Börsengang...

http://www.bloomberg.com/apps/news?pid=20601104&sid=a5E8z8jkX_WE&refer=mideast

Regional IPO offerings were $22.4 million in the October- November period compared with $6 billion raised from 10 IPOs during the same time a year earlier, Ernst & Young LLP said in an e-mail received today.

“The drop in activity in the last two months is the result of current investor sentiment and the effect of the global financial crisis on regional markets,” Phil Gandier, a Transaction Advisory Services partner at Ernst & Young, said in the statement. “Issuers are not willing to accept current market valuations and therefore scheduled IPOs coming to the markets are being delayed.”

Börsengänge sind im mittleren Osten im Oktober und November ganz besonders beliebt gewesen, mit einem Marktvolumen von $22.4 Mio. gegenüber $6000 Mio. ein Jahr vorher...

Ich möchte bei der Gelegenheit auf Länderdomino: Dubai verweisen: Nakheel-Gläubiger, die ihre Anleihen gegen Ausfall absichern wollten, mussten dafür zuletzt bis zu 20 Prozent der Kreditsumme hinblättern..

Wenn die 15 Mrd. an der Börse für Nakheel einsammeln können, sind ist JPMorgan entweder reichlich gut oder der Dollar um einen Faktor von 10 (ungefähr) entwertet worden.

[...]

The number of hours for which street-level pollution exceeded the danger level in some of the city's busiest districts rose by 14 per cent in 2008, according to Environmental Protection Department figures.

The department said air pollution levels in the three main shopping and business districts were dangerous for more than 2,000 hours last year -- the highest figure since it began taking roadside recordings in 2000.

Hong Kong 2008: 83 Tage mit Luftverschmutzung im gefährlichen Bereich.

Warum?

Wegen des Verkehrs und:

die ja bekanntlich im letzten Jahr wie die Fliegen gestorben sind. Irgendetwas ist da nicht so, wie es sein sollte.

btw: Ich finde es bezeichnend, daß die sich mehr um ihre Position als Finanzcenter als um die Gesundheit ihrer Menschen sorgen machen.

Export contracts by 12.1 per cent in October, showing a negative trend for the first time in the last five years. For the April-November period, the country's cumulative exports grew by 19.4 per cent to USD 119.30 billion.

Growth for the first half of the fiscal was 30.9 per cent. Imports between April and November went up by 33 per cent to USD 203.64 billion.

November: -9.9% gegenüber Vorjahr. Import: +6.1%. Außenhandelsdefizit: $10 Mrd (1 Monat).

Oktober: -12.1% gegenüber Vorjahr.

April bis November: Export $119 Mrd, Import $203 Mrd. Defizit: $74 Mrd.

Das könnte eine harte Landung werden.

Commercial and passenger vehicle sales in India and overseas reached 25,219 units last month, compared with 47,678 units a year earlier, Mumbai-based Tata Motors said in an e-mailed statement today. Commercial vehicle sales in India fell 51 percent to 14,056 units, it said.

Das ist ein gewaltiger Absturz: -47% verglichen mit dem Vorjahresmonat.

Tata baut SUVs? Naja, immerhin kann man mit den Zahlen etwas anfangen:

2007-11 2008-11

286xx => 14056 Commercial Vehicles = Transporter und so

19xxx => 11163 Autos und SUVs

142xx => 9838 Autos im Inland verkauft

47xx => 1325 Autos exportiert.

Das ist insgesamt nicht viel.

Die Börse steigt eben auch bei katastrophalen Nachrichten. Realitätsverleugnung pur.

Indien hat soeben 8 Seefernaufklärungsflugzeuge zum Gesamtpreis von $2.1 Mrd. bestellt.

Fernaufklärer - nicht etwa Kampfflugzeuge, nein.

Torpedos, Wasserbomben, Antischiffsraketen - die typische Ausrüstung eines Aufklärungsflugzeuges. Newspeak in Aktion.

Aber was sind schon 2.1 Mrd? Nur das kaufkraftbereinigte Jahreseinkommen von 650000 Indern... ohne Kaufkraftbereinigung wären es 2600000.

