| Sendedatum | 2008-12-31 23:23:54 |

|---|---|

| Ausgabe | 74 |

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Beginnen will ich diesmal mit einem Meisterwerk:

Inhaltsverzeichnis:

- Leveraged Buyouts

- Stock-Market Strategy Halts Fishing Collapse

- Air Travel, Freight Declines Accelerated in November, IATA Says

- Chemical Giant LyondellBasell Mulls Bankruptcy

- Texaco Toxic Past Haunts Chevron as Judgment Looms

- Infineon zweifelt an Qimonda-Rettung

- Steel output set for historic drop

- The collapse of financial globalization …

- Money flows out of hedge funds at record rate

- Nebenwirkung der Staatsanleihenschwemme

- Kundenbindung nach Art der Kreditkartenunternehmen

- As Taliban nears Kabul, shadow gov't takes hold

- Macquarie Office Shares Drop as Lender Talks Continue

- Argentinien Industrieproduktion im November 2008

- China: Arbeitslosigkeit im Anmarsch

- China: Verwüstung

- China: Wohnungspreisverfall in Shanghai

- South China Mall

- Italian Retail Sales Fall for 22nd Month on Deepening Recession

- Japan Economy May Shrink 12.1 Percent, Barclays Says

- Kirgisistan: Kein Strom => Kein Wasser

- Korea's Pension Fund to Cut Stock Investment in 2009

- Niederländischer Pensionsfonds ABP: -9.8% in den ersten 9 Monaten 2008

- Russia braced for unrest

- Gazprom in Schwierigkeiten

- Kuwait stoppt Schlüsselprojekt mit Dow Chemical

- Golfstaaten schaffen gemeinsame Währung

- VAE Update

- Spanien: Hauspreise

- Pound Falls to 98 Pence Per Euro for 1st Time on Housing Slump

- USA: Benzinverbrauch

- USA: Der GMAC-Bailout zeigt Wirkung

- Citigroup peppelt südkoreanische Tochter auf

- USA: Hauspreise

- Hauspreisverfall und Scheidungen

- Washington Mutual

- USA: Leihhäuser im Aufwind

- USA: Rezession in Las Vegas

- USA: State Lotteries Show Big Declines

- Military recruiters having no trouble filling quotas

- Venezuela to seize gold concessions as oil falls

Inhalt:

Der Artikel nennt noch einige LBOs, die in mehr oder weniger großen Schwierigkeiten stecken:

Harrah’s Entertainment, HCA und Clear Channel Communications.

The researchers analyzed more than 11,000 fisheries over 50 years and found that those being managed using catch shares were about half as likely to collapse as those without catch shares. And when fisheries switched to catch shares, fish populations stopped declining and, according to some analyses, may have reversed course. “I’ll be honest,” Costello says, “I was really surprised” by the size of the effect.

The system of catch shares works somewhat like a stock market: individual fishers can net a designated percentage of the total amount of a species set aside for fishing annually. The cap on each fish type is adjusted yearly by the government according to how the species is faring. If the population increases, the shares increase in value, too. And fishers can buy and sell shares to one another.

Catch shares give fishers a financial motive to treat the ocean with care, because they are literally invested in the future of their quarry.

Richtig überraschend ist das nicht, denn daß Fischfangquoten funktionieren ist eh' bekannt - aber daß der Handel mit Quoten zumindest keine negativen Auswirkungen hat, ist eine ausgesprochen erfreuliche Nachricht - im Hinblick auf Emissionshandel und den Umgang mit der Umwelt überhaupt.

[...]

The chemicals industry has been battered over the past year, first by high prices for oil and natural gas, which are key components of plastics and other chemicals, then by the weak economy, which has driven down demand for products. Companies have been forced to slash budgets and shut down production. On Sunday, Dow Chemical Co. announced that Kuwait had pulled out of multibillion-dollar joint venture to produce commodity chemicals.

Das klingt ja fast, als wäre die Firma operativ am Ende, nicht?

Nope, ist sie nicht - die Schuldenlast ist "nur" zu hoch, nach einem besonders wagemutigen Merger.

LyondellBasell’s bonds have been trading at distressed levels in recent months. A $100 million unsecured bond issue trades at about 30 cents on the dollar, a sign that investors are concerned about default. Another $225 million issue trades at around 23 cents, according to the investment banking firm of Robert W. Baird & Co.

Last year’s merger, which closed in December, made LyondellBasell one of the world’s largest chemical companies, but it saddled it with a heavy debt load. Some analysts questioned the deal. “This really isn’t a good time to buy. You should be waiting a couple more years for assets to get cheap,” HSBC analyst Hassan Ahmed said when the deal was announced that July.

da hatte der Analyst definitiv recht.

Chevron hat ein potentielles $27 Mrd. Problem:

The case, which has languished for 15 years in U.S. and Ecuadorean courts, highlights the growing human and environmental toll of the global quest for oil.

Die Schuldfrage ist diffizil, weil zwar Texaco für 25 Jahre Abwasser einfach so in die Umwelt entlassen hat, aber auch Petroecuador dasselbe danach für 17 Jahre tat.

Both sides in the Amazon case agree that for a quarter of a century, until 1990, Texaco discharged 16 billion gallons of wastewater that’s a byproduct of drilling.

In 1993, 76 people who lived near the wells -- including members of the indigenous Cofan and Quichua Indian tribes and people who came to the Amazon from other parts of Ecuador for jobs -- sued White Plains, New York-based Texaco in New York federal court.

Chevron Blames PetroEcuador

They claimed the pollution had ruined their livelihood as farmers and fishermen and made them and their families sick.

Chevron says Texaco had completely cleaned up its mess by 1998. PetroEcuador, which took over Texaco’s operations in 1990 -- and not Texaco -- is to blame for today’s pollution, Chevron says.

Und natürlich ist auch noch die Ursache umstritten. Es liest sich wie das übliche "Wir sollen schuld sein? Ach nein, es gibt noch 100 andere Sachen, die krank machen, aber unsere zählt nicht dazu".

Ein kleines Detail am Rande:

Texas banned unlined waste pits that leaked into groundwater as far back as 1969, says Steve Seni, former assistant director of environmental studies at the Texas Railroad Commission, which regulates the oil industry.

In Texas war es längst verboten, Abwässer so zu entsorgen daß sie ins Grundwasser entkommen konnten.

Die Hilfen seien ferner kein Garant dafür, "dass Qimonda weitere operative oder strategische Initiativen erfolgreich umsetzen kann, die geeignet sind, ihre finanzielle Lage zu verbessern."Für den Fall, dass die Tochter mit den Kreditverhandlungen und der Sanierung scheitere, "könnte Qimonda Schwierigkeiten haben, ihren fälligen Verpflichtungen nachzukommen", teilte Infineon mit.

