| Sendedatum | 2008-02-03 14:43:13 |

|---|---|

| Ausgabe | 33 |

Hallo,

hier eine weitere Ausgabe des beliebten Newsletters für Masochisten und Weltuntergangssekten. Je nach Newsreader kann die Darstellung weniger als perfekt befriedigend sein, daher könnte sich ein Blick auf die Onlineversion lohnen, die außerdem verschlagwortet ist.

Inhaltsverzeichnis:

- Re: Alles wird gut!!!33! - Kreditversicherer

- Re: Alles wird gut!!!33! - UK: Hypotheken teilweise >90% des Immobilienwertes

- Re: Alles wird gut!!!33! - UK: Hypotheken teilweise >90% des Immobilienwertes

- Re: Alles wird gut!!!33! - Citybank mag die besseren Kunden nicht

- Re: Alles wird gut!!!33! - Bank of America, Countrywide und der Hedgefond

- Re: Alles wird gut!!!33! - Subprime: Merrill Lynch / Norma

- Re: Alles wird gut!!!33! - Merrill Lynch und der Verkauf von CDOs an Springfield

- Re: Alles wird gut!!!33! - Subprime: Ermittlungen gegen UBS

Inhalt:

http://cnbc.com/id/15840232?video=633485538

Hm, das ist eine Summe, die viel realistischer klingt als die 11 oder 15

Milliarden, die letzten durch die Ticker liefen, nicht?

Frage: Wie konstruiert man eine Rettung mit 200 Mrd Kapital, _ohne_ daßdie Fed direkt eingreift?

Zitat:Sean Egan von einer angeblich unabhängigen Ratingagentur Egan-Jones

behauptet, daß 200 Mrd Dollar nötig sein, um den 7 (??) Versicherern

AAA-Status zu geben bzw. erhalten.

behauptet, daß 200 Mrd Dollar nötig sein, um den 7 (??) Versicherern

AAA-Status zu geben bzw. erhalten.

Hm, das ist eine Summe, die viel realistischer klingt als die 11 oder 15

Milliarden, die letzten durch die Ticker liefen, nicht?

Frage: Wie konstruiert man eine Rettung mit 200 Mrd Kapital, _ohne_ daßdie Fed direkt eingreift?

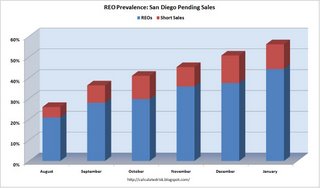

http://www.calculatedriskblog.com/2008/02/san-diego-reo-prevalence-above-50.html

Nette Graphik, für die man 2 Sachen wissen muß:

- REO ist Real Estate Owned. Nein, nicht "owned" beim Endkunden, "owned"

beim Geldverleiher, nachdem eine Zwangsversteigerung gescheitert ist.

- Ein "short sale" ist ein Verkauf, bei dem Bank/Hypothekenverleiher erlaubt hat, das Ding für weniger als die ausstehende Geldsumme zu verkaufen. Wird gemacht, um Zwangsversteigerungen zu vermeiden. Mit anderen Worten: Verlust für die Bank.

100% auf der Graphik entspricht allen versuchten Verkäufen, wenn ich das

richtig verstehe.

http://www.dailymail.co.uk/pages/live/articles/news/news.html?in_article_id=511874&in_page_id=1770

In einigen Bereichen Großbritanniens sind die durchschnittliche Hypotheken >90% der Werte. Anders gesagt: 10% Sturz der Immobilienpreise

= Katastrophe.

Zitat:It found that in some parts of Britain, the average mortgage debt

is more than 90 per cent of local property prices.

is more than 90 per cent of local property prices.

In einigen Bereichen Großbritanniens sind die durchschnittliche Hypotheken >90% der Werte. Anders gesagt: 10% Sturz der Immobilienpreise

= Katastrophe.

http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article3294727.ece

Banken wollen Kunden loswerden, die _keine_ Schwierigkeiten hatten, Kreditkartenrechnungen zu bezahlen, wegen "wenig Profit".

Citybank?

"better customers may be less welcome". Can't make this up.

Zitat:CREDIT card customers who pay off their balance each month are as

much risk from being cut off by their lender as those that have lost

control of their spiralling debts..

much risk from being cut off by their lender as those that have lost

control of their spiralling debts..