10% der italienischen Arbeitnehmer sind 2007 aus dem traditionellen staatlichen Rentensystem (7% Rendite) ausgetreten und in ein renditeträchtigeres privates Alternativsystem herein. Das war eines der großen Projekte der Regierung Prodi, mit dem das Rentensystem deutlich modernisiert werden sollte.

Damals wurde massiv Werbung für das neue System gemacht, und ich erinnere mich noch genau daran, daß die Quote von 10% eine ziemliche Enttäuschung war.

Nun stellt sich heraus, daß diese 10% die Verlierer sind:

Und schon -2.4% wäre weit unter dem, was die Leute erwartet haben:

Das könnte eine langfristig sehr signifikante Änderung sein:

That kind of thinking — which automakers here have dubbed "kuruma banare," or "demotorization" — is a U-turn from earlier generations of Japanese who viewed car ownership as a status symbol. The trend is worrying Japan's auto executives, who fear the nation's love affair with the auto may be coming to an end.

Jüngere Leute in Japan sehen das Auto nicht mehr als Statussymbol, unter anderem wegen Spritkosten, Parkkosten und Verkehrsproblemen.

Makino, the young man who plays what he calls "organic folk music," is typical of the new breed who scoffs at the sportscar-idolizing culture of the older generation.

He and his friends see cars as nothing more than a tool, much like a vacuum cleaner, not a reflection of their identity, tastes or income level. Makino's father own a car, but he has never owned one. And he doesn't know a Honda Fit from a Toyota Vitz.

Das ist schon eine gewisse Verschiebung der tektonischen Platten, auf denen die japanischen Autohersteller gebaut haben.

Motoharu Ishii has turned his Honda dealership into a special shop for dog-owners. Bigger dogs can't travel in Japanese trains, and so pet owners may be among the last holdouts in car ownership.

He helps them fit their vehicles with cages, offers discount coupons at dog runs, and has a fuzzy mat ready for visiting pets — in the same way some dealers prepare play areas for children.

Ein Autohändler, die sich auf Hundebesitzer spezialisiert hat, weil große Hunde nicht in den japanischen Zügen mitfahren können.

http://www.ri.pemex.com/files/dcpe/petro/evolexporta_ing.pdf sagt:

2003 1,844

2004 1,870

2005 1,817

2006 1,793

2007 1,686

2008 1,410

January 1,434

February 1,429

March 1,628

April 1,439

May 1,376

June 1,415

July 1,377

August 1,416

September 1,060

October 1,434

November 1,501

Man könnte auch sagen, der Export ist von 2005 auf jetzt um 300000 Barrel pro Tag zurückgegangen, und 2008 alleine in den ersten 11 Monaten um 17% geschrumpft gegenüber dem Vorjahreszeitraum.

http://www.ri.pemex.com/files/dcpe/petro/crudeoil.pdf

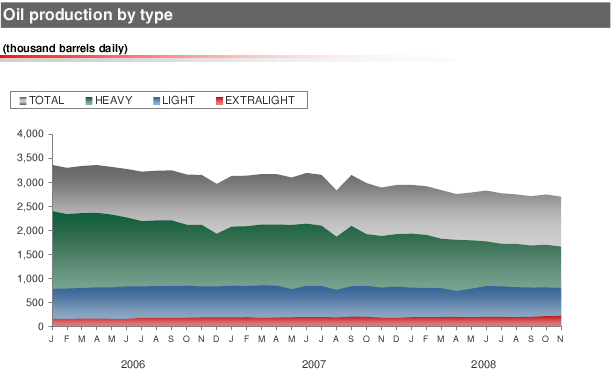

Die Ölproduktion ist von Anfang 2006 bis November 2008 um rund 600000 Barrel pro Tag gefallen:

Das sind etwas weniger als 20%.