Analysten sagen, daß die Stahlproduktion in 2009 mindestens 10% fällt. Das wäre der stärkste Fall seit 60 Jahren.

Ok, Analysten sagen viel und selten liegen sie richtig, aber...

Nach den pessimistischsten Vorhersagen dauert es mindestens 4 Jahre, bevor die Stahlproduktion wieder das Niveau von 2007 erreicht.

Michael Shillaker, an analyst at Credit Suisse, is slightly less gloomy, forecasting a year-on-year fall in 2009 of 10 per cent, with a pick-up only around the middle of the year.

-13.9 oder -10%. Naja, katastrophal ist beides.

Und wie ist der historische Kontext?

In 1945, the final year of the second world war, steel output fell 27.3 per cent – the biggest year-on-year fall since the industry started collecting comprehensive data at the start of the 20th century.

-10% wäre also schon der Negativrekord für Jahre, in denen nicht Weltkriege enden. Wow.

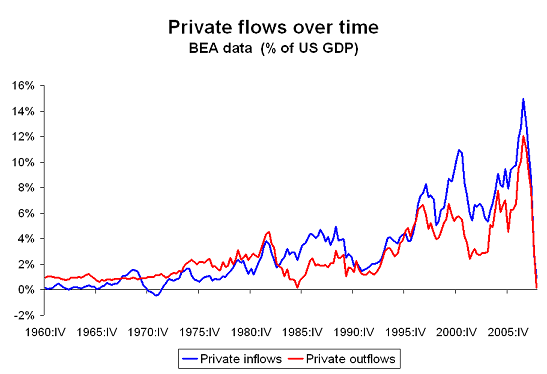

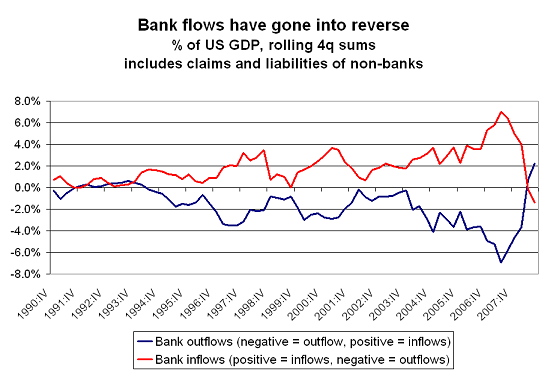

Bard Setzer über den "near-total collapse of private capital flows.":

Private Gelder sind relativ unbeteiligt an der Finanzierung des US-Defizits.

I think we now more or less know that the strong increase in gross capital inflows and outflows after 2004 (gross inflows and outflows basically doubled from late 2004 to mid 2007) was tied to the expansion of the shadow banking system.

China hat also im wesentlichen direkt US-Staatsanleihen aus dem Handelsüberschuß gekauft und damit das US-Defizit finanziert.

Und die privaten Gelder, die geflossen sind, sind größtenteils in das Schattenbankensystem geflossen.

Es gab schon 5 Jahre lang keinen großen Bedarf privater Investoren an US-Staatsanleihen.

=> Sobald China, Japan, ... keinen großen Außenhandelsüberschuß mehr haben - und der Zeitpunkt ist sehr nahe - wird es keine ausländischen Käufer für US-Staatsanleihen mehr geben.

Und das heißt dann nicht nur, daß die USA die FED-Bilanz nicht mehr "sterilisieren" kann, sondern auch, daß die USA massive Probleme haben werden, im Ausland zu kaufen. Das kann eine ganz, ganz üble Kettenreaktion werden.

Money has been taken out of funds following every strategy, even those – such as macro funds – which were showing returns, according to data from fund trackers Hedge Fund Research.

[...]

Conrad Gann, chief operating officer of TrimTabs, said: “We estimate outflows in November were $32bn, and there is an additional pipeline of redemptions that have not been filled, there could be $80bn [of redemptions] in December.

“There are $57bn of redemptions that we know are in, that are not reflected yet,” he said.

[...]

The funds had outflows of $43bn for the 10 months to the end of October, according to HFR. With TrimTabs’ estimate of further significant redemptions for November and December, the funds will show outflows of more than $100bn for the full year. In 1994, the only previous time they had outflows, the figure was $1m.

2008-01 bis 2008-10 flossen 43 Mrd. aus den Fonds ab, 2008-11 32 Mrd., und im Dezember könnten bis zu 80 Mrd. abfließen.

.

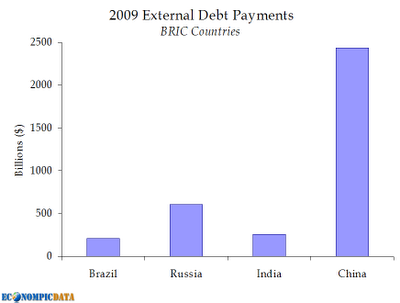

Analysts warn that emerging market borrowers could be crowded out of the credit markets by $3,000bn of government bonds expected to be issued by the big developed economies in 2009 – three times more than in 2008. The US alone is expected to issue about $2,000bn next year.

Die entwickelten Länder werden im nächsten Jahr Anleihen für $2000 Mrd mehr machen als in diesem Jahr...

David Spegel, global head of emerging markets strategy at ING, said: “Refinancing risk is going to be one of the biggest problems for emerging market issuers in 2009.

... und die emerging markets könnten diejenigen sein, die deshalb ihre Anleihen nicht oder nur zu höheren Strafaufschlägen loswerden.

Econompicdata hat diese wunderschöne Graphik erzeugt:

Das ist die Summe der Auslandsschulden, die der jeweilige Staat und Unternehmen aus Land in 2009 bezahlen oder refinanzieren müssen.

Johnson’s mood soured when he got to a letter from American Express, saying it had slashed the credit limit on his account.

[...]

“Other customers who have used their card at establishments where you recently shopped have a poor repayment history with American Express,” the letter said. Johnson complained to American Express by phone and letter.

[...]

Johnson checked his charges to try to figure out what might have raised a red flag in the American Express data-mining model. He didn’t see anything but typical transactions, including purchases at Amazon, Ruby Tuesday, Wal-Mart, Starbucks and Federal Express.

Ich verstehe ja, daß Kreditkartenunternehmen massive Angst vor faulen Krediten haben - aber daß sie erstklassigen Kunden den Kredit kürzen weil weniger erstklassige Kunden bei denselben Läden eingekauft haben, geht wohl doch einen Schritt zu weit, jedenfalls wenn man Selbstmord als Ziel des Unternehmens ausschließt.