Credit checking agencies say banks are beginning to weed out customers

with faultless borrowing histories because they can make little

profit on them.

Banken wollen Kunden loswerden, die _keine_ Schwierigkeiten hatten, Kreditkartenrechnungen zu bezahlen, wegen "wenig Profit".

Und wer ist es?

Zitat:

It comes as credit card company Egg was accused of withdrawing cards

from some of its most responsible customers as part of a cull of

those said to have a "higher than acceptable risk profile".

It comes as credit card company Egg was accused of withdrawing cards

from some of its most responsible customers as part of a cull of

those said to have a "higher than acceptable risk profile".

The lender, part of US investment bank Citigroup, wrote to 161,000

customers - 7% of its total base - last week to warn them their

cards would be withdrawn in 35 days. They can still repay balances

over time.

Citybank?

Zitat:

However, credit checker Experian said better customers may be less

welcome in future as banks chase profitable business to offset losses

from delinquent borrowers with rising bad debts.

"Put yourself in their shoes. You spend very little and pay it off

every month. You are not an ideal customer for them," said Peter

Brooker, a spokesman for the company.

However, credit checker Experian said better customers may be less

welcome in future as banks chase profitable business to offset losses

from delinquent borrowers with rising bad debts.

"Put yourself in their shoes. You spend very little and pay it off

every month. You are not an ideal customer for them," said Peter

Brooker, a spokesman for the company.

"better customers may be less welcome". Can't make this up.

http://www.marketwatch.com/news/story/bank-america-countrywide-face-hurdles/story.aspx?guid=%7B850195A9-C3A0-4886-8362-C820317275ED%7D

Ah, so wird BofA also aus dem Kauf von Countrywide herauskommen - ein

Hedge Fond hat die SEC gebeten, einige Handel von vor der Ankündigung

zu prüfen.

Zitat:Bank of America's planned acquisition of distressed mortgage company

Countrywide Financial Corp. may have hit a major snag this week

when hedge SRM Global Fund unveiled its 5.2% stake in the target,

issued a blistering attack on Bank of America and asked the SEC to

investigate trading ahead of the announcement.

Countrywide Financial Corp. may have hit a major snag this week

when hedge SRM Global Fund unveiled its 5.2% stake in the target,

issued a blistering attack on Bank of America and asked the SEC to

investigate trading ahead of the announcement.

Ah, so wird BofA also aus dem Kauf von Countrywide herauskommen - ein

Hedge Fond hat die SEC gebeten, einige Handel von vor der Ankündigung

zu prüfen.

http://money.cnn.com/news/newsfeeds/articles/primenewswire/135505.htm

Ich glaube nicht, daß Merrill Lynch in der Zukunft noch eine große

Rolle im Markt spielen wird, außer als (wahrscheinlich ignoriertes)

abschreckendes Beispiel.

Zitat:The Securities Law Firm of Klayman & Toskes,

P.A. ("K&T")(http://www.nasd-law.com) announced today that it is

investigating the damages sustained by institutional and retail

customers in a collateralized debt obligation ("CDO") called Norma

CDO I Ltd. ("Norma"). Norma, brought into existence by Merrill Lynch

(NYSE:MER), bet heavily on the success of the sub-prime market. Just

nine months after it sold about $1.5 billion in securities to its

investors, the value of Norma has been decimated in the collapse

of the housing market and is reported to be worth only a fraction

of its original value.

P.A. ("K&T")(http://www.nasd-law.com) announced today that it is

investigating the damages sustained by institutional and retail

customers in a collateralized debt obligation ("CDO") called Norma

CDO I Ltd. ("Norma"). Norma, brought into existence by Merrill Lynch

(NYSE:MER), bet heavily on the success of the sub-prime market. Just

nine months after it sold about $1.5 billion in securities to its

investors, the value of Norma has been decimated in the collapse

of the housing market and is reported to be worth only a fraction

of its original value.

Ich glaube nicht, daß Merrill Lynch in der Zukunft noch eine große

Rolle im Markt spielen wird, außer als (wahrscheinlich ignoriertes)

abschreckendes Beispiel.