Nun ist der einheimische Ölbedarf nicht gefallen, sondern eher noch leicht gestiegen (Quelle), daher muß eine der beiden Zahlen einfach falsch sein oder irgendein Faktor nicht eingeflossen sein. Aber egal was es ist: stark rückläufig sind Export und Produktion allemale.

http://www.pemex.com/index.cfm?action=statusfilecontent&contentfileid=22041

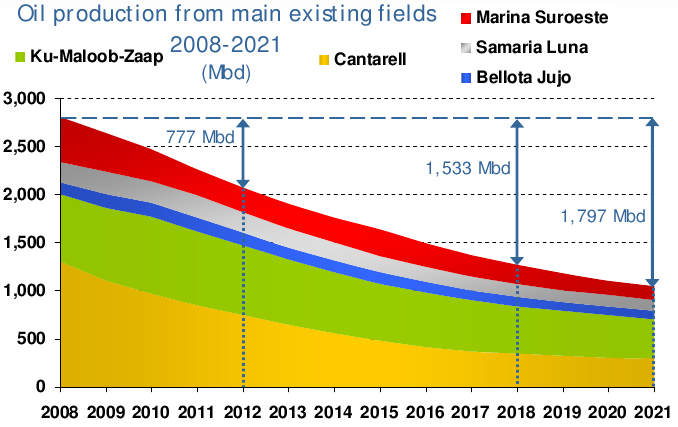

Die Vorhersage für den weiteren Produktionsverlauf der existierenden Felder ist auch nicht unbeschränkt erfreulich:

Bis 2012 müssen die also rund ein Viertel ihrer Produktion ersetzen - wenn alles nach Plan geht.

Und wie wollen sie das ersetzen? "deep water exploration" ist der Schlüssel - Suche nach Öl in der Tiefsee. Pemex beschreibt das selbst wirklich sehr gut:

· Development of the first economically viable reserves is still some years away:

· Pemex has contracted five drilling platforms, one of which is already in operation:

Vessel Capacity Days Start

name (ft.) contracted date

Ocean Voyager 3,000 931 Aug - 10 - 07

Noble Max Smith 6,000 1,095 Sep - 30 - 08

Sea Dragon I 7,000 1,825 Jan - 02 - 10

Petro Rig III 7,000 1,825 Jan - 03 - 10

Muralla III 10,000 1,825 Sep - 01 - 10

· The seismic acquisition program focuses on the most prospective areas

· 65,736 km2 of 3D seismic will be acquired in 2008-2012

· Accordingly, there is a solid expectation for identifying a significant number of exploration opportunities

· This program, coupled with the five deepwater drilling rigs will enable the discovery of new fields, with their potential future development

Also: von 2008 bis 2012 werden 65000 Quadratkilometer vermessen, und zwischen 2007 und 2015 werden Bohrungen unternommen - in der _Hoffnung_, neue Ölfelder zu finden. "Solid expectation", "significant number of exploration opportunities", "will enable the discovery of new fields" - nichts davon garantiert auch nur eine signifikante Entdeckung.

Von der Zukunft wieder in die Gegenwart:

http://www.bloomberg.com/apps/news?pid=20601086&sid=aCH3J3wXRtcI&refer=latin_america

Production dropped to 2.711 million barrels a day, from 2.901 million barrels a day a year earlier, the company known as Pemex said today on its Web site. In an e-mail, Pemex cited Cantarell, its largest field, as the reason for the drop.

The Mexico City-based company in October lowered its 2008 output forecast by 3.6 percent to as low as 2.7 million barrels a day after interruptions from hurricanes. It was the third time Pemex reduced its forecast this year, after a faster-than- expected decline at Cantarell, the world’s third-largest field.

Cantarell’s output fell 33 percent, more than twice as fast as government estimates, to 862,060 barrels a day from a year earlier. Declining pressure at Cantarell has made it more expensive and harder to continue pumping oil from the offshore deposit.

Das ist schon massiv erschreckend.

http://www.gasandoil.com/goc/news/ntl84194.htm

Anderenorts wird auf andere Probleme mit Mexikos Ölfeldern hingewiesen:

Baker argues the potential of the CB is "a highly speculative investment, given the adverse geological parameters of the field, the rapid annual decline rate of 50 % and the low rate of initial production, typically below 150 bpd."

The CB faces other issues as well:

(a) this onshore system covers an extended area of 2,400 sq miles, thus requiring extensive infrastructure development,

(b) the overwhelming majority of the reserves are classified as heavy,

(c) oil recovery rates barely reach 10 % and the field is expected to peak in 2016.