The public punishment was a clear sign to villagers that the Taliban are now in charge. And the province they took over lies just 30 miles from the Afghan capital of Kabul, right on the main highway.

[...]

In a growing number of regions, insurgents have put in place:

• Militant commanders who serve as self-described governors and police or military chiefs of provinces.

• A 10 percent "tax" — a forced payment at gunpoint, Western officials say — on rich families, or donations by poorer families of food and shelter for fighters.

• A military draft that forces fighting-age males to join the Taliban for months-long rotations.

• A parallel judicial system run by religious scholars who impose such punishments as tarring, public humiliation and the chopping off hands.

• The closing of Afghan schools or the forcing of schools to replace science with more religious study.

• Manned Taliban or militant checkpoints to demand highway taxes and search vehicles for government employees or foreigners.

Ich bin wirklich beeindruckt von den großen Erfolgen der Demokratisierung im mittleren Osten.

Macquarie Office shares fell 12 percent to 29 Australian cents at the close of trading today on the Australian stock exchange, extending their loss this year to almost 80 percent, after the company said banks agreed to extend the existing facility to March 1, 2009.

Australiens größter Immobilienfonds hat Zahlungsschwierigkeiten. Es geht um 74 Millionen.

Und das ist nicht der einzige Fonds der Gesellschaft, der in Schwierigkeiten steckt...

http://www.bloomberg.com/apps/news?pid=conewsstory&refer=conews&tkr=MOF%3AAU&sid=a_AYjnP3xW8Y

Macquarie Direct Property, which in August was forced to freeze cash redemptions, has put half its A$1 billion assets up for sale to increase cash holdings, the newspaper said, citing the fund's Chief Executive Officer Richard Cutler.

Another Macquarie fund plans to sell its half-stake in the No.1 Martin Place building in Sydney, while Macquarie Office Trust is selling buildings in Adelaide and North Sydney.

Macquarie ist eine Gruppe von Immobilienläden, die sich auf Immobilien in Kalifornien und Australien spezialisiert hat. Ja, Kalifornien, da wo die Immobilienpreise immer nur steigen...

Auch die letzte Quartalsbilanz von Macquarie Office Trust liest sich interessant:

http://www.bloomberg.com/apps/news?pid=conewsstory&refer=conews&tkr=MOF%3AAU&sid=ab8h5ZYgLxhk

September 30, 2008 December 31, 2007

Total assets $ 5,323,039 $ 5,749,778, davon

Deferred rents 61,140 49,292

Due from affiliates 1,707 1,740

Deferred leasing costs and value 159,913 192,269

of in-place leases, net

Deferred loan costs, net 33,471 38,725

Total liabilities 5,211,662 5,391,794

Ich lese das als "bereits tief unter Wasser" - wenn auch nur 40% des "deferred" permanent verzögert ist (deferred rents sind Mieten, bei denen der Vermieter zugestimmt hat, daß sie erst später gezahlt werden).

Auch Einnahmen und Ausgaben sind erhellend:

For the Three Months Ended For the Nine Months Ended

September 30, September 30, September 30, September 30,

2008 2007 2008 2007

Revenue:

Rental $ 84,432 $ 92,592 $ 256,710 $ 233,725

Tenant 28,133 27,534 82,431 75,241

reimbursements

Hotel 6,301 6,705 20,168 19,954

operations

Parking 13,034 12,369 40,154 34,190

Management,

leasing and 1,518 1,716 5,332 6,586

development

services

Interest and 2,159 3,869 8,901 8,829

other

Total revenue 135,577 144,785 413,696 378,525Expenses:

Rental

property 33,211 33,566 97,661 85,509

operating and

maintenance

Hotel

operating and 4,102 4,208 13,084 12,598

maintenance

Real estate 12,886 13,435 39,993 33,114

taxes

Parking 4,519 3,173 12,675 9,802

General and 9,052 8,973 52,797 27,888

administrative

Other expense 1,574 1,949 4,507 3,127

Depreciation

and 46,677 55,746 143,446 135,593

amortization

Interest 65,455 66,119 195,605 155,293

Loss from

early 1,463 12,440 1,463 20,776

extinguishment

of debt

Total expenses 178,939 199,609 561,231 483,700

Das ist ja durch die Bank tiefrot...

Factory output was down 0.9 percent in November from a month earlier, according to the government's seasonally adjusted data.

Production in the automotive sector slid 24.4 percent from November 2007 and 23.1 percent from October, as carmakers reacted swiftly to a sharp drop in demand in both the local market and the country's main export market, Brazil.

Steel and aluminum production fell 11.1 percent year-on-year in November and 13.8 percent from October. Oil refining dropped 12.4 percent from November 2007 and 12.9 percent from October.

Fabrikproduktion -0.9%, Automobilsektor -23.1%, Stahl und Aluminium -13.8%, Öl -12.9%, alles von Oktober auf November.

Danke, daß endlich meine Frage nach belastbaren Zahlen zur Arbeitslosigkeit unter Wanderarbeitern (China: Anstelle von Fakten bekommt man Gelaber) beantwortet wird. Ich hätte allerdings eine weniger verheerende Zahl schöner gefunden.

But even if China achieves 8 per cent growth, it will only be able to create a maximum of 9m jobs next year, Chinese premier Wen Jiabao said at the weekend.

16.5<->9 Millionen.

Aber es wird noch schlimmer:

Diese 10 Millionen arbeitslosen Wanderarbeiter wurden arbeitslos während die Ökonomie noch 9% wuchs. Wieviele Wanderarbeiter werden wohl bei 4, 0 oder -4% entlassen? Und will ich die Antwort auf diese Frage wirklich wissen?

2 Mio. Hektar neuer Wüste im Jahr sind langfristig doch etwas viel.

Und mit dem üblichen gefühlvollem Vorgehen von kommunistischen Großdiktaturen wird die Gelegenheit ergriffen, Menschen umzusiedeln und beruflich umzupflanzen - und das auch bei sowieso eher weniger geschätzten Minderheiten (Mongolen).

Und die kommen auch noch auf den Arbeitsmarkt, auch wenn sie eigentlich gar nicht wollen.

About 33,000 units of new homes have been sold during the second half, a decline of 25 percent from 44,000 units in the first six months, E-House said.

Chinas aufstrebender Mittelstand...

Bild: South China Mall, von Philip Gostelow für The National.

This mall has seven zones modeled on international cities, nations and regions, including Amsterdam, Paris, Rome, Venice, Egypt, the Caribbean, and California.