Re: Alles wird gut!!!33! - Merrill Lynch und der Verkauf von CDOs an Springfield

Uwe Ohse, 2008-02-03

Uwe Ohse, 2008-02-03

http://online.wsj.com/article/SB120182463055033655.html?mod=hpp_us_whats_news

und das ist noch nicht genug Ärger in dieser Angelegenheit:

"part of a larger investigation". Hört, hört. Wenn ich in Akten

investieren würde, dann in die von Anwaltskanzleien.

Und wenn ich shorten würden, dann Merrill und Citygroup. Rückwirkend zu

Freitag, natürlich. Ok, zugegeben, bei der City hätte ich das schon imAugust getan, und bei Merrill allerspätestens im September, wenn ich dennmit Geld spielen würde.

Zitat: NEW YORK -- Merrill Lynch & Co. has bought back, from Springfield,

Mass., complex debt securities that rapidly collapsed in value

during the credit crisis.

The securities, known as collateralized debt obligations, were

repurchased at the same price of $13.9 million that Merrill initially

sold them to the city last spring.

[...]

"The City of Springfield and the Springfield Financial Control

Board have said that neither body approved the purchases of these

investments," said Mark Herr, a Merrill spokesman. "After carefully

reviewing the facts, we have determined the purchases of these

securities were made without the express permission of the city. As

a result, we are making the city whole and we have taken appropriate

steps internally to ensure this conduct is not repeated."

Mass., complex debt securities that rapidly collapsed in value

during the credit crisis.

The securities, known as collateralized debt obligations, were

repurchased at the same price of $13.9 million that Merrill initially

sold them to the city last spring.

[...]

"The City of Springfield and the Springfield Financial Control

Board have said that neither body approved the purchases of these

investments," said Mark Herr, a Merrill spokesman. "After carefully

reviewing the facts, we have determined the purchases of these

securities were made without the express permission of the city. As

a result, we are making the city whole and we have taken appropriate

steps internally to ensure this conduct is not repeated."

und das ist noch nicht genug Ärger in dieser Angelegenheit:

Zitat:William Galvin, the Massachusetts secretary of state, filed a

civil fraud complaint against Merrill a day after the firm took

the unusual step of agreeing to reimburse Springfield for losses on

the investments.

[...]

“They are alleging fraud against a municipality, which carries with

it much more gravitas than a simple lawsuit,” Mark A. Flessner,

a partner at Sonnenschein Nath & Rosenthal in Chicago, said of the

complaint. An official in Mr. Galvin’s office said the Springfield

case was part of a larger investigation into Merrill’s sales of

similar investments to other Massachusetts towns and cities.

civil fraud complaint against Merrill a day after the firm took

the unusual step of agreeing to reimburse Springfield for losses on

the investments.

[...]

“They are alleging fraud against a municipality, which carries with

it much more gravitas than a simple lawsuit,” Mark A. Flessner,

a partner at Sonnenschein Nath & Rosenthal in Chicago, said of the

complaint. An official in Mr. Galvin’s office said the Springfield

case was part of a larger investigation into Merrill’s sales of

similar investments to other Massachusetts towns and cities.

"part of a larger investigation". Hört, hört. Wenn ich in Akten

investieren würde, dann in die von Anwaltskanzleien.

Und wenn ich shorten würden, dann Merrill und Citygroup. Rückwirkend zu

Freitag, natürlich. Ok, zugegeben, bei der City hätte ich das schon imAugust getan, und bei Merrill allerspätestens im September, wenn ich dennmit Geld spielen würde.

Apropos Merrill:

http://online.wsj.com/article/SB120191503643937097.html

Eine Bank, die Investoren täuschte? Ja, wie denn _das_?

Zitat:"The Subprime Cleanup Intensifies"

Federal criminal prosecutors in New York are investigating whether

UBS AG misled investors by booking inflated prices of mortgage

bonds it held despite knowledge that the valuations had dropped,

according to people familiar with the matter.

Federal criminal prosecutors in New York are investigating whether

UBS AG misled investors by booking inflated prices of mortgage

bonds it held despite knowledge that the valuations had dropped,

according to people familiar with the matter.

Eine Bank, die Investoren täuschte? Ja, wie denn _das_?

Gruß, Uwe

Wollen Sie den Digest abbestellen?