In his 2005 book, The Coming Oil Crisis, Colin Campbell claims Mexico systematically exaggerates the recoverable oil in the CB.

Chicontepec ist auch an anderer Stelle öfters mal als eher teures Feld beschrieben worden. Das da oben jedenfalls ist nicht die Beschreibung eines zweitklassigen Ölfeldes (und erst recht nicht die eines Erstklassigen).

(

Further, official Pemex documents have shown that oil quality and production at KMZ are falling, as water and salt seep into reservoirs. These quality issues make optimistic projections of future oil production at KMZ highly questionable.

Mexico is heavily investing in KMZ to offset the decline of Cantarell. A $ 4 bn investment was aimed at raising oil output by injecting nitrogen and natural gas into wells to provide an enhanced oil recovery surge.

Oil experts are sceptical that these procedures will make a significant difference. As John Padilla, an oil analyst with the energy consulting firm IPD Latin America has stated: "The big question is, can they have that much production online from KMZ? The problem is they do not have a Plan B."

Ku-Maloob-Zaap ist das Ölfeld, das den Produktionsrückgang von Cantarell auffangen soll. Es liefert aber reichlich schweres Öl - und genau damit können die USA mit ihrer relativ veralteten Raffinerien nicht so viel anfangen, wenn ich richtig informiert bin.

Ein weiteres Highlight, aus dem September 2008:

http://www.projectfinancemagazine.com/default.asp?page=7&PubID=4&ISS=24986&SID=711269

The decline in remittances “shows that one of the most important sources of inflows to the Mexican economy is shrinking,” said Bartosz Pawlowski, an emerging-market strategist at TD Securities Inc. in London. “The situation in the U.S. labor market has impacted the amount of money that Mexicans send back home. That’s troublesome.”

[...]

The plunging U.S. economy has put Mexican laborers out of work. About 38 percent of Mexican immigrants in the U.S. work in construction and manufacturing, according to the central bank. Transfers from abroad are heading for the first yearly decline since the central bank began tracking the data in 1995.

Im November haben im Ausland beschäftigte Mexikaner 11% weniger in die Heimat überwiesen als ein Jahr zuvor - das sind immerhin so rund $200 Mio.

http://www.ptinews.com/pti\ptisite.nsf/0/2327A33305ADFAFB65257531005A650A?OpenDocument

12 -> 16 Stunden Stromabschaltung am Tag? Igitt - das ist für mich als Computerjunkie keine schöne Vorstellung.

Abhilfe?

20 MW. Wow.

20 MW gegen ein Defizit von von 460 MW.

Und nochmal 70 MW in zwei Wochen:

The power crisis in the Himalayan state was created mainly due to low level of water in the major hydro power plants of Nepal.

macht dann 330 MW von benötigten 700...

Ob die 20MW vor allem für die Ruhigstellung dieser Leute eingekauft werden?

http://www.gmanews.tv/story/141934/Students-in-Nepal-cut-electricity-to-protest-power-cuts

Das zählt sicherlich teilweise in die Kategorie "hausgemachter Ärger":

Electricity is expensive and available only for a few hours. Gas pressure in many residential areas is inadequate even for cooking or heating homes.

Es ist kalt, der Strom fließt nur sporadisch und der Gasdruck ist in vielen Dinger sogar zum Kochen zu gering. Naja, wer braucht schon Heizung?

Domestic users are suffering in many residential localities and they get adequate gas pressure only after midnight when they cook food for next day. Some localities face no gas supply problem at all. Suburbs are facing more acute shortage than the main City.

Die Gasversorgung war in Lahore "immer" auf der Spitze des kalten Wetters unzureichend. Genug Gasdruck zum Kochen gibt vielerorts erst nach Mitternacht - und das, obwohl zuerst die Gasversorgung der Industrie und dann die der Erdgas-Tankstellen verringert wird.

Aber...

Petrol shortage has resulted partly from short petrol supply and partly from storage by vehicles owners. Petrol pumps are also unwilling to stock petrol fearing a price drop. Petrol pump owners want their commission increased - something the government had agreed to implement from January 1, 2009.

They won’t be interested in buying petrol on December 30 and 31.