Although the mall opened in 2005, it suffers from a lack of retailers. Much of the retail space remains empty, with 99.2 percent of the stores vacant. Many analysts say that the main reason the mall is so far largely unoccupied is that it is located in the suburbs of Dongguan, which means that it is only practical to travel there using a car. The mall was scheduled to close in July 2008.

99.2% Leerstand ist beeindruckend.

Das Einkaufszentrum war wohl für Chinas aufblühenden Mittelstand gedacht - und was bedeutet es wohl, daß es leer steht? Vielleicht daß es diesen Mittelstand nicht in so großer Zahl gibt?

Und was bedeutet das wohl für Chinas Chance auf Wachstum durch Belebung der Binnennachfrage?

http://www.thenational.ae/article/20080612/REVIEW/206990272/1042

[...]

The situation is even more complicated in China, where per capita income is about a fifteenth of the UAE’s. Much is expected of China in the next decade. Its economy continues to experience double-digit growth, and its factories now assemble most of the toys, shoes and microchips in the world. The country expects to quadruple its year 2000 per-capita income by 2020. China is rising, and before long – the conventional thinking goes – there will be a gigantic Chinese consumer class, four or five hundred millions of prosperous, educated people looking to stroll through malls and buy lots of stuff they don’t need. (At present, fewer than 10 per cent of China’s population of 1.3 billion have enough discretionary income to count as “middle-class”.)

About 500 new malls have been built in China over the last five years, estimates Kevin Jiang, a researcher at the Mall China Information Center. All of them are waiting for the arrival of this coming mega-middle class, as are the rest of China’s countless “visionary” development projects. These include a from-scratch “eco-city” for 500,000 residents north of Shanghai, a compound of a hundred luxury villas in the Ordos desert of Inner Mongolia and a thousand-acre theme-park replica of the old imperial Summer Palace, which was destroyed by British and French troops in the nineteenth century.

Bild: South China Mall, von Philip Gostelow für The National.

... wenn auch nicht mehr ganz so drastisch wie im November.

Declining sales prompted retailers to cut staff for a 12th month, the report said. The rate at which staff numbers were reduced was the fastest since Markit first compiled the data in January 2004.

und 12 Monate hintereinander haben Einzelhändler netto entlassen.

Micht dünkt, die italienischen Probleme sitzen tief - außer dem hohen Problem, daß sich als Ministerpräsident wählen läßt um Recht beugen zu können.

Gross domestic product in the three months ending tomorrow will fall at almost three times the 4.1 percent rate previously predicted, said Kyohei Morita, chief Japan economist at Barclays in Tokyo, after reports last week showed industrial production and exports posted the biggest declines on record in November.

12.1% Minus wäre fürchterlich - und das ist die Vorhersage für das vierte Quartal 2008.

Und damit wäre die Sache noch nicht vorbei, denn

Rezession bis mindestens ins 2. Quartal 2009.

Der Nikkei fiel dieses Jahr um 42%, mehr als die 39%, die 1990 ein Jahrzehnt von Stagnation und Deflation mit ausgelöst haben.

"The energy crisis and the drinking water supply have a direct connection. If there is no electricity, in most cases it means there is no water," Talant Ormushev, head of production at the Department of Rural Water Supply, told EurasiaNet.

According to Ormushev, the majority of Kyrgyzstan’s villages receive water supplied by water towers that, in turn, depend on electricity to fill their tanks. But electricity supplies are sporadic, with some villages reportedly receiving only five hours of power per day.

Einige Dörfer haben 5 Stunden Strom am Tag - zu wenig für die Wasserpumpen, und einige Wasserpumpen sind durch die unregelmäßige Stromversorgung bereits beschädigt.

Ishenbaev explained the increasing burden the burnt-out pumps are having on consumers. Villages collectively scrape together the repair fees. "To change a broken pump machine ... costs around 60 thousand som ($1,500). Every household must collect 100-200 som (up to $5). It’s a big financial burden for villagers."

Bruttosozialprodukt pro Kopf, landesweit: $1600.

Und natürlich hat das auch Auswirkungen auf die Wasserqualität...

Vor dem Bau der Wasserpipeline wurde das Wasser in Krügen mit Eseln geholt. Jetzt sind die Esel und die Krüge verkauft...

Es lebe die Pressefreiheit.

Domestic stocks will account for 17 percent of its assets by the end of 2009, down from its initial plan of 20.3 percent, the fund said today in an e-mailed statement. Bonds will make up 69.3 percent of assets next year, from 60.4 percent earlier, according to the statement. The fund expects assets to rise to 256 trillion won by the end of next year, it said.

Südkoreas Pensionsfonds fährt seinen Aktienanteil zurück (von 20.3 auf 17%). Das ist sehr wahrscheinlich die richtige Richtung. Dafür kommen dann mehr Staatsanleihen.

Und nächstes Jahr werden die Anlagen des Fonds um 13% wachsen (das scheint mir leicht optimistisch zu sein - netto zahlen auch die Koreaner nicht 24 Mrd Dollar in einem Jahr in den Fond ein...).

http://www.bloomberg.com/apps/news?pid=conewsstory&refer=conews&tkr=NPSVCZ%3AKS&sid=a_yvgjSfKg5E

The NPS, which had 228 trillion won ($189 billion) of assets at the end of August, was among pension funds that were net buyers of 3.2 trillion won in Kospi Index shares this month, according to stock exchange data. That helped to buffer overseas investors' net sales of 2.7 trillion won.

Im September haben die noch koreanische Aktien gekauft, und damit den Aktienmarkt Koreas deutlich gestützt, nachdem ausländische Gelder abgezogen wurden...

Ist das nun ein Pensionsfonds oder ein Aktienmarktmanipulationsvehikel?

Naja, von "228 trillion won ($189 billion) of assets at the end of August" auf "225 trillion won ($178 billion)" jetzt: -11 Mrd Dollar.

Oh, und vorher waren die Erfolge auch eher beschränkt:

http://www.bloomberg.com/apps/news?pid=conewsstory&refer=conews&tkr=NPSVCZ%3AKS&sid=al2B3YfFZEBY

The pension fund's return averaged a negative 1 percent between January and August, the Ministry for Health, Welfare and Family Affairs said in a statement today. It forecast annual returns to fall, the first drop since 2005. The fund had 228 trillion won ($197 billion) of assets at the end of August.

Einmal hatten sie am Ende des August $197 Mrd, einmal am selben Augustende $189 Mrd, jetzt haben sie $178 Mrd und von Januar bis August im Mittel -1% (im Mittel über was? Naja, nehmen wird mal an, sie meinen "-2 Mrd in dem Zeitraum") => von rund 200 Mrd auf 178 Mrd.