They also fear that petrol rates would decrease from January 1, 2009 in view of rapidly declining global crude oil rates. Dealers are not storing petrol because of fears of downward revision in its prices from January 1.

Ab dem 1.1. bekommen Tankstellenbetreiber eine höhere Kommission, und waren deshalb nicht daran interessiert, am 30.12 und 31.12 Benzin zu verkaufen

Außerdem befürchten Sie, daß die Benzinpreise sinken könnten ("downward revision" klingt wie Angst vor staatlicher Lenkung) und decken sich deshalb nicht mit Benzin ein.

[CNG ist "compressed natural has", komprimiertes Erdgas]

Auch CNG-Tankstellen arbeiten nur sporadisch; einige Tankstellen haben zwar Gas, aber nur sehr geringen Druck. Viele CNG-Tankstellen sind ganz geschlossen.

Shortage of Liquid Petroleum Gas (LPG) is not so acute but its price has increased substantially. This is the kitchen fuel for people who are without Sui gas connections.

All two stroke auto-rickshaws also run on LPG. Its price has shot up from Rs 720 for 11.5 kg cylinder to Rs 1,150. Naturally, rickshaw wallahs now seek higher fare than a few days ago.

Flüssiggas gibt's zwar genug, aber der Preis ist um 50% gestiegen.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-online/Politics/02-Jan-2009/Public-anger-boils-over-power-outages

Und weil das Problem grundsätzlich nicht nur Lahore betrifft, sind die Leute auch in anderen Teilen Pakistans recht wenig glücklich:

The protest rally was taken out on the call of Labour Qaumi Movement. Sizing Industry Association, Powerloom Owners Council and general public also took part in the demonstration.

Many small rallies also joined the Labour Qaumi Movement rally and blocked main roads of the city for many hours. Later, the angry mob staged a sit-in outside the Fesco office and chanted slogans against the government and Wapda.

Es geht da um die Abschaltung des Stroms - ohne den bekanntlich ganze Industrien nicht funktionieren.

Aber das Problem dürfte nur schwer beheben zu sein:

http://www.onlinenews.com.pk/details.php?id=138422

According to a press release issued here on Thursday, the Ministry of Clarified that PEPCO was currently generating 7000 MW at peak against a demand of 11000 MW, thus having a short-fall of around 4000 MW (36%).

The reasons for shortfall have been attributed to low water releases from the dams due to annual canal closure as well as oil and gas shortages. The current shortfall of water is 2500 MW, oil shortfall 2050 MW and Gas Short-fall 750 MW.

Strombedarf: 11000 MW, Verfügbar: 7000.

Und insgesamt riecht das nach Planungsversagen auf ganzer Linie - 2500 MW zu wenig wegen zu wenig Wasser in den Dämmen, 2050 wegen zu wenig Öl, 750 wegen zu wenig Gas.

The price index of private residential property fell to 163.4 points in the three months ended Dec. 31, from 173.30 in the previous quarter, the Urban Redevelopment Authority said in a statement on its Web site today. That’s the largest drop since the three months ended Dec. 31, 1998, according to data tracked by Bloomberg.

Prices for apartments in the so-called core central area dropped 6.3 percent in the three months ended Dec. 31 and slipped 5.5 percent elsewhere in central Singapore, according to the Urban Redevelopment Authority. They fell 4.7 percent across other parts of the island, today’s report showed.

Singapurs GDP im 4. Quartal: -12.5%.

[...]

In 2008, Singapore's economy grew by an estimated 1.5 percent, falling short of forecasts of 2.5 percent and well down on 2007's 7.7 percent growth.

Aber alles wird gut: 2009 wird sich das Wachstum zwischen -1% und +2% bewegen - in irgendeinem Alternativuniversum.

The fall in December's exports compared with expectations in a Reuters poll for a fall of 16.4 percent.

The Ministry of Knowledge Economy also said imports in December slid 21.5 percent over a year earlier, missing a 19.1 percent fall forecast in the Reuters poll.

Dies ist gar nicht gut.

"Prince of Lies and proud of it"

Dear Hank:

You have outdone yourself once again, my loyal servant, with these fraudulent, deliciously deceptive proposals to reform the utterly corrupt financial system you exploited so profitably as head of Goldman Sachs.

My plans for the destruction of the United States of America have been going along rather swimmingly until we rushed things a bit with Bear Stearns--ah, the wondrous power of pure, unmitigated greed! It remains my favorite tool--and calls for reform were suddenly everywhere.

The rules which would have undone us were simple indeed, as you know all too well:

1. complete transparency of risk and leverage in all financial documents and financial instruments

2. the marking to market of all financial instruments and assets at the close of the trading day, as is currently done with commodities futures and stock options

3. the banning of "off balance sheet" accounting

4. the banning of offshore accounts and holding companies

5. the uniform enforcement of these regulations across all financial classes, assets, firms, brokers and banks

As you know, Hank, transparency, mark-to-market and strictly enforced regulations of all banks, broker-dealers and financial institutions would deal a death blow to my plans to destroy the U.S. via destruction of its financial system. Having sold your soul to me for the glory and riches you received at Goldman Sachs, you had to comply with my orders to destroy any such useful regulations with cunning "fixes" of your own.

Though I counted on your native feral survival instincts, I did not expect a plan of such evil genius. Imagine how foolish and naive humans must be to accept your "fix"! My mind boggles at the ease with which you have conned the gullible gallery of idiots in Congress and the mainstream media:

1. you diminish the powers of the Federal agencies and favor the "shadow government" Federal Reserve, which is not even a government agency but a private institution

2. Instead of proposing transparency, you are adding another layer of secrecy in what the Fed can investigate and do to "fix" future problems

3. Enable more "self-regulation" (hahahaha, I can't stop laughing at this one! You really are a comedian!)

I am still amused that the American populace hasn't noticed that you, Master of the Dark Arts at Goldman Sachs, have been duly appointed as the wolf assigned to guard the sheep. Now you have suggested opening the rusty wire fencing and lighting the opening so your brethren can more easily slip in and slaughter as many sheep as they wish--and the American sheep sit there mesmerized by my other crowning achievement, the TV, blithely accepted that the most voracious, cleverest wolf is now their "guardian." Never in my wildest imaginations did I hope for such gross stupidity, ignorance and naivite.

Keep up the fine work--

Your Lord and Master,

Lucifer

No Cause for Optimism

Die US-Arbeitslosigkeit ist so viel niedriger als 1931, und das bedeutet .... genau gar nichts.

Der Zusammenhang zwischen Hauspreisen und Waldbränden:

In another a move toward normalcy, GMAC said it will extend its low-rate loans to those with less-than-perfect credit.

Ford Motor analyst George Pipas says too many would-be buyers still are being kept out of the market by tight credit. Many can't get a loan even as Ford runs an employee-pricing promotion, through Monday, that Pipas says offers the deepest discounts of the year.

Besides low interest, GM is offering incentives up to $10,000 on some remaining 2008 models.

With gas prices down, pickups are hot at Prestige Ford in Garland, Texas. "We've been busy," says John Thull, the general sales manager. "Good deals to be had on just about everything."

Sales are brisk — helped by a 0.9% interest rate — at Bob Smith BMW/Mini in Calabasas, Calif., says Tim Smith, president.

Peterson Super Center in Boise, for instance, has a "two-for-the-price-of-one" sale this week: Buy a full-size Cadillac or Chevy SUV or Chevy diesel pickup at full price and get a free 2009 Chevy Cobalt sedan. Interest in the deal has been "really good," ad director Sharon Potter says.

Das nennt man "ein weiterer Schritt Richtung Normalität":

- 0 bis 4.9% Zinsen auf 2008er-Modelle - auch für wenig kreditwürdige Kunden.

- Schleuderpreise durch Mitarbeiterpreisaktionen.

- $10000 Bar auf die Hand nach Kauf bestimmter 2008er-Modelle.

- 2 Autos für den Preis von Einem (kaufe ein $35000-Auto und bekomme ein $13500er dazu - wobei ich jetzt nicht wirklich danach gesucht haben, ob 35000 die Untergrenze ist).

Normalität?

Das US-Weihnachtsgeschäft in den offline-Geschäften war ja grottenschlecht.