Wenn man ihnen glauben kann, natürlich.

ABP has notified De Nederlandsche Bank (DNB) that the coverage ratio of the pension fund has fallen below the required coverage ratio of about 125%. At the end of the third quarter the coverage ratio was 118%. With this percentage the pension fund still has financial buffers of several tens of billions of euros, but less than pension fund regulator De Nederlandsche Bank requires. There is therefore a shortage of reserves.

ABP is now legally required to draw up a recovery plan in which the fund shows that the asset position will satisfy the statutory requirements within a period of 15 years maximum. ABP will present DNB with a recovery plan by the end of this year.

A cut on Friday extended six weeks of devaluations by Russia’s central bank designed to offset the impact of the global economic crisis and falling oil prices as the country’s main export commodity approached its lowest level since 2004.

Der Rubel verfällt...

... und wird voraussichtlich weiter verfallen.

Und was könnte die Folge sein? Zivilisierte Briefe an den Kreml, vielleicht?

Nein, so wohl nicht:

His remarks coincided with criticism of the Kremlin’s rough handling of the protests in Vladivostok. Moscow-based Omon riot police detained about 61 people in the protests against car import duties designed to prop up domestic car producers, but making foreign vehicles prohibitively expensive for ordinary Russians.

Nein, die Leute protestieren, obwohl sie zu ihrem eigenen Besten gezwungen werden, und müssen dann eingesperrt werden.

Und wie umschreibt man das schön?

“It was a deal,” he told the FT in an interview this week. “But it has fallen apart and that is why people are appearing on the streets. The process has started . . . Things could spin out of control when people wake up and realise their neighbours have lost their jobs and they are at risk of losing theirs.” He added that “the authorities had reacted “cynically and in a very nervous manner for nothing,” against a peaceful demonstration.

Zynische und sehr nervöse Reaktionen gegen friedliche Demonstrationen in Rußland? In China ist ein Sack Reis umgefallen.

Aber obwohl ich eigentlich der Meinung bin, daß alles gut ist, was Putin die Chance auf eine frühzeitige Rente gibt: Offene Proteste auf der Straße mit Bildern von Straßenschlachten im Fernsehen und Internet sind sicherlich nichts, was den Rubelverfall stoppen könnte. Und unter Putin wird Rußland jedenfalls keine Atomwaffen an Terroristen verkaufen...

Today, Gazprom is deep in debt and negotiating a government bailout. Its market cap, the total value of all the company’s shares, has fallen 76 percent since the beginning of the year. Instead of becoming the world’s largest company, it has tumbled to 35th place. And while bailouts are increasingly common, none of Gazprom’s big private sector competitors in the West is looking for one.

Wobei ich gerade anderenorts etwas von Rekordgewinnen von Gazprom in 2008 gelesen haben, in der Größenordnung von $10 Mrd - und von beachtlich hohen Anleihen, die 2009 und 2010 fällig werden, die aber zusammen um die $16 Mrd wiegen.

Es ist durchaus denkbar, daß die wirklich überschuldet sind...

As a result, by the time the downturn came, they entered the credit crisis deeply in debt and with a backlog of capital investment needs.

Naja, aber warum einen Bailout machen und nicht die Unternehmen pleite gehen lassen und dann verstaatlichen?

Das Kabinett habe das Projekt K-Dow Petrochemicals abgesagt, gegen das sich Widerstand im Parlament regte, meldete die amtliche kuwaitische Nachrichtenagentur Kuna am Sonntag. Kuwait sehe angesichts der Finanzkrise keine Vorzüge mehr in dem Projekt, hieß es in Medienberichten.

Die staatliche Petrochemical Industries (PIC) hatte das Joint Venture erst Anfang des Monats mit Dow Chemical besiegelt. Im Zuge der Vereinbarung sollte Dow Chemical von Kuwait für seinen Anteil etwa 7,5 Mrd. $ erhalten. Mit dem Geld wollte Dow einen Großteil der 18,8 Mrd. $ teuren Übernahme des US-Spezialchemiekonzerns Rohm & Haas bezahlen.

http://www.iht.com/articles/2008/12/28/business/dow.php

Also ist entweder Dow Chemical in einer sehr schwierigen Position - oder Kuweit.

Und für mein Gefühl ist Kuweit in Problemen...

http://www.livemint.com/2008/12/23234136/Dow-Chemical-to-exit-petrochem.html

In India, too, Dow Chemical International Pvt. Ltd is writing a new script. Ramesh Ramachandran, who took over as president and chief executive of the company’s India operations last year, wants to exit the petrochemical business in the country to focus on speciality chemicals. The company currently buys petrochemical products from its parent for trading in India.

... aber Dow Chemical halt auch.

Über die für 2010 anvisierte Währungsunion debattiert die GCC, eine vergleichsweise lose politische und wirtschaftliche Vereinigung, bereits seit Jahren. Das Treffen des Kooperationsrats am Montag und Dienstag war durch einen Streit zwischen den beiden größten Mitgliedstaaten Saudi-Arabien und den Vereinigten Arabischen Emiraten über eine Abkehr von der Dollar-Bindung und die Einführung eines Währungskorbes belastet worden.

Also, _das_ ist bestimmt der Beginn einer Währungsgemeinschaft voller Harmonie und gemeinsamen Interessen. Das wird bestimmt noch viel besser funktionieren als die Opec.

Economic growth in the U.A.E., the second-biggest Arab economy, will slow to 2.7 percent in 2009 and 3.5 percent in 2010, led by a slump in its real-estate and banking industries, Standard Chartered Plc said Dec. 15. The U.A.E. economy probably grew 7 percent this year, the International Monetary Fund estimates.

Ok, ok, 2.7% ist immer noch sehr viel. Kein Grund zur Sorge...

Hypotheken machen als nur 10% des Kreditgeschäfts aus. Und das ist ungefährlich.

Auch wenn 50% der Hypotheken ausfallen und die Banken um den Faktor 20 gehebelt sind?

Dubai:

Der Preis von Villen in Dubai sank von September auf Oktober um 19%. Davon müssen wohl ziemlich viele auf dem Markt sein.

Dubei: fast 50% des Bruttosozialproduktes mit Immobilien und Bau erwirtschaftet.

Wenn der Bereich auch nur, sagen wir mal, 25% fällt, dann sehen die einem Wachstum des BSP von -10% entgegen.