Aber alle Berichte, die ich gesehen habe, sagten, daß das Onlinegeschäft deutlich besser abgeschnitten hätte - mit nur 1% Verlust (USA: Weihnachtsgeschäft).

Überraschung: Es war nicht mal im Ansatz besser.

2008 Holiday Season vs. Corresponding Days* in 2007

Non-Travel (Retail) Spending

Excludes Auctions and Large Corporate Purchases

Total U.S. – Home/Work/University Locations

Source: comScore, Inc.

Millions ($)

Holiday Season 2007 2008 Pct Change

November 1 – December 23 $26,332 $25,537 -3%

Demgegenüber sieht das Offline-Weihnachtsgeschäft laut ebenso vorläufigen Zahlen ja richtig gut aus:

http://www.nytimes.com/2009/01/01/business/economy/01retail.html?_r=2&hp

Das bestätigt meinen Eindruck, daß die Rabattschlacht, die man in den Geschäften beobachten konnte, im Onlinebereich nicht zu finden war.

Im November hat eine Nielsenstudie ergeben, daß 21% der britischen Familien kein verfügbares Einkommen mehr nach Abzug der unabwendbaren Ausgaben haben. Einzelhandelsinsider erwarten, daß die Quote auf 25% wächst.

Eine PWC-Studie in der letzten Woche ergab, daß 6 von 10 Briten glauben, dieses Jahr weniger verfügbares Einkommen als in 2008 zu haben.

Das ist in der Tat das zukünftige europäische Armenhaus.

http://business.timesonline.co.uk/tol/business/economics/article5439216.ece

Such a failure rate would mark a huge increase from previous years. In 2007 some 13,500 firms went under. In the two years of the last recession in 1991-92, 100,000 firms failed.

Mass failures of small and medium enterprises would also add to Britain’s mounting job losses because such companies employ 60% of the 22m workforce.

200000 kleine britische Firmen, von insgesamt 4.7 Mio., könnten in 2009 schließen. Das sei die Vorhersage für den schlechtesten Fall, der eintreffen könnte, wenn die Banken ihre Kreditvergabe in den nächsten Monaten nicht vergrößern.

Was ist eigentlich die Vorhersage für den Fall, daß Banken die Kreditvergabe nicht vergrößern, sondern verkleinern, und 6 von 10 Briten weniger verfügbares Einkommen als 2008 haben?

Aber nicht doch - Einteilung nach Geschäftssektoren macht richtig viel Sinn, denn die Annahme, daß im Grunde überflüssige Ausgaben zurückgefahren werden, gilt für den ganzen überflüssigen Ausgabensektor.

http://www.guardian.co.uk/business/2009/jan/03/banks-credit-house-prices

Apropos "für den Fall, daß Banken die Kreditvergabe nicht vergrößern, sondern verkleinern":

Natürlich verkleinern die britischen Banken gerade die Kreditvergabe.

Der Prozentsatz der Hypotheken bei Fannie Mae, die nicht zurückgezahlt werden, steigt drastisch.

Das ist übrigens deutlich besser als der US-Gesamtmarkt, siehe Uran.

At stake is one of the largest oil reserves in the world, a vast cache trapped beneath the Rocky Mountains containing an estimated 800 billion barrels -- about three times the reserves of Saudi Arabia.

800 Mrd. Barrel Öl in Schiefer - da muß doch dran zu kommen sein...

... hat auch Bush gedacht und die Jagd auf das Öl im Schiefer eröffnet.

That water-to-oil equation has inflamed officials in the upper Rockies, who are raising the alarm about the cumulative effect of energy projects on the region's water supplies, which ultimately feed Southern California reservoirs via the Colorado River.

"There are estimates that oil shale could use all of the remaining water in upper Colorado River Basin," said Susan Daggett, a commissioner on the Denver Water Board. "That essentially pits oil shale against people's needs."

Ich würde ja, wenn es nicht ausgerechnet Kalifornien träfe, gesagt haben, daß man halt für das Wohl der Mehrheit Kompromisse eingehen muß...

To prevent the brewing hydrocarbons from spoiling groundwater, the heated rock core is surrounded by 20-to-30-foot-thick impermeable ice walls, frozen by electric refrigeration units.

Fassen wir mal zusammen: Zum Produktion von Ölschiefer ist es nötig, eine große "Wanne" Schiefer in vielen Hundert Meter Tiefe einzufrieren, in dann den Schiefer auf 700 Grad (Fahrenheit, hoffentlich - das wären immer noch 371 Grad Celsius) zu erhitzen, diese Temperaturen dann Wochen oder Monate zu halten, bis Kerogen entsteht...

Gab es eigentlich irgendeinen Grund, warum es in Bergwerken so warm ist? Seufz.

The study's sobering bottom line is that meeting oil shale's energy demands could require more water than Colorado is entitled to under an interstate compact.

Das Wall Street Journal schreibt über die staatlichen Pensionsfonds und vermeidet das Wort "loss" vollständig.

"Nachdem sie 2008 durchlitten haben, denken einige große Pensionsfonds anders über ihre Anlagen in nichttraditionellen Anlageformen".

Das ist eine schöne Umschreibung für "am 31.10.2008 sind die Werte der Pensionsfonds wieder auf den Stand von 2003 gefallen" - denn das ist es, was die Graphik im Artikel aussagt:

Was sind schon 1000 Mrd. Dollar? Könnte ich bitte auch eine haben?

Soso, die Steuereinnahmen fallen und die Haushaltsdefizite der Staaten steigen.

The remainder would be used to fund middle-class tax cuts, stimulate the embattled housing market, and stem the tide of home foreclosures through a loan-modification program.

Und deshalb sind "middle-class tax cuts" auch so sinnvoll, weil wenn man Steuern kürzt, steigen bekanntlich die Steuereinnahmen.

Also, ganz durchdacht ist das nicht.

“There are some really extraordinary opportunities in the credit world,” said David Swensen, the school’s investment chief, in a phone interview from his office at the New Haven, Connecticut, university. “Everything, from bank loans to investment-grade bonds to less-than-investment grade bonds, is priced at really extraordinarily cheap levels.”

Swensen, 54, increased Yale’s endowment to $22.9 billion on June 30, from $1 billion in 1985 when he assumed the job, making it the second-wealthiest university in the U.S. The school estimated on Dec. 16 that the fund had fallen 25 percent, to $17 billion, because of the global financial crisis. Swensen, who has updated his 2000 book on investing for re-release Jan. 6, said periodic losses are inevitable in a portfolio tilted toward stocks and built to grow over many years.

Es ist ja noch sehr früh im Jahr 2009, aber Swensen bemüht sich schon um eine Nominierung zum Verlierer des Jahres.

Mir fällt dazu leider nicht Sachliches ein, was der Sache angemessen wäre. Ein "der liegt meiner Meinung nach völlig falsch" wird ihm einfach nicht gerecht.

Das heißt, die Zirkulationsgeschwindigkeit des Dollars ist deutlich gefallen, und Banken verleihen weniger, als sie haben...

http://www.bloomberg.com/apps/news?pid=20601087&sid=a.IBTa8Eg2RM

http://www.theautochannel.com/news/2009/01/05/347117.html

2008-11 2008

versus 2007-11 vs. 2007

Daimler -24% +1.5%

Subaru -8% +0.3%

VW -14% -4.5%

Honda -35% -7.9%

BMW -36% -9.7%

Kia -39% -10.5%

Nissan -31% -10.9%

Mazda -27% -10.9%

Hyundai +25% -14.0%

Toyota -37% -15.4%

Suzuki -15.4% (geschätzt)

Acura -39% -20.0%

Ford -32% -20.5%

GM -31% -22.7%

Mitsubishi -23% -24.6%

Porsche -25% -25.0%

Chrysler -53% -30.0%

Jaguar+Landrover -31.7%

Isuzu -62% -33.0% (stellt Produktlinien auf GM-Basis ein)

Hyundai verzerrt die Sache ein bischen, die hatten wohl gerade Modellwechsel.

Zukünftig machen die ein Programm "lose your job? return your car".

Vor einem Jahr schrieb ich, als Chryslers Dezemberverkäufe um 7.9% eingebrochen waren:

Heute würde man es auch bemerkenswert finden, nur eben anders.

Wollen Sie den Digest abbestellen?