Wenn der Bereich um 50% fällt, und der Ölpreis im nächsten Jahr unter 50$ bleibt, dann sehen die einem BSP-Wachstum von -30% entgegen.

Aber in den "fast 50%" steckt noch eine andere Nachricht: All das, was die in Dubai aufbauen wollten - Medienindustrie und so - erwirtschaftet noch nichts Nennenswertes. Damit wird auch fraglich, ob Dubai die Leute, die in ihren Wolkenkratzern arbeiten sollen, überhaupt wird ins Land locken können.

The price of used and new homes fell 1.7 percent in the third quarter from the previous three months when prices declined 0.3 percent, the Madrid-based National Statistics Institute said today. Compared with a year earlier, home prices fell 3 percent in the third quarter.

Spaniens Hauspreise sind in einem Jahr um 3% gefallen. Da hatte ich mit deutlich Schlimmerem gerechnet.

Das ist ein sehr signifikanter Sturz:

Das ist ganz, ganz schlecht - seit mittlerweile etwas über 2 Jahren muß Großbritannien netto Öl importieren und in Dollar zahlen... ich habe keinerlei Ahnung, wie die da heraus kommen wollen.

Britain’s currency also dropped versus 14 of its 16 most- traded counterparts, falling for a second day against the Swiss franc and tumbling to a 14-year low against Japan’s yen. Property research company Hometrack Ltd. said U.K. house values slid 8.7 percent this year, led by a 10.1 percent drop in London, and that prices will “inevitably” decline in 2009.

http://www.guardian.co.uk/money/2008/dec/29/house-prices-fall

[...]

Melanie Bien, director of mortgage brokers Savills Private Finance, said her company measured the drop in house prices in 2008 at closer to 12% and expected prices to fall by another 11% in the new year.

The four-week moving average for gasoline demand, which is often more indicative of long-term trends, was down 3.0 percent compared to year-ago levels, according to MasterCard. Year-to-date, gasoline demand was running 3.2 percent below 2007, the report said.

Laut Mastercard ist der Benzinbedarf in den USA um 3% gegenüber letztem Jahr eingebrochen. Die gewinnen die Daten aus den Kreditkartenzahlungen an Tankstellen.

The rates range from no interest to 5.9 percent annually, are available through Jan. 5 and may be used with cash rebates of as much as $4,250, Detroit-based GM said today in a statement. The interest-free financing is on models including 2008 Chevrolet TrailBlazer sport-utility vehicles and Saab 9-5 sedans.

Kaum gibt Vater Staat Geld, wird's auch gleich wieder zum Fenster heraus geworfen. 5 Jahre ohne Zinsen bedeuten beim 9-5 ($40000) locker $10000 verlorene Zinsen.

Ok, in dem Fall kann man GM noch nicht mal einen Vorwurf machen, Vater Staat will das ja so.

http://www.bloomberg.com/apps/news?pid=20601209&sid=aDMdKyrurYNc&refer=transportation

“The economy has stopped on a dime, and the Fed is looking anywhere there are large markets they can affect in big ways,” said Greg Prost, chief investment officer at Ambassador Capital Management in Detroit, which manages about $800 million. “If they are going to save the car companies, there is going to have to be financing.”

GMAC will now lend to vehicle buyers with credit scores of 621 or higher, compared with a previous standard of at least 700, according to a company statement. The higher threshold had excluded about 42 percent of U.S. consumers.

Staatsgeld ist ja so wertlos, damit kann man jeden bedienen. Ist es nicht zum Kotzen?

Übrigens meine ich "jeden": Laut Wikipedia ist der Fico-Medianwert 723.

Also, GM bietet Kredite von 0 bis 5.9%, und GMAC zahlt 8% Zinsen? Welche Drogen muß man nehmen, um das für ein nachhaltiges Geschäftsmodell zu halten?

Ich verstehe den Anleihenmarkt nicht mehr. Da wird GMAC noch mehr Miese machen, und noch 23 Jahre laufende GMAC-Anleihen steigen im Wert...

Sixty percent of the injection will be used to issue new shares while the remaining 40 percent will be for subordinated debt, both to be acquired by the New York-based banking giant, Citi said.

Ich hab' eine Weile geglaubt, der Unsinn mit den Tochterunternehmen wäre dadurch bedingt, daß man Tochterunternehmen dann auch mal Pleite gehen lassen kann. Die letzten Jahre haben mich davon überzeugt, daß das nicht der Fall ist.

Nein, Tochterunternehmen sind dazu da, zusätzliche Risiken zu verstecken.

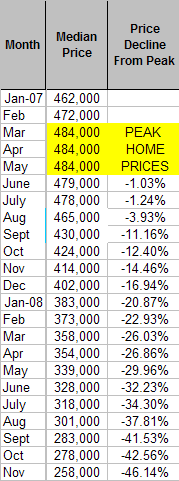

The indexes showed prices in 10 major metropolitan areas fell 19% in October from a year earlier and 3.6% from September. The drop marks the 10-city index's 13th straight monthly report of a record decline.

In 20 major metropolitan areas, home prices dropped 18% from the prior year, also a record, and 2.2% from September.

Year-over-year, Dallas and Charlotte again had the best relative performance, with declines of 3% and 4.4%, respectively.

http://mrmortgage.ml-implode.com/2008/12/30/the-scariest-housing-related-chart-ever/

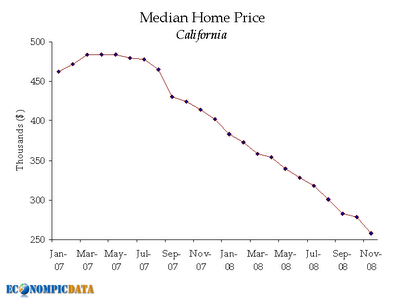

Medianwerte kalifornischer Hauspreise laut Dataquick. 46% runter seit dem Gipfel. Der Autor betitelt sie mit The Scariest Housing-Related Chart Ever, und es fällt schwer, das zu bestreiten.

Hier ist das in eine Kurve umgesetzt (Quelle: Econompicdata).

Allerdings neigen die Dataquick-Daten eventuell etwas zur Übertreibung.

It is important to remember that the index averages sale prices over the three months from September through November. Sales contracts are typically signed 6-8 weeks before sales are closed. This means that the contracts for the homes sold during this period were mostly written up in the months July through September. Most data show the economy turning sharply lower in September, which means that two of the three months in which the contracts in the October index were signed preceded the sharp downturn.

Die Hauspreisdaten für den Oktober reflektieren die dramatische Entwicklung im September noch nicht.

http://www.calculatedriskblog.com/2008/12/office-rents-off-as-much-as-25-in-new.html

[...]

Brokers say that actual rents have fallen much further than the data suggests. Studley said that the asking rents for 40 percent of the spaces included in its research are listed as “negotiable.”

[...]

[A]ctual rents have slipped as much as 25 percent since the summer, said Mitchell L. Konsker, a vice chairman of Cushman & Wakefield.

Das wird sicherlich dem einen oder anderen Immobilien"besitzer", der gehebelt sprich kreditfinanziert auf immer steigende Preise gesetzt hat, das Genick brechen.

Bei so viel düsterer Realität wird's doch mal Zeit, etwas Positives zu zeigen:

http://www.realestatelibrary.com/norent.html

That reminds me of one of the best advantages to buying real estate, the benefit of leverage. As I said, if you buy a house for $400,000 in ten years it'll be worth $800,000 so you doubled your money in 10 years. By the way, this is not theory, but actual events that we have witnessed and participated in. We own many properties ourselves, and so I'm able to look back and give you the benefit of having done it.

But here's my point - you didn't have to come up with the whole $400,000 for the house, you only put 10% down. You only invested $40,000! So when your $40,000 becomes $400,000, that isn't a double, it's a ten-fold increase in your money!

Das ist ein wirklich wunderbarer Text, der einen viel verstehen läßt.

Abschließend möchte ich die Earthtimes zitieren:

http://www.earthtimes.org/articles/show/12242.html

Titel: U.K. house prices continue to climb forever upwards

Hm, ja, in Zimbawbe-Dollars vielleicht.

Wo fast jedes sechste Haus weniger wert ist als seine Hypothek, haben Scheidungsanwälte die ganz neue Erfahrung, daß nicht mehr darum gekämpft wird wer das Haus behält, sondern wer es los wird.

es ist noch nicht mal mehr feststellbar, was ein Haus wert wäre - es verkaufen sich keine Häuser.

Die New York Times hat da einiges über die Art und Weise, wie WaMu Kredite vergab, zusammengeschrieben. Ich zitiere mal die interessantesten Punkte:

Babysitter mit Gehältern von Collegepräsidenten und Schullehrer mit Einkommen ähnlich denen von Aktienhändlern? Kein Problem.

Mr. Parsons could not verify the singer’s income, so he had him photographed in front of his home dressed in his mariachi outfit. The photo went into a WaMu file. Approved.

Mariachi ist eine mexikanische Musikform, die typischerweise mindestens 8 Instrumente erfordert - und üblicherweise singen die Leute selbst. Große Reichtümer kann man bei den Leuten nicht erwarten.

Naja, um einen Kredit zu kriegen, brauchte der Mann sich nur im Outfit vor sein Häuschen stellen und fotografieren lassen.

“In our world, it was tolerated,” said Sherri Zaback, who worked for Mr. Parsons and recalls seeing drug paraphernalia on his desk. “Everybody said, ‘He gets the job done.’ ”

Klar, Kontrolleure arbeiten besonders gut, wenn sie unter Drogen stehen. Ist doch bei Dir auch so?

Je riskanter der Kredit, desto höher die Gebühren, desto höher die Boni für die Chefetage.

Um das aber gebündelt auf den Markt werfen zu können, mußte das wieder etwas weniger riskant aussehen, deshalb wurden ... die Werte der Immobilien hochgerechnet.

Auch das ist ein Grund, warum die Blase entstand.

If Ms. Zweibel doubted whether customers could pay, supervisors directed her to keep selling, she said.

“We were told from up above that that’s not our concern,” she said. “Our concern is just to write the loan.”

Zweifelt der Mitarbeiter daran, daß der Kunde den Kredit sich leisten kann? Warum tut er das, er soll doch den Kredit vergeben...

“WaMu came out with that slogan, and that was what we had to live by,” Ms. Zaback said. “We joked about it a lot.” A file would get marked problematic and then somehow get approved. “We’d say: ‘O.K.! The power of yes.’ ”

Die meisten der Kredite erforderten von den Schuldern gerade mal Adresse, Sozialversicherungsnummer, und die Angabe von Einkommen und Besitz. Seufz.

On one loan application in 2005, a borrower identified himself as a gardener and listed his monthly income at $12,000, Ms. Zaback recalled. She could not verify his business license, so she took the file to her boss, Mr. Parsons.

He used the mariachi singer as inspiration: a photo of the borrower’s truck emblazoned with the name of his landscaping business went into the file. Approved.

Ein Gärtner mit Monatseinkommen von $12000? Es gibt Schwierigkeiten beim Überprüfen seiner Lizenz? Ein Photo vom LKW, und gut ist.

The loan officer yelled at her, Ms. Zaback recalled. “She said, ‘We don’t call the bank to verify.’ ” Ms. Zaback said she told Mr. Parsons that she no longer wanted to work with that loan officer, but he replied: “Too bad.”

Das ist nahezu unglaublich. "Wir rufen nicht bei der Bank an, um Angaben zu prüfen".

“I’d typically spend a maximum of 35 minutes per file,” she said. “It was just disheartening. Just spit it out and get it done. That’s what they wanted us to do. Garbage in, and garbage out.”

Ok, bei 35 Minuten maximal pro Antrag kann man auch nicht viel Zeit für einen Anruf bei der Bank opfern.

“We had a flier that said, ‘A thin file is a good file,’ ” recalled Michele Culbertson, a wholesale sales agent with WaMu.

"Eine dünner Ordner ist ein guter Ordner". Hey, möglichst wenig Informationen...

“We were looking for people who understood how to do loans at WaMu,” Ms. Lado said.

Die Frau schulte Mitarbeiter darin, daß sie Teile von Anträgen nicht ausfüllten, wenn diese Teile Überprüfungen herausfordern würden. "Wir suchten Leute, die verstanden wie man Kredite bei WaMu machte". Wozu nur? Eine Stempelmaschine kann das doch viel besser...

Übel.

In September, Mr. Killinger was forced to retire. Later that month, with WaMu buckling under roughly $180 billion in mortgage-related loans, regulators seized the bank and sold it to JPMorgan for $1.9 billion, a fraction of the $40 billion valuation the stock market gave WaMu at its peak.

Im September 2008 ist dann der Boss des Ladens entlassen worden... und etwas später hat JP Morgan Chase den Laden aufgekauft - für 1.9 Mrd (nicht lange später hat JP M. C. dann 25 Mrd vom Staat bekommen).

Ich bin sicher nicht sicher, wie viele Milliarden JP Morgan Chase zuviel gezahlt hat - aber wahrscheinlich eine astronomische Summe.

Hypothekenverluste sind bei der Berechnung der Managerboni _nicht_ berechnet worden.

Ich vermute, dem Aufkäufer von WaMu ist _sehr_ unwohl. Und ich würde, wäre ich Topmanager bei WaMu gewesen, mich längst in ein Land begeben haben, das kein Auslieferungsabkommen mit den USA hat.

10% mehr Kunden, und 10% weniger Auslösungen.

Gute Aussichten für noch eine Industrie...

http://www.time.com/time/business/article/0,8599,1868932,00.html?cnn=yes

Las Vegas:

8.5% weniger Spieleinnahmen in diesem Jahr.

24.3% weniger Spieleinnahmen im Oktober gegenüber dem Vorjahresoktober.

3% weniger Besucher.

A mile or two down the Strip, MGM Mirage just sold off Treasure Island for $775 million to billionaire casino operator Phil Ruffin. The cash infusion should help the corporation finish construction on its $9.1 billion CityCenter, the largest private construction job in the U.S.

Der Artikel hat übrigens ein Bild vom CityCenter. Ich kenne jemanden, der sich bei so einem Anblick fragt, worum die in die Höhe bauen, wo sie doch so viel Land haben...

Lottery officials have long praised their games as low-cost entertainment that grow even more appealing to players when the economy turns down. But lottery sales nationwide fell about $215 million, or nearly 2%, from July through September compared with the same stretch in 2007, according to La Fleur's magazine, which tracks the lottery business.

Noch eine angeblich rezessionsfeste Industrie erlebt einen Einbruch: Die Lotterien.

und das sieht noch ein bischen schlimmer als: Dauerspieler "small cutbacks", aber 27% der Gelegenheitsspieler spielen 81 bis 100% weniger.

Und wen trifft der Einbruch:

In Bridgewater, 25 miles south of Boston, that aid accounts for about 10% of town revenue, and a cut this year would probably require closing a library or a center for senior citizens, said Paul Sullivan, the municipal administrator.

Natürlich wieder das Sozialsystem. Ich bin immer wieder fasziniert, auf wie tönernen Füßen Staaten ihre soziale Infrastruktur aufbauen.

Just four years after South Florida recruiters struggled to meet even half their quotas, the Army is exceeding enlistment goals by appealing to a wide range of candidates who see limited job options in the civilian world.

Stabilität und Gesundheit im Militär? Im US-Militär? Manchmal zweifele ich ja an der geistigen Stabilität der Leute.

Now, fatalities in Iraq are fewer, jobs are scarce and the Army has sweetened incentives. Enlistment bonuses can run as high as $40,000. A new GI Bill taking effect next year will cover tuition and fees for any in-state public university and provide allowances for housing and books.

The maximum age for enlistment was raised to 42 in 2005, minimum test scores were lowered and the Army began issuing more waivers for criminal offenses. A felony conviction for cocaine possession, for example, does not necessarily disqualify an otherwise good candidate.

Etwas Neues aus Venezuela:

Chavez named no specific contracts or companies to be affected, but his mining minister has vowed to next year take over the nation's largest mine, Las Cristinas, which is operated by Canadian mining company Crystallex International Corp.

"We are taking back some concessions that former governments have given, and whose permits are still held by some rich people," in order to reduce public reliance on oil, Chavez said.

Naja, ist der Ruf ist ruiniert, braucht man sich um das Vertrauen der Investoren in das Land ja auch keine großen Sorgen mehr machen. Und rich people sind ja von Natur aus böse und schuldig.

Mining operations have not yet begun at Las Cristinas — located in Venezuela's biologically rich Imataca Forest Reserve, which covers 8.6 million acres (3.5 million hectares). Environmentalists warn that mining there could upset the delicate ecology.

Venezuela produced roughly 4.2 tons (4.3 metric tons) of gold in 2007, and Chavez said he hopes to double that figure next year. The country is also rich in diamonds, bauxite and other minerals.

Also hat Crystallex die Mine aufgebaut und produktionsfertig gemacht, aber nie produzieren dürfen, und wird jetzt enteignet.

Na, wie lange es wohl dauert, bis das Ausland wieder bereit ist in Venezuela zu investieren? DUmmheit stirbt nie aus, ich weiß, aber Chavez geht da sehr weit.

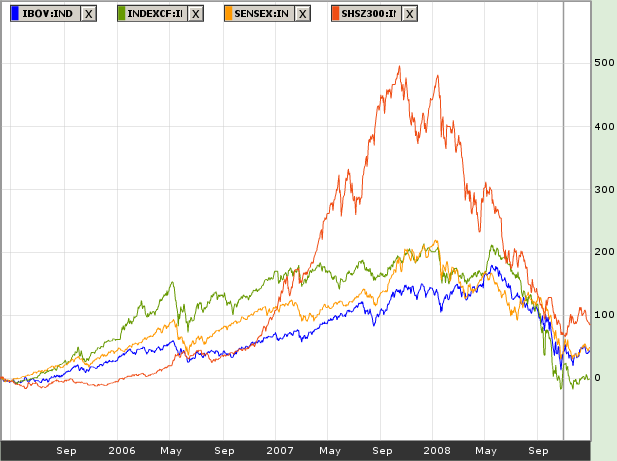

Blau Brasilien, Grün Rußland, Gelb Indien, Rot China. Wenn man die Inflation einrechnet, ist der Kursgewinn sicherlich noch geringer.

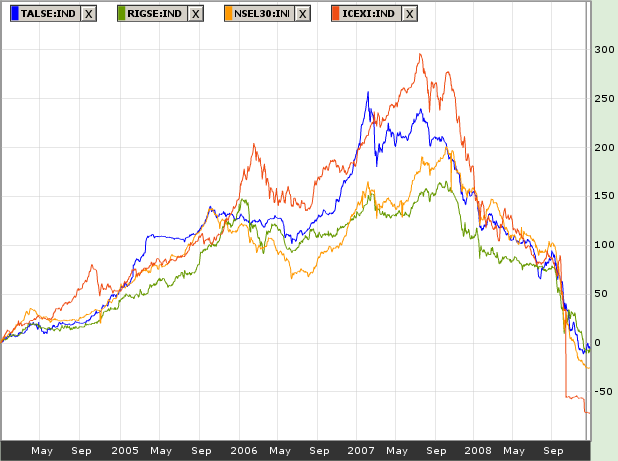

Blau Estland, Grün Lettland, Gelb Litauen, Rot ist Island.

Aufgrund der großen Nachfrage noch ein Bonusbild:

London, Tokio, Frankfurt, New York

Gruß, Uwe

Wollen Sie den Digest abbestellen?